Dental membrane and bone graft substitutes are used in bone graft surgeries. Bone graft surgery is essential when a tooth is lost due to an accident, a dental disease, or old age. The global Dental Membrane and Bone Graft Substitutes market is expected to rise at a considerable rate in the forthcoming years. The rise in the number of patients suffering from dental and oral diseases increases the demand for dental surgeries. This is a key factor to boost the growth of the Dental Membrane and Bone Graft Substitutes market.

Additionally, Globally, the population with periodontal scores in the range of ~5% and 70% among older people aged over 65 years. Therefore, the increasing old age population worldwide further propelling the growth of the Dental Membrane and Bone Graft Substitutes market steadily. According to the World Health Organization, between 2015 and 2050, the proportion of the world's population over 60 years will nearly double from 12% to 22%.

Moreover, growing medical tourism for dental procedures is another crucial factor to fuel the growth of the market in the coming years. As per Healthy Travel Media, publishers of a popular U.S. information portal, dental tourism is increasing in developing countries such as Mexico, India, and China, due to the availability of cost-effective dental services.

On the other hand, the high costs of these advanced Dental procedures and treatments is expected to hamper the growth of the Dental Membrane and Bone Graft Substitutes market.

Covid-19 Impact on Dental Membrane and Bone Graft Substitutes Market:

In addition, the current Dental Membrane and Bone Graft Substitutes Market study offer a detailed analysis of the current COVID-19 pandemic impact on the market growth and its influence on the future growth of the Dental Membrane and Bone Graft Substitutes Market. The recently published report demonstrates the elevation in the demand for the healthcare sector. The healthcare manufacturers have experienced long term as well as short term effect which includes supply shortages, panic buying, and stocking, regulation changes as short-term whereas approval delays and possible trend variations in consumption could be perceived as long-term impacts of COVID-19 on the health and pharmaceutical market.

The increasing need for a cure has pushed vaccine research and manufacturers to the limit. In addition to this, panic conditions have already spurred the demand for many healthcare products and services which are discussed in detail in this report. Moreover, the impact of COVID-19 on overall market revenue for the base year 2020 and its projection up to 2027 is provided in detail in this report.

Dental Membrane and Bone Graft Substitutes Market Segment Overview

Based on product, the Dental Bone Grafts is the largest segment in the Dental Membrane and Bone Graft Substitutes Market. High revenues generated by the segment can be attributed to the higher costs of dental bone grafts over dental membranes. According to the material, the human cell sources segment has the largest share of the market and this trend is expected to continue during the forecast period. An increase in the usage of this material in allografts and xenografts of bone graft substitutes as well as resorbable membrane of dental membranes contributes to the growth of the segment.

Dental Membrane and Bone Graft Substitutes Market, By Product

- Dental Membranes

- Resorbable

- Non-resorbable

- Dental Bone Grafts

- Autograft

- Allograft

- Demineralized Bone Matrix

- Xenograft

- Synthetic Bone Graft Substitutes

· Hydrogel

· Collagen

· Polytetrafluoroethylene (PTFE)

· Human Cell Sources

· Other Species

· Hydroxyapatite (HA)

· Tricalcium Phosphate (TCP)

Dental Membrane and Bone Graft Substitutes Market, By End User

- Hospitals

- Dental Clinics

- Individual Practice

- Group Practice

- Ambulatory Surgical Centers

In terms of region, Europe commanded a major share of the global dental membrane and bone graft substitutes market, in terms of revenue, and is predictable to maintain its supremacy over the forecast period. As per estimates, over 700,000 resorbable dental membranes were used in 2017. In addition to this, as per the report of Straumann, one of the leading market players, the demand for dental membranes and bone graft substitutes was prominent in Europe in 2017. These factors are remarkably fuelling the growth of the market in this region. Likewise, the Asia Pacific is expected to register the fastest growth during the forecast period, due to increasing the old age population and rising prevalence of dental diseases in this region. Additionally, the focus of market players based in India and Japan on leveraging opportunities in emerging markets is further contributing to the development of the market in this region.

