Finance Cloud Market Overview and Analysis:

The Finance Cloud Market size is estimated at USD 27.9 billion in 2023 and is expected to register a CAGR of 20.05% during the forecast period (2024-2031).

Get Complete Analysis Of The Report - Download Free Sample PDF

Finance Cloud is a specialized cloud computing solution tailored for the financial industry, providing a secure and scalable platform for financial institutions to streamline operations. By harnessing cloud technology, it offers services like data storage, processing, and analytics, facilitating real-time access to financial data and promoting collaboration. The deployment of financial applications is made more efficient, aiming to improve overall operational efficiency, reduce costs, and ensure compliance with regulatory requirements. This empowers financial organizations to adapt to dynamic market conditions and deliver innovative and agile financial services.

In response to the growing trend of digital applications in the banking, financial, and insurance sectors, companies are embracing Finance Cloud to swiftly address customer queries and gain long-term benefits for a competitive edge. An example is Ess Kay Fincorp, which reduced loan approval time by 33% through a cloud-based lending platform. Operational efficiency is a key driver, exemplified by Roha Housing Finance achieving a 50% faster end-to-end loan processing time, and adopting cloud-based technology to prioritize a "customer-first" approach.

Finance Cloud Market Trends:

The Finance Cloud market is experiencing dynamic trends driven by the increasing adoption of digital solutions in the financial sector. One prominent trend is the growing preference among banking services, financial, and insurance companies for digital applications. These organizations are recognizing the value of Finance Cloud solutions in swiftly addressing customer inquiries while considering long-term benefits and gaining a competitive advantage. A noteworthy example is Ess Kay Fincorp, which achieved a 33% reduction in loan approval time by digitizing its lending business through a cloud-based platform. Operational efficiency is a significant factor fueling the growth of the Finance Cloud market. Companies such as Roha Housing Finance are leveraging cloud-based technology to enhance agility and cost efficiency, aiming for a "customer-first" approach. This has enabled them to achieve a remarkable 50% faster end-to-end loan processing time compared to industry benchmarks. Additionally, the Finance Cloud market is witnessing increased demand from financial institutions seeking secure and scalable platforms. The emphasis on real-time access to financial data, data analytics, and collaboration features is driving the adoption of cloud solutions. As the industry recognizes the need for adaptability to rapidly evolving market conditions, Finance Cloud solutions are becoming integral for delivering innovative and agile financial services. Overall, the Finance Cloud market is poised for continued growth, driven by these key trends in digitization, operational efficiency, and enhanced customer-centric approaches within the financial sector.

Market Segmentation: The Finance Cloud Market is segmented by solution and service (financial forecasting, financial reporting and analysis, risk and compliance, and managed service), deployment (public cloud and private cloud), and geography (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa). The market size and forecasts are provided in terms of value (in USD) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Rapid adoption of the cloud in small & medium enterprises across the globe

The rapid adoption of cloud technology in small and medium enterprises (SMEs) globally has become a transformative trend, particularly in the context of Finance Cloud solutions. Small and medium-sized enterprises, known for their agility and resource efficiency, are increasingly recognizing the strategic advantages offered by cloud-based financial services. Cloud adoption in SMEs provides cost-effective solutions, allowing businesses to access advanced financial tools without the need for significant upfront investments in infrastructure. Finance Cloud solutions cater specifically to the needs of SMEs, offering scalable and flexible platforms that streamline financial processes, enhance collaboration, and provide real-time access to critical data. This shift to cloud-based financial services enables SMEs to compete on a more level playing field with larger enterprises, as they gain access to sophisticated tools that were traditionally reserved for larger organizations. The Finance Cloud market is witnessing a surge in demand from SMEs looking to leverage cloud technology for various financial functions, including accounting, procurement, and supply chain management. The scalability and accessibility of Finance Cloud solutions empower SMEs to adapt quickly to market changes, improve operational efficiency, and remain competitive in an ever-evolving business landscape. As SMEs across the globe continue to embrace the cloud for their financial needs, the Finance Cloud market is poised for significant growth, with technology providers tailoring solutions to cater specifically to the unique requirements and challenges faced by small and medium-sized enterprises. This trend signifies a paradigm shift in how SMEs approach financial management, harnessing the power of the cloud to drive innovation and efficiency in their operations.

Increase in the need for transparency & operational efficiency in business processes

The escalating demand for transparency and operational efficiency in business processes has fueled the rapid adoption of Finance Cloud solutions. Businesses, driven by the need for accurate and real-time financial information, turn to cloud-based platforms that centralize data, ensuring transparency across various functions and facilitating compliance with regulatory standards. Simultaneously, Finance Cloud enhances operational efficiency by automating financial processes, reducing errors, and promoting collaboration among different departments. This symbiotic relationship between transparency and operational efficiency positions Finance Cloud as a pivotal tool for businesses navigating complex regulatory landscapes and striving for competitiveness in dynamic markets.

