As the COVID-19 pandemic continuing its effect around the world, many defense and aerospace companies are facing its impact during this time around the world. For instance, commercial aviation companies in the U.S., France, Germany, and Canada are facing disruption in the production process and reduced demand as workforces staying at home, passengers stop traveling, and delay in delivery of new aircraft. Analysts expecting a drop from 3,000 to 4,000 aircraft during the pandemic period. On the defense side, contractors operating in the sector are in a better position, hence the impact of the pandemic is likely low in the short to mid-term. However, low demand due to budget constraints affecting the production as in aircraft manufacturing.

Market Overview

The software defined radio market is anticipated to witness considerable growth during forecast period. The idea of software defined radio is quite old, although, in last few years, the market has witnessed important growth due to developments in technology and development of digital electronics. Rise in defense expenditure to improve the defense communication systems is major factor propelling demand for the software defined radio systems. Additionally, market for global SDR has witnessed substantial growth owing to growing need for communication devices to be software configurable and more flexible. Moreover, SDR is extensively adopted in the space communication as increases the performance of satellite and can operate across numerous frequency bands in precise manner. Furthermore, the pandemic COVID 19 is also accepted to have significant impact on the market growth. The economic slowdown as a result of the pandemic will have long term impact over the markets.

SDR allows users to receive signals from several mobile standards such as GSM and WiMAX. To fulfill growing demand for the higher data speed which require additional hardware expenditures on core network, the mobile operators are implementing SDRs. SDR systems help progress connectivity solutions by eradicating hardware constraints. Furthermore, Network Function Virtualization (NFV) and SDR are anticipated to play major role in integration of various communication technologies. 5G radio access is based on the SDR or NFV infrastructure that is another factor propelling the market for SDR systems.

Segment Overview

Based on component, hardware segment dominated market for software defined radio in the year 2019 owing to rising popularity of portable SDRs. Hardware segment is driven by combination of digital technology and analog on single chip, which is major factor contributing to reduction in weight and size. In addition, growing popularity of the field-programmable gate array (FPGA) with combined analog-to-digital converters (ADCs) and the digital-to-analog converters (DACs) drives segment growth.

The software component segment is anticipated to witness important growth owing to growing use in commercial applications. Software in SDR is used to describe its functions and specifications. Software provides improved flexibility for eliminating capacity bottlenecks and network load balancing for the packet-switched core backhaul.

Regional Overview

North America dominated SDR market in 2019, mainly owing to Joint Tactical Networking Center (JTNC) program, that provides technical support for the wireless communication systems to U.S. Department of the Defense. The software defined radio systems are extensively used in defense sector owing to the research programs and the integration of all communication systems in federal and state agencies in North America. In addition, growing funds by U.S. government for developing the next-generation radio of communication systems which are capable of accommodating the X-band frequencies drive demand for the market.

The Asia Pacific market for SDR is expected to witness highest growth over forecast period owing to rise in terrorism in Asian countries including Pakistan, Bangladesh, and Afghanistan. In response, military and intelligence organizations in region are progressively deploying SDR to improve communication systems allowing improved information sharing, secure collaboration, and shared situational analysis. For instance, in Dec 2018, People’s Liberation Army of the China awarded contract to the Elbit Systems Ltd. for CNR-710MB airborne radios. Furthermore, need for enhanced communication by the law enforcement through times of natural calamities drives demand for the market. Furthermore, government funding for the R&D for SDR in countries including China and Australia is anticipated to drive demand for SDR in Asia Pacific.

Competitor overview

Mergers, acquisitions, collaborations and product launches, are some strategies implemented by key players for the business expansion. Furthermore, space research organizations including NASA and European Space Agency (ESA) focus on development of radiation toughened electronic components that can endure high radiations, which are utilized for space signal transmission in the SDR systems. For instance, the NASA, in partnership with Department of Defense (DoD), developed radiation hardened universal purpose processor for the SDR in December 2016.

Key Players

- Collins Aerospace Systems

- Harris Corporation

- Elbit Systems Ltd.

- L3 Technologies, Inc.

- BAE Systems

- Huawei Technologies Co., Ltd.

