Intelligence Surveillance and Reconnaissance Market Overview and Analysis:

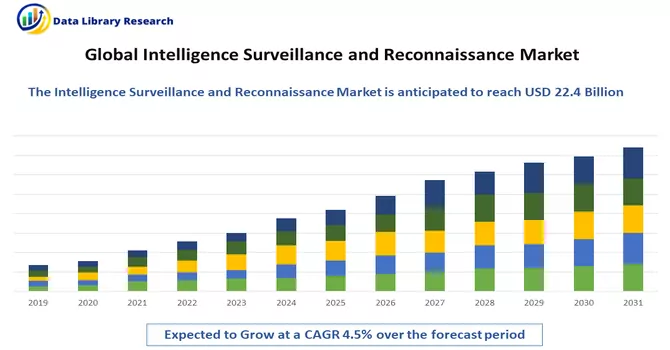

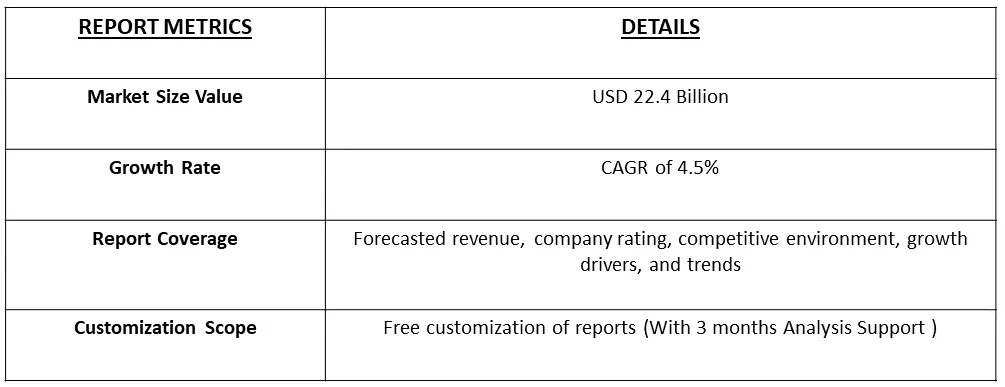

The Intelligence Surveillance and Reconnaissance market in is estimated at USD 22.4 Billion in the year 2022, and is expected to register a CAGR of 4.5% over the forecast period, 2023-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Intelligence, Surveillance, and Reconnaissance, commonly abbreviated as ISR, represent a comprehensive set of activities and capabilities employed by military, defense, and security organizations to gather, analyze, and interpret information for strategic decision-making. These three components work collaboratively to provide a comprehensive understanding of the operational environment. Intelligence involves the systematic collection, analysis, and interpretation of information to generate insights and knowledge relevant to the decision-making process. Intelligence encompasses a wide range of data sources, including human intelligence (HUMINT), signals intelligence (SIGINT), imagery intelligence (IMINT), and other forms of information gathered through various means.

The demand for integrated ISR solutions that enable information fusion and networking is on the rise. Interoperability and connectivity between different ISR components facilitate a comprehensive and coordinated approach to intelligence gathering and analysis. The growing importance of cybersecurity in ISR systems drives investments in secure and resilient communication networks. Ensuring the protection of ISR data from cyber threats is a critical factor influencing market growth.

Market Segmentation: The Report Covers Global Intelligence Surveillance and Reconnaissance (ISR) Market and it is Segmented by Platform (Land, Air, Sea, and Space) and by Geography (North America, Europe, Asia-Pacific, South America, and the Middle East and Africa). The market size and forecasts are provided in terms of value (USD Million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Intelligence Surveillance and Reconnaissance Market Latest Trends:

The Intelligence, Surveillance, and Reconnaissance (ISR) market is witnessing dynamic trends that reflect advancements in technology, changing security landscapes, and evolving mission requirements. AI is increasingly integrated into ISR systems to enhance data analysis and decision-making capabilities. Machine learning algorithms enable automated data processing, pattern recognition, and predictive analytics, providing actionable intelligence in real-time. The trend towards miniaturization of sensors and the development of micro Unmanned Aerial Vehicles (UAVs) contribute to enhanced covert surveillance capabilities. These compact systems are agile, versatile, and suitable for various environments, including urban and densely populated areas.

Market Drivers:

Rising global Security threats

The escalating complexity and diverse nature of global security threats have ushered in a heightened demand for advanced Intelligence, Surveillance, and Reconnaissance (ISR) capabilities. This imperative is driven by the multifaceted challenges posed by various factors, including terrorism, cyber threats, and geopolitical tensions. Governments and defense organizations are compelled to seek comprehensive solutions that significantly augment their situational awareness and empower them to respond effectively to the ever-evolving landscape of emerging threats. The persistent and evolving nature of terrorism poses a significant challenge to global security. Traditional and non-traditional terrorist threats necessitate sophisticated ISR capabilities to monitor, analyze, and counter potential risks. Governments require real-time intelligence to identify, track, and neutralize terrorist activities, making advanced ISR systems integral to counterterrorism efforts. Thus, such factors are expected to contribute to the growth of the studied market.

