The LIS market witnessed significant growth in the past few years due to its widespread incorporation amongst laboratories to tackle operational workflow issues associated with regulatory compliance and data security. In addition, the introduction of technologically advanced software solutions that facilitate clinical laboratory workflow management is anticipated to drive demand over the forecast period. For instance, many laboratories incorporate Enterprise Content Management (ECM) software to streamline the processing of sample data delivered to public health organizations.

The market is anticipated to witness growth due to the rising demand for scientific data integration solutions amongst the end-use industries including life sciences, contract research organizations, food & beverage, and chemicals. An increasing need for clinical workflow management in laboratories to improve operational efficiency is expected to propel the growth in the coming years. Furthermore, rising adoption of Laboratory Information Systems (LIS) amongst independent and hospital-based labs to reduce the incidence of diagnostic errors and manage high data volumes is likely to boost the growth of the lab informatics market over the forecast period.In April 2017, Abbott Informatics launched upgraded version of STARLIMS laboratory information management system 11.4 in a probe to gain more market share

Segment Overview

Key components analyzed in the laboratory information systems vertical are software and services. The services segment held the dominant share in 2015 and is expected to exhibit a sturdy growth rate in the future. On the other hand, the software segment is anticipated to exhibit growth owing to the introduction of technologically advanced software solutions, such as SaaS, which has revolutionized LIS.

The life sciences industry was the largest end-use segment and accounted for a share in 2018. Increasing advances in the healthcare industry due to rising R&D activities in the field of medical research is anticipated to fuel the demand for laboratory information systems in the coming years. Increasing incorporation of LIS, particularly in research & hospital labs, because of its growing application scope, including patient engagement, patient health information tracking, workflow management, billing, and quality assurance at hospitals, labs, and other life science companies, is expected to propel the laboratory informatics market growth. The CRO segment is anticipated to grow lucratively over the forecast period due to the increasing outsourcing trend in the pharmaceutical & biotech industries

Regional Overview

Geographically, the market has been segmented into four major economies including North America, Europe, Asia-Pacific, and LAMEA. North America consists of US, Canada, and the Rest of North America. Europe comprises of the major countries including the UK, Germany, France, Italy, Spain and the Rest of Europe. Similarly, Asia Pacific consists of major countries such as, Japan, China, India, South Korea, Australia and, the Rest of Asia Pacific. LAMEA consists of Brazil, Saudi Arabia, UAE, and the Rest of LAMEA.

North America region accounted for the major market share in 2018. The presence of established pharmaceutical companies and research labs coupled with higher awareness levels of LIS amongst the end-users is expected to drive the demand. Furthermore, increasing R&D activities in the biotech &pharmaceutical industry and the existence of stringent regulatory compliance requirements is expected to fuel the growth of this vertical during the forecast period. Asia pacific is emerging as an outsourcing hub for the laboratory informatics market due to its surging demand amongst the pharmaceutical manufacturers. Manufacturers outsource LIS activities to improve operational efficiency and reduce the cost of LIS support systems. The presence of numerous CROs in the fast-growing economies, such as Iran & China, is anticipated to boost the demand.

Competitor overview

Some of the key market participants include LabWare, Thermo Fisher Scientific, Inc., Core Informatics, LabVantage Solutions, Inc., PerkinElmer Inc., LabLynx, Inc., Abbott Laboratories, Agilent Technologies, IDBS, Waters, McKesson Corporation, and Cerner Corporation. Technologically advanced platforms offered by the industry players, such as SaaS for smaller organizations, are anticipated to boost the adoption of LIS. In March 2017, Thermo Fisher Scientific acquired Core Informatics in an attempt to significantly enhance Thermo Fisher’s existing informatics solutions

Key Players

- Thermo Fisher Scientific, Inc

- Epic

- Sunquest

- LabWare

- Core Informatics

- Abbott Laboratories

- LabVantage Solutions Inc.

- LabLynx, Inc

- PerkinElmer, Inc.

