As the COVID-19 pandemic continuing its effect around the world, many defense and aerospace companies are facing its impact during this time around the world. For instance, commercial aviation companies in the U.S., France, Germany, and Canada are facing disruption in the production process and reduced demand as workforces staying at home, passengers stop traveling, and delay in delivery of new aircraft. Analysts expecting a drop from 3,000 to 4,000 aircraft during the pandemic period. On the defense side, contractors operating in the sector are in a better position, hence the impact of the pandemic is likely low in the short to mid-term. However, low demand due to budget constraints affecting the production as in aircraft manufacturing.

Market Overview

These Unmanned Aerial Vehicles are finding growing application across the energy sectors, entertainment, and agriculture which is ultimately anticipated to impact the growth of the market. Primarily viewed as a military device, drones have established a noteworthy presence in commercial world in the past few years.

One of the important factors driving their demand in the commercial sectors is that these devices have the ability to complete hazardous tasks, such as examining utility pipelines, with cost-effectiveness and advanced precision as compared to conventional approaches. Newer drone-supportive guidelines by government bodies globally are anticipated to lower the entry obstructions for the new start-ups and the innovators in the drone market.

Factors including upsurge in technological developments; UAV venture funding; and rising application in the commercial sectors, including drone delivery and 3D mapping; are likely to contribute to the market growth.

Segment Overview

Filming and photography is likely to emerge as the major revenue generating segment during the forecast period. The segment is anticipated to witness the profound growth over the forecast period. Drones are progressively being used in film, record e,nts movies, and functions, and also to carry out mid-air photography.

The advent of drones is set to transform media industry as it allows journalism sector to cover the news even in areas where the human entry is prohibited. These devices also find uses in proficiently shooting action sequences in the movies from aerial view and photographing unreachable places.

Regional Overview

North America accounted for largest market share in revenue terms in 2019 and is projected to continue leading the market over the forecast period owing to the favourable government initiatives concerning the advancement in technology coupled with growing demand from the businesses for drone-acquired informations. Moreover, Federal Aviation Administration (FAA) in U.S. has released new guidelines to provide more consistent and coherent rules concerning the safe and legal operation of drones in commercial spaces. Such regulations are likely to reduce the entry barriers and surge the regional product adoption.

Asia Pacific is likely to witness the fastest growth over the forecast period. Countries such as japan and China are increasingly implementing advanced technologies across wide range of industries to counter rising labour costs.

Competitor overview

Some of the noticeable companies operating in the global drone market are DJI; Xiaomi; AeroVironment Inc.; Parrot Drones SAS; 3D Robotics; EHANG.Increasing and INSITU; funding by collaborations and Venture Capitals (VCs) with technology giants and government agencies are anticipated to create a number of growth opportunities for the market players. Technology licensing, new product launches, mergers and acquisitions, and strategic partnerships are few of the key strategies accepted by the players to gain competitive edge.

Key Players

- Aeronavics Ltd.

- AeroVironment Inc.

- Aeryon Labs Inc.

- DJI

- Draganfly Innovations Inc.