- Datasoft Corporation

- Raytheon Company

- Northrop Grumman Corporation

Market Segmentation

By Components

- Transmitter

- Receiver

- Software

- Auxiliary System

- VHF

- UHF

- HF

- Airborne

- Land

- Naval

- Space

- Defence

- Commercial

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- UAE

- Rest of LAMEA

1 Executive Summary 16

2 Market Introduction 18

- 2.1 Definition 19

- 2.2 Scope of the Study 19

- 2.3 Market Structure 19

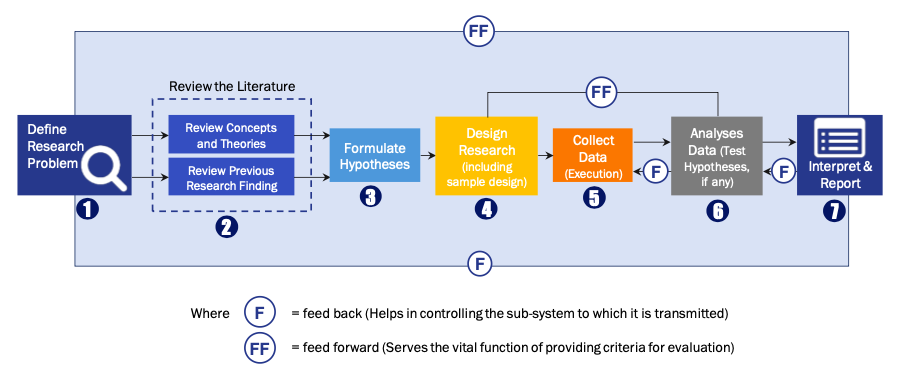

3 Research Methodology 20

- 3.1 Research Process 21

- 3.2 Primary Research 22

- 3.3 Secondary Research 23

- 3.4 Market Size Estimation 24

- 3.5 Forecast Model 24

- 3.6 List of Assumptions 25

4 Market Dynamics 26

- 4.1 Introduction 27

- 4.2 Drivers 28

- 4.2.1 Increase in Military Spending 28

- 4.2.2 Focus on Improving Military Communication System 29

- 4.2.3 Drivers Impact Analysis 30

- 4.3 Restraints 30

- 4.3.1 Security Issues in Software Defined Radio 30

- 4.3.2 Restraints Impact Analysis 30

- 4.4 Opportunity 31

- 4.4.1 Use of Technologically-Advanced Equipment by Military Forces 31

- 4.4.2 Use of SDR in Private Security Services Industry 31

5 Market Factor Analysis 32

- 5.1 Supply Chain 33

- 5.2 Porter’s Five Forces Model 34

- 5.2.1 Threat of New Entrants 34

- 5.2.2 Bargaining Power of Suppliers 34

- 5.2.3 Bargaining Power of Buyers 34

- 5.2.4 Threat of Substitutes 35

- 5.2.5 Rivalry 35

6 Global Software Defined Radio Market, by Component 36

- 6.1 Overview 37

- 6.2 Transmitter 37

- 6.3 Receiver 37

- 6.4 Software 37

- 6.5 Auxiliary System 37

7 Global Software Defined Radio Market, by Frequency Band 39

- 7.1 Overview 40

- 7.2 HF 40

- 7.3 VHF 40

- 7.4 UHF 40

8 Global Software Defined Radio Market, by Platform 42

- 8.1 Overview 43

- 8.2 Land 43

- 8.3 Airborne 43

- 8.4 Naval 43

- 8.5 Space 43

9 Global Software Defined Radio Market, by Application 45

- 9.1 Overview 46

- 9.2 Defense 46

- 9.3 Commercial 46

10 Global Software Defined Radio Market, by Region 47

- 10.1 Overview 48

- 10.2 North America 49

- 10.2.1 US 51

- 10.2.1.1 US by Component 51

- 10.2.1.2 US by Frequency Band 51

- 10.2.1.3 US by Platform 52

- 10.2.1.4 US by Application 52

- 10.2.2 Canada 53

- 10.2.2.1 Canada by Component 53

- 10.2.2.2 Canada by Frequency Band 53

- 10.2.2.3 Canada by Platform 54

- 10.2.2.4 Canada by Application 54

- 10.2.1 US 51

- 10.3.1 Germany 57

- 10.3.1.1 Germany by Component 57

- 10.3.1.2 Germany by Frequency Band 58