Rising Use of AI

The integration of Artificial Intelligence (AI) into Intelligence, Surveillance, and Reconnaissance (ISR) systems represents a transformative advancement that significantly enhances the capabilities of these systems. This integration is driven by the need for more efficient and effective data analysis and decision-making in complex operational environments. AI facilitates automated data processing within ISR systems. Traditional ISR systems generate vast amounts of data from various sources, including sensors, satellites, and unmanned vehicles. Machine learning algorithms enable these systems to automatically process and organize data, reducing the burden on human operators and ensuring a more streamlined analysis process. AI enables predictive analytics within ISR systems, allowing them to forecast potential developments based on historical data and ongoing trends. Machine learning algorithms analyze patterns over time, making it possible to anticipate future events or actions. This predictive capability enhances the proactive nature of ISR operations, providing decision-makers with valuable foresight. Thus, such factors are expected to drive the growth of the studied market over the forecast period.

Market Restraints:

Privacy and Ethical Concerns

The use of advanced ISR technologies, especially in urban or civilian environments, raises privacy and ethical concerns. Balancing the need for enhanced security with individual privacy rights is a delicate challenge, and public resistance or regulatory restrictions can impact the deployment of certain ISR systems. Thus, ISR systems offer unprecedented capabilities for intelligence gathering and situational awareness, these market restraints highlight the multifaceted challenges that must be addressed for successful implementation and widespread acceptance. Addressing these challenges requires a holistic approach involving technological innovation, regulatory considerations, and effective risk management strategies.

COVID-19 impact on Intelligence Surveillance and Reconnaissance Market

The pandemic led to operational disruptions across industries, affecting the deployment and maintenance of ISR systems. Restrictions on travel, lockdowns, and social distancing measures impeded the regular maintenance and servicing of ISR technologies, potentially impacting their operational readiness. The ISR market relies on a complex global supply chain for components, sensors, and technologies. Disruptions in the supply chain due to factory closures, transportation restrictions, and labor shortages have led to delays in the production and delivery of ISR systems. The pandemic highlighted the interconnected nature of global security challenges. Security concerns related to the pandemic, including misinformation, cyber threats, and geopolitical tensions, may have influenced the development and deployment of ISR capabilities to address emerging threats.In summary, the COVID-19 pandemic has introduced a range of challenges and opportunities for the ISR market. While certain operational aspects were disrupted, the increased awareness of health security and the acceleration of technology adoption have influenced the trajectory of ISR developments in response to evolving global security dynamics.

Segmental Analysis :

Air Segment is Expected to Witness Significant Growth Over the Forecast Period

The airborne segment of the intelligence, surveillance, and reconnaissance (ISR) market is poised for rapid growth, driven by the increasing popularity of Unmanned Aerial Vehicles (UAVs) and advanced communication systems. It is anticipated that the airborne segment will seize nearly one-third of the market share. Simultaneously, the space segment is expected to garner significant attention, emerging as a focal point for exploration within the ISR market.

Recent trends indicate a shift towards consolidation and integration of ISR systems across diverse platforms. This strategic move towards consolidation is expected to enhance efficiency and overall system performance. In the airborne segment, there is a rising demand for electronic support and countermeasures (ESM and ECM), airborne Command, Control, and Communications (C3), as well as surveillance and maritime patrol aircraft. This increasing demand is attributed to the growing necessity for comprehensive situational awareness, air superiority, and survivability.

An illustrative example of industry collaboration is the partnership between Raytheon Technologies and L3Harris, working together on the second phase of the United States Army's High Accuracy Detection and Exploitation System (HADES). This multi-domain sensing system (MDSS) focuses on improving aerial intelligence. The initial phase, initiated in June 2021, tasked Raytheon and L3Harris with demonstrating, developing, and building prototype electronic intelligence and communications intelligence (COMINT) sensors. The fiscal year 2023 has allocated USD 49.9 million for research and development in the HADES program. The market dynamics suggest a trajectory of growth for the airborne segment, fueled by advancements in UAVs, communication systems, and integration efforts. Concurrently, the space segment is positioned as a promising frontier for exploration within the ISR market. The overarching trend of consolidation and integration is expected to optimize system capabilities, paving the way for enhanced performance and efficiency across all ISR platforms.

North American Region is Expected to Witness significant growth Over the Forecast Period

North America currently holds a significant market share in the intelligence, surveillance, and reconnaissance (ISR) sector, with the United States leading the way due to its prominence in defense platforms and substantial defense spending. The U.S. government allocates substantial funds to facilitate cooperation among its naval, airborne, space, and land forces, exemplified by initiatives such as the United States Coast Guard's Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance Systems Acquisition Program. This program represents a multi-year commitment to design, develop, and integrate cutting-edge equipment for the Coast Guard's newest assets, including national security cutters, offshore patrol cutters, and various surveillance aircraft.

Despite North America's current dominance, market dynamics are witnessing a shift towards the Asia-Pacific region. Both China and India, ranking among the top five nations globally in defense spending, are making significant advancements to bolster the capabilities of their armed forces. Additionally, these countries have ambitious plans to enhance their unmanned aerial systems, a development that is expected to drive market growth in the region.