Dental Membrane and Bone Graft Substitutes Market, By Geography

· North America (US & Canada)

· Europe (UK, Germany, France, Italy, Spain, Russia & Rest of Europe)

· Asia-Pacific (Japan, China, India, Australia, & South Korea, & Rest of Asia-Pacific)

· LAMEA (Brazil, Saudi Arabia, UAE & Rest of LAMEA)

Dental Membrane and Bone Graft Substitutes Market Competitor overview

Some key developments and strategies adopted by manufacturers in Dental Membrane and Bone Graft Substitutes are highlighted below.

· In December 2020, Collagen Matrix, Inc., a global leader in regenerative, collagen-based, xenograft-derived medical devices, and portfolio company of Linden Capital Partners announced the acquisition of Sunstar's Degradable Solutions division including its GUIDOR® branded line of resorbable synthetic medical implants.

Dental Membrane and Bone Graft Substitutes Market, Key Players

· Institut Straumann AG

· Danaher Corporation (Nobel Biocare Services AG)

· Geistlich Pharma AG

· Zimmer Biomet Holdings, Inc.

· Integra LifeSciences Holdings Corporation

· Dentsply Sirona, Inc.

· BioHorizons, Inc.

· NovaBone Products, LLC

· Collagen Matrix, Inc.

· Maxigen Biotech, Inc.

· Osteogenics Biomedical

1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

2. Executive Summary

3. Market Dynamics

- 3.1. Market Drivers

- 3.2. Market Restraints

- 3.3. Market Opportunities

4. Key Insights

- 4.1. Key Emerging Trends – For Major Countries

- 4.2. Latest Technological Advancement

- 4.3. Regulatory Landscape

- 4.4. Industry SWOT Analysis

- 4.5. Porters Five Forces Analysis

5. Global Dental Membrane and Bone Graft Substitutes Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 5.1. Key Findings / Summary

- 5.2. Market Analysis, Insights and Forecast – By Product

- 5.2.1. Dental Membranes

- 5.2.1.1. Resorbable

- 5.2.1.2. Non-resorbable

- 5.2.2. Dental Bone Grafts

- 5.2.2.1. Autograft

- 5.2.2.2. Allograft

- 5.2.2.3. Demineralized Bone Matrix

- 5.2.2.4. Xenograft

- 5.2.2.5. Synthetic Bone Graft Substitutes

- 5.2.1. Dental Membranes

- 5.3.1. Hydrogel

- 5.3.2. Collagen

- 5.3.3. Polytetrafluoroethylene (PTFE)

- 5.3.4. Human Cell Sources

- 5.3.5. Other Species

- 5.3.6. Hydroxyapatite (HA)

- 5.3.7. Tricalcium Phosphate (TCP)

- 5.4.1. Hospitals

- 5.4.2. Dental Clinics

- 5.4.2.1. Individual Practice

- 5.4.2.2. Group Practice

- 5.4.3. Ambulatory Surgical Centers

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Latin America, Middle East and Africa

6. North America Dental Membrane and Bone Graft Substitutes Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 6.1. Key Findings / Summary

- 6.2. Market Analysis, Insights and Forecast – By Product

- 6.2.1. Dental Membranes

- 6.2.1.1. Resorbable

- 6.2.1.2. Non-resorbable

- 6.2.2. Dental Bone Grafts

- 6.2.2.1. Autograft

- 6.2.2.2. Allograft

- 6.2.2.3. Demineralized Bone Matrix

- 6.2.2.4. Xenograft

- 6.2.2.5. Synthetic Bone Graft Substitutes

- 6.2.1. Dental Membranes

- 6.3.1. Hydrogel

- 6.3.2. Collagen

- 6.3.3. Polytetrafluoroethylene (PTFE)

- 6.3.4. Human Cell Sources

- 6.3.5. Other Species

- 6.3.6. Hydroxyapatite (HA)

- 6.3.7. Tricalcium Phosphate (TCP)

- 6.4.1. Hospitals

- 6.4.2. Dental Clinics

- 6.4.2.1. Individual Practice

- 6.4.2.2. Group Practice

- 6.4.3. Ambulatory Surgical Centers

- 6.5.1. U.S.

