High-Speed Steel Cutting Tools Market Overview and Analysis:

The global high-speed steel-cutting tools market size reached USD 10.1 Billion in 2024, exhibiting a growth rate (CAGR) of 4.1% during 2024-2031.

High-speed steel (HSS) cutting tools are essential in machining, and renowned for their ability to withstand high temperatures and maintain hardness during elevated cutting speeds. Comprising alloying elements like tungsten and cobalt, HSS tools undergo heat treatment for exceptional hardness, crucial for preventing wear and extending tool life in high-speed machining applications. Their versatility spans turning, milling, and drilling for both ferrous and non-ferrous materials. Noteworthy for their toughness, these tools resist shocks during machining, enhancing durability. Moreover, the ease of sharpening with standard equipment ensures the maintenance of the cutting edge, further extending tool lifespan. Widely used in industries like metalworking and aerospace, HSS cutting tools remain a cost-effective choice for general-purpose machining, despite advancements in alternative materials like carbide and ceramic offering higher hardness and wear resistance in specialized applications.

The high-speed steel cutting tools market is experiencing growth propelled by several key factors. The enduring demand is fueled by the versatile applicability of these tools across a spectrum of machining operations, catering to diverse industries such as aerospace, automotive, and general machining. The ability of high-speed steel tools to withstand elevated temperatures without compromising hardness is a significant driver, making them indispensable for high-speed machining applications and contributing to extended tool life. Additionally, the cost-effectiveness of high-speed steel relative to alternative materials, coupled with the ease of sharpening and maintenance, enhances their attractiveness for general-purpose machining. As industries continue to seek efficiency and productivity improvements, the market for high-speed steel cutting tools is further stimulated by ongoing technological advancements and innovations in tool design and materials, meeting the evolving needs of the manufacturing sector.

Market Segmentation: The Global Steel Cutting Tools Market is segmented by Type (Milling, Drilling, Tapping, and Other Tools), End-user (Manufacturing and Automotive, Oil and Gas, Mining, and Quarrying, Agriculture, Fishing, and Forestry, Construction, Distributive Trade, Healthcare and Pharmaceutical, and Other End Users), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America). The market provides the value (in USD million) for the above-mentioned segments.

High-Speed Steel Cutting Tools Market Trends:

The high-speed cutting tools market is witnessing notable trends that are shaping its trajectory. One significant trend is the increasing adoption of advanced coatings and surface treatments for high-speed steel tools, enhancing their wear resistance and overall performance. As industries prioritize precision and efficiency, there is a growing demand for customized and specialized cutting tool geometries to address specific machining requirements. The market is also experiencing a shift towards integrated solutions, including tooling systems that offer improved tool life and cost-effectiveness. Moreover, the rise of Industry 4.0 and smart manufacturing has led to the incorporation of digital technologies in cutting tool design and monitoring, contributing to enhanced productivity and predictive maintenance. Sustainability concerns are driving the development of eco-friendly cutting tool materials and manufacturing processes, aligning with the broader industry focus on environmental responsibility. Additionally, global supply chain dynamics and geopolitical factors are influencing market dynamics, leading to a focus on regionalization and resilience strategies within the high-speed cutting tools sector. Overall, these trends reflect the industry's commitment to innovation, efficiency, and sustainability in response to evolving market demands.

Market Drivers:

The versatility of HSS tools for a wide range of machining operations in various industries, including aerospace, automotive, and general manufacturing

The versatility of High-Speed Steel (HSS) cutting tools stands as a pivotal driver in the market, offering a broad applicability across a spectrum of machining operations in diverse industries. From aerospace to automotive and general manufacturing, HSS tools demonstrate their efficacy in various cutting tasks. Their ability to adapt to different materials, coupled with the toughness and heat resistance inherent in HSS, makes them indispensable in applications where a wide range of machining operations is required. This versatility not only enhances the overall efficiency of manufacturing processes but also positions HSS tools as preferred choices for industries seeking adaptability and performance across different sectors.

High cost-effectiveness of HSS tools

The cost-effectiveness of High-Speed Steel (HSS) cutting tools constitutes a significant driver in their market preference. Particularly notable in situations where economic considerations play a crucial role, HSS tools offer a compelling alternative due to their relatively lower cost compared to alternative cutting tool materials. Despite facing competition from advanced materials such as carbide and ceramics, the affordability of HSS tools makes them an attractive choice, especially in general-purpose machining applications. This cost advantage extends beyond the initial investment, as HSS tools are often easier to sharpen and maintain, contributing to prolonged tool life and overall economic viability. The balance between performance and cost-effectiveness positions HSS tools as a pragmatic solution for industries seeking efficient and budget-conscious machining solutions.

