The Cellulose Ether & Its Derivatives Market is anticipated to increase by 10.1% CAGR from USD 8.1 billion in 2023 to USD 12.5 billion in 2030.

Increased competition for cellulose ether and its derivatives in pharmaceuticals, personal care, foods, and beverages, as well as paints and coatings, is a primary factor influencing the market growth. Certain key factors include rising growth in the pharmaceuticals application, expanding construction industry, boosting oil drilling activities, and continuing to increase global demand for polyvinyl chloride.

Furthermore, expanding the use of Carboxymethylcellulose in micro flotation processes and rising growth in end-use industries in emerging nations would generate great possibilities for the cellulose ether and its derivatives market in the forecast period.

However, rising emissions of hazardous air pollutants during manufacturing, as well as combusting as well as other health hazard risks, are major restraints, while the resurgence of substitute products in various applications will further critique the growth of the cellulose ether and its derivatives market during the projected timeframe.

Covid-19 Impact on Cellulose Ether & Its Derivatives Market:

The ongoing COVID-19 pandemic conditions have severely affected every sector around the world. Whereas, the chemicals and materials sectors were moderately affected during the pandemic. This is primarily due to the uncut demand for chemicals for healthcare, life science, and cleaning agents. However, other elements of chemical and material sectors such as paints, industrial oil, construction materials are facing diminution in demand. Strict lockdown resulted in a nearly 50-60% reduction in supply for raw materials, which directly affected the manufacturing process. Further, halt on many end-use industries directly affected the chemical demand all around the world.

Cellulose Ether & Its Derivatives Market Segment Overview

By type, the market is segmented into Methyl Cellulose (MC), Hydroxypropyl Methylcellulose (HPMC), Hydroxymethyl Methylcellulose (HMC), Carboxymethyl Cellulose (CMC), Hydroxyethyl Cellulose (HEC), Ethyl Cellulose (EC), Hydroxypropyl Cellulose (HPC), And Hydrophobically Modified Cellulose Ethers (EHEC, HM-EHEC). Among these Carboxymethyl Cellulose (CMC) held the major share in the global cellulose ether & its derivatives market. The expansion of the processed food sector, rising pharmaceutical and cosmetics production, and rising oil drilling operations are all driving the CMC market forward.

In terms of application, the market is segmented into Foods & Beverages, Construction, Paints & Coatings,

Drilling Fluids, Pharmaceuticals, Personal Care, Mining, And Other Applications. Among these pharmaceuticals, segment is expected to hold the major share in the market by the end of 2027. High glass transition temperatures, chemical and photochemical stability, solubility, limited crystallinity, hydrogen bonding capability, and low toxicity make them particularly useful in pharmaceutical applications.

Market Analysis, Insights, and Forecast – By Type

· Methyl Cellulose (MC)

· Hydroxypropyl Methylcellulose (HPMC)

· Hydroxymethyl Methylcellulose (HMC)

· Carboxymethyl Cellulose (CMC)

· Hydroxyethyl Cellulose (HEC)

· Ethyl Cellulose (EC)

· Hydroxypropyl Cellulose (HPC)

· Hydrophobically modified cellulose ethers (EHEC, HM-EHEC)

Market Analysis, Insights, and Forecast – By Application

· Foods & Beverages

· Construction

· Paints & Coatings

· Drilling Fluids

· Pharmaceuticals

· Personal Care

· Mining

· Others

Cellulose Ether & Its Derivatives Market Regional Overview

The regional analysis includes the adoption of Cellulose Ether & Its Derivatives products across North America, Europe, Asia-Pacific (APAC), Latin America Middle East & Africa (MEA). Asia-Pacific accounted for the largest market share in 2020 and is anticipated to maintain its dominance by the end of 2027. The rapid growth of population, along with rising industries and increase in disposable income, has increased the spending on cars in the Asia Pacific region. In addition, increased production of the cellulose ether & its derivatives in countries, such as South Korea, Japan, China, and Taiwan, has also boosted the cellulose ether & its derivatives market in the region.

