The health insurance market trends is accelerating in rural areas at a quicker rate because it offers varied advantages like reimbursing the insured person’s ill health treatment price and paying a payment quantity in prolonged case. Additionally, customers in rural areas are additional conscious of health insurance comprehensive coverages, like in-patient hospitalization expense, pre-hospitalization & post-hospitalization expenses, automobile expenditures, and lodging hospitalization prices, that drives the market growth. Moreover, doctors and academics in rural areas have accrued the attention of insurance policy that is propellant the expansion of the insurance market. Moreover, government organizations, like bank and co-operative bank, play a major role to extend the penetration of health insurance product in rural areas because it delivers cheap insurance policy and streamlines the claim settlement method. Therefore, increase in awareness of insurance in rural areas is propellant the expansion of the market across the world.

Companies providing health insurance have accrued the payment price, because of rise in attention expenses like price of medicines, hospital admission charges, and price of assorted different treatments. Additionally, most of the shoppers across the world are infected with many chronic diseases like heart condition, Alzheimer’s, and polygenic disorder. Attention professionals are imposing Brobdingnag and price for the treatments of such chronic diseases. Therefore, insurance corporations are accountable to deal with large claim settlement price that hinders the market growth.

| Report Metric | Details |

| Market size available for years | 2023–2030 |

| Base year considered | 2023 |

| Forecast period | 2024–2030 |

| Forecast unit | Value (USD Million) |

| Segments covered | Service Provider Type, Type, Network Provider, Age Group, Time Period , and Region |

| Regions covered | North America (the U.S. and Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Rest of Europe), Asia-Pacific (China, India, Japan, Australia, South East Asia, Rest of Asia Pacific), Latin America and the Middle East and Africa (Brazil, Saudi Arabia, UAE, Rest of LAMEA) |

| Companies covered | Aetna Inc. (CVS Health Corporation), AIA Group Limited, Allianz SE, Aviva Plc, Berkshire Hathaway Inc., Cigna Corporation, International Medical Group Inc. (Sirius International Insurance Group Ltd.), Prudential Plc, United Health Group Inc., and Zurich Insurance Group AG. |

The covid-19 Impact on Health Insurance Market:

Like several different industries, COVID-19 badly knocked the electronic and semiconductor trade. This new event has compact nearly 230 countries in exactly a couple of weeks, leading to the forced conclusion of producing and transportation activities at intervals and across the countries. This has directly affected the expansion of the sector. It's calculable that COVID-19 to depart over USD thirty billion impacts on the physics and semiconductor trade. The arena is majorly affected thanks to transport restrictions on major physics and semiconductor staple suppliers. However, the rising want for semiconductors in many industries can supply fast market recovery over the longer-term amount.

Health Insurance Market Segment Overview

By Service Provide Service Provider Type, The private segment within the led market was valued at around USD one. Personal insurance policies give additional facilities to families against unexpected or accidental medical conditions.

By Type, The health insurance market for medical insurance segment accounted impelled by the rising awareness among the population relating to health insurance. In developing countries, governments have launched initiatives relating to women's health. In addition, sure medical policies provide cashless claim benefits which will more propel the industry demand.

By Network Provider, The preferred provider organization (PPO) segment within the health insurance market .This can increase the acceptance rate, thereby supplementing the section expansion. Moreover, within the PPO plan, less work is needed that may additional foster the business price of insurance.

By Age Group, Increasing prevalence of lifestyle diseases among adults can spur the market progression.

By Time Period, High preference for life insurance among the population can fuel the market expansion

Market Analysis, Insights and Forecast – By Service Provider Type

· Private

· Public

Market Analysis, Insights and Forecast – By Type

· Hospitalization Insurance

· Critical Illness Insurance

· Income Protection Insurance

· Medical Insurance

Market Analysis, Insights and Forecast – By Network Provider

· Health Maintenance Organization [HMO]

· Preferred Provider Organization [PPO]

· Exclusive Provider Organization [EPO]

· Others

Market Analysis, Insights and Forecast – By Age-group

· Minors

· Adults

· Senior Citizens

Market Analysis, Insights and Forecast – By Time Period

· Life Insurance

· Term Insurance

Health Insurance Market Regional Overview

Region-wise, in terms of regions, North America is predicted to dominate the market and exhibit a CAGR over the forecast amount. This can be attributed to the employment of analytic software in industries of media, retail, oil & gas, mining, and others. The info has been used in influencing selections bearing on the acquisition of the latest technology or upgrades in infrastructure.

Health Insurance Market, By Geography

· North America (US & Canada)

· Europe (UK, Germany, France, Italy, Spain, & Rest of Europe)

· Asia-Pacific (Japan, China, India, Australia, & South Korea, & Rest of Asia-Pacific)

· LAMEA (Brazil, Saudi Arabia, UAE & Rest of LAMEA)

Health Insurance Market Competitor overview

Some key developments and strategies adopted by manufacturers in the Health Insurance are highlighted below.