Market Restraints:

Concerns related to data security and protection

Concerns related to data security and protection pose significant challenges that could potentially impede the growth of the Finance Cloud market. As financial institutions increasingly rely on cloud-based solutions, the sensitive nature of financial data becomes a focal point for scrutiny. Issues such as data breaches, unauthorized access, and cyber threats raise apprehensions about the security robustness of cloud platforms. Financial regulations and compliance standards further amplify these concerns, necessitating stringent measures to ensure the confidentiality and integrity of financial information. Companies in the Finance Cloud market must prioritize implementing robust security protocols, encryption mechanisms, and compliance frameworks to address these apprehensions. Building trust through transparent security practices and proactive risk mitigation strategies is crucial to overcoming these concerns and fostering sustained growth in the Finance Cloud market. As the industry grapples with evolving cybersecurity challenges, the ability of Finance Cloud providers to address and alleviate these concerns will play a pivotal role in shaping the market's trajectory.

COVID-19 Impact on Finance Cloud Market:

The COVID-19 pandemic has had a dual impact on the Finance Cloud market. On one hand, it accelerated the adoption of cloud-based financial solutions as businesses sought digital alternatives for remote work and business continuity. On the other hand, economic uncertainties prompted some organizations to reassess spending, leading to delays in Finance Cloud adoption. The crisis highlighted the importance of robust cybersecurity in the Finance Cloud market due to increased remote work vulnerabilities. Despite short-term challenges, the market is poised for recovery as businesses recognize the long-term benefits of cloud solutions in terms of agility, efficiency, and innovation, emphasizing the role of Finance Cloud in adapting to unforeseen challenges and ensuring resilience in a digital financial landscape.

Segmental Analysis:

Financial Reporting and Analysis Segment is Expected to Witness Significant Growth Over the Forecast Period

Financial reporting and analysis have undergone a transformative shift with the integration of Financial Cloud solutions. These platforms offer a centralized and real-time approach to accessing financial data, streamlining the reporting process, and fostering collaboration among different departments. The cloud-based nature of these solutions not only enhances the speed and accuracy of financial reporting but also provides advanced analytics tools for in-depth analysis, trend identification, and strategic decision-making. Moreover, Financial Cloud solutions address data security concerns by implementing robust measures and ensuring compliance with industry regulations. As businesses increasingly prioritize agility and data-driven insights, the adoption of Financial Cloud platforms becomes instrumental in optimizing financial management processes and adapting to evolving reporting requirements.

Private Cloud Segment is Expected to Witness Significant Growth Over the Forecast Period

Private Cloud and Financial Cloud represent tailored approaches within cloud computing for the financial sector. Private Cloud offers dedicated infrastructure, ensuring enhanced control and security for sensitive financial data, aligning with the industry's stringent regulatory requirements. In contrast, Financial Cloud specializes in providing cloud solutions designed explicitly for financial institutions, featuring real-time data access, advanced analytics, and tools for financial reporting. Both paradigms play vital roles in the financial sector, with Private Cloud addressing overarching security concerns and Financial Cloud offering industry-specific features to streamline operations and foster innovation. In certain scenarios, financial institutions may opt for a hybrid model, combining the dedicated control of the Private Cloud with the specialized functionalities of the Financial Cloud to strike a balance between security and tailored financial capabilities.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

In 2021, North America emerged as the dominant force in the Finance Cloud market, accounting for an impressive revenue share. This regional supremacy is expected to continue its trajectory, with a projected Compound Annual Growth Rate (CAGR) of 18.9% through 2030. The significant market share in 2021 can be attributed to several factors, including the robust economy in the region and higher rates of internet penetration, which have collectively fueled the adoption of Finance Cloud solutions. One notable trend in North America is the migration of isolated financial infrastructure to the cloud. The region's businesses have been actively embracing cloud-based technologies, driven by the need for enhanced agility, security, and operational efficiency. The shift to Finance Cloud solutions is further propelled by the advantages they offer, including reduced capital expenditure (CapEx) and decreased complexity in IT administration. The robust economy of North America provides businesses with the financial capacity to invest in advanced cloud solutions, allowing for the optimization of financial processes. The higher internet penetration rates in the region facilitate seamless connectivity and real-time access to financial data, contributing to the growing reliance on Finance Cloud platforms. Moreover, the Finance Cloud industry in North America is buoyed by the ongoing efforts to improve agility and security. The dynamic nature of the financial sector demands swift responses to market changes, making cloud solutions an ideal choice for adapting to evolving conditions. Additionally, the cost-effectiveness of Finance Cloud platforms, characterized by lower CapEx and simplified IT administration, further drives their adoption across various financial institutions in the North American region. Thus, North America's dominance in the Finance Cloud market in 2021 is underpinned by a robust economy, high internet penetration rates, and a proactive shift towards cloud technologies. The projected CAGR of 18.9% through 2030 signifies the region's sustained growth, propelled by the continuous adoption of Finance Cloud solutions for enhanced agility, security, and operational efficiency in the financial sector.