Cellulose Ether & Its Derivatives Market, By Geography

· North America (US & Canada)

· Europe (UK, Germany, France, Italy, Spain, & Rest of Europe)

· Asia-Pacific (Japan, China, India, Australia, & South Korea, & Rest of Asia-Pacific)

· LAMEA (Brazil, Saudi Arabia, UAE & Rest of LAMEA)

Cellulose Ether & Its Derivatives Market Competitor overview

Some key developments and strategies adopted by manufacturers in the Cellulose Ether & Its Derivatives are highlighted below.

· In May 2021, Rayonier Advanced Materials Expands Cellulose Technology Platform Through Its Strategic Investment In Anomera. Anomera produces the highest quality Cellulose Nanocrystals (CNC) in the world under the brand names DextraCel™, ChromaPur™, and ChromAllur™.

Cellulose Ether & Its Derivatives Market, Key Players

· The Dow Chemical Company

· Lotte Fine Chemicals

· Shin-Etsu Chemical Co. Ltd.

· Ashland Inc.

· Nouryon Chemicals LLC

· Rayonier Advanced Materials

· Akzonobel

· Daicel Finechem Ltd.

· J. Rettenmaier & Söhne GmbH + Co.Kg (JRS)

· Reliance Cellulose Products Ltd.

1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

2. Executive Summary

3. Market Dynamics

- 3.1. Market Drivers

- 3.2. Market Restraints

- 3.3. Market Opportunities

4. Key Insights

- 4.1. Key Emerging Trends – For Major Countries

- 4.2. Latest Technological Advancement

- 4.3. Regulatory Landscape

- 4.4. Industry SWOT Analysis

- 4.5. Porters Five Forces Analysis

5. Global Cellulose Ether & Its Derivatives Market Analysis (USD Billion), Insights and Forecast, 2023-2030

- 5.1. Key Findings / Summary

- 5.2. Market Analysis, Insights and Forecast – By Type

- 5.2.1. Methyl Cellulose (MC)

- 5.2.2. Hydroxypropyl Methylcellulose (HPMC)

- 5.2.3. Hydroxymethyl Methylcellulose (HMC)

- 5.2.4. Carboxymethyl Cellulose (CMC)

- 5.2.5. Hydroxyethyl Cellulose (HEC)

- 5.2.6. Ethyl Cellulose (EC)

- 5.2.7. Hydroxypropyl Cellulose (HPC)

- 5.2.8. Hydrophobically modified cellulose ethers (EHEC, HM-EHEC)

- 5.3. Market Analysis, Insights, and Forecast – By Application

- 5.3.1. Foods & Beverages

- 5.3.2. Construction

- 5.3.3. Paints & Coatings

- 5.3.4. Drilling Fluids

- 5.3.5. Pharmaceuticals

- 5.3.6. Personal Care

- 5.3.7. Mining

- 5.3.8. Others

- 5.4. Industrial SectorsMarket Analysis, Insights and Forecast – By Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America, Middle East, and Africa

6. North America Cellulose Ether & Its Derivatives Market Analysis (USD Billion), Insights and Forecast, 2023-2030

- 6.1. Key Findings / Summary

- 6.2. Market Analysis, Insights and Forecast – By Type

- 6.2.1. Methyl Cellulose (MC)

- 6.2.2. Hydroxypropyl Methylcellulose (HPMC)

- 6.2.3. Hydroxymethyl Methylcellulose (HMC)

- 6.2.4. Carboxymethyl Cellulose (CMC)

- 6.2.5. Hydroxyethyl Cellulose (HEC)

- 6.2.6. Ethyl Cellulose (EC)

- 6.2.7. Hydroxypropyl Cellulose (HPC)

- 6.2.8. Hydrophobically modified cellulose ethers (EHEC, HM-EHEC)

- 6.3. Market Analysis, Insights, and Forecast – By Application

- 6.3.1. Foods & Beverages

- 6.3.2. Construction

- 6.3.3. Paints & Coatings

- 6.3.4. Drilling Fluids

- 6.3.5. Pharmaceuticals

- 6.3.6. Personal Care

- 6.3.7. Mining

- 6.3.8. Others

- 6.4. Market Analysis, Insights and Forecast – By Country

- 6.4.1. U.S.

