The Food Traceability Market is expected to grow at a sound pace in the times to follow. One of the important reasons expected to promote the growth of the global food traceability market in the next years is the emergence of innovative food traceability technologies. To extend their application base and build their presence in the global market, the major players in the market are focusing on creating new technologies. Furthermore, rising consumer awareness of food safety is propelling the global food traceability market even further.

Because of rising applications in many industries such as logistics, packaging, storage, retail, and handling, the global food traceability market is expected to grow significantly in the near future. The key factors likely to boost the growth of the global food traceability market in the next years are technological improvements and the increasing number of product recalls and traces contamination.

However, increased privacy concerns in data sharing, as well as the additional cost of traceability systems, are projected to slow the market's growth in the near future.

| Report Metric | Details |

| Market size available for years | 2023–2030 |

| Base year considered | 2023 |

| Forecast period | 2024–2030 |

| Forecast unit | Value (USD Million) |

| Segments covered | Technology, Software, Application, and Region. |

| Regions covered | North America (the U.S. and Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Rest of Europe), Asia-Pacific (China, India, Japan, Australia, South East Asia, Rest of Asia Pacific), Latin America and the Middle East and Africa (Brazil, Saudi Arabia, UAE, Rest of LAMEA) |

| Companies covered | IBM Corp., A2B Tracking Solutions, Motorola Solutions, Inc., Picarro Inc., Barcoding Inc., Merit-Trax Technologies Inc. |

Covid-19 Impact on Food Traceability Market

A pandemic such as COVID-19 has not only affected the smooth operations of food supply chains but also resulted in food insecurity conditions in several nations. Manufacturers working in the sector are facing challenges in regards to operations, supply chain, training, safety, emergency responses, awareness, incident management, recreating business models, digitalization, and other unanticipated impacts. Alcohol, a major component in the beverage industry is facing a devastating effect of a pandemic. Around 13% to 15% of the craft beer sector in the world is in the process of shutting up shop, and the wine industry is in severe distress. Besides, shortage of raw materials caused to shut down of many small to medium food processing companies around the world

Food Traceability Market Segment Overview

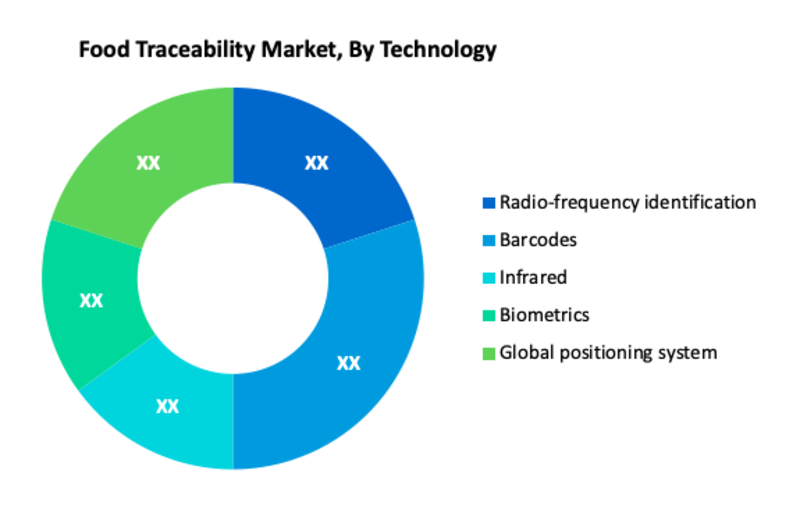

Based on Technology, Barcode is a major segment in the global Food Traceability Market. RFID, barcode, biometrics, infrared, and GPS are some of the most widely utilized food traceability technologies around the world. These technologies can be used in a variety of food products and at various stages of the food supply chain. Currently, barcodes are widely used for packaged foods, whereas GPS and RFID are extensively used for food that involves the movement of live feedstock.

Food Traceability Market, By Technology

· Radio-frequency identification

· Barcodes

· Infrared

· Biometrics

· Global positioning system

Food Traceability Market, By Software

· Enterprise Resource Planning (ERP)

· Friction welding

· Laboratory Information Management Software (LIMS)

· Warehouse software

· Other

Food Traceability Market, By Application

· Beverages

· Canned Or Bottled Food

· Meat

· Vegetables And Fruits (Fresh Produce/Seeds)

· Dairy Products

· Fish Or Seafood

· Poultry

· Others

Food Traceability Regional Overview

Based on the region, Asia Pacific is expected to account for the fastest-growing market in the forecast period. Because of the region's large population and spending power, consumers are looking for high-quality, safe food to eat. The demand for food traceability services is expanding as the population's consumption habits change as a result of increased awareness about healthy foods and beverages. The millennial generation is driving demand for clean and safe food and beverages, which is propelling the food traceability market once again.