Market Restraints:

The HSS cutting tools market faces certain restraints. The limitations of HSS tools in terms of hardness and wear resistance compared to advanced materials like carbide and ceramics can hinder their adoption in high-performance and specialized applications. As industries increasingly demand higher precision and efficiency, the competition from alternative cutting tool materials poses a challenge. Moreover, the environmental impact of traditional manufacturing processes using HSS tools has prompted a shift towards eco-friendly materials and methods, challenging the conventional market. Global economic uncertainties, geopolitical factors, and fluctuations in raw material prices can also act as restraints, affecting the overall stability and growth of the HSS cutting tools market. Balancing these factors and adapting to evolving industry needs will be crucial for navigating the challenges and opportunities within the market.

COVID-19 Impact on High-Speed Steel Cutting Tools Market:

The High-Speed Steel (HSS) Cutting Tools market underwent significant impacts during the COVID-19 pandemic, facing disruptions in the supply chain, production delays, and reduced operational capacities due to global lockdowns. Industries heavily reliant on HSS cutting tools, such as aerospace and automotive, experienced a temporary decline in demand amid an economic slowdown. However, the latter part of the pandemic saw a resurgence in certain sectors, contributing to the market's gradual recovery. Affordability became a key factor as cost-effective solutions gained importance during economic uncertainties, sustaining the use of HSS cutting tools. Manufacturers responded by innovating their products to align with evolving industry needs, with a notable trend towards the development of smart cutting tools integrating digitalization and automation technologies for enhanced precision. The market's future trajectory is expected to be influenced by ongoing global economic recovery, technological advancements, and continued adaptations to changing industry dynamics.

Segmental Analysis:

Drilling Segment is Expected to Witness Significant Growth Over the Forecast Period

Drilling applications showcase the versatility and efficacy of High-Speed Steel (HSS) tools, underscoring their crucial role in the metalworking industry. HSS drill bits, known for their toughness, heat resistance, and cost-effectiveness, are widely utilized in various drilling operations across diverse materials. The ability of HSS tools to withstand high temperatures generated during drilling, coupled with their durability and ease of sharpening, makes them suitable for both ferrous and non-ferrous materials. Whether in precision drilling for aerospace components or general drilling in automotive and manufacturing processes, HSS tools demonstrate their adaptability and efficiency, affirming their status as reliable choices in the ever-evolving landscape of drilling applications.

Manufacturing Segment is Expected to Witness Significant Growth Over the Forecast Period

The manufacturing and automotive industries, the indispensable role of drilling machines is evident, driving efficiency, precision, and overall productivity. These machines find applications across diverse sectors, from aerospace to consumer electronics, facilitating precision machining, mass production, and customization. In the automotive industry, drilling machines play a crucial role in engine manufacturing, chassis and body construction, as well as repair and maintenance. The benefits of drilling machines, including precision, efficiency, versatility, and cost-effectiveness, underscore their importance in modern production processes. As industries continue to advance, embracing the latest technological innovations in drilling machines becomes imperative, ensuring high-quality products and a competitive edge in the market.

Asia Pacific Region is Expected to Witness Significant Growth Over the Forecast Period

In the Asia Pacific region, the utilization of High-Speed Steel (HSS) tools has become instrumental in driving manufacturing and industrial growth. HSS tools, known for their exceptional hardness, heat resistance, and durability, play a pivotal role in machining processes across various industries in the region. With a focus on precision and efficiency, HSS tools are widely employed in metalworking, automotive manufacturing, and aerospace sectors, contributing to the production of high-quality components. The adaptability of HSS tools to a diverse range of materials aligns with the region's dynamic manufacturing landscape, allowing for the creation of intricate and accurate parts. As the Asia Pacific continues to be a hub for industrial development, the strategic integration of HSS tools underscores their significance in advancing technological capabilities, enhancing productivity, and maintaining a competitive edge in the global market.

High-Speed Steel Cutting Tools Market Competitive Landscape:

The market for high-speed steel-cutting tools exhibits a notably fragmented landscape, characterized by the coexistence of major international players alongside numerous small and medium-sized local entities. Within this diverse ecosystem, a considerable number of players contribute to the distribution of market share. The industry is marked by a blend of global giants and regional enterprises, each bringing its unique strengths and capabilities to the competitive arena. This fragmentation underscores the diverse dynamics at play within the high-speed steel-cutting tools market, reflecting a mix of both established and emerging participants vying for prominence in this competitive landscape. Some of the market players working in this market segment are:

- Erasteel

- Kennametal, Inc.

