Mobile payment is a concept wherein a portable electronic device such as a smartphone, tablet, or cell phone is used as a payment medium. Mobile payment technology allows consumers to make immediate payments for products and services. The global Mobile Payment Technologies market is projected to grow at a sound pace in the times to follow.

Increasing adoption of advanced technologies such as near field communication (NFC), wearable devices, and mobile point-of-sale (m-POS) are anticipated to boost the growth of Mobile Payment Technologies in the near future. At present, the increasing number of mobile users and the growing adoption of smart devices such as smartphones & tablets are anticipated to propel the growth of the global Mobile Payment Technologies market. In addition, mobile payment solutions are progressively adopted by developing countries, and increasing adoption of smart appliances and a rise in mobile data usage are estimated to boost the growth of the Mobile Payment Technologies market over the forecast period. This is mainly due to the ease of communication and increasing demand for convenient transactions by consumers around the globe.

Moreover, smart appliances such as smartphones and tablets, with their related applications, are the prime requirement for mobile payment technology, which allows payment without using traditional financial transaction channels. Similarly, demand for digital payment solutions is escalating around the world. Further, digital payment systems allow consumers to make immediate payments by using a smartphone. All these key factors are contributed more to the expansion of the global Mobile Payment Technologies market.

Covid-19 Impact on Mobile Payment Technologies Market

Like many other industries, COVID-19 badly knocked the electronic and semiconductor industries. This unprecedented event has impacted nearly 230 countries in just a few weeks, resulting in the forced shutdown of manufacturing and transportation activities within and across the countries. This has directly affected the overall sector's growth. It is estimated that COVID-19 to leave more than USD 30 billion impacts on the electronics and semiconductor industry. The sector is majorly affected due to transport restrictions on major electronics and semiconductor raw material providers. However, the emerging need for semiconductors in several industries will offer rapid market recovery over the future period.

Mobile Payment Technologies Market Segment Overview

Based on Type, the Remote Payment segment has significant growth in the Mobile Payment Technologies Market. It is the most popular among users. It includes internet payments, in-app payments, telephone payments, mail order payments. According to Purchase Type, the Money Transfers & Payments segment hold the largest share in the market. By End-User, the Retail Sector is the largest segment in the market. The retail sector is looking for mobile payment technologies to ease payment transactions. Some major factors such as urbanization, income growth, favorable government regulations and policies, and changes in tastes & preferences of consumers across the globe are remarkably boosting the growth of the segment. The retail sector is also projected to see exponential growth in the forthcoming years.

Mobile Payment Technologies Market, By Type

- Proximity Payment

- Near Field Communication

- QR Code Payment

- Remote Payment

- SMS-based

- USSD/STK

- Direct Operator Billing

- Digital Wallet

· Airtime Transfers & Top-ups

· Money Transfers & Payments

· Merchandise & Coupons

· Travel & Ticketing

· Others

Mobile Payment Technologies Market, By End-User

· Hospitality & Tourism Sector

· BFSI

· Media & Entertainment

· Retail Sector

· Health care

· Education

· IT & Telecommunication

· Others

Mobile Payment Technologies Market Regional Overview

In terms of geography, Asia Pacific is expected to hold a major share of the global Mobile Payment Technologies market during the forecast period. The increasing adoption of smart appliances such as mobile phones, smartphones, and tablets is a major factor that escalating the growth of the mobile payment technologies market in the Asia Pacific. Moreover, the increase in advance payment solution offerings by technology providers has led to the growing adoption of ground-breaking mobile payment technologies across the region. In addition to this, the government-led initiatives in China and India to promote digitization are further helping in the growth of the market. Apart from this, many service providers are investing in tools development specific to a particular application and are focused on new product developments, partnerships, and mergers and acquisitions to boost their presence in the regional market. This fact further intensifies the growth of the global mobile payment technologies market in the Asia Pacific.

Mobile Payment Technologies Market, By Geography

· North America (US & Canada)

· Europe (UK, Germany, France, Italy, Spain, Russia & Rest of Europe)

· Asia-Pacific (Japan, China, India, Australia, & South Korea, & Rest of Asia-Pacific)

· LAMEA (Brazil, Saudi Arabia, UAE & Rest of LAMEA)

Mobile Payment Technologies Market Competitor overview

Some key developments and strategies adopted by manufacturers in Mobile Payment Technologies are highlighted below.

· In September 2021, The international branch of the National Payment Corporation of India, NPCI International Payments Ltd (NIPL), has collaborated with Mashreq, among the UAE's top financial firms, to enable the implementation of its mobile-based real-time payment system, Unified Payments Interface (UPI), in the UAE.

Mobile Payment Technologies Market, Key Players

· MasterCard International Inc.

· Visa, Inc.

· American Express, Co.

· Boku, Inc.

· Fortumo

· PayPal, Inc.

· Bharti Airtel Ltd.

· Vodafone Ltd.

· AT & T, Inc.

· Google, Inc.

