A glucose tolerance measures how well body’s cells is capable to absorb glucose, sugar, after patient consume given amount of sugar. Specialists and doctor use fasting blood sugar and haemoglobin A1C values to detect type I and type II diabetes, and the pre-diabetes whereas glucose tolerance exam can be used. Doctors primarily use glucose tolerance test to diagnose the gestational diabetes in patients.

The aspects that are expected to propel growth of global glucose tolerance test market include growing prevalence and occurrence of diabetes mellitus (DM), novelty in technology, investigation funding in diabetes treatment and diagnosis, and rising awareness and screening for the diabetes mellitus. Though, the stringent reimbursement and the insurance policies in various developing nations, coupled with high-cost of diagnosis and treatment of diabetes are expected to hamper the market development in coming future.

Segment Overview

Rising incidence and prevalence of diabetes mellitus, research funding in the diabetes diagnosis and treatment, technological innovations, and the awareness and screening for diabetes mellitus are factors that propels the growth of market. For instance, As per WHO, in 2016, almost 1.6 million deaths were caused by diabetes globally. Also, according to diabetes prevalence figures proposed by Australian Bureau of Statistics, over than 5.1% of Australian population diagnosed with the diabetes in 2016.

Many government and private associations in the developed and developing countries are contributing towards the diabetes prevention and research programs. Numerous researchers have founded new devices to treat and diagnose diabetes that on their own have noteworthy market potential. The foremost aim of these organizations is to encourage and support research in field of diabetes with rapid diffusion of assimilated knowledge to facilitate application. The expenditure on the diabetes care research eventually leads to healthcare delivery.

Regional Overview

The North America is likely to rule the market owing to the increasing prevalence of the diabetes mellitus, well-developed technology, and also high healthcare expenditure. As per the American Diabetes Association, closely 30 million Americans are currently dealing with diabetes and each 21 seconds one individual is diagnosed with the disease.

The European market has been the second largest market for the glucose tolerance Test. The Europe has been further divided into Germany, Italy, Spain, France, UK, and the rest of Europe. Europe holds second largest market share owing to the increasing administration support for research and development, strong healthcare infrastructure, and the presence of geriatric population.

Competitor overview

In Jan 2016, company, Panasonic Healthcare Holdings, Co., Ltd declared completion of Panasonic Healthcare’s acquisition of the Bayer AG’s Diabetes Care business.

In Sep 2016, market leader, Abbott received approval from U.S. Food and Drug Administration for FreeStyle Libre Pro system.

Key Players

- Panasonic,

- Dexcom, Inc.,

- Abbott Laboratories,

- F. Hoffman-La Roche Ltd,

- LifeScan, Inc.,

- Sanofi, Medtronic PLC,

Market Segmentation

By Type

- Blood Glucose Testing Kit

- Others

- Diabetes

- Insulin Resistance

- Gestational Diabetes

- Reactive Hypoglycaemia

- Diagnostic Clinics

- Home

- Hospitals

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- UAE

- Rest of LAMEA

1 Report Prologue 11

2 Introduction 14

- 2.1 Research Objective 14

- 2.2 Assumptions & Limitations 14

- 2.2.1 Assumptions 14

- 2.2.2 Limitations 14

- 2.3 Market Structure 15

3 Research Methodology 16

- 3.1 Research Process 16

- 3.2 Primary Research 17

- 3.3 Secondary Research 17

- 3.4 Market Size Estimation 18

- 3.4.1 Trade Analysis 19

- 3.4.2 Market Pricing Approach 19

4 Market Dynamics 20

- 4.1 Drivers 20

- 4.1.1 Increasing prevalence and incidence of diabetes mellitus (DM) 20

- 4.1.2 Rise in technological innovations 21

- 4.1.3 Research funding in diabetes diagnosis and treatment 22

- 4.1.4 Rising awareness and screening for Diabetes Mellitus 23

- 4.2 Restraints 24

- 4.2.1 Stringent reimbursement and insurance policies in developing nations, can hamper the market growth in coming future 24