· In 2021, ICICI prudential life insurance tied up with the National Payments Corporation of India (NPCI) to provide a unified payments interface autopay.

Health Insurance Market, Key Players

· AETNA INC.

· AIA GROUP LIMITED

· ALLIANZ

· ASSICURAZIONI GENERALI S.P.A.

· AVIVA

· AXA

· CIGNA

· PING AN INSURANCE (GROUP) COMPANY OF CHINA, LTD.

· UNITEDHEALTH GROUP

· ZURICH

Frequently Asked Questions (FAQ) :

Q1. What is the total CAGR expected to be recorded for the Health Insurance market during the forecast period?

Q2. Which segment is projected to hold the largest share in the Health Insurance Market?

Q3. What are the driving factors for the Health Insurance market?

Q4. Which Segments are covered in the Health Insurance market report?

Q5. Which are the prominent players offering Health Insurance?

1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

2. Executive Summary

3. Market Dynamics

- 3.1. Market Drivers

- 3.2. Market Restraints

- 3.3. Market Opportunities

4. Key Insights

- 4.1. Key Emerging Trends – For Major Countries

- 4.2. Latest Technological Advancement

- 4.3. Regulatory Landscape

- 4.4. Industry SWOT Analysis

- 4.5. Porters Five Forces Analysis

5. Global Health Insurance Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 5.1. Key Findings / Summary

- 5.2. Market Analysis, Insights and Forecast – By Service Provider Type

- 5.2.1. Private

- 5.2.2. Public

- 5.3. Market Analysis, Insights and Forecast – By Type

- 5.3.1. Hospitalization Insurance

- 5.3.2. Critical Illness Insurance

- 5.3.3. Income Protection Insurance

- 5.3.4. Medical Insurance

- 5.4. Market Analysis, Insights and Forecast – By Network Provider

- 5.4.1. Health Maintenance Organization [HMO]

- 5.4.2. Preferred Provider Organization [PPO]

- 5.4.3. Exclusive Provider Organization [EPO]

- 5.4.4. Others

- 5.5. Market Analysis, Insights and Forecast – By Age Group

- 5.5.1. Minors

- 5.5.2. Adults

- 5.5.3. Senior Citizens

- 5.6. Market Analysis, Insights and Forecast – By Time Period

- 5.6.1. Life Insurance

- 5.6.2. Term Insurance

- 5.7. Market Analysis, Insights and Forecast – By Region

- 5.7.1. North America

- 5.7.2. Europe

- 5.7.3. Asia Pacific

- 5.7.4. Latin America, Middle East, and Africa

6. North America Health Insurance Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 6.1. Key Findings / Summary

- 6.2. Market Analysis, Insights and Forecast – By Service Provider Type

- 6.2.1. Private

- 6.2.2. Public

- 6.3. Market Analysis, Insights and Forecast – By Type

- 6.3.1. Hospitalization Insurance

- 6.3.2. Critical Illness Insurance

- 6.3.3. Income Protection Insurance

- 6.3.4. Medical Insurance

- 6.4. Market Analysis, Insights and Forecast – By Network Provider

- 6.4.1. Health Maintenance Organization [HMO]

- 6.4.2. Preferred Provider Organization [PPO]

- 6.4.3. Exclusive Provider Organization [EPO]

- 6.4.4. Others

- 6.5. Market Analysis, Insights and Forecast – By Age Group

- 6.5.1. Minors

- 6.5.2. Adults

- 6.5.3. Senior Citizens

- 6.6. Market Analysis, Insights and Forecast – By Time Period

- 6.6.1. Life Insurance

- 6.6.2. Term Insurance

- 6.7. Market Analysis, Insights and Forecast – By Country

- 6.7.1. U.S.

- 6.7.2. Canada

7. Europe Health Insurance Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 7.1. Key Findings / Summary

- 7.2. Market Analysis, Insights and Forecast – By Service Provider Type

- 7.2.1. Private

- 7.2.2. Public

- 7.3. Market Analysis, Insights and Forecast – By Type

- 7.3.1. Hospitalization Insurance

- 7.3.2. Critical Illness Insurance

- 7.3.3. Income Protection Insurance

- 7.3.4. Medical Insurance

- 7.4. Market Analysis, Insights and Forecast – By Network Provider

- 7.4.1. Health Maintenance Organization [HMO]

- 7.4.2. Preferred Provider Organization [PPO]

- 7.4.3. Exclusive Provider Organization [EPO]