· Apple, Inc.

· Microsoft Corporation

· Ant Financial Services Group

1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

2. Executive Summary

3. Market Dynamics

- 3.1. Market Drivers

- 3.2. Market Restraints

- 3.3. Market Opportunities

4. Key Insights

- 4.1. Key Emerging Trends – For Major Countries

- 4.2. Latest Technological Advancement

- 4.3. Regulatory Landscape

- 4.4. Industry SWOT Analysis

- 4.5. Porters Five Forces Analysis

5. Global Mobile Payment Technologies Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 5.1. Key Findings / Summary

- 5.2. Market Analysis, Insights and Forecast – By Type

- 5.2.1. Proximity Payment

- 5.2.1.1. Near Field Communication

- 5.2.1.2. QR Code Payment

- 5.2.2. Remote Payment

- 5.2.2.1. SMS-based

- 5.2.2.2. USSD/STK

- 5.2.2.3. Direct Operator Billing

- 5.2.2.4. Digital Wallet

- 5.2.1. Proximity Payment

- 5.3.1. Airtime Transfers & Top-ups

- 5.3.2. Money Transfers & Payments

- 5.3.3. Merchandise & Coupons

- 5.3.4. Travel & Ticketing

- 5.3.5. Others

- 5.4.1. Hospitality & Tourism Sector

- 5.4.2. BFSI

- 5.4.3. Media & Entertainment

- 5.4.4. Retail Sector

- 5.4.5. Health care

- 5.4.6. Education

- 5.4.7. IT & Telecommunication

- 5.4.8. Others

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Latin America, Middle East and Africa

6. North America Mobile Payment Technologies Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 6.1. Key Findings / Summary

- 6.2. Market Analysis, Insights and Forecast – By Type

- 6.2.1. Proximity Payment

- 6.2.1.1. Near Field Communication

- 6.2.1.2. QR Code Payment

- 6.2.2. Remote Payment

- 6.2.2.1. SMS-based

- 6.2.2.2. USSD/STK

- 6.2.2.3. Direct Operator Billing

- 6.2.2.4. Digital Wallet

- 6.2.1. Proximity Payment

- 6.3.1. Airtime Transfers & Top-ups

- 6.3.2. Money Transfers & Payments

- 6.3.3. Merchandise & Coupons

- 6.3.4. Travel & Ticketing

- 6.3.5. Others

- 6.4.1. Hospitality & Tourism Sector

- 6.4.2. BFSI

- 6.4.3. Media & Entertainment

- 6.4.4. Retail Sector

- 6.4.5. Health care

- 6.4.6. Education

- 6.4.7. IT & Telecommunication

- 6.4.8. Others

- 6.5.1. U.S.

- 6.5.2. Canada

7. Europe Mobile Payment Technologies Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 7.1. Key Findings / Summary

- 7.2. Market Analysis, Insights and Forecast – By Type

- 7.2.1. Proximity Payment

- 7.2.1.1. Near Field Communication

- 7.2.1.2. QR Code Payment

- 7.2.2. Remote Payment

- 7.2.2.1. SMS-based

- 7.2.2.2. USSD/STK

- 7.2.2.3. Direct Operator Billing

- 7.2.2.4. Digital Wallet

- 7.2.1. Proximity Payment

- 7.3.1. Airtime Transfers & Top-ups

- 7.3.2. Money Transfers & Payments

- 7.3.3. Merchandise & Coupons

- 7.3.4. Travel & Ticketing

- 7.3.5. Others

- 7.4.1. Hospitality & Tourism Sector

- 7.4.2. BFSI

- 7.4.3. Media & Entertainment

- 7.4.4. Retail Sector

- 7.4.5. Health care

- 7.4.6. Education

- 7.4.7. IT & Telecommunication

- 7.4.8. Others

- 7.5.1. UK

- 7.5.2. Germany

- 7.5.3. France

- 7.5.4. Italy

- 7.5.5. Spain

- 7.5.6. Russia

- 7.5.7. Rest of Europe

8. Asia Pacific Mobile Payment Technologies Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 8.1. Key Findings / Summary

- 8.2. Market Analysis, Insights and Forecast – By Type

- 8.2.1. Proximity Payment

- 8.2.1.1. Near Field Communication

- 8.2.1.2. QR Code Payment

- 8.2.2. Remote Payment

- 8.2.2.1. SMS-based

- 8.2.2.2. USSD/STK

- 8.2.2.3. Direct Operator Billing

- 8.2.2.4. Digital Wallet

- 8.2.1. Proximity Payment

- 8.3.1. Airtime Transfers & Top-ups

- 8.3.2. Money Transfers & Payments

- 8.3.3. Merchandise & Coupons

- 8.3.4. Travel & Ticketing

- 8.3.5. Others

- 8.4.1. Hospitality & Tourism Sector

- 8.4.2. BFSI

- 8.4.3. Media & Entertainment

- 8.4.4. Retail Sector

- 8.4.5. Health care

- 8.4.6. Education

- 8.4.7. IT & Telecommunication

- 8.4.8. Others

- 8.5.1. China

- 8.5.2. India

- 8.5.3. Japan

- 8.5.4. Australia

- 8.5.5. South East Asia

- 8.5.6. Rest of Asia Pacific

9. Latin America, Middle East and Africa Mobile Payment Technologies Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 9.1. Key Findings / Summary