- 10.3.1.3 Germany by Platform 58

- 10.3.1.4 Germany by Application 58

- 10.3.2 UK 59

- 10.3.2.1 UK by Component 59

- 10.3.2.2 UK by Frequency Band 59

- 10.3.2.3 UK by Platform 60

- 10.3.2.4 UK by Application 60

- 10.3.3 Russia 61

- 10.3.3.1 Russia by Component 61

- 10.3.3.2 Russia by Frequency Band 61

- 10.3.3.3 Russia by Platform 62

- 10.3.3.4 Russia by Application 62

- 10.3.4 France 63

- 10.3.4.1 France by Component 63

- 10.3.4.2 France by Frequency Band 63

- 10.3.4.3 France by Platform 64

- 10.3.4.4 France by Application 64

- 10.3.5 Rest of Europe 65

- 10.3.5.1 Rest of Europe by Component 65

- 10.3.5.2 Rest of Europe by Frequency Band 65

- 10.3.5.3 Rest of Europe by Platform 66

- 10.3.5.4 Rest of Europe by Application 66

- 10.4.1 China 70

- 10.4.1.1 China by Component 70

- 10.4.1.2 China by Frequency Band 70

- 10.4.1.3 China by Platform 71

- 10.4.1.4 China by Application 71

- 10.4.2 Japan 72

- 10.4.2.1 Japan by Component 72

- 10.4.2.2 Japan by Frequency Band 72

- 10.4.2.3 Japan by Platform 73

- 10.4.2.4 Japan by Application 73

- 10.4.3 India 74

- 10.4.3.1 India by Component 74

- 10.4.3.2 India by Frequency Band 74

- 10.4.3.3 India by Platform 75

- 10.4.3.4 India by Application 75

- 10.4.4 South Korea 76

- 10.4.4.1 South Korea by Component 76

- 10.4.4.2 South Korea by Frequency Band 76

- 10.4.4.3 South Korea by Platform 77

- 10.4.4.4 South Korea by Application 77

- 10.4.5 Rest of Asia-Pacific 78

- 10.4.5.1 Rest of Asia-Pacific by Component 78

- 10.4.5.2 Rest of Asia-Pacific by Frequency Band 78

- 10.4.5.3 Rest of Asia-Pacific by Platform 79

- 10.4.5.4 Rest of Asia-Pacific by Application 79

- 10.5.1 Saudi Arabia 83

- 10.5.1.1 Saudi Arabia by Component 83

- 10.5.1.2 Saudi Arabia by Frequency Band 83

- 10.5.1.3 Saudi Arabia by Platform 84

- 10.5.1.4 Saudi Arabia by Application 84

- 10.5.2 Israel 85

- 10.5.2.1 Israel by Component 85

- 10.5.2.2 Israel by Frequency Band 85

- 10.5.2.3 Israel by Platform 86

- 10.5.2.4 Israel by Application 86

- 10.5.3 Rest of Middle East 87

- 10.5.3.1 Rest of Middle East by Component 87

- 10.5.3.2 Rest of Middle East by Frequency Band 87

- 10.5.3.3 Rest of Middle East by Platform 88

- 10.5.3.4 Rest of Middle East by Application 88

- 10.6.1 Brazil 91

- 10.6.1.1 Brazil by Component 91

- 10.6.1.2 Brazil by Frequency Band 92

- 10.6.1.3 Brazil by Platform 92

- 10.6.1.4 Brazil by Application 93

- 10.6.2 Rest of Latin America 93

- 10.6.2.1 Rest of Latin America by Component 93