Get Complete Analysis Of The Report - Download Free Sample PDF

Finance Cloud Market Competitive Landscape:

The market for finance cloud is characterized by a fragmented competitive landscape, encompassing numerous global and regional players. In response to the intense competitive environment, key participants are actively engaging in strategic collaborations, partnerships, and mergers & acquisitions to extend their business reach. This approach is crucial for survival and growth in the highly dynamic market. Additionally, cloud providers within the finance sector are making substantial investments in research & development initiatives. This strategic focus aims to integrate new and cutting-edge technologies into their offerings. By developing advanced products, these providers seek to establish a competitive edge over other market players. The commitment to innovation and technological evolution is essential in meeting the evolving demands of the finance industry and staying ahead in the competitive race. Overall, the finance cloud market is witnessing a dynamic landscape shaped by collaborative efforts, strategic alliances, and a continuous commitment to research & development, highlighting the industry's recognition of the need for innovation and adaptability in the face of fierce competition. Some prominent players in the global finance cloud market are:

- Acumatica, Inc.

- Amazon Web Services, Inc.

- ARYAKA NETWORKS, INC.

- Cisco Systems, Inc.

- Google (Alphabet Inc.)

- IBM

- Microsoft

- Oracle

- Sage Group plc

- SAP

- Unit4

- Wipro

Recent Development:

1) In February 2023, Thoma Bravo, a software investment firm, successfully concluded its acquisition of Coupa Software, a leading provider of a cloud-based business spend management platform that integrates processes across the supply chain, procurement, and finance functions. The acquisition, valued at approximately USD 8.0 billion, marks a strategic move by Thoma Bravo into the realm of cloud-based business solutions.

2) In January 2022, Avaloq, a company specializing in Software as a Service (SaaS) and Business Process as a Service (BPaaS), reinforced its longstanding partnership with RBC Wealth Management, a division of the Royal Bank of Canada, particularly in the Asian region. This collaboration aims to enhance RBC Wealth Management's operations by adopting a cloud-based SaaS model, bringing about modernization in their wealth management platform. The initiative includes the implementation of more advanced solutions, aligning with industry trends and technology evolution to further optimize and innovate the financial services provided by RBC Wealth Management.

Frequently Asked Questions (FAQ) :

Q1. What was the Finance Cloud Market size in 2023?

As per Data Library Research the Finance Cloud Market size is estimated at USD 27.9 billion in 2023.

Q2. At what CAGR is the Finance Cloud market projected to grow within the forecast period?

Finance Cloud Market is expected to register a CAGR of 20.05% during the forecast period.

Q3. What are the Growth Drivers of the Finance Cloud Market?

Rapid adoption of the cloud in small & medium enterprises across the globe and Increase in the need for transparency & operational efficiency in business processes are the Growth Drivers of the Finance Cloud Market.

Q4. Which region has the largest share of the Finance Cloud market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here

Request for TOC

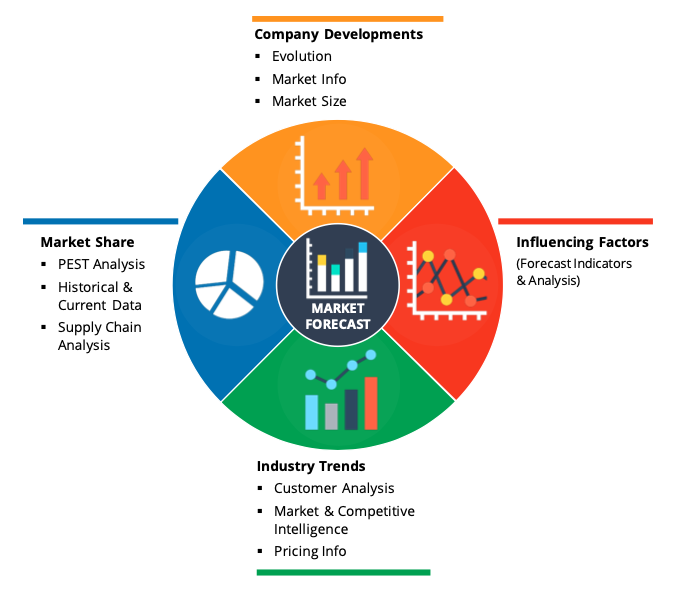

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

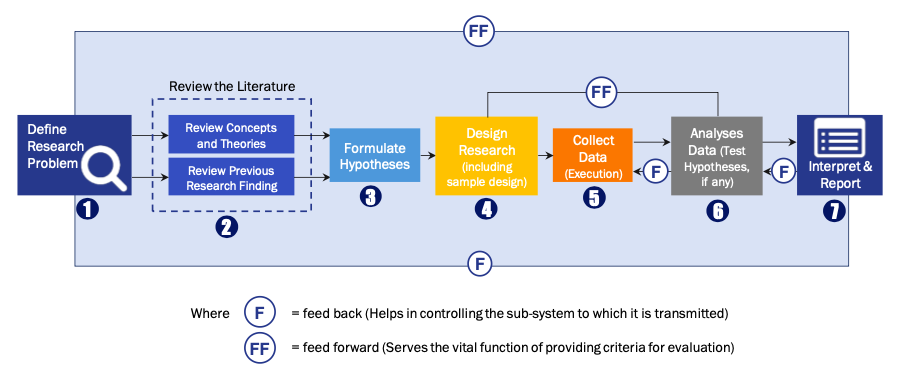

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model