- 9.2. Market Analysis, Insights and Forecast – By Type

- 9.2.1. Proximity Payment

- 9.2.1.1. Near Field Communication

- 9.2.1.2. QR Code Payment

- 9.2.2. Remote Payment

- 9.2.2.1. SMS-based

- 9.2.2.2. USSD/STK

- 9.2.2.3. Direct Operator Billing

- 9.2.2.4. Digital Wallet

- 9.2.1. Proximity Payment

- 9.3.1. Airtime Transfers & Top-ups

- 9.3.2. Money Transfers & Payments

- 9.3.3. Merchandise & Coupons

- 9.3.4. Travel & Ticketing

- 9.3.5. Others

- 9.4.1. Hospitality & Tourism Sector

- 9.4.2. BFSI

- 9.4.3. Media & Entertainment

- 9.4.4. Retail Sector

- 9.4.5. Health care

- 9.4.6. Education

- 9.4.7. IT & Telecommunication

- 9.4.8. Others

- 9.5.1. Brazil

- 9.5.2. Saudi Arabia

- 9.5.3. UAE

- 9.5.4. Rest of LAMEA

10. Competitive Analysis

- 10.1. Company Market Share Analysis, 2018

- 10.2. Key Industry Developments

- 10.3. Company Profile

- 10.4. MasterCard International Inc.

- 10.4.1. Business Overview

- 10.4.2. Segment 1 & Service Offering

- 10.4.3. Overall Revenue

- 10.4.4. Geographic Presence

- 10.4.5. Recent Development

- 10.5. Visa, Inc.

- 10.6. American Express, Co.

- 10.7. Boku, Inc.

- 10.8. Fortumo

- 10.9. PayPal, Inc.

- 10.10. Bharti Airtel Ltd.

- 10.11. Vodafone Ltd.

- 10.12. AT & T, Inc.

- 10.13. Google, Inc.

- 10.14. Apple, Inc.

- 10.15. Microsoft Corporation

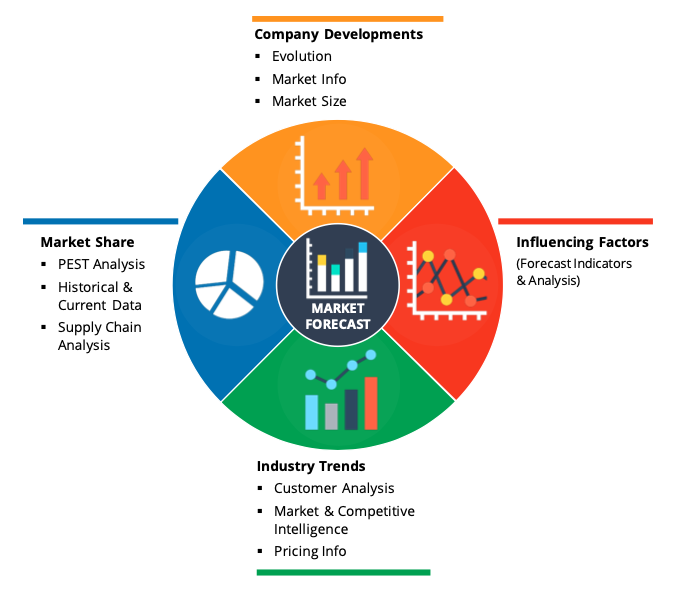

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

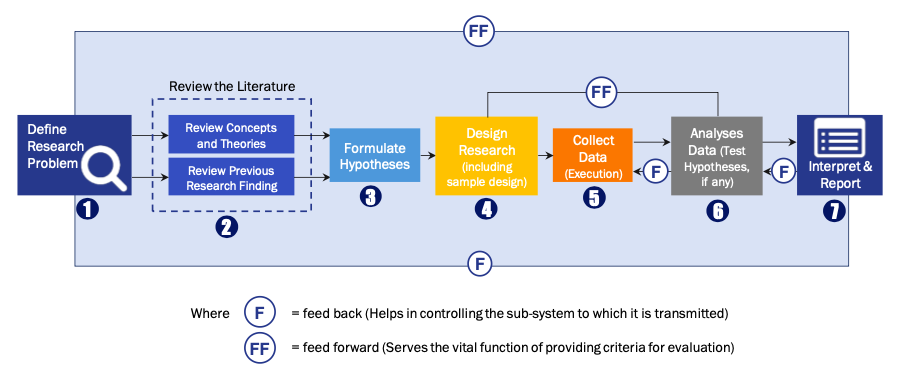

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model