The global real time health monitoring devices market is rising at tremendous rate. Need to have a programmed flow of data between the patients and the healthcare professional’s forms base of growth in this market. Increasing demand for integration of various health monitoring devices in healthcare and medical sector is creating a productive opportunities for the market.

The growth can be attributed to the ability of the devices in field of flexible monitoring and management providing the real-time analysis of patient’s health parameters proficiently. Rising population, growing awareness and inclination towards keeping good health with the augmenting uptake of such devices fuelled by improving conditions and growing influence of the media industry; such factors are promoting the market growth to quite an extent. GetWellNetwork, acquired HealthLoop in November 2018, with incorporating around 7.2 million patient communications annually and evaluating risks in real time. Later proactively helps the patients intervening before escalation of any cost and complications. Moreover, it enables over 80,000 digitized general practitioner visits every month. The strategic initiatives is expected to expand the GetWellNetwork’s reach to over 700 care providers.

Segment Overview

Nokia re-launched entire Withings portfolio of digital health devices under Nokia brand, the company declared the same at Mobile World Congress (MWC) in Sept 2017, in Barcelona.

In May-2016, Fitbit, Inc., leader in fitness and connected health market, acquired the wearable payment assets of Coin, Silicon Valley financial technology and consumer Electronics Company. The deal comprises intellectual property and key personnel specific to the Coin’s wearable payment platform. The acquisition accelerated the Fitbit’s ability to develop active NFC payment solution which could be embedded into the future Fitbit devices, widening its smart capabilities. The strategic move excluded the smart payment products, including Coin 2.0.

Regional Overview

North America leads the market owing to the factors such as increasing diseases management for growing geriatric population. Furthermore, presence of developed economies such as Canada and the U.S. provides technological backgrounds for market growth.

Europe holds second largest market. The continuous need to reduce healthcare costs and increase patient health management for ageing population has led to adoption of the devices in this region. The Asia Pacific region is likely to be the fastest growing region. The Middle East and Africa held the least share of the market.

Competitor overview

In 2016, giant GE Healthcare acquired the company Biosafe Group that supplied integrated cell bioprocessing systems for regenerative medicine industry and cell therapy, for an undisclosed sum. The acquisition was aimed at expanding GE Healthcare’s ecosystem of solutions, products, and services for cell therapy customers and also at expanding Company’s reach to number of new cell as well as therapy types.

In October-2017, Company named Qualcomm, along with the Netgear, and Australian carrier Telstra, Ericsson, announced the launch of first product to support the gigabit LTE, mobile hotspot. Hotspot makes use of range of technologies to hit the high speeds, including the carrier aggregation. It runs on the Telstra’s current LTE networks.

Key Players

- GE Healthcare

- Qualcomm

- Jawbone Inc.

- Withings SA

- Fitbit Inc.

- Garmin Ltd.

- Omron Corporation

- Airstrip Technologies

- AT&T Inc.

- Athenahealth, Inc.

- St. Jude Medical

- Phillips Healthcare

By Type

- Comprises Wearable Devices

- Home Health Medical Devices

- Others

- Specialty Centers

- Hospitals & Clinics

- Ambulatory Centers

- Homecare Settings

- Others

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- UAE

- Rest of LAMEA

1 Introduction 10

- 1.1 Scope of Study 10

- 1.2 Research Objective 10

- 1.3 Assumptions & Limitations 11

- 1.3.1 Assumptions 11

- 1.3.2 Limitations 11

- 1.4 Market Structure 11

2 Research Methodology 12

- 2.1 Primary Research 13

- 2.2 Secondary Research 13

3 Market Dynamics 14

- 3.1 Introduction 14

- 3.2 Drivers 15

- 3.2.1 Increasing use of Smartphones and wearable devices into healthcare 15

- 3.2.2 Cost effectiveness and Patients’ Convenience to use these devices 15

- 3.2.3 Increased Usage Of Smart Devices For Health Management 16

- 3.3 Restraints 17

- 3.3.1 Lack of Awareness about the possible applications of real time health monitoring devices 17

- 3.3.2 Reluctance to share information regarding the health 17

- 3.4 Opportunities 18

- 3.4.1 Growing partnership between the companies has become the entrance gateway for new firms 18

- 3.4.2 Introduction of real time health monitoring device in developing economies will boost the growth of these device 18

- 3.5 Challenges 19

- 3.5.1 Low rate of literacy and language barriers in low- and middle-income countries (LMICs) is a big challenge for the real time health monitoring device solutions 19

- 3.5.2 Potential risk of Hardware or Software failure will barred the growth of the market 19