- Waters

- Agilent Technologies

Market Segmentation

By Product

- Laboratory Information Management Systems (LIMS)

- Electronic Lab Notebooks (ELN)

- Scientific Data Management Systems

- Laboratory Execution Systems

- Electronic Data Capture & Clinical Data Management Systems

- Chromatography Data Systems

- Enterprise Content Management

- Software

- Services

- By Delivery Mode

- On-premise

- Web Hosted

- Cloud Based

- Laboratories

- Healthcare CROs

- Pharmaceutical Companies & Related R&D Labs

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- UAE

- Rest of LAMEA

- 1.1 Market Definition 11

- 1.2 Market Breakdown by Application, Component and Delivery 11

- 1.3 Market Breakdown by Geography 12

- 1.4 Research Methodology and Sources 13

- 2.1 Key Findings 14

- 2.2 Research Summary 14

- 3.1 Introduction 17

- 3.1.1 Laboratory information system process 18

- 3.2 Trends in the Market 19

- 3.2.1 Usage of advanced diagnostics techniques and tools 19

- 3.2.2 Adoption of mobile based solutions and application 19

- 3.2.3 Development of new and innovative products 20

- 3.3 Opportunities in the Market 20

- 3.3.1 Increasing demand in personalized medical care 20

- 3.3.2 Untapped market in emerging economies 21

- 3.3.3 Growth of remote patient monitoring 21

- 3.3.4 Need of integrated IT systems in diagnostics and medical laboratories 22

- 3.4 Factors Driving the Market and its Impact on Market Forecast 22

- 3.4.1 Need for advanced healthcare information system 22

- 3.4.2 Growth in molecular diagnostics 23

- 3.4.3 Cloud computing in LIS 23

- 3.4.4 Need for increased lab productivity 23

- 3.4.5 Cost improvement measures of hospitals 25

- 3.4.6 Compliance with government regulations and initiatives 25

- 3.4.7 Increasing investment from healthcare IT players 26

- 3.4.8 Large geriatric population base in emerging economies 26

- 3.4.9 Impact analysis of drivers on the market forecast 27

- 3.5 Factors Hindering the Market and its Impact on Market Forecast 27

- 3.5.1 Lack of skilled professionals 27

- 3.5.2 Difficulty in integration of information with laboratory equipment 28

- 3.5.3 Risk related to confidentiality and managing information 28

- 3.5.4 High capital expenditure and maintenance requirement 28

- 3.5.5 Impact analysis of restraints on market forecast 29

- 4.1 Global Market Breakdown by Application 31

- 4.2 Global Market Breakdown by Components 32

- 4.3 Global Market Breakdown by Delivery 33

- 4.4 Global Market Breakdown by Region 34

- 5.1 Clinical LIS Market 35

- 5.2 Drug Discovery LIS Market 37

- 5.3 Industrial LIS Market 38

- 6.1 Software in LIS Market 41

- 6.2 Hardware in LIS Market 42

- 6.3 Services in LIS Market 43

- 7.1 Web-based LIS Market 46

- 7.2 On-premise based LIS Market 47

- 7.3 Cloud-based LIS Market 49

- 8.1 North America LIS Market Breakdown by Country 52