- 6.4.2. Canada

7. Europe Cellulose Ether & Its Derivatives Market Analysis (USD Billion), Insights and Forecast, 2023-2030

- 7.1. Key Findings / Summary

- 7.2. Market Analysis, Insights and Forecast – By Type

- 7.2.1. Methyl Cellulose (MC)

- 7.2.2. Hydroxypropyl Methylcellulose (HPMC)

- 7.2.3. Hydroxymethyl Methylcellulose (HMC)

- 7.2.4. Carboxymethyl Cellulose (CMC)

- 7.2.5. Hydroxyethyl Cellulose (HEC)

- 7.2.6. Ethyl Cellulose (EC)

- 7.2.7. Hydroxypropyl Cellulose (HPC)

- 7.2.8. Hydrophobically modified cellulose ethers (EHEC, HM-EHEC)

- 7.3. Market Analysis, Insights, and Forecast – By Application

- 7.3.1. Foods & Beverages

- 7.3.2. Construction

- 7.3.3. Paints & Coatings

- 7.3.4. Drilling Fluids

- 7.3.5. Pharmaceuticals

- 7.3.6. Personal Care

- 7.3.7. Mining

- 7.3.8. Others

- 7.4. Market Analysis, Insights and Forecast – By Country

- 7.4.1. UK

- 7.4.2. Germany

- 7.4.3. France

- 7.4.4. Italy

- 7.4.5. Spain

- 7.4.6. Russia

- 7.4.7. Rest of Europe

8. Asia Pacific Cellulose Ether & Its Derivatives Market Analysis (USD Billion), Insights and Forecast, 2023-2030

- 8.1. Key Findings / Summary

- 8.2. Market Analysis, Insights and Forecast – By Type

- 8.2.1. Methyl Cellulose (MC)

- 8.2.2. Hydroxypropyl Methylcellulose (HPMC)

- 8.2.3. Hydroxymethyl Methylcellulose (HMC)

- 8.2.4. Carboxymethyl Cellulose (CMC)

- 8.2.5. Hydroxyethyl Cellulose (HEC)

- 8.2.6. Ethyl Cellulose (EC)

- 8.2.7. Hydroxypropyl Cellulose (HPC)

- 8.2.8. Hydrophobically modified cellulose ethers (EHEC, HM-EHEC)

- 8.3. Market Analysis, Insights, and Forecast – By Application

- 8.3.1. Foods & Beverages

- 8.3.2. Construction

- 8.3.3. Paints & Coatings

- 8.3.4. Drilling Fluids

- 8.3.5. Pharmaceuticals

- 8.3.6. Personal Care

- 8.3.7. Mining

- 8.3.8. Others

- 8.4. Market Analysis, Insights and Forecast – By Country

- 8.4.1. China

- 8.4.2. India

- 8.4.3. Japan

- 8.4.4. Australia

- 8.4.5. South East Asia

- 8.4.6. Rest of Asia Pacific

9. Latin America, Middle East, and Africa Cellulose Ether & Its Derivatives Market Analysis (USD Billion), Insights and Forecast, 2023-2030

- 9.1. Key Findings / Summary

- 9.2. Market Analysis, Insights and Forecast – By Type

- 9.2.1. Methyl Cellulose (MC)

- 9.2.2. Hydroxypropyl Methylcellulose (HPMC)

- 9.2.3. Hydroxymethyl Methylcellulose (HMC)

- 9.2.4. Carboxymethyl Cellulose (CMC)

- 9.2.5. Hydroxyethyl Cellulose (HEC)

- 9.2.6. Ethyl Cellulose (EC)

- 9.2.7. Hydroxypropyl Cellulose (HPC)

- 9.2.8. Hydrophobically modified cellulose ethers (EHEC, HM-EHEC)