- 4.2.2 High cost associated with diagnosis and treatment of diabetes 25

- 4.3 Opportunities 26

- 4.4 Macroeconomic Indicators 27

5 Market Factor Analysis 28

- 5.1 Porter’s Five Forces Model 28

- 5.1.1 Bargaining Power of Suppliers 29

- 5.1.2 Bargaining Power of Buyers 29

- 5.1.3 Threat of New Entrants 29

- 5.1.4 Threat of Substitutes 29

- 5.1.5 Intensity of Rivalry 30

- 5.2 Value Chain Analysis 30

- 5.2.1 Raw Material 30

- 5.2.2 Supplier 31

- 5.2.3 Manufacturer 33

- 5.2.4 Distributer 33

- 5.2.5 Customer 34

- 5.2.6 Consumer 34

- 5.3 Demand & Supply: Gap Analysis 35

6 Global Glucose Tolerance Test Market By Products 36

- 6.1 Introduction 36

- 6.2 Blood glucose testing kit 38

- 6.3 Smart sensors 38

7 Global Glucose Tolerance Test Market By Indication 39

- 7.1 Introduction 39

- 7.2 Diabetes 41

- 7.3 Gestational diabetes 41

- 7.4 Insulin resistance 42

- 7.5 Reactive hypoglycemia 42

8 Global Glucose Tolerance Test Market By End Users 43

- 8.1 Introduction 43

- 8.2 Diagnostic Clinics 44

- 8.3 Hospitals 45

- 8.4 Home 45

9 Global Glucose Tolerance Test Market By Regions 46

- 9.1 Introduction 46

- 9.2 Americas 47

- 9.2.1 North America 50

- 9.2.1.1 US 51

- 9.2.1.2 Canada 53

- 9.2.2 South America 54

- 9.2.1 North America 50

- 9.3 Europe 56

- 9.3.1 Western Europe 58

- 9.3.1.1 Germany 60

- 9.3.1.2 France 61

- 9.3.1.3 Italy 63

- 9.3.1.4 Spain 64

- 9.3.1.5 UK 66

- 9.3.1.6 Rest of Western Europe 67

- 9.3.1.7 Eastern Europe 69

- 9.3.1 Western Europe 58

- 9.4.1 China 73

- 9.4.2 India 74

- 9.4.3 Japan 76

- 9.4.4 South Korea 78

- 9.4.5 Australia 79

- 9.4.6 Rest of Asia Pacific 81

- 9.5.1 UAE 85

- 9.5.2 Saudi Arabia 86

- 9.5.3 Oman 88

- 9.5.4 Kuwait 89

- 9.5.5 Qatar 91

- 9.5.6 Rest of Middle East & Africa 92

10 Competitive Landscape 94

- 10.1 Introduction 94

11 Company Profile 95

- 11.1 Panasonic 95

- 11.1.1 Company Overview 95

- 11.1.2 Financials 95

- 11.1.3 Products 95

- 11.1.4 Strategy 95

- 11.1.5 Key Developments 95

- 11.2 Dexcom, Inc. 96

- 11.2.1 Company Overview 96

- 11.2.2 Financials 96

- 11.2.3 Products 96

- 11.2.4 Strategy 96

- 11.2.5 Key Developments 96

- 11.3 Abbott Laboratories 97

- 11.3.1 Company Overview 97

- 11.3.2 Financials 97

- 11.3.3 Products 97

- 11.3.4 Strategy 97

- 11.3.5 Key Developments 97

97

- 11.4 F. Hoffman-La Roche Ltd 98

- 11.4.1 Company Overview 98

- 11.4.2 Financials 98

- 11.4.3 Products 98

- 11.4.4 Strategy 98

- 11.4.5 Key Developments 98

- 11.5 LifeScan, Inc. 99

- 11.5.1 Company Overview 99

- 11.5.2 Financials 99

- 11.5.3 Products 99

- 11.5.4 Strategy 99

- 11.5.5 Key Developments 99

- 11.6 Sanofi 100

- 11.6.1 Company Overview 100

- 11.6.2 Financials 100

- 11.6.3 Products 100

- 11.6.4 Strategy 100

- 11.6.5 Key Developments 100

- 11.7 Medtronic Plc 101

- 11.7.1 Company Overview 101

- 11.7.2 Financials 101

- 11.7.3 Products 101

- 11.7.4 Strategy 101

- 11.7.5 Key Developments 101

12 Conclusion 102

- 12.1 Key Findings 102

- 12.1.1 From CEO’s View Point 102

- 12.2 Key companies to watch 102

13 Appendix 103

- 13.1 Discussion Blue Print 103

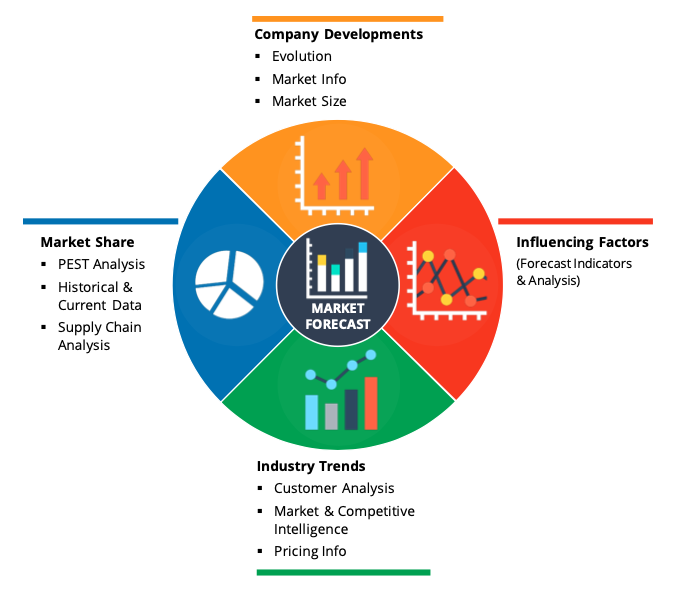

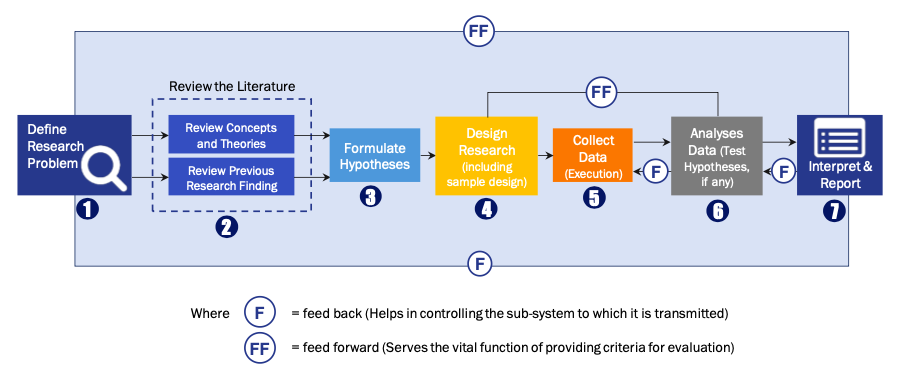

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model