In the automotive industry, wiring harnesses are widely utilized to transfer signals in a variety of electrical applications. Although wiring harnesses are extensively used in a variety of industries, the automotive industry is predicted to be the most dominant end-use industry. Because of the continual development in the demand for automobiles around the world, the need for automotive wire harness is predicted to grow at a stable rate. The increasing use of automotive wiring harness to improve vehicle performance is likely to drive the growth of the automotive wiring harness market in the coming years.

In the next few years, global adoption of electric automobiles, primarily mild hybrids, is expected to increase, boosting the need for high voltage wiring harness. The demand for higher voltage wires is expected to expand as the demand for electric vehicles grows. The popularity of mild hybrid and 48V vehicles is expected to grow, presenting an opportunity for the automotive wiring harness market.

The global demand for the automotive wiring harness market is being propelled by rising GDP and technological advances. The utilization of wiring material per vehicle is increasing as vehicles get more complicated due to the integration of modern driver assistance technologies and automation. As a result, the automotive wiring harness market is booming.

On the negative side, manufacturers of wiring harnesses rely largely on raw materials like copper. Manufacturers' revenues are hampered by rising copper prices and market instability.

| Report Metric | Details |

| Market size available for years | 2023–2030 |

| Base year considered | 2023 |

| Forecast period | 2024–2030 |

| Forecast unit | Value (USD Million) |

| Segments covered | Type, Vehicle Type, Sales Channel, and Region. |

| Regions covered | North America (the U.S. and Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Rest of Europe), Asia-Pacific (China, India, Japan, Australia, South East Asia, Rest of Asia Pacific), Latin America and the Middle East and Africa (Brazil, Saudi Arabia, UAE, Rest of LAMEA) |

| Companies covered | Delphi Automotive LLP, Furukawa Electric Co. Ltd, Sumitomo Electric Industries, Ltd., Lear Corporation, THB Group, SPARK MINDA, Samvardhana Motherson Group, Nexans Autoelectric, Yazaki Corporation, Yura Corporation, Leoni Ag, Fujikura Ltd., QINGDAO SANYUAN GROUP, and PKC Group. |

Covid-19 Impact on Automotive Wiring Harness Market

The outbreak of the covid-19 has a severe and swift impact on the automobile and transportation industry. This is majorly due to the shutdown of assembly plants in the US, interruptions across Europe in large-scale manufacturing, and disruption in the export of Chinese parts. In addition to this, the industry is dealing with reduced demand across the globe due to changes in customer behavior and shifts in a supply-demand chain. A recent study shows a 39% decline in sales of automotive all over the world. Moreover, the nationwide lockdowns have substantially affected the transportation sector. Restrictions on transportation accounted for a 45 to 55% decline in public as well as private transport sectors.

Automotive Wiring Harness Market Segment Overview

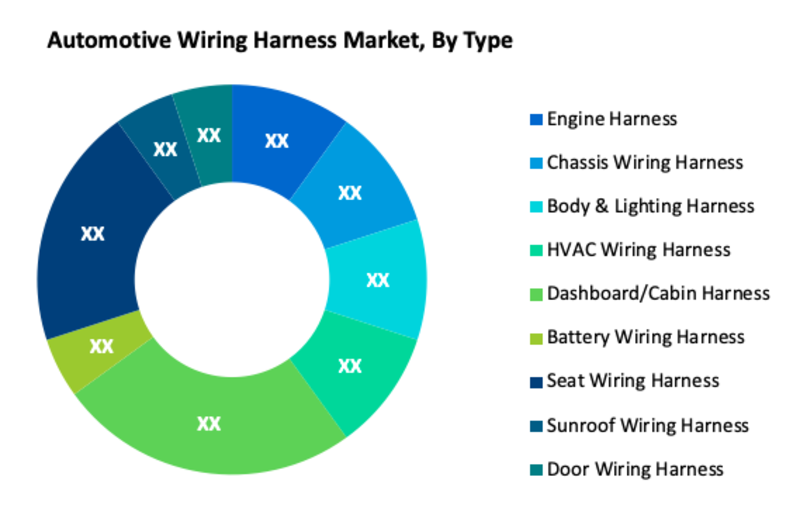

Based on type, the Dashboard/Cabin Harness segment holds the largest share of the global automotive wiring harness market. This is due to the increasing use of infotainment systems and dashboard screens in vehicles. The use of wiring harness in car seats is increased by heated seats and the installation of technologies such as active health monitoring, which drives the seat harness segment of the market. Moreover, according to the vehicle type, the passenger vehicle is one of the largest segments of the global automotive wiring harness market.

