Robotics Virtual Commissioning Market Overview and Analysis:

The global Robotics Virtual Commissioning market is projected to grow from $13.86 billion in 2023 to $50.50 billion in 2030, at a CAGR of 20.3% in forecast period.

Robotics virtual commissioning is the process of testing and optimising the functionality and performance of a robotic system in a simulated or virtual environment before the physical system is installed and operational. This method allows for thorough testing, validation, and fine-tuning of the robotic system without requiring physical prototypes or interfering with actual production processes.

Robotics virtual commissioning is an important technology in the field of industrial automation because it provides a simulated testing environment for robotic systems prior to their physical deployment. Virtual commissioning allows for comprehensive testing, validation, and optimisation of the robotic system's functionality by creating a virtual replica of the intended robotic setup, including the manufacturing environment, control systems, and safety features.

This process aids in the controlled and cost-effective identification and resolution of potential issues such as programming errors, collision risks, or inefficiencies. Finally, using robotics virtual commissioning reduces the time and resources required for the commissioning phase, reduces the risk of interruptions in actual production, and ensures that the robotic system operates reliably and safely in a real-world industrial setting.

The global robotics virtual commissioning market is expected to experience significant growth over the next few years. This growth is driven by a number of factors, including the increasing adoption of industrial automation, the need for efficient and cost-effective commissioning processes, and the growing demand for virtual commissioning solutions.

Robotics Virtual Commissioning Market Latest Trends:

The growing demand for virtual commissioning solutions is also expected to drive growth in the market. Virtual commissioning solutions can help reduce the risk of errors and delays during the commissioning process, improve system performance, and reduce downtime associated with system testing and optimization.

Overall, the global robotics virtual commissioning market is expected to experience significant growth over the next few years, as the industry continues to adopt robotics and automation solutions and seeks to improve the efficiency and cost-effectiveness of commissioning processes. The market is expected to be driven by the increasing adoption of industrial automation, the need for efficient and cost-effective commissioning processes, and the growing demand for virtual commissioning solutions.

Market Segmentation:

The global Robotics Virtual Commissioning market is segmented based on technology, application, end-user industry, and geographic region.

By Component:

- Software

- Services

By Technology:

- Simulation Tools

- Digital Twin Technology

- Control System Integration

By Application:

- Automotive

- Electronics

- Food and Beverage

- Pharmaceuticals and Healthcare

- Other Industries

By End-User Industry:

- Manufacturing

- Healthcare

- Automotive

- Electronics

- Other Industries

Geography:

- North America

- Europe

- Asia-Pacific

- Middle East

- Africa

- South America

Market Drivers:

One of the key drivers of growth in the market is the increasing adoption of industrial automation. Robotics and automation are increasingly being used in various industries, such as manufacturing, automotive, and logistics, to improve operational efficiency and reduce costs. Virtual commissioning solutions can help accelerate the deployment of robotics systems, enabling faster time-to-market and reducing costs associated with commissioning and testing.

Another factor driving growth in the market is the need for efficient and cost-effective commissioning processes. Commissioning is a critical stage in the deployment of robotics systems, as it ensures that the system is functioning as intended and meets the required performance standards. Virtual commissioning solutions can help reduce the time and costs associated with commissioning by allowing engineers to test and optimize the system in a virtual environment, before it is deployed in the real world.

Market Restraints:

Despite advancements, there may be some technological limitations in virtual commissioning tools. This could include difficulties in accurately replicating all real-world variables or simulating highly complex scenarios.It can be difficult to ensure that virtual commissioning processes adhere to industry regulations and standards. Pharmaceuticals and healthcare, which have stringent regulatory requirements, may face additional challenges.

COVID-19 Impact on the Robotics Virtual Commissioning Market

The COVID-19 pandemic has had a significant impact on Robotics Virtual Commissioning. While supply chain disruptions and project delays were notable challenges, the crisis also highlighted the importance of automation for operational resilience. Industries, particularly those considering digital transformation, have accelerated their adoption of robotics virtual commissioning technologies to optimize manufacturing processes remotely. The increased emphasis on ensuring operational continuity and worker safety, combined with a greater understanding of digital twins, has positioned virtual commissioning as a strategic solution for industries seeking to improve efficiency and adaptability in a post-pandemic landscape. The pandemic accelerated the adoption of automation technologies, such as virtual commissioning, as industries recognized the need for agile and digitally-enabled manufacturing practices.

Segmental Analysis:

The Robotics Virtual Commissioning market exhibits a dynamic segmentation analysis in several dimensions. Parts-wise, the software section is crucial to enabling realistic testing because it contains tools for virtual commissioning and simulation. Two key technological developments that enable realistic simulation of real robotic systems in virtual environments are digital twin and control system integration. The application segment demonstrates the range of industries in which virtual commissioning finds applications, including the automotive, electronics, healthcare, and other sectors. The end-user industry segment demonstrates the wide-ranging effects of virtual commissioning, from robotic system refinement in healthcare facilities to production optimisation in large manufacturing companies.

