Like many other industries, COVID-19 badly knocked the electronic and semiconductor industries. This unprecedented event has impacted nearly 230 countries in just a few weeks, resulting in the forced shutdown of manufacturing and transportation activities within and across the countries. This has directly affected the overall sector's growth. It is estimated that COVID-19 to leave more than USD 30 billion impacts on the electronics and semiconductor industry. The sector is majorly affected due to transport restrictions on major electronics and semiconductor raw material providers. However, the emerging need for semiconductors in several industries will offer rapid market recovery over the future period.

Silicon Photonics Market Overview

Silicon photonics is a material platform from which photonic integrated circuits can be made. It uses silicon as the main fabrication element. Global Silicon Photonics Market is projected to witness a significant upsurge over the next few years. Some important factors such as vastly increasing internet traffic and cloud computing performance needs for the data center are driving the growth of the silicon photonics market.

Generally, silicon photonics technology uses lasers to transfer data into light pulses. Hence, features such as high density of interconnects, high optical functions integration, low environmental footprint, and low error rate are other noteworthy factors fruitful for the Market’s growth in different end-use industries including healthcare, Telecommunication, military and aerospace, sensors, and others.

On the downside, the key reason for restraining the market’s growth is the high-power consumption of laser devices that generate infrared beams and carry data through them. But, increasing investment in research and development is expected to change the scenario in the forthcoming years.

Silicon Photonics Market Segment Overview

Based on the product, silicon photonics transceivers are likely to hold a major share of the market. This is due to their high integration density, which allows high-speed data transmission, as well as their ability to consume low power. Furthermore, these transceivers can be upgraded to handle higher capacity bandwidth, thus enabling optical modules to handle the data center network speed of up to 100 Gbps, 400 Gbps, and beyond.

As silicon photonics technology has exceeded optical and copper technologies, this fact is encouraged by government and regulatory authorities across the world. Additionally, many market players such as Intel Corporation, IBM Corporation, Cisco Systems, Inc., etc. are significantly investing in silicon photonics to capture a large market share. Moreover, some research institutions are taking efforts for the direct storage of optical information on the optical chips. All these important facts contribute more to the silicon photonics market’s expansion in the coming years.

Silicon Photonics Market Regional Overview

Based on the region, North America is anticipated to dominate the overall market, throughout the forecast period. This is because it is the hub of many technology companies and R&D establishments, it leads to prominent innovations and technological advancements. Other than that, there is a huge and steady flow of financial investment available for research and development from governments and venture entrepreneurs. All these progressing facts remarkably affect the silicon photonics market development in this region.

Silicon Photonics Market Competitor overview

· In June 2021, Sivers Semiconductors AB announced that its subsidiary Sivers Photonics has reached a significant milestone, together with its partners imec and ASM AMICRA. In their joint silicon photonics project, they have successfully managed a wafer-scale integration of indium phosphide (InP) distributed feedback (DFB) lasers from Sivers’ InP100 platform onto imec’s silicon photonics platform (iSiPP). This is a significant achievement since it will boost the adoption of silicon photonics in a wide range of applications from optical interconnects, over LiDAR, to biomedical sensing.

Silicon Photonics Market, Key Players

· Infinera Corporation

· OneChip Photonics Inc.

· NeoPhotonics Corporation

· Mellanox Technologies, Inc.

· Skorpios technologies Inc.

· Cisco Systems, Inc.

· Luxtera, Inc.

· Intel Corporation

· Keopsys Group

· Finisar Corporation

· Hamamatsu Photonics K.K.

· IBM Corporation

· STMicroelectronics N.V.

· Aurrion, Inc.

