The ongoing COVID-19 pandemic conditions have severely affected every sector around the world. Whereas, the chemicals and materials sectors were moderately affected during the pandemic. This is primarily due to the uncut demand for chemicals for healthcare, life science, and cleaning agents. However, other elements of chemical and material sectors such as paints, industrial oil, construction materials are facing diminution in demand. Strict lockdown resulted in a nearly 50-60% reduction in supply for raw materials, which directly affected the manufacturing process. Further, halt on many end-use industries directly affected the chemical demand all around the world.

Silicone and Silane Market Overview

Silicone is polymer entail of hydrogen, carbon and the other chemicals and used as grease, resin, oil and other in numerous industries such as construction, electronics automobile, medical, and others. Silane is organic compound consists of the multiple or single silicon carbon bond and produced by reaction of the silica sand with the magnesium in presence of hydrochloric acid (Hcl). Silane helps in binding of two compounds composed in different industries.

There has been surge in industrialization in developing region over the prediction period. Additionally, increase in the technological advancement and occurrence of developed infrastructure and the wide application in diverse industries are predictable to contribute growth of the silicone and silane market.

The various other factors include augmented adoption of coating, paints, sealants, adhesives, rubber, and other for numerous purposes with high constancy at maximum temperature and lining or insulation are also anticipated to drive market growth. Though, unstable prices of the raw materials are projected to inhibit growth of the silicone and silane market. Furthermore, augmented demand of electronics and the semiconductors coupled with the untapped opportunities from various sectors are predictable to create plenty opportunities in silicone and silane market over forecast period.

Silicone and Silane Market Segment Overview

Rise in demand of products from emergent end-use sectors, growing number of building project in developing countries and rising infrastructural renovation activities in developed regions are major factors driving silanes and silicones market. The growing demand for coating and paint products from the rising construction sector, rush in demand for numerous adhesives, industrial coatings, and plastic components amongst others and increasing demand for many light-weights, tough plastic components and the tires accelerate silanes and silicones market growth. High use of the products in automotive sector for sustained production operations, high operation of silane gas in the semiconductors and integration of components in electronics industry influence silanes and silicones market.

Silicone and Silane Regional Overview

Asia-Pacific dominates silanes and silicones market because of high demand for the plastic compounds and rubber substrata in automotive, construction, industrial machinery, packaging, and the electrical and electronics industries. The North America is considered to be second largest market due to the growing construction and automotive sectors, development of residential construction and increase in demand for the adhesives and sealants from regional construction.

Silicone and Silane Market Competitor overview

In recent past there have been numerous developments taken place in market and also predictable to takes place in the near future which are supplementary expected to improve overall market growth. For illustration, in Dec 2019, the WACKER has introduced the two anti-misting silicone releasing coatings for vary high-speed coaters. The DEHESIVE 982 AMA provides fast curing, steady release properties and permits good coverage. It is universal product for both the paper and filmic substrates. The DEHESIVE 276 AMA is designed for the paper coating features flat release profile. The product cures with low sums of platinum and so provides high cost presentation for the manufacturers. Additional WACKER highlight during launch is the DEHESIVE PSA 845R, silicone press-sensitive adhesive. The high adhesion, fast curing properties and decent stability, product is ideal for construction of protective films for the electronic products and the high-temperature tapes.

Silicone and Silane Market, Key Players

Silicone and Silane Market Segmentation

Silicone and Silane Market, By Type

Silicone and Silane Market, By End Use

Silicone and Silane market, By Region:

