The global Electric Power Assisted Steering (EPAS) market is forecast to reach USD 29.8 billion by 2029. The market is expected to grow at a CAGR of 9.4% during the forecast period. The growing demand for fuel-efficient vehicles and the increasing stringency of emission norms are the major factors driving the growth of the EPAS market. The rising adoption of electric vehicles is also contributing to market growth. However, the high cost of EPAS systems is restraining the market growth. The report provides a detailed analysis of the key players in the EPAS market, along with their company profiles, recent developments, and key market strategies. The major players profiled in this report include Robert Bosch GmbH (Germany), ZF Friedrichshafen AG (Germany), JTEKT Corporation (Japan), Aisin Seiki Co., Ltd. (Japan), Nexteer Automotive (US), ThyssenKrupp AG (Germany), Mando Corporation (South Korea), Mobis (South Korea), and NSK Ltd. (Japan).

Electric power assisted steering (EPAS) is a technology that uses an electric motor to assist in the steering of a vehicle. EPAS can be used in a variety of vehicles, including cars, trucks, buses, and motorcycles. The market for electric power assisted steering (EPAS) is growing rapidly as the automotive industry moves towards electrification. The main drivers of this market are the need for improved fuel economy and emissions reduction.

EPAS systems offer a number of advantages over traditional hydraulic power steering systems, including improved fuel economy, reduced emissions, and increased torque. They are also more compact and require less maintenance.

Covid-19 Impact on Electric Power Assisted Steering (EPAS) Market

The outbreak of the covid-19 has a severe and swift impact on the automobile and transportation industry. This is majorly due to the shutdown of assembly plants in the US, interruptions across Europe in large-scale manufacturing, and disruption in the export of Chinese parts. In addition to this, the industry is dealing with reduced demand across the globe due to changes in customer behavior and shifts in a supply-demand chain. A recent study shows a 39% decline in sales of automotive all over the world. Moreover, the nationwide lockdowns have substantially affected the transportation sector. Restrictions on transportation accounted for a 45 to 55% decline in public as well as private transport sectors.

Report Includes

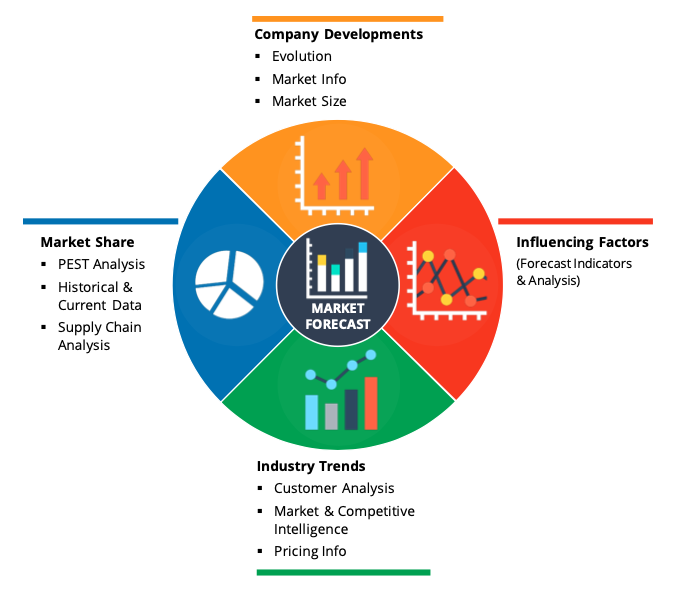

An overview of the global Electric Power Assisted Steering (EPAS) market, and related technologies and developments. Analyses of global market trends, with historical data from 2018, 2019, and 2020 estimates and projections of CAGRs through 2029. It also includes breakdowns of the overall Electric Power Assisted Steering (EPAS) market along with various segments, and by geographic region. Analysis of the stakeholder value chain in the Electric Power Assisted Steering (EPAS) market and comprehensive profiles of leading companies in the industry

Report Scope

The report forecasts the size of the Electric Power Assisted Steering (EPAS) market for components from 2022 through 2029

The Executive Summary provides a snapshot of key findings of the report. The introduction chapter includes research scope, market segmentation, research methodology, and definitions and assumptions. It involves extreme rigorous scientific methods, tools and techniques to estimate the market size. Exhaustive secondary research is being carried out to collect information related to the market, the parent market, and the peer market. Primary research is undertaken to validate the assumptions, findings, and sizing with the industry experts and professionals across the value chain of the market. Both top-down and bottom-up approaches are employed to estimate the complete market size.