Silicon Photonics Market Segmentation

Silicon Photonics Market, By Product

· Optical Multiplexers

· Transreceivers

· Active Optic Cables

· Optical Attenuator

· Rf Circuits

· Others

Silicon Photonics Market, By Component

- Active Component

- Optical Waveguide

- Splitters

- Isolators

- Passive Components

- Optical Modulator

- Photo Detector

- Others

· Data Center and High-performance Computing

· Telecommunication

· Military, Defense, and Aerospace

· Medical and Life Science

· Sensing

Silicon Photonics Market, By Region

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East and Africa

- GCC

- South Africa

- Rest of Middle East and Africa

1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

2. Executive Summary

3. Market Dynamics

- 3.1. Market Drivers

- 3.2. Market Restraints

- 3.3. Market Opportunities

4. Key Insights

- 4.1. Key Emerging Trends – For Major Countries

- 4.2. Latest Technological Advancement

- 4.3. Regulatory Landscape

- 4.4. Industry SWOT Analysis

- 4.5. Porters Five Forces Analysis

5. Global Silicon Photonics Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 5.1. Key Findings / Summary

- 5.2. Market Analysis, Insights and Forecast – By Product

- 5.2.1. Optical Multiplexers

- 5.2.2. Transreceivers

- 5.2.3. Active Optic Cables

- 5.2.4. Optical Attenuator

- 5.2.5. Rf Circuits

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast – By Component

- 5.3.1. Active Component

- 5.3.1.1. Optical Waveguide

- 5.3.1.2. Splitters

- 5.3.1.3. Isolators

- 5.3.2. Passive Components

- 5.3.2.1. Optical Modulator

- 5.3.2.2. Photo Detector

- 5.3.2.3. Others

- 5.3.1. Active Component

- 5.4.1. Data Center and High-performance Computing

- 5.4.2. Telecommunication

- 5.4.3. Military, Defense, and Aerospace

- 5.4.4. Medical and Life Science

- 5.4.5. Sensing

- 5.5.1. North America

- 5.5.2. Latin America

- 5.5.3. Europe

- 5.5.4. Asia Pacific

- 5.5.5. Middle East and Africa

6. North America Silicon Photonics Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 6.1. Key Findings / Summary

- 6.2. Market Analysis, Insights and Forecast – By Product

- 6.2.1. Optical Multiplexers

- 6.2.2. Transreceivers

- 6.2.3. Active Optic Cables

- 6.2.4. Optical Attenuator

- 6.2.5. Rf Circuits

- 6.2.6. Others

- 6.3. Market Analysis, Insights and Forecast – By Component

- 6.3.1. Active Component

- 6.3.1.1. Optical Waveguide

- 6.3.1.2. Splitters

- 6.3.1.3. Isolators

- 6.3.2. Passive Components

- 6.3.2.1. Optical Modulator

- 6.3.2.2. Photo Detector

- 6.3.2.3. Others

- 6.3.1. Active Component

- 6.4.1. Data Center and High-performance Computing

- 6.4.2. Telecommunication

- 6.4.3. Military, Defense, and Aerospace

- 6.4.4. Medical and Life Science

- 6.4.5. Sensing

- 6.5.1. U.S.

- 6.5.2. Canada

7. Latin America Silicon Photonics Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 7.1. Key Findings / Summary

- 7.2. Market Analysis, Insights and Forecast – By Product

- 7.2.1. Optical Multiplexers

- 7.2.2. Transreceivers

- 7.2.3. Active Optic Cables

- 7.2.4. Optical Attenuator

- 7.2.5. Rf Circuits

- 7.2.6. Others

- 7.3. Market Analysis, Insights and Forecast – By Component

- 7.3.1. Active Component

- 7.3.1.1. Optical Waveguide

- 7.3.1.2. Splitters

- 7.3.1.3. Isolators

- 7.3.2. Passive Components

- 7.3.2.1. Optical Modulator

- 7.3.2.2. Photo Detector

- 7.3.2.3. Others

- 7.3.1. Active Component

- 7.4.1. Data Center and High-performance Computing

- 7.4.2. Telecommunication

- 7.4.3. Military, Defense, and Aerospace

- 7.4.4. Medical and Life Science

- 7.4.5. Sensing

- 7.5.1. Brazil

- 7.5.2. Mexico

- 7.5.3. Rest of Latin America

8. Europe Silicon Photonics Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 8.1. Key Findings / Summary

- 8.2. Market Analysis, Insights and Forecast – By Product

- 8.2.1. Optical Multiplexers

- 8.2.2. Transreceivers

- 8.2.3. Active Optic Cables

- 8.2.4. Optical Attenuator

- 8.2.5. Rf Circuits

- 8.2.6. Others

- 8.3. Market Analysis, Insights and Forecast – By Component

- 8.3.1. Active Component

- 8.3.1.1. Optical Waveguide

- 8.3.1.2. Splitters

- 8.3.1.3. Isolators

- 8.3.2. Passive Components

- 8.3.2.1. Optical Modulator

- 8.3.2.2. Photo Detector

- 8.3.2.3. Others

- 8.3.1. Active Component

- 8.4.1. Data Center and High-performance Computing

- 8.4.2. Telecommunication

- 8.4.3. Military, Defense, and Aerospace

- 8.4.4. Medical and Life Science

- 8.4.5. Sensing

- 8.5.1. UK

- 8.5.2. Germany

- 8.5.3. France

- 8.5.4. Italy

- 8.5.5. Spain

- 8.5.6. Russia

- 8.5.7. Rest of Europe

9. Asia Pacific Silicon Photonics Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 9.1. Key Findings / Summary

- 9.2. Market Analysis, Insights and Forecast – By Product

- 9.2.1. Optical Multiplexers

- 9.2.2. Transreceivers

- 9.2.3. Active Optic Cables

- 9.2.4. Optical Attenuator

- 9.2.5. Rf Circuits

- 9.2.6. Others

- 9.3. Market Analysis, Insights and Forecast – By Component

- 9.3.1. Active Component

- 9.3.1.1. Optical Waveguide

- 9.3.1.2. Splitters

- 9.3.1.3. Isolators

- 9.3.2. Passive Components

- 9.3.2.1. Optical Modulator

- 9.3.2.2. Photo Detector

- 9.3.2.3. Others

- 9.3.1. Active Component

- 9.4.1. Data Center and High-performance Computing

- 9.4.2. Telecommunication

- 9.4.3. Military, Defense, and Aerospace

- 9.4.4. Medical and Life Science

- 9.4.5. Sensing

- 9.5.1. China

- 9.5.2. India

- 9.5.3. Japan

- 9.5.4. Australia

- 9.5.5. South East Asia

- 9.5.6. Rest of Asia Pacific

10. Middle East & Africa Silicon Photonics Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 10.1. Key Findings / Summary