- 6.5.2. Canada

7. Europe Dental Membrane and Bone Graft Substitutes Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 7.1. Key Findings / Summary

- 7.2. Market Analysis, Insights and Forecast – By Product

- 7.2.1. Dental Membranes

- 7.2.1.1. Resorbable

- 7.2.1.2. Non-resorbable

- 7.2.2. Dental Bone Grafts

- 7.2.2.1. Autograft

- 7.2.2.2. Allograft

- 7.2.2.3. Demineralized Bone Matrix

- 7.2.2.4. Xenograft

- 7.2.2.5. Synthetic Bone Graft Substitutes

- 7.2.1. Dental Membranes

- 7.3.1. Hydrogel

- 7.3.2. Collagen

- 7.3.3. Polytetrafluoroethylene (PTFE)

- 7.3.4. Human Cell Sources

- 7.3.5. Other Species

- 7.3.6. Hydroxyapatite (HA)

- 7.3.7. Tricalcium Phosphate (TCP)

- 7.4.1. Hospitals

- 7.4.2. Dental Clinics

- 7.4.2.1. Individual Practice

- 7.4.2.2. Group Practice

- 7.4.3. Ambulatory Surgical Centers

- 7.5.1. UK

- 7.5.2. Germany

- 7.5.3. France

- 7.5.4. Italy

- 7.5.5. Spain

- 7.5.6. Russia

- 7.5.7. Rest of Europe

8. Asia Pacific Dental Membrane and Bone Graft Substitutes Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 8.1. Key Findings / Summary

- 8.2. Market Analysis, Insights and Forecast – By Product

- 8.2.1. Dental Membranes

- 8.2.1.1. Resorbable

- 8.2.1.2. Non-resorbable

- 8.2.2. Dental Bone Grafts

- 8.2.2.1. Autograft

- 8.2.2.2. Allograft

- 8.2.2.3. Demineralized Bone Matrix

- 8.2.2.4. Xenograft

- 8.2.2.5. Synthetic Bone Graft Substitutes

- 8.2.1. Dental Membranes

- 8.3.1. Hydrogel

- 8.3.2. Collagen

- 8.3.3. Polytetrafluoroethylene (PTFE)

- 8.3.4. Human Cell Sources

- 8.3.5. Other Species

- 8.3.6. Hydroxyapatite (HA)

- 8.3.7. Tricalcium Phosphate (TCP)

- 8.4.1. Hospitals

- 8.4.2. Dental Clinics

- 8.4.2.1. Individual Practice

- 8.4.2.2. Group Practice

- 8.4.3. Ambulatory Surgical Centers

- 8.5.1. China

- 8.5.2. India

- 8.5.3. Japan

- 8.5.4. Australia

- 8.5.5. South East Asia

- 8.5.6. Rest of Asia Pacific

9. Latin America, Middle East and Africa Dental Membrane and Bone Graft Substitutes Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 9.1. Key Findings / Summary

- 9.2. Market Analysis, Insights and Forecast – By Product

- 9.2.1. Dental Membranes

- 9.2.1.1. Resorbable

- 9.2.1.2. Non-resorbable

- 9.2.2. Dental Bone Grafts

- 9.2.2.1. Autograft

- 9.2.2.2. Allograft

- 9.2.2.3. Demineralized Bone Matrix

- 9.2.2.4. Xenograft

- 9.2.2.5. Synthetic Bone Graft Substitutes

- 9.2.1. Dental Membranes

- 9.3.1. Hydrogel

- 9.3.2. Collagen

- 9.3.3. Polytetrafluoroethylene (PTFE)