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East and Africa

- GCC

- South Africa

- Rest of Middle East and Africa

1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

2. Executive Summary

3. Market Dynamics

- 3.1. Market Drivers

- 3.2. Market Restraints

- 3.3. Market Opportunities

4. Key Insights

- 4.1. Key Emerging Trends – For Major Countries

- 4.2. Latest Technological Advancement

- 4.3. Regulatory Landscape

- 4.4. Industry SWOT Analysis

- 4.5. Porters Five Forces Analysis

5. Global Silicone and Silane Market Analysis (USD Billion), Insights and Forecast, 2016-2027

- 5.1. Key Findings / Summary

- 5.2. Market Analysis, Insights and Forecast – By Segment 1

- 5.2.1. Sub-Segment 1

- 5.2.2. Sub-Segment 2

- 5.3. Market Analysis, Insights and Forecast – By Segment 2

- 5.3.1. Sub-Segment 1

- 5.3.2. Sub-Segment 2

- 5.3.3. Sub-Segment 3

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast – By Segment 3

- 5.4.1. Sub-Segment 1

- 5.4.2. Sub-Segment 2

- 5.4.3. Sub-Segment 3

- 5.4.4. Others

- 5.5. Market Analysis, Insights and Forecast – By Region

- 5.5.1. North America

- 5.5.2. Latin America

- 5.5.3. Europe

- 5.5.4. Asia Pacific

- 5.5.5. Middle East and Africa

6. North America Silicone and Silane Market Analysis (USD Billion), Insights and Forecast, 2016-2027

- 6.1. Key Findings / Summary

- 6.2. Market Analysis, Insights and Forecast – By Segment 1

- 6.2.1. Sub-Segment 1

- 6.2.2. Sub-Segment 2

- 6.3. Market Analysis, Insights and Forecast – By Segment 2

- 6.3.1. Sub-Segment 1

- 6.3.2. Sub-Segment 2

- 6.3.3. Sub-Segment 3

- 6.3.4. Others

- 6.4. Market Analysis, Insights and Forecast – By Segment 3

- 6.4.1. Sub-Segment 1

- 6.4.2. Sub-Segment 2

- 6.4.3. Sub-Segment 3

- 6.4.4. Others

- 6.5. Market Analysis, Insights and Forecast – By Country

- 6.5.1. U.S.