Food Traceability Market, By Geography

· North America (US & Canada)

· Europe (UK, Germany, France, Italy, Spain, Russia & Rest of Europe)

· Asia-Pacific (Japan, China, India, Australia, & South Korea, & Rest of Asia-Pacific)

· LAMEA (Brazil, Saudi Arabia, UAE & Rest of LAMEA)

Food Traceability Market Competitor overview

Some key developments and strategies adopted by manufacturers in Food Traceability are highlighted below.

· In December 2021, The Specialty Soya and Grains Alliance announces the introduction of U.S. Identity Preserved, a designation signifying a premium crop with a verifiable origin. This quality assurance program represents a significant advancement in food traceability for food manufacturers, processors and exporters.

Food Traceability Market, Key Players

· IBM Corp.

· A2B Tracking Solutions

· Motorola Solutions, Inc.

· Picarro Inc.

· Barcoding Inc.

· Merit-Trax Technologies Inc.

Frequently Asked Questions (FAQ) :

Q1. What are the driving factors for the global Food Traceability market?

Q2. What are the restraining factors for the global Food Traceability market?

Q3. Which segment is projected to hold the largest share in the global Food Traceability market. ?

Q4. Which region holds the largest share in the global Food Traceability market?

Q5. Which are the prominent players in the global Food Traceability market?

1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

2. Executive Summary

3. Market Dynamics

- 3.1. Market Drivers

- 3.2. Market Restraints

- 3.3. Market Opportunities

4. Key Insights

- 4.1. Key Emerging Trends – For Major Countries

- 4.2. Latest Technological Advancement

- 4.3. Regulatory Landscape

- 4.4. Industry SWOT Analysis

- 4.5. Porters Five Forces Analysis

5. Global Food Traceability Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 5.1. Key Findings / Summary

- 5.2. Market Analysis, Insights and Forecast – By Technology

- 5.2.1. Radio-frequency identification

- 5.2.2. Barcodes

- 5.2.3. Infrared

- 5.2.4. Biometrics

- 5.2.5. Global positioning system

- 5.3. Market Analysis, Insights and Forecast – By Software

- 5.3.1. Enterprise Resource Planning (ERP)

- 5.3.2. Friction welding

- 5.3.3. Laboratory Information Management Software (LIMS)

- 5.3.4. Warehouse software

- 5.3.5. Other

- 5.4. Market Analysis, Insights and Forecast – By Application

- 5.4.1. Beverages

- 5.4.2. Canned Or Bottled Food

- 5.4.3. Meat

- 5.4.4. Vegetables And Fruits (Fresh Produce/Seeds)

- 5.4.5. Dairy Products

- 5.4.6. Fish Or Seafood

- 5.4.7. Poultry

- 5.4.8. Others

- 5.5. Market Analysis, Insights and Forecast – By Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Latin America, Middle East and Africa

6. North America Food Traceability Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 6.1. Key Findings / Summary

- 6.2. Market Analysis, Insights and Forecast – By Technology

- 6.2.1. Radio-frequency identification

- 6.2.2. Barcodes

- 6.2.3. Infrared

- 6.2.4. Biometrics

- 6.2.5. Global positioning system

- 6.3. Market Analysis, Insights and Forecast – By Software

- 6.3.1. Enterprise Resource Planning (ERP)

- 6.3.2. Friction welding

- 6.3.3. Laboratory Information Management Software (LIMS)

- 6.3.4. Warehouse software

- 6.3.5. Other

- 6.4. Market Analysis, Insights and Forecast – By Application

- 6.4.1. Beverages

- 6.4.2. Canned Or Bottled Food

- 6.4.3. Meat

- 6.4.4. Vegetables And Fruits (Fresh Produce/Seeds)

- 6.4.5. Dairy Products

- 6.4.6. Fish Or Seafood

- 6.4.7. Poultry

- 6.4.8. Others

- 6.5. Market Analysis, Insights and Forecast – By Country

- 6.5.1. U.S.

- 6.5.2. Canada

7. Europe Food Traceability Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 7.1. Key Findings / Summary

- 7.2. Market Analysis, Insights and Forecast – By Technology

- 7.2.1. Radio-frequency identification

- 7.2.2. Barcodes

- 7.2.3. Infrared

- 7.2.4. Biometrics

- 7.2.5. Global positioning system

- 7.3. Market Analysis, Insights and Forecast – By Software

- 7.3.1. Enterprise Resource Planning (ERP)

- 7.3.2. Friction welding

- 7.3.3. Laboratory Information Management Software (LIMS)

- 7.3.4. Warehouse software

- 7.3.5. Other

- 7.4. Market Analysis, Insights and Forecast – By Application

- 7.4.1. Beverages

- 7.4.2. Canned Or Bottled Food

- 7.4.3. Meat

- 7.4.4. Vegetables And Fruits (Fresh Produce/Seeds)