Recent developments further underscore the evolving landscape of the ISR market. For instance, in November 2022, Elbit Systems Ltd secured a USD 72 million contract from an undisclosed international customer. This contract encompasses the acquisition of the Hermes 900 Unmanned Aircraft System (UAS) equipped with the SkEye Wide Area Persistent Surveillance System, the SPECTRO XR multi-spectral electro-optical payload, satellite communication, signal intelligence (SIGINT) payloads, and additional capabilities. Moreover, in October 2022, a groundbreaking multi-orbit satellite communication system (SATCOM) was demonstrated through a collaborative effort involving General Atomics Aeronautical Systems Inc., SES, and Hughes Network Systems. The demonstration featured a SkyGuardian remotely piloted aircraft (RPA) supplied by GA-ASI. These developments reflect the dynamic nature of the ISR market, with Asia-Pacific emerging as a key player in response to the robust defense initiatives of China and India. The continued advancements and investments in unmanned aerial systems, satellite communication technologies, and other ISR capabilities highlight the sector's anticipated growth over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

Intelligence Surveillance and Reconnaissance Market Competitive Landscape:

The moderate consolidation in the intelligence, surveillance, and reconnaissance market is a result of the dominance of major players, strategic mergers and acquisitions, technological advancements, global defense contracts, high entry barriers, the long lifecycle of products, collaboration with government agencies, and the complexity of integrated solutions. This landscape is dynamic, with ongoing competition and opportunities for new entrants to carve out niche positions within the industry. Collaboration and partnerships with government defense and intelligence agencies play a significant role in market consolidation. Companies that have longstanding relationships and collaborative projects with these agencies often secure a prominent position within the ISR market.

Some of the key market players working in this market segment are:

- L3Harris Technologies Inc.

- General Dynamics Corporation

- The Boeing Company

- Elbit Systems Ltd

- BAE Systems PLC

- ThalesRaytheonSystems

- Rheinmetall AG

- CACI International Inc.

- Northrop Grumman Corporation

- Kratos Defense & Security Solutions Inc.

Recent Development

1) In October 2022, L3Harris disclosed its collaboration with Mag Aerospace to contribute to the United States Army's Theater Level High-Altitude Expeditionary Next-Gen ISR Radar Program (ATHENA-R). Specifically, the ATHENA-R aircraft, a modified Bombardier Global Express 6500s equipped with ISR mission capabilities, aims to elevate the United States Army's Intelligence, Surveillance, and Reconnaissance (ISR) capabilities at higher altitudes. As the ISR market progresses, it is anticipated to enter a mature phase, wherein smaller regional players are projected to undergo acquisitions or mergers with industry giants to navigate and endure the intensifying competition.

2) In December 2021, Korea Aerospace Industries (KAI) secured a contract valued at USD 675 million from the Defense Acquisition Program Administration of South Korea. The contract entails the development and production of four intelligence, surveillance, and reconnaissance (ISR) aircraft for the Republic of Korea Air Force (RoKAF).

Frequently Asked Questions (FAQ) :

Q1. What was the Intelligence Surveillance and Reconnaissance Market size in 2022?

As per Data Library Research the Intelligence Surveillance and Reconnaissance market in is estimated at USD 22.4 Billion in the year 2022.

Q2. At what CAGR is the Intelligence Surveillance and Reconnaissance Market projected to grow within the forecast period?

Intelligence Surveillance and Reconnaissance Market is expected to register a CAGR of 4.5% over the forecast period.

Q3. What are the factors driving the Intelligence Surveillance and Reconnaissance Market?

Key factors that are driving the growth include the Rising global Security threats and Rising Use of AI

Q4. Who are the key players in Intelligence Surveillance and Reconnaissance Market?

Some key players operating in the market include

- L3Harris Technologies Inc.

- General Dynamics Corporation

- The Boeing Company

- Elbit Systems Ltd

Request for TOC

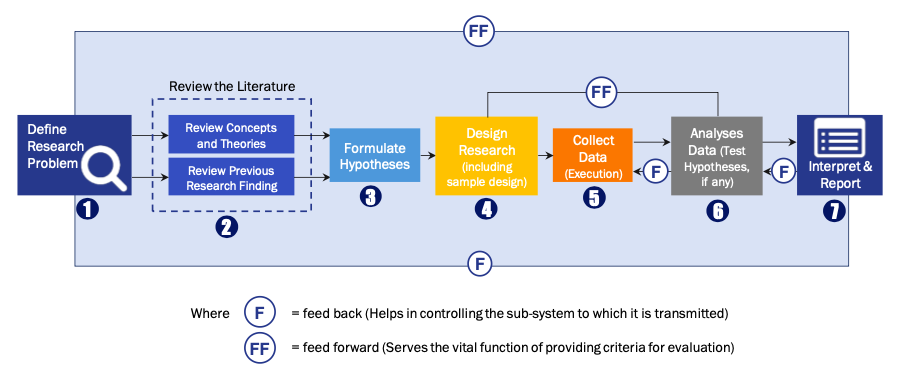

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model