The chapter on market dynamics includes market drivers, restraints, and opportunities which helps familiarise with market potential and upcoming opportunities. The chapter on key insights includes emerging trends from major countries, latest technological advancement, regulatory landscape, SWOT analysis, and porters five forces analysis. This chapter provides a detailed insights of market which derives the market trends, changing phase of investments, scope of profit potential, and helps to take appropriate business decisions. The chapter on competitive analysis includes profiling of leading companies in the global market to map the leading companies and their focus of interest in the market.

After deriving the market size from the market size estimation process, the total market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, the data triangulation and market breakdown procedures is being used. The data triangulation is carried out by studying various factors and trends from demand and supply perspectives.

Segmentation Analysis:

The global Electric Power Assisted Steering (EPAS) market is segmented by vehicle type, component, and geography.

Vehicle Type:

Passenger Cars: The passenger car segment is expected to grow at the highest CAGR during the forecast period.

Light Commercial Vehicles: The light commercial vehicle segment is anticipated to grow at a significant CAGR during the forecast period.

Heavy Commercial Vehicles: The heavy commercial vehicle segment is projected to grow at a moderate CAGR during the forecast period.

Component:

Steering Columns: The steering columns segment is projected to grow at the highest CAGR during the forecast period. Steering columns are an important component of EPAS systems and are responsible for transferring torque from the motor to the wheels. They are generally made of aluminum or steel and can be either telescopic or non-telescopic. Telescopic steering columns are adjustable in length and provide better driver comfort, while non-telescopic steering columns are fixed in length. EPAS systems with telescopic steering columns are expected to gain popularity in the coming years as they offer better driver comfort and safety.

Steering Motors: The steering motors segment is anticipated to grow at a significant CAGR during the forecast period. Steering motors are used in EPAS systems to provide assistive force to the steering wheel and help drivers steer the vehicle more easily. They are generally brushless DC motors that offer high reliability and durability.

Global Electric Power Assisted Steering (EPAS) market Competitive Analysis:

Key players in the Global Electric Power Assisted Steering (EPAS) market are Robert Bosch Automotive Steering GmbH, Mitsubishi Electric Corporation, ZF Friedrichshafen Group, Nexteer Automotive, NSK Global, JTEKT Corporation, SHOWA Corporation, thyssenkrupp Presta AG, Mando Corporation, Hyundai Mobis, Zhuzhou Elite Electro Mechanical Co. Ltdamong other players.

*All our reports are customizable as per customer requirements

This study forecasts revenue and volume growth at global, regional, and country levels from 2018 to 2029. The Global Electric Power Assisted Steering (EPAS) market is distributed on the basis of the below-mentioned segments:

Global Electric Power Assisted Steering (EPAS) Market, By Type:

- C-EPS

- P-EPS

- R-EPS

- Others

- Commercial Vehicles

- Passenger Vehicles

- Others

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East and Africa

- GCC

- South Africa

- Rest of Middle East and Africa

1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

2. Executive Summary

3. Market Dynamics

- 3.1. Market Drivers

- 3.2. Market Restraints

- 3.3. Market Opportunities

4. Key Insights

- 4.1. Key Emerging Trends – For Major Countries

- 4.2. Latest Technological Advancement

- 4.3. Regulatory Landscape

- 4.4. Industry SWOT Analysis

- 4.5. Porters Five Forces Analysis

5. Global Electric Power Assisted Steering (EPAS) Market Analysis (USD Billion), Insights and Forecast, 2018-2029

- 5.1. Key Findings / Summary

- 5.2. Market Analysis, Insights and Forecast – By Segment 1

- 5.2.1. Sub-Segment 1

- 5.2.2. Sub-Segment 2

- 5.3. Market Analysis, Insights and Forecast – By Segment 2

- 5.3.1. Sub-Segment 1

- 5.3.2. Sub-Segment 2

- 5.3.3. Sub-Segment 3

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast – By Segment 3

- 5.4.1. Sub-Segment 1

- 5.4.2. Sub-Segment 2

- 5.4.3. Sub-Segment 3

- 5.4.4. Others

- 5.5. Market Analysis, Insights and Forecast – By Region

- 5.5.1. North America

- 5.5.2. Latin America

- 5.5.3. Europe

- 5.5.4. Asia Pacific

- 5.5.5. Middle East and Africa

6. North America Electric Power Assisted Steering (EPAS) Market Analysis (USD Billion), Insights and Forecast, 2018-2029

- 6.1. Key Findings / Summary

- 6.2. Market Analysis, Insights and Forecast – By Segment 1

- 6.2.1. Sub-Segment 1

- 6.2.2. Sub-Segment 2

- 6.3. Market Analysis, Insights and Forecast – By Segment 2

- 6.3.1. Sub-Segment 1

- 6.3.2. Sub-Segment 2

- 6.3.3. Sub-Segment 3

- 6.3.4. Others

- 6.4. Market Analysis, Insights and Forecast – By Segment 3

- 6.4.1. Sub-Segment 1

- 6.4.2. Sub-Segment 2

- 6.4.3. Sub-Segment 3

- 6.4.4. Others

- 6.5. Market Analysis, Insights and Forecast – By Country

- 6.5.1. U.S.