- Nachi America, Inc.

- OSG Korea Corporation

- Niagara Cutter, Inc.

- Addison & Co., Ltd

- Sumitomo Electric Industries

- Tiangong International

- Walter AG

- NACHI-FUJIKOSHI CORP

- DeWALT

- Somta Tools (Pty) Ltd

- Morse Cutting Tools

- Sandvik Group

- Arch Cutting Tools

Recent Development:

1) In January 2023, a notable development occurred in the cutting tools industry as Walter, a leading player, introduced the MD340 and MD344 Supreme solid carbide milling cutters. The MD340 Supreme, designed for diameters ranging from 2 to 25 mm (1/16"-"), is tailored for roughing, full slotting, and dynamic milling of steel materials. On the other hand, the MD344 Supreme, featuring a unique face geometry and available in diameters from 6 to 20 mm, is specifically crafted for 90° plunging or ramping applications.

2) In January 2023, ARCH Cutting Tools Corp. made a strategic move by acquiring Custom Carbide Cutter, Inc. (CCCI), based in Cincinnati. CCCI is renowned for providing high-quality cutting tools to manufacturers and distributors. This acquisition is set to bolster ARCH Cutting Tools' position in the realm of high-performance custom tooling, showcasing the industry's continuous evolution and commitment to innovation.

Frequently Asked Questions (FAQ) :

Q1. What is the current High-Speed Steel Cutting Tools Market size?

The global high-speed steel-cutting tools market size reached USD 10.1 Billion in 2024.

Q2. What is the Growth Rate of the High-Speed Steel Cutting Tools Market?

High-Speed Steel Cutting Tools Market is exhibiting a growth rate (CAGR) of 4.1% during the forecast period.

Q3. Which Region is expected to hold the highest Market share?

Aisa-Pacific Region is expected to hold the highest Market share.

Q4. Who are the key players in High-Speed Steel Cutting Tools Market?

Some key players operating in the market include

- Erasteel

- Kennametal, Inc.

- Nachi America, Inc.

- OSG Korea Corporation

Request for TOC

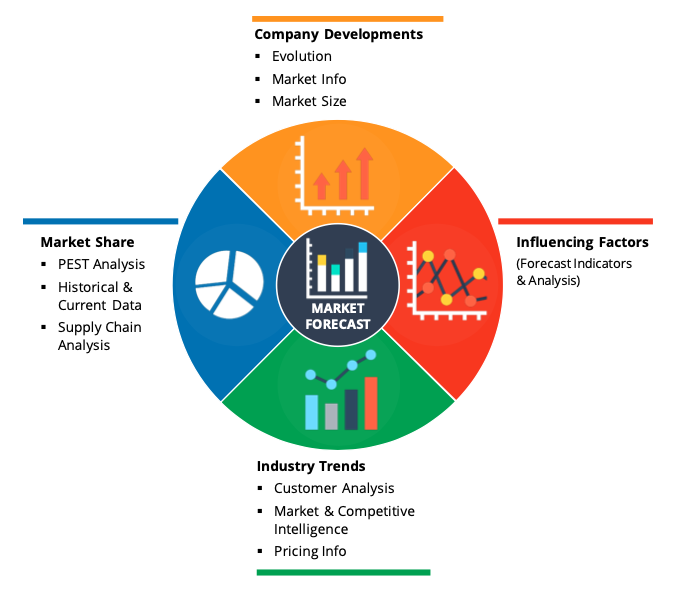

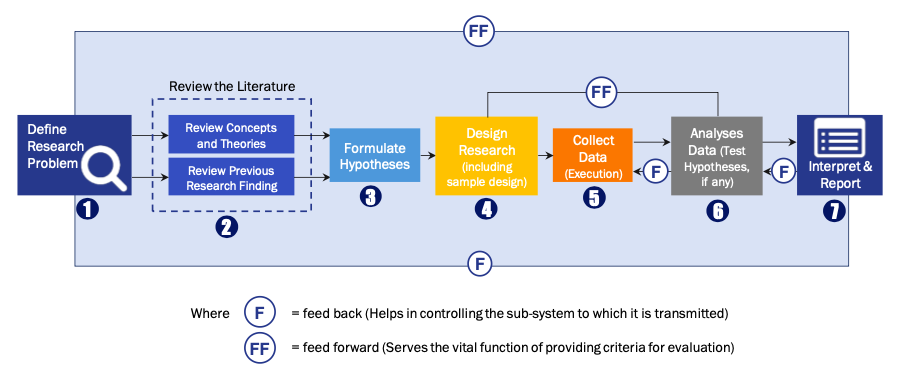

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model