- 10.2. Market Analysis, Insights and Forecast – By Product

- 10.2.1. Optical Multiplexers

- 10.2.2. Transreceivers

- 10.2.3. Active Optic Cables

- 10.2.4. Optical Attenuator

- 10.2.5. Rf Circuits

- 10.2.6. Others

- 10.3. Market Analysis, Insights and Forecast – By Component

- 10.3.1. Active Component

- 10.3.1.1. Optical Waveguide

- 10.3.1.2. Splitters

- 10.3.1.3. Isolators

- 10.3.2. Passive Components

- 10.3.2.1. Optical Modulator

- 10.3.2.2. Photo Detector

- 10.3.2.3. Others

- 10.3.1. Active Component

- 10.4.1. Data Center and High-performance Computing

- 10.4.2. Telecommunication

- 10.4.3. Military, Defense, and Aerospace

- 10.4.4. Medical and Life Science

- 10.4.5. Sensing

- 10.5.1. GCC

- 10.5.2. South Africa

- 10.5.3. Rest of Middle East & Africa

11. Competitive Analysis

- 11.1. Company Market Share Analysis, 2018

- 11.2. Key Industry Developments

- 11.3. Company Profile

- 11.4. Infinera Corporation

- 11.4.1. Business Overview

- 11.4.2. Segment 1 & Service Offering

- 11.4.3. Overall Revenue

- 11.4.4. Geographic Presence

- 11.4.5. Recent Development

- 11.5. OneChip Photonics Inc.

- 11.6. NeoPhotonics Corporation

- 11.7. Mellanox Technologies, Inc.

- 11.8. Skorpios technologies Inc.

- 11.9. Cisco Systems, Inc.

- 11.10. Luxtera, Inc.

- 11.11. Intel Corporation

- 11.12. Keopsys Group

- 11.13. Finisar Corporation

- 11.14. Hamamatsu Photonics K.K.

- 11.15. IBM Corporation

- 11.16. STMicroelectronics N.V.

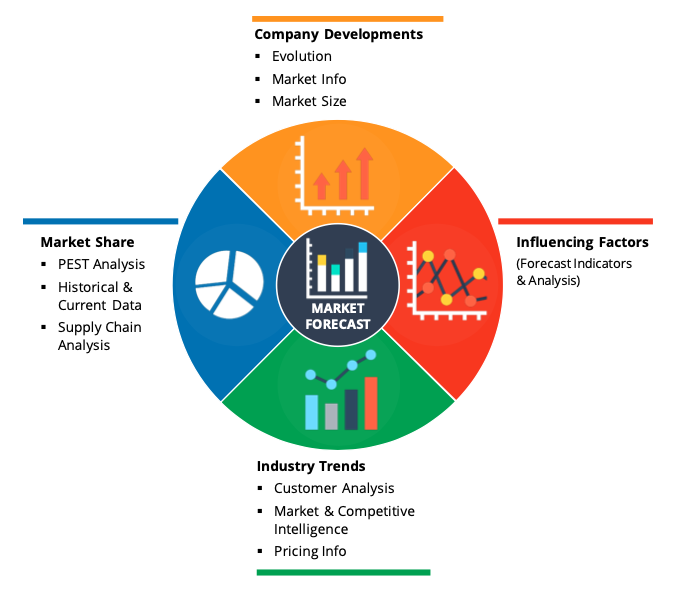

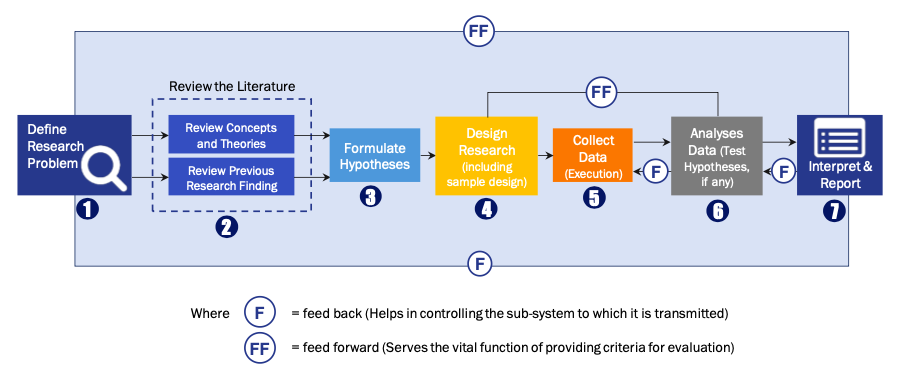

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model