- 7.4.5. Dairy Products

- 7.4.6. Fish Or Seafood

- 7.4.7. Poultry

- 7.4.8. Others

- 7.5. Market Analysis, Insights and Forecast – By Country

- 7.5.1. UK

- 7.5.2. Germany

- 7.5.3. France

- 7.5.4. Italy

- 7.5.5. Spain

- 7.5.6. Russia

- 7.5.7. Rest of Europe

8. Asia Pacific Food Traceability Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 8.1. Key Findings / Summary

- 8.2. Market Analysis, Insights and Forecast – By Technology

- 8.2.1. Radio-frequency identification

- 8.2.2. Barcodes

- 8.2.3. Infrared

- 8.2.4. Biometrics

- 8.2.5. Global positioning system

- 8.3. Market Analysis, Insights and Forecast – By Software

- 8.3.1. Enterprise Resource Planning (ERP)

- 8.3.2. Friction welding

- 8.3.3. Laboratory Information Management Software (LIMS)

- 8.3.4. Warehouse software

- 8.3.5. Other

- 8.4. Market Analysis, Insights and Forecast – By Application

- 8.4.1. Beverages

- 8.4.2. Canned Or Bottled Food

- 8.4.3. Meat

- 8.4.4. Vegetables And Fruits (Fresh Produce/Seeds)

- 8.4.5. Dairy Products

- 8.4.6. Fish Or Seafood

- 8.4.7. Poultry

- 8.4.8. Others

- 8.5. Market Analysis, Insights and Forecast – By Country

- 8.5.1. China

- 8.5.2. India

- 8.5.3. Japan

- 8.5.4. Australia

- 8.5.5. South East Asia

- 8.5.6. Rest of Asia Pacific

9. Latin America, Middle East and Africa Food Traceability Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 9.1. Key Findings / Summary

- 9.2. Market Analysis, Insights and Forecast – By Technology

- 9.2.1. Radio-frequency identification

- 9.2.2. Barcodes

- 9.2.3. Infrared

- 9.2.4. Biometrics

- 9.2.5. Global positioning system

- 9.3. Market Analysis, Insights and Forecast – By Software

- 9.3.1. Enterprise Resource Planning (ERP)

- 9.3.2. Friction welding

- 9.3.3. Laboratory Information Management Software (LIMS)

- 9.3.4. Warehouse software

- 9.3.5. Other

- 9.4. Market Analysis, Insights and Forecast – By Application

- 9.4.1. Beverages

- 9.4.2. Canned Or Bottled Food

- 9.4.3. Meat

- 9.4.4. Vegetables And Fruits (Fresh Produce/Seeds)

- 9.4.5. Dairy Products

- 9.4.6. Fish Or Seafood

- 9.4.7. Poultry

- 9.4.8. Others

- 9.5. Market Analysis, Insights and Forecast – By Country

- 9.5.1. Brazil

- 9.5.2. Saudi Arabia

- 9.5.3. UAE

- 9.5.4. Rest of LAMEA

10. Competitive Analysis

- 10.1. Company Market Share Analysis, 2018

- 10.2. Key Industry Developments

- 10.3. Company Profile

- 10.4. IBM Corp.

- 10.4.1. Business Overview

- 10.4.2. Segment 1 & Service Offering

- 10.4.3. Overall Revenue

- 10.4.4. Geographic Presence

- 10.4.5. Recent Development

- 10.5. A2B Tracking Solutions

- 10.6. Motorola Solutions, Inc.

- 10.7. Picarro Inc.

- 10.8. Barcoding Inc.

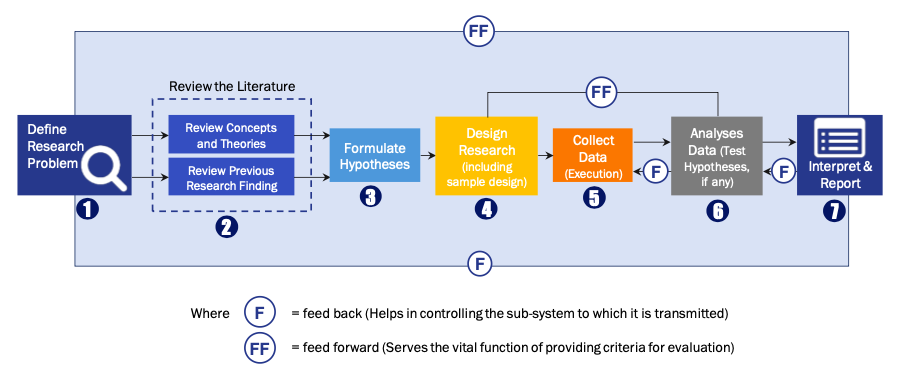

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model