Automotive Wiring Harness Market, By Type

· Engine Harness

· Chassis Wiring Harness

· Body & Lighting Harness

· HVAC Wiring Harness

· Dashboard/Cabin Harness

· Battery Wiring Harness

· Seat Wiring Harness

· Sunroof Wiring Harness

· Door Wiring Harness

Automotive Wiring Harness Market, By Vehicle Type

· Passenger Vehicle

· Commercial Vehicle

Automotive Wiring Harness Market, By Sales Channel

· OEM

· Aftermarket

Automotive Wiring Harness Regional Overview

Geographically, the global automotive wiring harness market has been divided into North America, Latin America, Europe, Asia Pacific, and Middle East & Africa. The Asia Pacific is one of the most prominent regions for the market. The automotive market in the Asia Pacific is being driven by rising GDP and disposable income. As modern vehicles require safety features and advanced electrical devices, this stimulates demand for the automotive wiring harness, which in turn fuels demand wires and cables used in vehicles.

Moreover, Europe accounted for a sizable portion of the global automotive wiring harness market. The presence of car companies like Mercedes-Benz, BMW, and Audi in Europe is propelling the industry in the region, as it produces an exponential demand for premium passenger vehicles.

Automotive Wiring Harness Market, By Geography

· North America (US & Canada)

· Europe (UK, Germany, France, Italy, Spain, Russia & Rest of Europe)

· Asia-Pacific (Japan, China, India, Australia, & South Korea, & Rest of Asia-Pacific)

· LAMEA (Brazil, Saudi Arabia, UAE & Rest of LAMEA)

Automotive Wiring Harness Market, Key Players

· Delphi Automotive LLP

· Furukawa Electric Co. Ltd

· Sumitomo Electric Industries, Ltd.

· Lear Corporation

· THB Group

· SPARK MINDA

· Samvardhana Motherson Group

· Nexans Autoelectric

· Yazaki Corporation

· Yura Corporation

· Leoni Ag

· Fujikura Ltd.

· QINGDAO SANYUAN GROUP

· PKC Group

Frequently Asked Questions (FAQ) :

Q1. What are the driving factors for the global Automotive Wiring Harness market?

Q2. Which Segments are covered in the global Automotive Wiring Harness market report?

Q3. Which segment is projected to hold the largest share in the global Automotive Wiring Harness market?

Q4. Which region holds the largest share in the global Automotive Wiring Harness market?

Q5. Which are the prominent players in the global Automotive Wiring Harness market?

1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

2. Executive Summary

3. Market Dynamics

- 3.1. Market Drivers

- 3.2. Market Restraints

- 3.3. Market Opportunities

4. Key Insights

- 4.1. Key Emerging Trends – For Major Countries

- 4.2. Latest Technological Advancement

- 4.3. Regulatory Landscape

- 4.4. Industry SWOT Analysis

- 4.5. Porters Five Forces Analysis

5. Global Automotive Wiring Harness Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 5.1. Key Findings / Summary

- 5.2. Market Analysis, Insights and Forecast – By Type

- 5.2.1. Engine Harness

- 5.2.2. Chassis Wiring Harness

- 5.2.3. Body & Lighting Harness

- 5.2.4. HVAC Wiring Harness

- 5.2.5. Dashboard/Cabin Harness

- 5.2.6. Battery Wiring Harness

- 5.2.7. Seat Wiring Harness

- 5.2.8. Sunroof Wiring Harness

- 5.2.9. Door Wiring Harness

- 5.3. Market Analysis, Insights and Forecast – By Vehicle Type

- 5.3.1. Passenger Vehicle

- 5.3.2. Commercial Vehicle

- 5.4. Market Analysis, Insights and Forecast – By Sales Channel

- 5.4.1. OEM

- 5.4.2. Aftermarket

- 5.5. Market Analysis, Insights and Forecast – By Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Latin America, Middle East and Africa

6. North America Automotive Wiring Harness Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 6.1. Key Findings / Summary

- 6.2. Market Analysis, Insights and Forecast – By Type

- 6.2.1. Engine Harness

- 6.2.2. Chassis Wiring Harness

- 6.2.3. Body & Lighting Harness

- 6.2.4. HVAC Wiring Harness

- 6.2.5. Dashboard/Cabin Harness

- 6.2.6. Battery Wiring Harness

- 6.2.7. Seat Wiring Harness

- 6.2.8. Sunroof Wiring Harness

- 6.2.9. Door Wiring Harness

- 6.3. Market Analysis, Insights and Forecast – By Vehicle Type

- 6.3.1. Passenger Vehicle

- 6.3.2. Commercial Vehicle

- 6.4. Market Analysis, Insights and Forecast – By Sales Channel

- 6.4.1. OEM

- 6.4.2. Aftermarket

- 6.5. Market Analysis, Insights and Forecast – By Country

- 6.5.1. U.S.