Geographically, the market exhibits a range of adoption rates; North America and Europe are major centres for technological breakthroughs, whereas the Asia-Pacific area offers prospects for market growth. The competitive landscape shows both well-established companies and up-and-coming innovators vying to offer sophisticated solutions that will propel ongoing improvements in digital twin, control integration, and simulation technologies to satisfy the changing demands of various industries.

Robotics Virtual Commissioning Market Competitive Landscape:

The competitive robotics virtual commissioning landscape is defined by the existence of major players providing all-inclusive services and solutions. Prominent firms in the domains of control system integration, digital twin technologies, and simulation software have made names for themselves with cutting-edge products. These players prioritise on-going technological advancements, strategic alliances, and international expansions in order to fortify their market positions. In order to meet the growing demand for virtual commissioning across a wide range of industries, a dynamic mix of established industry giants and up-and-coming start-ups are entering the market. Key players in the Global Robotics Virtual Commissioning market are

- Siemens Software

- Rockwell Automation

- Dassault Systèmes

- ABB KUKA Nordic

- Maplesoft

- CENIT

- HEITEC AG

- Machineering

- Teknologisk Institut

- EDS Technologies

Recent Development:

1) May 2021: To support industrial bots, Automation Anywhere Inc. introduced a cloud-based robotic process automation solution. Applications developed by Automation Anywhere Inc. are server-managed, scalable, and deployable.

2) July 2020: Together with Minit, Nice Systems Ltd. was able to automate discovery accuracy and boost return on investment. The amalgamation of both enterprises expedited automation and interactive procedures to enhance operational efficacy.

1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

2. Executive Summary

3. Market Dynamics

- 3.1. Market Drivers

- 3.2. Market Restraints

- 3.3. Market Opportunities

4. Key Insights

- 4.1. Key Emerging Trends – For Major Countries

- 4.2. Latest Technological Advancement

- 4.3. Regulatory Landscape

- 4.4. Industry SWOT Analysis

- 4.5. Porters Five Forces Analysis

5. Global Robotics Virtual Commissioning Market Analysis (USD Billion), Insights and Forecast, 2018-2029

- 5.1. Key Findings / Summary

- 5.2. Market Analysis, Insights and Forecast – By Segment 1

- 5.2.1. Sub-Segment 1

- 5.2.2. Sub-Segment 2

- 5.3. Market Analysis, Insights and Forecast – By Segment 2

- 5.3.1. Sub-Segment 1

- 5.3.2. Sub-Segment 2

- 5.3.3. Sub-Segment 3

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast – By Segment 3

- 5.4.1. Sub-Segment 1

- 5.4.2. Sub-Segment 2

- 5.4.3. Sub-Segment 3

- 5.4.4. Others

- 5.5. Market Analysis, Insights and Forecast – By Region

- 5.5.1. North America

- 5.5.2. Latin America

- 5.5.3. Europe

- 5.5.4. Asia Pacific

- 5.5.5. Middle East and Africa

6. North America Robotics Virtual Commissioning Market Analysis (USD Billion), Insights and Forecast, 2018-2029

- 6.1. Key Findings / Summary

- 6.2. Market Analysis, Insights and Forecast – By Segment 1

- 6.2.1. Sub-Segment 1

- 6.2.2. Sub-Segment 2

- 6.3. Market Analysis, Insights and Forecast – By Segment 2

- 6.3.1. Sub-Segment 1

- 6.3.2. Sub-Segment 2

- 6.3.3. Sub-Segment 3

- 6.3.4. Others

- 6.4. Market Analysis, Insights and Forecast – By Segment 3

- 6.4.1. Sub-Segment 1

- 6.4.2. Sub-Segment 2

- 6.4.3. Sub-Segment 3

- 6.4.4. Others

- 6.5. Market Analysis, Insights and Forecast – By Country

- 6.5.1. U.S.

