Managed pressure drilling is defined as an adaptive drilling process used to control the annular pressure profile throughout the wellbore. It provides a closed-loop circulation system in which pore pressure, formation fracture pressure, and bottom-hole pressure in the wellbore are balanced and managed at the surface. The global Managed Pressure Drilling Service market is expected to grow at a significant rate in the forthcoming years.

Important factors, such as increasing depths of wells being drilled combined with increasing offshore exploration and production activities, are anticipated to increase the demand for managed pressure drilling services. This key fact boosts the growth of the global Managed Pressure Drilling Service market. Furthermore, sustained fossil fuel demand coupled with declining production of onshore oil & gas reserves is projected to propel the growth of the market over the forecast period. Moreover, the increasing success rate of managed drilling services over other conventional techniques is also estimated to boost the growth of the market.

On the downside, the high volatility of oil and gas prices is estimated to act as a restraint to the growth of the managed pressure drilling services market during the forecast period. Besides this, the development in technology in managed pressure drilling techniques coupled with the adoption of industry 4.0 is projected to create several new opportunities for the market players in the near future.

Covid-19 Impact on Managed Pressure Drilling Service Market

The ongoing COVID-19 pandemic conditions have severely affected every sector around the world. Whereas, the chemicals and materials sectors were moderately affected during the pandemic. This is primarily due to the uncut demand for chemicals for healthcare, life science, and cleaning agents. However, other elements of chemical and material sectors such as paints, industrial oil, construction materials are facing diminution in demand. Strict lockdown resulted in a nearly 50-60% reduction in supply for raw materials, which directly affected the manufacturing process. Further, halt on many end-use industries directly affected the chemical demand all around the world.

Managed Pressure Drilling Service Market Segment Overview

Based on Technology, the Constant Bottom-Hole Pressure (CBHP) segment is expected to hold the largest share in the Managed Pressure Drilling Service market during the forecast period. This growth is attributed to widespread utilization of the technology for drilling offshore wells across the U.S. Gulf of Mexico as well as in other regions of the world. In terms of application, the Offshore segment dominated the market and is expected to keep its dominance in the market during the forecast period. This can be attributed to the frequent use of managed pressure drilling in High-Pressure High Temperature (HPHT) wells and deepwater resources.

Managed Pressure Drilling Service Market, By Technology

· Constant Bottom-Hole Pressure (CBHP)

· Mud Cap Drilling (MCD)

· Return Flow Control Drilling (RFCD)

Managed Pressure Drilling Service Market, By Application

· Offshore

· Onshore

Managed Pressure Drilling Service Market Regional Overview

In terms of region, North America dominated the Managed Pressure Drilling Service market. This can be mainly attributed to the increase in oil & gas activities in offshore regions in the U.S. As well, the discovery of shale oil in North Dakota in North America has increased the growth of the market. Similarly, the market in the Asia Pacific is projected to rise at a considerable rate in the forecast period. This market has been expanding in countries in the Asia Pacific such as India, China, and Japan owing to the increase in maritime security activities, rise in offshore oil and gas production activities, and improvement in underwater communications. Further, the market in countries such as the U.K., Germany, France, and Norway in Europe is projected to expand owing to the rise in oil & gas drilling activities and improvement in offshore drilling activities.

Managed Pressure Drilling Service Market, By Geography

· North America (US & Canada)

· Europe (UK, Germany, France, Italy, Spain, Russia & Rest of Europe)

· Asia-Pacific (Japan, China, India, Australia, & South Korea, & Rest of Asia-Pacific)

· LAMEA (Brazil, Saudi Arabia, UAE & Rest of LAMEA)

Managed Pressure Drilling Service Market Competitor overview

Some key developments and strategies adopted by manufacturers in Managed Pressure Drilling Service are highlighted below.

· In September 2021, Offshore drilling firm Aquadrill, formerly known as Seadrill Partners, has entered into a charter hire agreement with drilling contractor Diamond Offshore Drilling for its Auriga drillship. Aquadrill said that, under the contract, it would be the drillship’s rig manager and provide the 7th generation dynamically positioned drillship with a one-year drilling contract plus a one-year mutually agreed option for operations in the U.S. Gulf of Mexico.

· In September 2021, Drilling services provider the ModuResources (MR) Group has acquired Deepwater Subsea, a specialist in subsea equipment, BOP compliance, and developer of the Janus24 real-time monitoring platform.

Managed Pressure Drilling Service Market, Key Players

· Baker Hughes Incorporated

· Schlumberger Ltd

· Weatherford International

· Halliburton

· Transocean

· Aker Solutions

1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

2. Executive Summary

3. Market Dynamics

- 3.1. Market Drivers

- 3.2. Market Restraints

- 3.3. Market Opportunities

4. Key Insights

- 4.1. Key Emerging Trends – For Major Countries

- 4.2. Latest Technological Advancement

- 4.3. Regulatory Landscape

- 4.4. Industry SWOT Analysis

- 4.5. Porters Five Forces Analysis

5. Global Managed Pressure Drilling Service Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 5.1. Key Findings / Summary

- 5.2. Market Analysis, Insights and Forecast – By Technology

- 5.2.1. Constant Bottom-Hole Pressure (CBHP)

- 5.2.2. Mud Cap Drilling (MCD)

- 5.2.3. Return Flow Control Drilling (RFCD)

- 5.3. Market Analysis, Insights and Forecast – By Application

- 5.3.1. Offshore

- 5.3.2. Onshore

- 5.4. Market Analysis, Insights and Forecast – By Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America, Middle East and Africa

6. North America Managed Pressure Drilling Service Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 6.1. Key Findings / Summary

- 6.2. Market Analysis, Insights and Forecast – By Technology

- 6.2.1. Constant Bottom-Hole Pressure (CBHP)

- 6.2.2. Mud Cap Drilling (MCD)

- 6.2.3. Return Flow Control Drilling (RFCD)

- 6.3. Market Analysis, Insights and Forecast – By Application

- 6.3.1. Offshore

- 6.3.2. Onshore

- 6.4. Market Analysis, Insights and Forecast – By Country

- 6.4.1. U.S.