- 10.6.2.2 Rest of Latin America by Frequency Band 94

- 10.6.2.3 Rest of Latin America by Platform 94

- 10.6.2.4 Rest of Latin America by Application 94

11 Competitive Landscape 95

12 Company Profiles 97

- 12.1 BAE Systems 98

- 12.1.1 Company Overview 98

- 12.1.2 Financial Overview 98

- 12.1.3 Services Offered 99

- 12.1.4 Key Developments 100

- 12.1.5 SWOT Analysis 100

- 12.1.6 Key Strategy 100

- 12.2 Elbit Systems Ltd 101

- 12.2.1 Company Overview 101

- 12.2.2 Financial Overview 101

- 12.2.3 Solutions Offered 102

- 12.2.4 Key Developments 102

- 12.2.5 SWOT Analysis 103

- 12.2.6 Key Strategy 103

- 12.3 General Dynamics Corporation 104

- 12.3.1 Company Overview 104

- 12.3.2 Financial Overview 104

- 12.3.3 Products Offerings 105

- 12.3.4 Key Developments 105

- 12.3.5 SWOT Analysis 105

- 12.3.6 Key Strategy 106

- 12.4 Harris Corporation 107

- 12.4.1 Company Overview 107

- 12.4.2 Financial Overview 107

- 12.4.3 Product Offerings 109

- 12.4.4 Key Developments 109

- 12.4.5 SWOT Analysis 110

- 12.4.6 Key Strategy 110

- 12.5 Leonardo S.p.A 111

- 12.5.1 Company Overview 111

- 12.5.2 Financial Overview 111

- 12.5.3 Products Offered 112

- 12.5.4 Key Developments 112

- 12.5.5 SWOT Analysis 113

- 12.5.6 Key Strategy 113

- 12.6 Northrop Grumman Corporation 114

- 12.6.1 Company Overview 114

- 12.6.2 Financial Overview 114

- 12.6.3 Products Offered 115

- 12.6.4 Key Developments 115

- 12.6.5 SWOT Analysis 116

- 12.6.6 Key Strategy 116

- 12.7 Collins Aerospace (a part of United Technologies Corporation) 117

- 12.7.1 Company Overview 117

- 12.7.2 Financial Overview 117

- 12.7.3 Products Offered 118

- 12.7.4 Key Developments 119

- 12.7.5 SWOT Analysis 119

- 12.7.6 Key Strategy 119

- 12.8 Rohde & Schwarz 120

- 12.8.1 Company Overview 120

- 12.8.2 Financial Overview 120

- 12.8.3 Product Offerings 120

- 12.8.4 Key Developments 121

- 12.8.5 SWOT Analysis 121

- 12.8.6 Key Strategy 121

- 12.9 Thales Group 122

- 12.9.1 Company Overview 122

- 12.9.2 Financial Overview 122

- 12.9.3 Products Offered 123

- 12.9.4 Key Developments 124

- 12.9.5 SWOT Analysis 124

- 12.9.6 Key Strategy 124

- 12.10 Viasat Inc. 125

- 12.10.1 Company Overview 125

- 12.10.2 Financial Overview 125

- 12.10.3 Products Offered 126

- 12.10.4 Key Developments 126

- 12.10.5 SWOT Analysis 127

- 12.10.6 Key Strategy 127

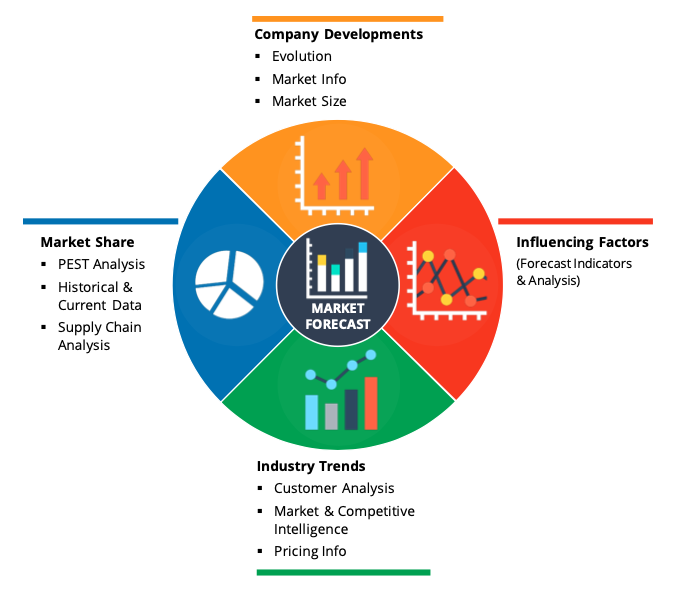

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model