4 Market Factor Analysis 20

- 4.1 Real Time Health Monitoring Device: Porter’s Five Force Analysis 20

- 4.1.1 Threat from a New Entrant 22

- 4.1.2 Bargaining Power of Supplier 22

- 4.1.3 Threat from substitute 22

- 4.1.4 Bargaining Power of Buyer 22

- 4.1.5 Intensity of Competitive Rivalry 23

- 4.2 Value Chain Analysis 24

- 4.2.1 Device Manufacturers 25

- 4.2.2 App Developers 25

- 4.2.3 Network providers/ Mobile operators 25

- 4.2.4 Healthcare providers and Pharmaceuticals 25

- 4.2.5 Patients 26

5 Global Real Time Health Monitoring Devices Market, By Type 27

- 5.1 Introduction 27

- 5.2 Wearable Devices 29

- 5.2.1 Fitness Bands 30

- 5.2.2 Head Bands 30

- 5.2.3 Smart Watch 31

- 5.2.4 Smart Clothing 31

- 5.2.5 Others 32

- 5.3 Home Health Medical Devices 33

- 5.3.1 Blood Pressure Monitors 35

- 5.3.2 Glucometers 35

- 5.3.3 Pulse Oximeters 36

- 5.3.4 Other Medical Devices 36

6 Global Real Time Health Monitoring Devices Market, By End User 37

- 6.1 Introduction 37

- 6.1.1 Hospitals 38

- 6.1.2 Clinics 39

- 6.1.3 Ambulatory Centers 40

- 6.1.4 Home Settings 41

7 Global Real Time Health Monitoring Devices Market, By Region 42

- 7.1 Introduction 42

- 7.1.1 North America 43

- 7.1.2 U.S. 47

- 7.1.3 Canada 49

- 7.2 Europe 51

- 7.2.1 Germany 54

- 7.2.2 France 56

- 7.2.3 U.K. 58

- 7.2.4 Italy 60

- 7.2.5 Spain 62

- 7.2.6 Rest of Europe 64

- 7.3 Asia-Pacific 66

- 7.3.1 Japan 69

- 7.3.2 China 71

- 7.3.3 India 73

- 7.3.4 Australia 75

- 7.3.5 Republic of Korea 77

- 7.3.6 Rest of Asia-Pacific 79

- 7.4 Middle East & Africa 81

- 7.4.1 UAE 84

- 7.4.2 Africa 86

- 7.4.3 Rest of Middle East 88

8 Competitive Landscape 90

- 8.1 Introduction 90

9 Company Profile 91

- 9.1 GE Healthcare 91

- 9.1.1 Company Overview 91

- 9.1.2 Product/Business Segment Overview 91

- 9.1.3 Financial Overview 92

- 9.1.4 Key Development 93

- 9.1.5 SWOT Analysis 94

- 9.2 Qualcomm 95

- 9.2.1 Company Overview 95

- 9.2.2 Product/Business Segment Overview 95

- 9.2.3 Financial Overview 95

- 9.2.4 Key Development 96

- 9.2.5 SWOT Analysis 97

- 9.3 Jawbone, Inc. 98

- 9.3.1 Overview 98

- 9.3.2 Product/Business Segment Overview 98

- 9.3.3 Financials 98

- 9.3.4 Key Developments 99

- 9.3.5 SWOT Analysis 100

- 9.4 Withings SA 101

- 9.4.1 Overview 101

- 9.4.2 Product/Business Segment Overview 101

- 9.4.3 Financials 101

- 9.4.4 Key Developments 102

- 9.4.5 SWOT Analysis 103

- 9.5 Fitbit, Inc. 104

- 9.5.1 Overview 104

- 9.5.2 Product/Business Segment Overview 104

- 9.5.3 Financials 104

- 9.5.4 Key Developments 105

- 9.5.5 SWOT Analysis 105

- 9.6 Garmin Ltd. 106

- 9.6.1 Overview 106

- 9.6.2 Product/Business Segment Overview 106

- 9.6.3 Financials 107

- 9.6.4 Key Developments 108

- 9.6.5 SWOT Analysis 109

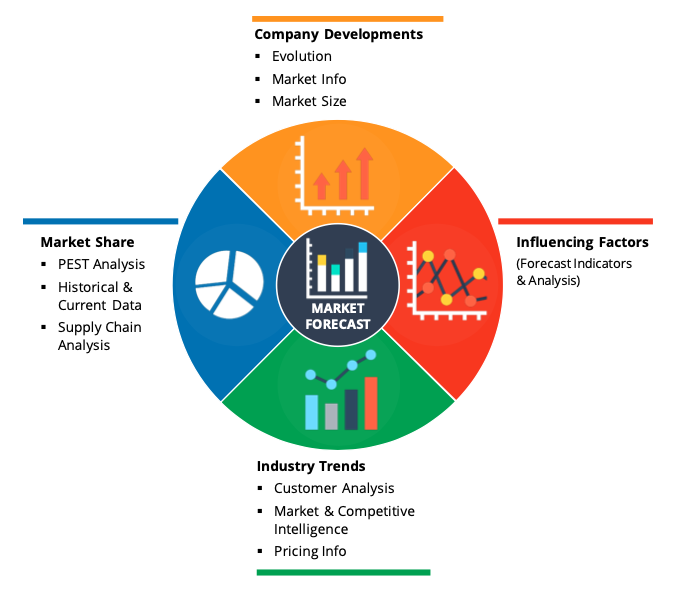

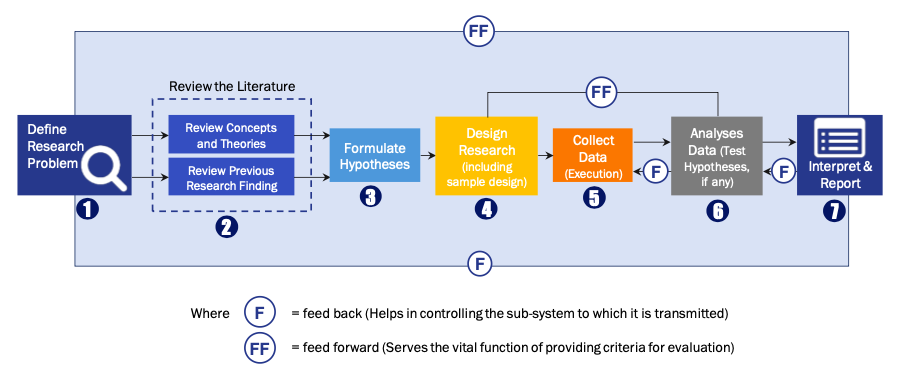

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model