- 7.4.4. Others

- 7.5. Market Analysis, Insights and Forecast – By Age Group

- 7.5.1. Minors

- 7.5.2. Adults

- 7.5.3. Senior Citizens

- 7.6. Market Analysis, Insights and Forecast – By Time Period

- 7.6.1. Life Insurance

- 7.6.2. Term Insurance

- 7.7. Market Analysis, Insights and Forecast – By Country

- 7.7.1. UK

- 7.7.2. Germany

- 7.7.3. France

- 7.7.4. Italy

- 7.7.5. Spain

- 7.7.6. Russia

- 7.7.7. Rest of Europe

8. Asia Pacific Health Insurance Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 8.1. Key Findings / Summary

- 8.2. Market Analysis, Insights and Forecast – By Service Provider Type

- 8.2.1. Private

- 8.2.2. Public

- 8.3. Market Analysis, Insights and Forecast – By Type

- 8.3.1. Hospitalization Insurance

- 8.3.2. Critical Illness Insurance

- 8.3.3. Income Protection Insurance

- 8.3.4. Medical Insurance

- 8.4. Market Analysis, Insights and Forecast – By Network Provider

- 8.4.1. Health Maintenance Organization [HMO]

- 8.4.2. Preferred Provider Organization [PPO]

- 8.4.3. Exclusive Provider Organization [EPO]

- 8.4.4. Others

- 8.5. Market Analysis, Insights and Forecast – By Age Group

- 8.5.1. Minors

- 8.5.2. Adults

- 8.5.3. Senior Citizens

- 8.6. Market Analysis, Insights and Forecast – By Time Period

- 8.6.1. Life Insurance

- 8.6.2. Term Insurance

- 8.7. Market Analysis, Insights and Forecast – By Country

- 8.7.1. China

- 8.7.2. India

- 8.7.3. Japan

- 8.7.4. Australia

- 8.7.5. South East Asia

- 8.7.6. Rest of Asia Pacific

9. Latin America, Middle East, and Africa Health Insurance Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 9.1. Key Findings / Summary

- 9.2. Market Analysis, Insights and Forecast – By Service Provider Type

- 9.2.1. Private

- 9.2.2. Public

- 9.3. Market Analysis, Insights and Forecast – By Type

- 9.3.1. Hospitalization Insurance

- 9.3.2. Critical Illness Insurance

- 9.3.3. Income Protection Insurance

- 9.3.4. Medical Insurance

- 9.4. Market Analysis, Insights and Forecast – By Network Provider

- 9.4.1. Health Maintenance Organization [HMO]

- 9.4.2. Preferred Provider Organization [PPO]

- 9.4.3. Exclusive Provider Organization [EPO]

- 9.4.4. Others

- 9.5. Market Analysis, Insights and Forecast – By Age Group

- 9.5.1. Minors

- 9.5.2. Adults

- 9.5.3. Senior Citizens

- 9.6. Market Analysis, Insights and Forecast – By Time Period

- 9.6.1. Life Insurance

- 9.6.2. Term Insurance

- 9.7. Market Analysis, Insights and Forecast – By Country

- 9.7.1. Brazil

- 9.7.2. Saudi Arabia

- 9.7.3. UAE

- 9.7.4. Rest of LAMEA

10. Competitive Analysis

- 10.1. Company Market Share Analysis, 2018

- 10.2. Key Industry Developments

- 10.3. Company Profile

- 10.4. AETNA INC.

- 10.4.1. Business Overview

- 10.4.2. Segment 1 & Service Offering

- 10.4.3. Overall Revenue

- 10.4.4. Geographic Presence

- 10.4.5. Recent Development

- 10.5. AIA GROUP LIMITED

- 10.6. ALLIANZ

- 10.7. ASSICURAZIONI GENERALI S.P.A.

- 10.8. AVIVA

- 10.9. AXA

- 10.10. CIGNA

- 10.11. PING AN INSURANCE (GROUP) COMPANY OF CHINA, LTD.

- 10.12. UNITEDHEALTH GROUP

- 10.13. ZURICH

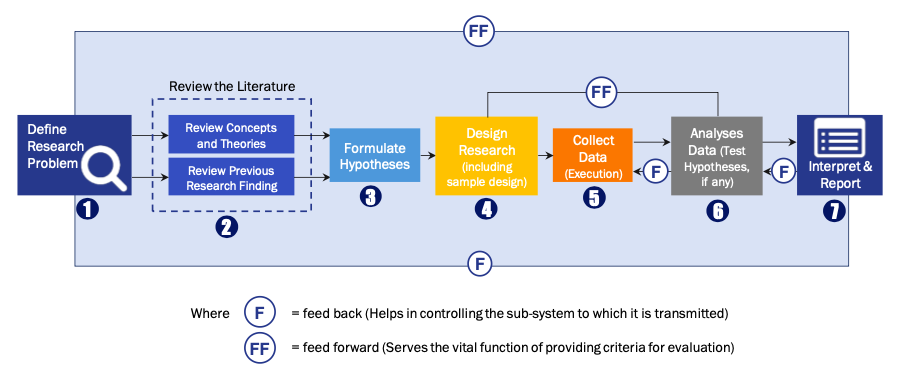

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model