- EHANG

- Intel Corporation

- Parrot Drones SAS

- PrecisionHawk

- YUNEEC

Market Segmentation

By Application

- Mapping & Surveying

- Filming & Photography

- Inspection & Maintenance

- Precision Agriculture

- Surveillance & Monitoring

- Others

- Fixed-Wing

- Hybrid

- Rotary Blade

- Agriculture

- Delivery & Logistics

- Security & Law Enforcement

- Energy

- Media & Entertainment

- Real Estate & Construction

- Others

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- UAE

- Rest of LAMEA

1 Executive Summary 14

2 Market Introduction 17

- 2.1 Definition 18

- 2.2 Scope of the Study 18

- 2.3 List of Assumptions 19

- 2.4 Market Structure 19

- 2.5 Key Takeaways 20

- 2.6 Key Buying Criteria 20

3 Research Methodology 21

- 3.1 Research Process 22

- 3.2 Primary Research 22

- 3.3 Secondary Research 23

- 3.4 Market Size Estimation 24

- 3.5 Forecast Model 25

4 Market Dynamics 26

- 4.1 Introduction 27

- 4.2 Drivers 27

- 4.2.1 Development of Electric Drones 27

- 4.2.2 Increasing Use of UAVs in Commercial Sector 27

- 4.2.3 No Fuel Emissions 28

- 4.2.4 Rising Usage of Drones for Industrial Applications 28

- 4.3 Restraints 29

- 4.3.1 Issues Associated with Data Processing 29

- 4.3.2 Limited Flight Range & Endurance 29

- 4.4 Opportunities 29

- 4.4.1 3D-Printed Drones 29

- 4.4.2 Introduction of Solar Powered Drones 30

- 4.4.3 Usage of Drones in the Energy Sector 30

- 4.5 Challenges 30

- 4.5.1 Prone to Cyber Attacks 30

- 4.5.2 Regulatory Norms & Safety Issues 31

5 Market Factor Analysis 32

- 5.1 Supply Chain 33

- 5.2 Porter’s Five Forces Model 34

- 5.2.1 Threat of New Entrants 35

- 5.2.2 Bargaining Power of Suppliers 35

- 5.2.3 Bargaining Power of Buyers 35

- 5.2.4 Threat of Substitutes 35

- 5.2.5 Intensity of Rivalry 35

6 Global Passenger Drones Market, By Component 36

- 6.1 Overview 37

- 6.1.1 Airframe 37

- 6.1.2 Controller System 37

- 6.1.3 Navigation System 37

- 6.1.4 Propulsion System 37

- 6.1.5 Others 37

7 Global Passenger Drones Market, By Capacity 40

- 7.1 Overview 41

- 7.1.1 Up to 100 kg 41

- 7.1.2 Over 100 kg 41

8 Global Passenger Drones Market, By Application 43

- 8.1 Overview 44

- 8.1.1 Commercial 44

- 8.1.2 Personal 44

9 Global Passenger Drones Market, By Rotor 46

- 9.1 Overview 47

- 9.1.1 Less than 10 47

- 9.1.2 More than 10 47

10 Global Passenger Drones Market, By Region 49

- 10.1 Overview 50

- 10.2 North America 52

- 10.2.1 U.S. 55

- 10.2.1.1 U.S. by Component 55

- 10.2.1.2 U.S. by Capacity 55

- 10.2.1.3 U.S. by Application 56

- 10.2.1 U.S. 55

- 10.3.1 Germany 61

- 10.3.1.1 Germany by Component 61

- 10.3.1.2 Germany by Capacity 61

- 10.3.1.3 Germany by Application 62

- 10.3.2 U.K 63

- 10.3.2.1 U.K by Component 63

- 10.3.2.2 U.K by Capacity 63

- 10.3.2.3 U.K by Application 64

- 10.3.3 France 65

- 10.3.3.1 France by Component 65

- 10.3.3.2 France by Capacity 65

- 10.3.3.3 France by Application 66

- 10.3.4 Italy 67

- 10.3.4.1 Italy by Component 67

- 10.3.4.2 Italy by Capacity 67

- 10.3.4.3 Italy by Application 68

- 10.3.5 Rest of Europe 69

- 10.3.5.1 Rest of Europe by Component 69

- 10.3.5.2 Rest of Europe by Capacity 69

- 10.3.5.3 Rest of Europe by Application 70

- 10.4.1 China 75

- 10.4.1.1 China by Component 75

- 10.4.1.2 China by Capacity 75

- 10.4.1.3 China by Application 76

- 10.4.2 Japan 77

- 10.4.2.1 Japan by Component 77

- 10.4.2.2 Japan by Capacity 77