- 6.5.2. Canada

7. Latin America Electric Power Assisted Steering (EPAS) Market Analysis (USD Billion), Insights and Forecast, 2018-2029

- 7.1. Key Findings / Summary

- 7.2. Market Analysis, Insights and Forecast – By Segment 1

- 7.2.1. Sub-Segment 1

- 7.2.2. Sub-Segment 2

- 7.3. Market Analysis, Insights and Forecast – By Segment 2

- 7.3.1. Sub-Segment 1

- 7.3.2. Sub-Segment 2

- 7.3.3. Sub-Segment 3

- 7.3.4. Others

- 7.4. Market Analysis, Insights and Forecast – By Segment 3

- 7.4.1. Sub-Segment 1

- 7.4.2. Sub-Segment 2

- 7.4.3. Sub-Segment 3

- 7.4.4. Others

- 7.5. Insights and Forecast – By Country

- 7.5.1. Brazil

- 7.5.2. Mexico

- 7.5.3. Rest of Latin America

8. Europe Electric Power Assisted Steering (EPAS) Market Analysis (USD Billion), Insights and Forecast, 2018-2029

- 8.1. Key Findings / Summary

- 8.2. Market Analysis, Insights and Forecast – By Segment 1

- 8.2.1. Sub-Segment 1

- 8.2.2. Sub-Segment 2

- 8.3. Market Analysis, Insights and Forecast – By Segment 2

- 8.3.1. Sub-Segment 1

- 8.3.2. Sub-Segment 2

- 8.3.3. Sub-Segment 3

- 8.3.4. Others

- 8.4. Market Analysis, Insights and Forecast – By Segment 3

- 8.4.1. Sub-Segment 1

- 8.4.2. Sub-Segment 2

- 8.4.3. Sub-Segment 3

- 8.4.4. Others

- 8.5. Market Analysis, Insights and Forecast – By Country

- 8.5.1. UK

- 8.5.2. Germany

- 8.5.3. France

- 8.5.4. Italy

- 8.5.5. Spain

- 8.5.6. Russia

- 8.5.7. Rest of Europe

9. Asia Pacific Electric Power Assisted Steering (EPAS) Market Analysis (USD Billion), Insights and Forecast, 2018-2029

- 9.1. Key Findings / Summary

- 9.2. Market Analysis, Insights and Forecast – By Segment 1

- 9.2.1. Sub-Segment 1

- 9.2.2. Sub-Segment 2

- 9.3. Market Analysis, Insights and Forecast – By Segment 2

- 9.3.1. Sub-Segment 1

- 9.3.2. Sub-Segment 2

- 9.3.3. Sub-Segment 3

- 9.3.4. Others

- 9.4. Market Analysis, Insights and Forecast – By Segment 3

- 9.4.1. Sub-Segment 1

- 9.4.2. Sub-Segment 2

- 9.4.3. Sub-Segment 3

- 9.4.4. Others

- 9.5. Market Analysis, Insights and Forecast – By Country

- 9.5.1. China

- 9.5.2. India

- 9.5.3. Japan

- 9.5.4. Australia

- 9.5.5. South East Asia

- 9.5.6. Rest of Asia Pacific

10. Middle East & Africa Electric Power Assisted Steering (EPAS) Market Analysis (USD Billion), Insights and Forecast, 2018-2029

- 10.1. Key Findings / Summary

- 10.2. Market Analysis, Insights and Forecast – By Segment 1

- 10.2.1. Sub-Segment 1

- 10.2.2. Sub-Segment 2

- 10.3. Market Analysis, Insights and Forecast – By Segment 2

- 10.3.1. Sub-Segment 1

- 10.3.2. Sub-Segment 2

- 10.3.3. Sub-Segment 3

- 10.3.4. Others

- 10.4. Market Analysis, Insights and Forecast – By Segment 3

- 10.4.1. Sub-Segment 1

- 10.4.2. Sub-Segment 2

- 10.4.3. Sub-Segment 3

- 10.4.4. Others

- 10.5. Market Analysis, Insights and Forecast – By Country

- 10.5.1. GCC

- 10.5.2. South Africa

- 10.5.3. Rest of Middle East & Africa

11. Competitive Analysis

- 11.1. Company Market Share Analysis, 2018

- 11.2. Key Industry Developments

- 11.3. Company Profile

- 11.3.1. Company 1

- 11.3.1.1. Business Overview

- 11.3.1.2. Segment 1 & Service Offering

- 11.3.1.3. Overall Revenue

- 11.3.1.4. Geographic Presence

- 11.3.1.5. Recent Development

- 11.3.2. Company 2

- 11.3.3. Company 3

- 11.3.4. Company 4

- 11.3.5. Company 5

- 11.3.6. Company 6

- 11.3.7. Company 7

- 11.3.8. Company 8

- 11.3.9. Company 9

- 11.3.10. Company 10

- 11.3.11. Company 11

- 11.3.12. Company 12

- 11.3.1. Company 1

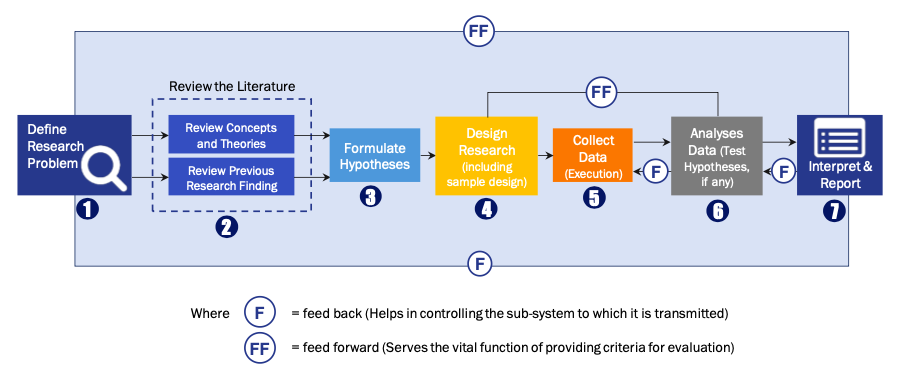

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model