- 9.3. Market Analysis, Insights, and Forecast – By Application

- 9.3.1. Foods & Beverages

- 9.3.2. Construction

- 9.3.3. Paints & Coatings

- 9.3.4. Drilling Fluids

- 9.3.5. Pharmaceuticals

- 9.3.6. Personal Care

- 9.3.7. Mining

- 9.3.8. Others

- 9.4. Market Analysis, Insights and Forecast – By Country

- 9.4.1. Brazil

- 9.4.2. Saudi Arabia

- 9.4.3. UAE

- 9.4.4. Rest of LAMEA

10. Competitive Analysis

- 10.1. Company Market Share Analysis, 2023

- 10.2. Key Industry Developments

- 10.3. Company Profile

- 10.4. The Dow Chemical Company

- 10.4.1. Business Overview

- 10.4.2. Segment 1 & Service Offering

- 10.4.3. Overall Revenue

- 10.4.4. Geographic Presence

- 10.4.5. Recent Development

- 10.5. Lotte Fine Chemicals

- 10.6. Shin-Etsu Chemical Co. Ltd.

- 10.7. Ashland Inc.

- 10.8. Nouryon Chemicals LLC

- 10.9. Rayonier Advanced Materials

- 10.10. Akzonobel

- 10.11. Daicel Finechem Ltd.

- 10.12. J. Rettenmaier & Söhne GmbH + Co.Kg (JRS)

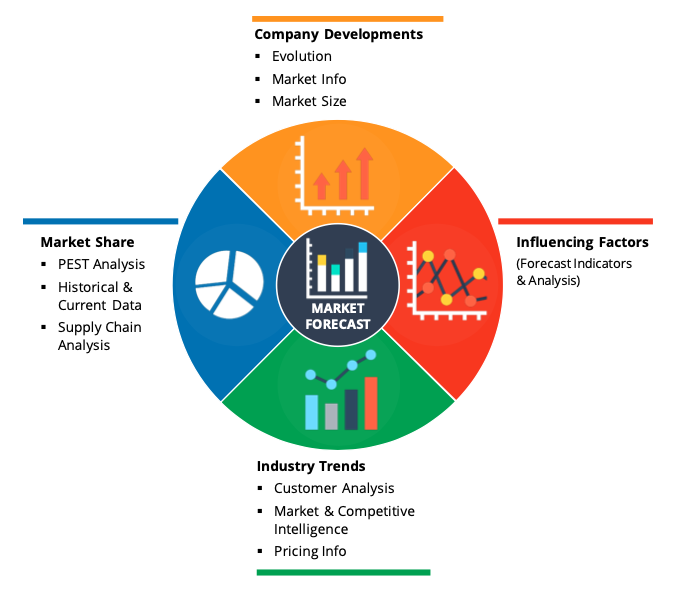

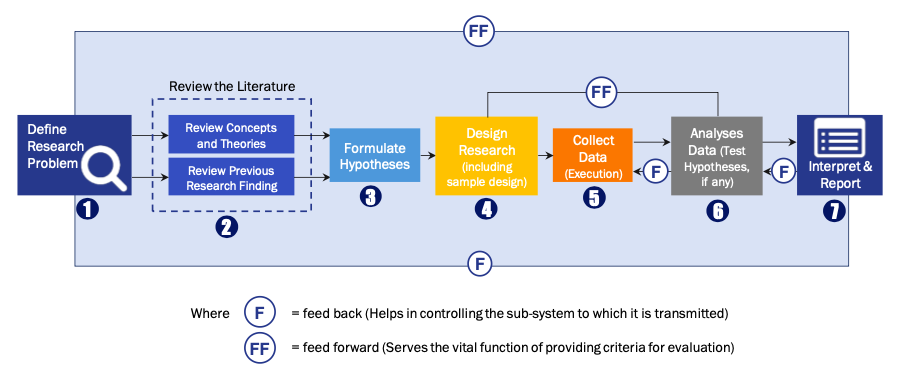

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model