- 8.2 Europe LIS Market Breakdown by Country 54

- 8.3 Asia-Pacific LIS Market Breakdown by Country 57

- 8.4 Rest of the World (RoW) LIS Market 59

- 9.1 Porter's Five Forces of Competitive Position Analysis 61

- 9.1.1 Bargaining Power of Buyers 61

- 9.1.2 Bargaining Power of Suppliers 62

- 9.1.3 Threat of New Entrants 62

- 9.1.4 Intensity of Rivalry 62

- 9.1.5 Threat of Substitutes 63

- 9.2 Merger and Acquisition (M&A) Activities in the Market 63

- 9.2.1 Cerner acquisition of Siemens Health Services (Aug 2014) 63

- 9.2.2 Accelrys acquisition of Vialis AG (Jan 2013) 63

- 9.2.3 Roper Industries acquisition of Sunquest (Aug 2012) 64

- 9.2.4 Abbott acquisition of STARLIMS Australia(Jun 2012) 64

- 9.2.5 Sunquest acquisition of PowerPath (Oct 2011) 64

- 9.2.6 Allscripts acquisition of Eclipsys (Jun 2010) 65

- 9.2.7 Abbott acquisition of STARLIMS (Dec 2009) 65

- 9.3 Competitive Positioning of Key Competitors and Market Share Analysis 65

- 10.1 Cerner Corporation 67

- 10.1.1 Business Overview 67

- 10.1.2 Products and Services 67

- 10.2 Recent Developments 68

- 10.2.1 Key P&L Metrics 69

- 10.3 Eclipsys Corporation (Allscripts Healthcare Solutions) 69

- 10.3.1 Business Overview 69

- 10.3.2 Products and Services 70

- 10.3.3 Key P&L Metrics 70

- 10.4 LabVantage Solutions Inc 70

- 10.4.1 Business Overview 70

- 10.4.2 Products and Services 71

- 10.4.3 Recent Developments 71

- 10.4.4 Key P&L Metrics 72

- 10.5 LabWare Inc 72

- 10.5.1 Business Overview 72

- 10.5.2 Products and Services 73

- 10.5.3 Recent Developments 73

- 10.5.4 Key P&L Metrics 73

- 10.6 McKesson Corporation 74

- 10.6.1 Business Overview 74

- 10.6.2 Products and Services 74

- 10.6.3 Recent Developments 75

- 10.6.4 Key P&L Metrics 75

- 10.7 Medical Information Technology Inc. (Meditech) 76

- 10.7.1 Business Overview 76

- 10.7.2 Products and Services 76

- 10.7.3 Recent Developments 77

- 10.7.4 Key P&L Metrics 77

- 10.8 Merge Healthcare Inc 77

- 10.8.1 Business Overview 77

- 10.8.2 Products and Services 78

- 10.8.3 Recent Developments 78

- 10.8.4 Key P&L Metrics 79

- 10.9 STARLIMS Corporation (Abbott Laboratories) 79

- 10.9.1 Business Overview 79

- 10.9.2 Products and Services 80

- 10.9.3 Recent Developments 80

- 10.9.4 Key P&L Metrics 81

- 10.10 Sunquest Corporation (Roper Industries) 81

- 10.10.1 Business Overview 81

- 10.10.2 Products and Services 81

- 10.10.3 Recent Developments 82

- 10.10.4 Key P&L Metrics 82

- 10.11 Thermo Fisher Scientific Inc 83

- 10.11.1 Business Overview 83

- 10.11.2 Products and Services 83

- 10.11.3 Recent Developments 84

- 10.11.4 Key P&L Metrics 84

- 11.1 List of Abbreviations 85

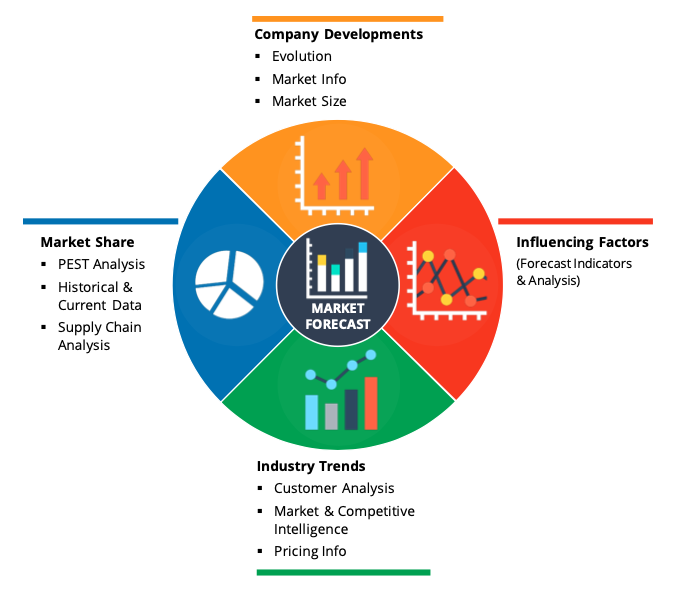

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

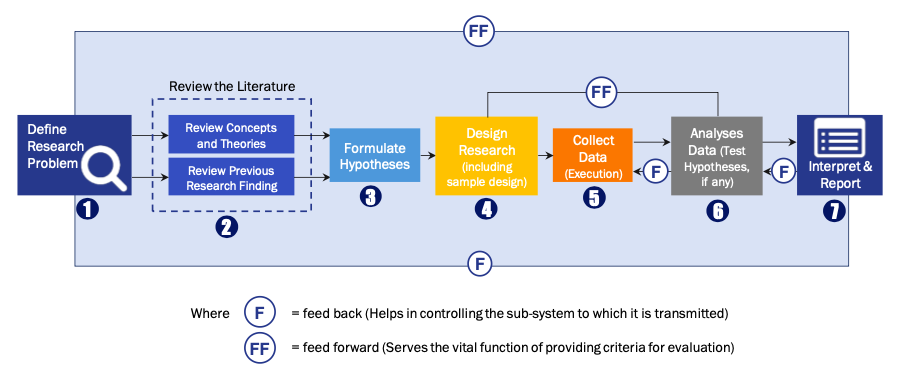

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model