- 6.4.2. Canada

7. Europe Managed Pressure Drilling Service Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 7.1. Key Findings / Summary

- 7.2. Market Analysis, Insights and Forecast – By Technology

- 7.2.1. Constant Bottom-Hole Pressure (CBHP)

- 7.2.2. Mud Cap Drilling (MCD)

- 7.2.3. Return Flow Control Drilling (RFCD)

- 7.3. Market Analysis, Insights and Forecast – By Application

- 7.3.1. Offshore

- 7.3.2. Onshore

- 7.4. Market Analysis, Insights and Forecast – By Country

- 7.4.1. UK

- 7.4.2. Germany

- 7.4.3. France

- 7.4.4. Italy

- 7.4.5. Spain

- 7.4.6. Russia

- 7.4.7. Rest of Europe

8. Asia Pacific Managed Pressure Drilling Service Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 8.1. Key Findings / Summary

- 8.2. Market Analysis, Insights and Forecast – By Technology

- 8.2.1. Constant Bottom-Hole Pressure (CBHP)

- 8.2.2. Mud Cap Drilling (MCD)

- 8.2.3. Return Flow Control Drilling (RFCD)

- 8.3. Market Analysis, Insights and Forecast – By Application

- 8.3.1. Offshore

- 8.3.2. Onshore

- 8.4. Market Analysis, Insights and Forecast – By Country

- 8.4.1. China

- 8.4.2. India

- 8.4.3. Japan

- 8.4.4. Australia

- 8.4.5. South East Asia

- 8.4.6. Rest of Asia Pacific

9. Latin America, Middle East and Africa Managed Pressure Drilling Service Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 9.1. Key Findings / Summary

- 9.2. Market Analysis, Insights and Forecast – By Technology

- 9.2.1. Constant Bottom-Hole Pressure (CBHP)

- 9.2.2. Mud Cap Drilling (MCD)

- 9.2.3. Return Flow Control Drilling (RFCD)

- 9.3. Market Analysis, Insights and Forecast – By Application

- 9.3.1. Offshore

- 9.3.2. Onshore

- 9.4. Market Analysis, Insights and Forecast – By Country

- 9.4.1. Brazil

- 9.4.2. Saudi Arabia

- 9.4.3. UAE

- 9.4.4. Rest of LAMEA

10. Competitive Analysis

- 10.1. Company Market Share Analysis, 2018

- 10.2. Key Industry Developments

- 10.3. Company Profile

- 10.4. Baker Hughes Incorporated

- 10.4.1. Business Overview

- 10.4.2. Segment 1 & Service Offering

- 10.4.3. Overall Revenue

- 10.4.4. Geographic Presence

- 10.4.5. Recent Development

- 10.5. Schlumberger Ltd

- 10.6. Weatherford International

- 10.7. Halliburton

- 10.8. Transocean

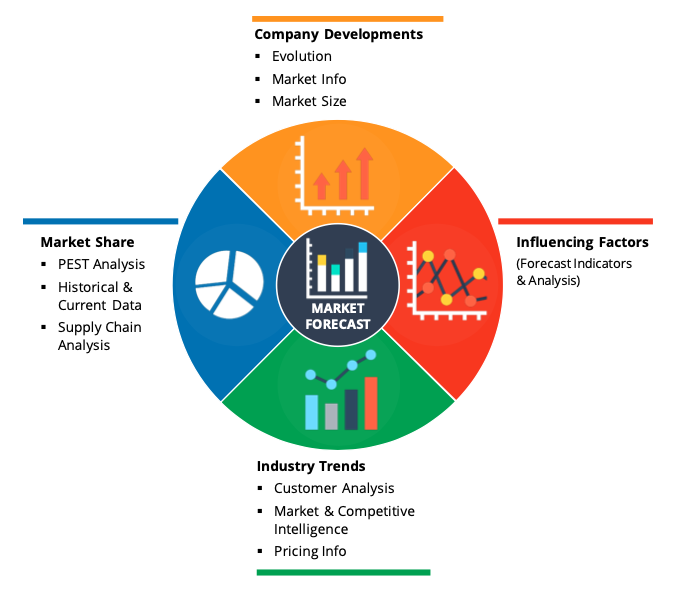

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

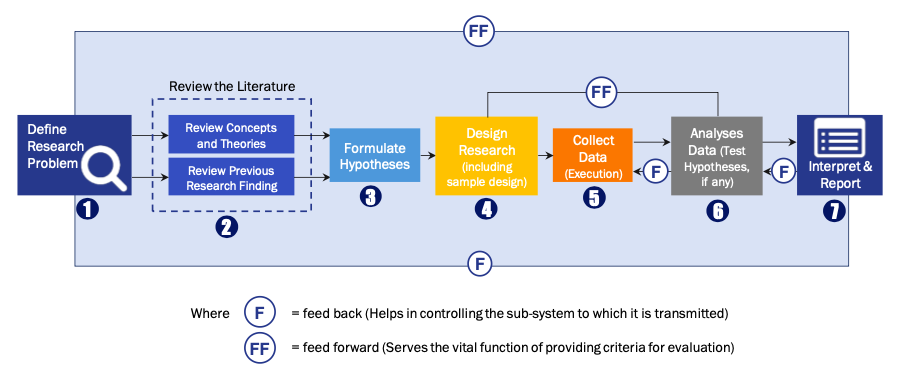

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model