- 9.3.4. Human Cell Sources

- 9.3.5. Other Species

- 9.3.6. Hydroxyapatite (HA)

- 9.3.7. Tricalcium Phosphate (TCP)

- 9.4.1. Hospitals

- 9.4.2. Dental Clinics

- 9.4.2.1. Individual Practice

- 9.4.2.2. Group Practice

- 9.4.3. Ambulatory Surgical Centers

- 9.5.1. Brazil

- 9.5.2. Saudi Arabia

- 9.5.3. UAE

- 9.5.4. Rest of LAMEA

10. Competitive Analysis

- 10.1. Company Market Share Analysis, 2018

- 10.2. Key Industry Developments

- 10.3. Company Profile

- 10.4. Institut Straumann AG

- 10.4.1. Business Overview

- 10.4.2. Segment 1 & Service Offering

- 10.4.3. Overall Revenue

- 10.4.4. Geographic Presence

- 10.4.5. Recent Development

- 10.5. Danaher Corporation (Nobel Biocare Services AG)

- 10.6. Geistlich Pharma AG

- 10.7. Zimmer Biomet Holdings, Inc.

- 10.8. Integra LifeSciences Holdings Corporation

- 10.9. Dentsply Sirona, Inc.

- 10.10. BioHorizons, Inc.

- 10.11. NovaBone Products, LLC

- 10.12. Collagen Matrix, Inc.

- 10.13. Maxigen Biotech, Inc.

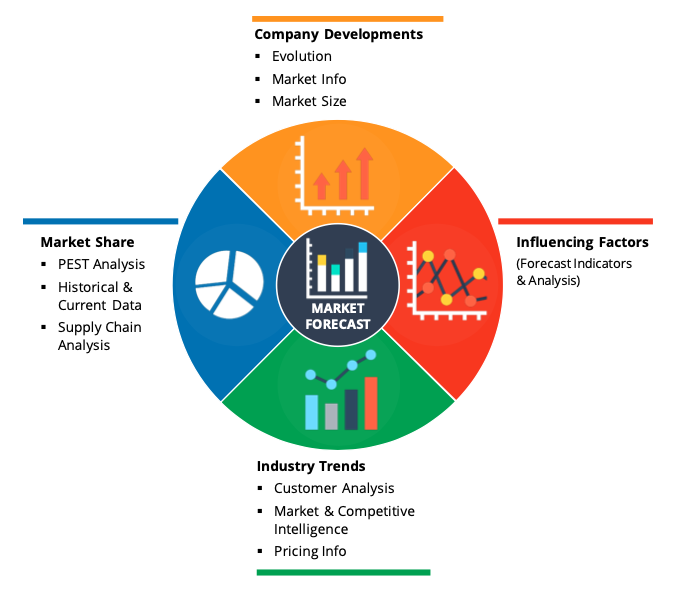

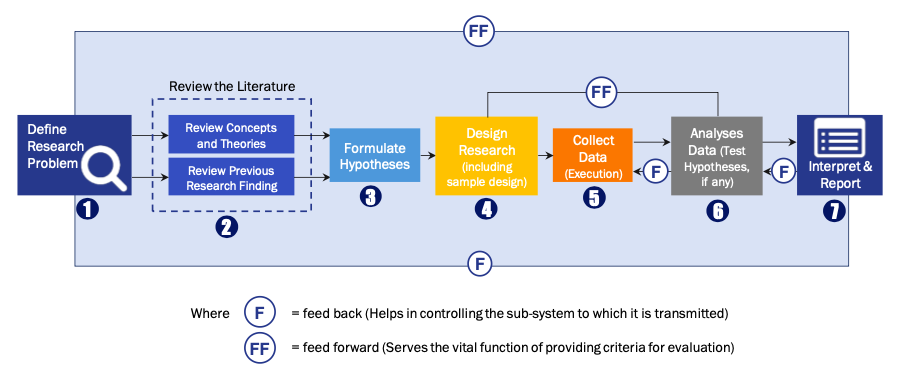

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model