- 6.5.2. Canada

7. Europe Automotive Wiring Harness Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 7.1. Key Findings / Summary

- 7.2. Market Analysis, Insights and Forecast – By Type

- 7.2.1. Engine Harness

- 7.2.2. Chassis Wiring Harness

- 7.2.3. Body & Lighting Harness

- 7.2.4. HVAC Wiring Harness

- 7.2.5. Dashboard/Cabin Harness

- 7.2.6. Battery Wiring Harness

- 7.2.7. Seat Wiring Harness

- 7.2.8. Sunroof Wiring Harness

- 7.2.9. Door Wiring Harness

- 7.3. Market Analysis, Insights and Forecast – By Vehicle Type

- 7.3.1. Passenger Vehicle

- 7.3.2. Commercial Vehicle

- 7.4. Market Analysis, Insights and Forecast – By Sales Channel

- 7.4.1. OEM

- 7.4.2. Aftermarket

- 7.5. Market Analysis, Insights and Forecast – By Country

- 7.5.1. UK

- 7.5.2. Germany

- 7.5.3. France

- 7.5.4. Italy

- 7.5.5. Spain

- 7.5.6. Russia

- 7.5.7. Rest of Europe

8. Asia Pacific Automotive Wiring Harness Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 8.1. Key Findings / Summary

- 8.2. Market Analysis, Insights and Forecast – By Type

- 8.2.1. Engine Harness

- 8.2.2. Chassis Wiring Harness

- 8.2.3. Body & Lighting Harness

- 8.2.4. HVAC Wiring Harness

- 8.2.5. Dashboard/Cabin Harness

- 8.2.6. Battery Wiring Harness

- 8.2.7. Seat Wiring Harness

- 8.2.8. Sunroof Wiring Harness

- 8.2.9. Door Wiring Harness

- 8.3. Market Analysis, Insights and Forecast – By Vehicle Type

- 8.3.1. Passenger Vehicle

- 8.3.2. Commercial Vehicle

- 8.4. Market Analysis, Insights and Forecast – By Sales Channel

- 8.4.1. OEM

- 8.4.2. Aftermarket

- 8.5. Market Analysis, Insights and Forecast – By Country

- 8.5.1. China

- 8.5.2. India

- 8.5.3. Japan

- 8.5.4. Australia

- 8.5.5. South East Asia

- 8.5.6. Rest of Asia Pacific

9. Latin America, Middle East and Africa Automotive Wiring Harness Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 9.1. Key Findings / Summary

- 9.2. Market Analysis, Insights and Forecast – By Type

- 9.2.1. Engine Harness

- 9.2.2. Chassis Wiring Harness

- 9.2.3. Body & Lighting Harness

- 9.2.4. HVAC Wiring Harness

- 9.2.5. Dashboard/Cabin Harness

- 9.2.6. Battery Wiring Harness

- 9.2.7. Seat Wiring Harness

- 9.2.8. Sunroof Wiring Harness

- 9.2.9. Door Wiring Harness

- 9.3. Market Analysis, Insights and Forecast – By Vehicle Type

- 9.3.1. Passenger Vehicle

- 9.3.2. Commercial Vehicle

- 9.4. Market Analysis, Insights and Forecast – By Sales Channel

- 9.4.1. OEM

- 9.4.2. Aftermarket

- 9.5. Market Analysis, Insights and Forecast – By Country

- 9.5.1. Brazil

- 9.5.2. Saudi Arabia

- 9.5.3. UAE

- 9.5.4. Rest of LAMEA

10. Competitive Analysis

- 10.1. Company Market Share Analysis, 2018

- 10.2. Key Industry Developments

- 10.3. Company Profile

- 10.4. Delphi Automotive LLP

- 10.4.1. Business Overview

- 10.4.2. Segment 1 & Service Offering

- 10.4.3. Overall Revenue

- 10.4.4. Geographic Presence

- 10.4.5. Recent Development

- 10.5. Furukawa Electric Co. Ltd

- 10.6. Sumitomo Electric Industries, Ltd.

- 10.7. Lear Corporation

- 10.8. THB Group

- 10.9. SPARK MINDA

- 10.10. Samvardhana Motherson Group

- 10.11. Nexans Autoelectric

- 10.12. Yazaki Corporation

- 10.13. Yura Corporation

- 10.14. Leoni Ag

- 10.15. Fujikura Ltd.

- 10.16. QINGDAO SANYUAN GROUP

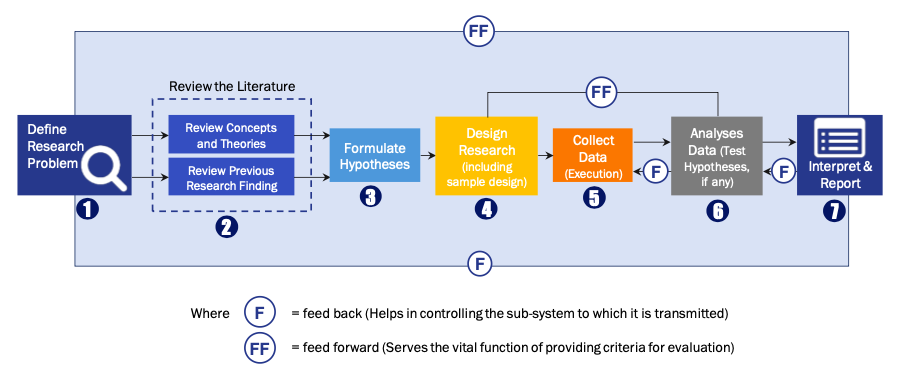

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model