- 10.4.2.3 Japan by Application 78

- 10.4.3 South Korea 79

- 10.4.3.1 South Korea by Component 79

- 10.4.3.2 South Korea by Capacity 79

- 10.4.3.3 South Korea by Application 80

- 10.4.4 Rest of Asia Pacific 81

- 10.4.4.1 Rest of Asia Pacific by Component 81

- 10.4.4.2 Rest of Asia Pacific by Capacity 81

- 10.4.4.3 Rest of Asia Pacific by Application 82

- 10.5.1 UAE 87

- 10.5.1.1 UAE by Component 87

- 10.5.1.2 UAE by Capacity 87

- 10.5.1.3 UAE by Application 88

- 10.5.2 Saudi Arabia 89

- 10.5.2.1 Saudi Arabia by Component 89

- 10.5.2.2 Saudi Arabia by Capacity 89

- 10.5.2.3 Saudi Arabia by Application 90

- 10.5.3 Israel 91

- 10.5.3.1 Israel by Component 91

- 10.5.3.2 Israel by Capacity 91

- 10.5.3.3 Israel by Application 92

- 10.5.4 Other Countries 93

- 10.5.4.1 Other Countries by Component 93

- 10.5.4.2 Other Countries by Capacity 93

- 10.5.4.3 Other Countries by Application 94

11 Competitive Landscape 95

- 11.1 Competitive Scenario 96

- 11.2 Market Share Analysis 96

- 11.3 Mergers & Acquisitions 97

- 11.4 Competitive Benchmarking 97

12 Company Profiles 98

- 12.1 AeroMobil 99

- 12.1.1 Company Overview 99

- 12.1.2 Financial Overview 99

- 12.1.3 Product Offerings 99

- 12.1.4 Key Developments 100

- 12.1.5 SWOT Analysis 100

- 12.1.6 Key Strategy 100

- 12.2 Airbus S.A.S 101

- 12.2.1 Company Overview 101

- 12.2.2 Financial Overview 101

- 12.2.3 Product Offerings 102

- 12.2.4 Key Developments 103

- 12.2.5 SWOT Analysis 103

- 12.2.6 Key Strategy 103

- 12.3 Boeing 104

- 12.3.1 Company Overview 104

- 12.3.2 Financial Overview 104

- 12.3.3 Products Offerings 105

- 12.3.4 Key Developments 106

- 12.3.5 SWOT Analysis 106

- 12.3.6 Key Strategy 106

- 12.4 Cartivator 107

- 12.4.1 Company Overview 107

- 12.4.2 Financial Overview 107

- 12.4.3 Product Offerings 107

- 12.4.4 Key Developments 107

- 12.4.5 SWOT Analysis 108

- 12.4.6 Key Strategy 108

- 12.5 EHANG 109

- 12.5.1 Company Overview 109

- 12.5.2 Financial Overview 109

- 12.5.3 Product Offerings 109

- 12.5.4 Key Developments 109

- 12.5.5 SWOT Analysis 110

- 12.5.6 Key Strategy 110

- 12.6 Joby Aviation 111

- 12.6.1 Company Overview 111

- 12.6.2 Financial Overview 111

- 12.6.3 Product Offerings 111

- 12.6.4 Key Developments 111

- 12.6.5 SWOT Analysis 112

- 12.6.6 Key Strategy 112

- 12.7 Lilium 113

- 12.7.1 Company Overview 113

- 12.7.2 Financial Overview 113

- 12.7.3 Product Offerings 113

- 12.7.4 Key Developments 114

- 12.7.5 SWOT Analysis 114

- 12.7.6 Key Strategy 114

- 12.8 TERRAFUGIA 115

- 12.8.1 Company Overview 115

- 12.8.2 Financial Overview 115

- 12.8.3 Product Offerings 115

- 12.8.4 Key Developments 116

- 12.8.5 SWOT Analysis 116

- 12.8.6 Key Strategy 116

- 12.9 Uber Technologies Inc. 117

- 12.9.1 Company Overview 117

- 12.9.2 Financial Overview 117

- 12.9.3 Product Offerings 117

- 12.9.4 Key Developments 117

- 12.9.5 SWOT Analysis 118

- 12.9.6 Key Strategy 118

- 12.10 Volocopter GmbH 119

- 12.10.1 Company Overview 119

- 12.10.2 Financial Overview 119

- 12.10.3 Product Offerings 119

- 12.10.4 Key Developments 119

- 12.10.5 SWOT Analysis 120

- 12.10.6 Key Strategy 120

13 Conclusion 121

14 Appendix 123

- 14.1 References 124

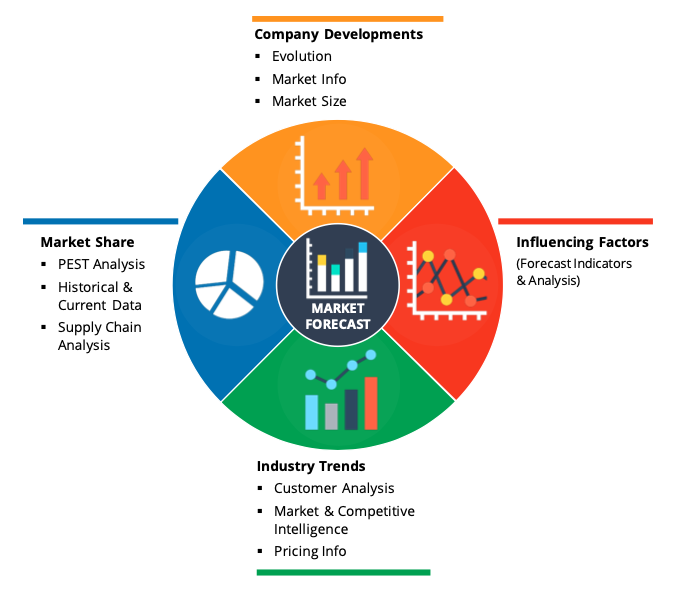

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

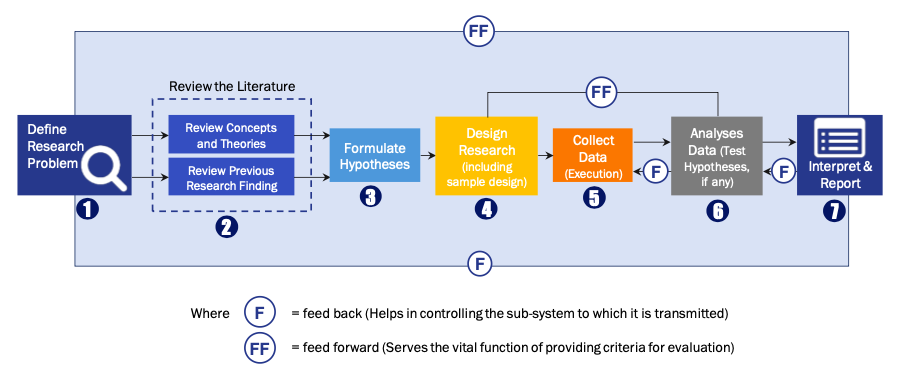

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model