- 6.5.2. Canada

7. Latin America Silicone and Silane Market Analysis (USD Billion), Insights and Forecast, 2016-2027

- 7.1. Key Findings / Summary

- 7.2. Market Analysis, Insights and Forecast – By Segment 1

- 7.2.1. Sub-Segment 1

- 7.2.2. Sub-Segment 2

- 7.3. Market Analysis, Insights and Forecast – By Segment 2

- 7.3.1. Sub-Segment 1

- 7.3.2. Sub-Segment 2

- 7.3.3. Sub-Segment 3

- 7.3.4. Others

- 7.4. Market Analysis, Insights and Forecast – By Segment 3

- 7.4.1. Sub-Segment 1

- 7.4.2. Sub-Segment 2

- 7.4.3. Sub-Segment 3

- 7.4.4. Others

- 7.5. Insights and Forecast – By Country

- 7.5.1. Brazil

- 7.5.2. Mexico

- 7.5.3. Rest of Latin America

8. Europe Silicone and Silane Market Analysis (USD Billion), Insights and Forecast, 2016-2027

- 8.1. Key Findings / Summary

- 8.2. Market Analysis, Insights and Forecast – By Segment 1

- 8.2.1. Sub-Segment 1

- 8.2.2. Sub-Segment 2

- 8.3. Market Analysis, Insights and Forecast – By Segment 2

- 8.3.1. Sub-Segment 1

- 8.3.2. Sub-Segment 2

- 8.3.3. Sub-Segment 3

- 8.3.4. Others

- 8.4. Market Analysis, Insights and Forecast – By Segment 3

- 8.4.1. Sub-Segment 1

- 8.4.2. Sub-Segment 2

- 8.4.3. Sub-Segment 3

- 8.4.4. Others

- 8.5. Market Analysis, Insights and Forecast – By Country

- 8.5.1. UK

- 8.5.2. Germany

- 8.5.3. France

- 8.5.4. Italy

- 8.5.5. Spain

- 8.5.6. Russia

- 8.5.7. Rest of Europe

9. Asia Pacific Silicone and Silane Market Analysis (USD Billion), Insights and Forecast, 2016-2027

- 9.1. Key Findings / Summary

- 9.2. Market Analysis, Insights and Forecast – By Segment 1

- 9.2.1. Sub-Segment 1

- 9.2.2. Sub-Segment 2

- 9.3. Market Analysis, Insights and Forecast – By Segment 2

- 9.3.1. Sub-Segment 1

- 9.3.2. Sub-Segment 2

- 9.3.3. Sub-Segment 3

- 9.3.4. Others

- 9.4. Market Analysis, Insights and Forecast – By Segment 3

- 9.4.1. Sub-Segment 1

- 9.4.2. Sub-Segment 2

- 9.4.3. Sub-Segment 3

- 9.4.4. Others

- 9.5. Market Analysis, Insights and Forecast – By Country

- 9.5.1. China

- 9.5.2. India

- 9.5.3. Japan

- 9.5.4. Australia

- 9.5.5. South East Asia

- 9.5.6. Rest of Asia Pacific

10. Middle East & Africa Silicone and Silane Market Analysis (USD Billion), Insights and Forecast, 2016-2027

- 10.1. Key Findings / Summary

- 10.2. Market Analysis, Insights and Forecast – By Segment 1

- 10.2.1. Sub-Segment 1

- 10.2.2. Sub-Segment 2

- 10.3. Market Analysis, Insights and Forecast – By Segment 2

- 10.3.1. Sub-Segment 1

- 10.3.2. Sub-Segment 2

- 10.3.3. Sub-Segment 3

- 10.3.4. Others

- 10.4. Market Analysis, Insights and Forecast – By Segment 3

- 10.4.1. Sub-Segment 1

- 10.4.2. Sub-Segment 2

- 10.4.3. Sub-Segment 3

- 10.4.4. Others

- 10.5. Market Analysis, Insights and Forecast – By Country

- 10.5.1. GCC

- 10.5.2. South Africa

- 10.5.3. Rest of Middle East & Africa

11. Competitive Analysis

- 11.1. Company Market Share Analysis, 2018

- 11.2. Key Industry Developments

- 11.3. Company Profile

- 11.3.1. Company 1

- 11.3.1.1. Business Overview

- 11.3.1.2. Segment 1 & Service Offering

- 11.3.1.3. Overall Revenue

- 11.3.1.4. Geographic Presence

- 11.3.1.5. Recent Development

- 11.3.2. Company 2

- 11.3.3. Company 3

- 11.3.4. Company 4

- 11.3.5. Company 5

- 11.3.6. Company 6

- 11.3.7. Company 7

- 11.3.8. Company 8

- 11.3.9. Company 9

- 11.3.10. Company 10

- 11.3.11. Company 11

- 11.3.12. Company 12

- 11.3.1. Company 1

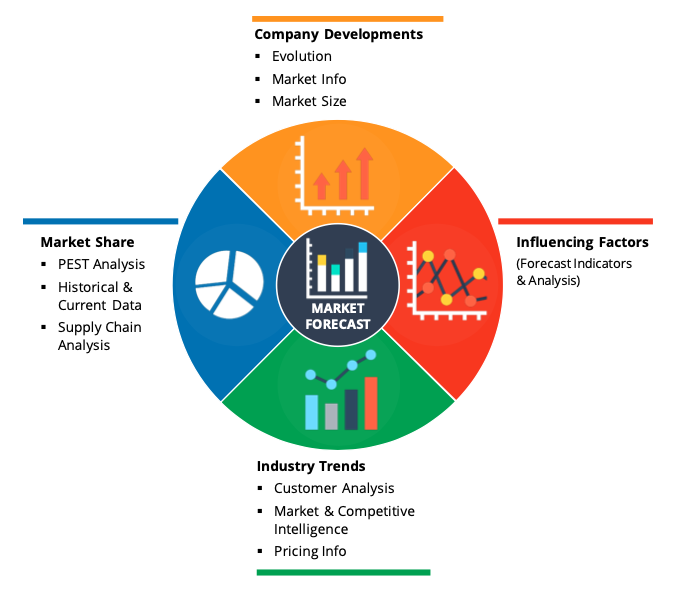

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

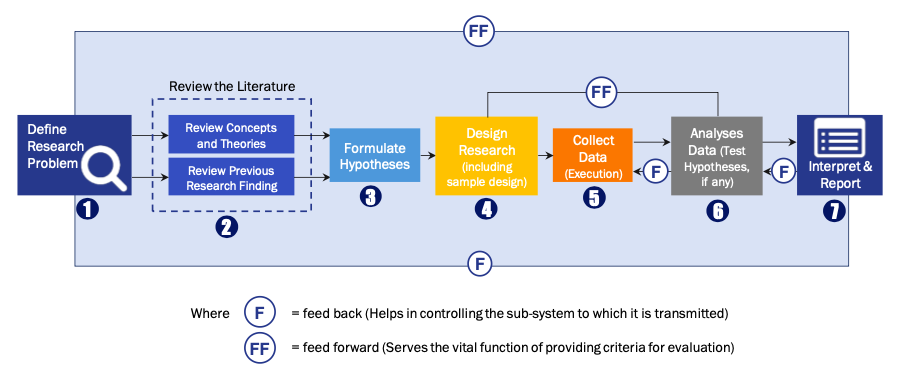

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model