- 6.5.2. Canada

7. Latin America Robotics Virtual Commissioning Market Analysis (USD Billion), Insights and Forecast, 2018-2029

- 7.1. Key Findings / Summary

- 7.2. Market Analysis, Insights and Forecast – By Segment 1

- 7.2.1. Sub-Segment 1

- 7.2.2. Sub-Segment 2

- 7.3. Market Analysis, Insights and Forecast – By Segment 2

- 7.3.1. Sub-Segment 1

- 7.3.2. Sub-Segment 2

- 7.3.3. Sub-Segment 3

- 7.3.4. Others

- 7.4. Market Analysis, Insights and Forecast – By Segment 3

- 7.4.1. Sub-Segment 1

- 7.4.2. Sub-Segment 2

- 7.4.3. Sub-Segment 3

- 7.4.4. Others

- 7.5. Insights and Forecast – By Country

- 7.5.1. Brazil

- 7.5.2. Mexico

- 7.5.3. Rest of Latin America

8. Europe Robotics Virtual Commissioning Market Analysis (USD Billion), Insights and Forecast, 2018-2029

- 8.1. Key Findings / Summary

- 8.2. Market Analysis, Insights and Forecast – By Segment 1

- 8.2.1. Sub-Segment 1

- 8.2.2. Sub-Segment 2

- 8.3. Market Analysis, Insights and Forecast – By Segment 2

- 8.3.1. Sub-Segment 1

- 8.3.2. Sub-Segment 2

- 8.3.3. Sub-Segment 3

- 8.3.4. Others

- 8.4. Market Analysis, Insights and Forecast – By Segment 3

- 8.4.1. Sub-Segment 1

- 8.4.2. Sub-Segment 2

- 8.4.3. Sub-Segment 3

- 8.4.4. Others

- 8.5. Market Analysis, Insights and Forecast – By Country

- 8.5.1. UK

- 8.5.2. Germany

- 8.5.3. France

- 8.5.4. Italy

- 8.5.5. Spain

- 8.5.6. Russia

- 8.5.7. Rest of Europe

9. Asia Pacific Robotics Virtual Commissioning Market Analysis (USD Billion), Insights and Forecast, 2018-2029

- 9.1. Key Findings / Summary

- 9.2. Market Analysis, Insights and Forecast – By Segment 1

- 9.2.1. Sub-Segment 1

- 9.2.2. Sub-Segment 2

- 9.3. Market Analysis, Insights and Forecast – By Segment 2

- 9.3.1. Sub-Segment 1

- 9.3.2. Sub-Segment 2

- 9.3.3. Sub-Segment 3

- 9.3.4. Others

- 9.4. Market Analysis, Insights and Forecast – By Segment 3

- 9.4.1. Sub-Segment 1

- 9.4.2. Sub-Segment 2

- 9.4.3. Sub-Segment 3

- 9.4.4. Others

- 9.5. Market Analysis, Insights and Forecast – By Country

- 9.5.1. China

- 9.5.2. India

- 9.5.3. Japan

- 9.5.4. Australia

- 9.5.5. South East Asia

- 9.5.6. Rest of Asia Pacific

10. Middle East & Africa Robotics Virtual Commissioning Market Analysis (USD Billion), Insights and Forecast, 2018-2029

- 10.1. Key Findings / Summary

- 10.2. Market Analysis, Insights and Forecast – By Segment 1

- 10.2.1. Sub-Segment 1

- 10.2.2. Sub-Segment 2

- 10.3. Market Analysis, Insights and Forecast – By Segment 2

- 10.3.1. Sub-Segment 1

- 10.3.2. Sub-Segment 2

- 10.3.3. Sub-Segment 3

- 10.3.4. Others

- 10.4. Market Analysis, Insights and Forecast – By Segment 3

- 10.4.1. Sub-Segment 1

- 10.4.2. Sub-Segment 2

- 10.4.3. Sub-Segment 3

- 10.4.4. Others

- 10.5. Market Analysis, Insights and Forecast – By Country

- 10.5.1. GCC

- 10.5.2. South Africa

- 10.5.3. Rest of Middle East & Africa

11. Competitive Analysis

- 11.1. Company Market Share Analysis, 2018

- 11.2. Key Industry Developments

- 11.3. Company Profile

- 11.3.1. Company 1

- 11.3.1.1. Business Overview

- 11.3.1.2. Segment 1 & Service Offering

- 11.3.1.3. Overall Revenue

- 11.3.1.4. Geographic Presence

- 11.3.1.5. Recent Development

- 11.3.2. Company 2

- 11.3.3. Company 3

- 11.3.4. Company 4

- 11.3.5. Company 5

- 11.3.6. Company 6

- 11.3.7. Company 7

- 11.3.8. Company 8

- 11.3.9. Company 9

- 11.3.10. Company 10

- 11.3.11. Company 11

- 11.3.12. Company 12

- 11.3.1. Company 1

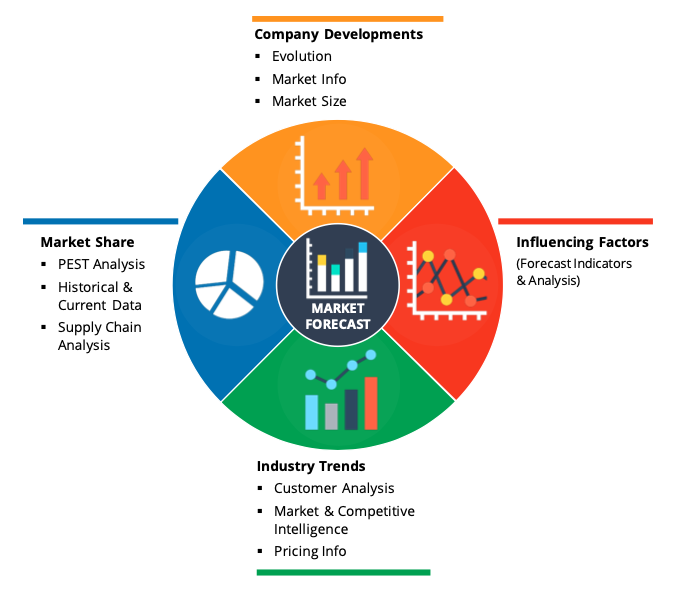

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

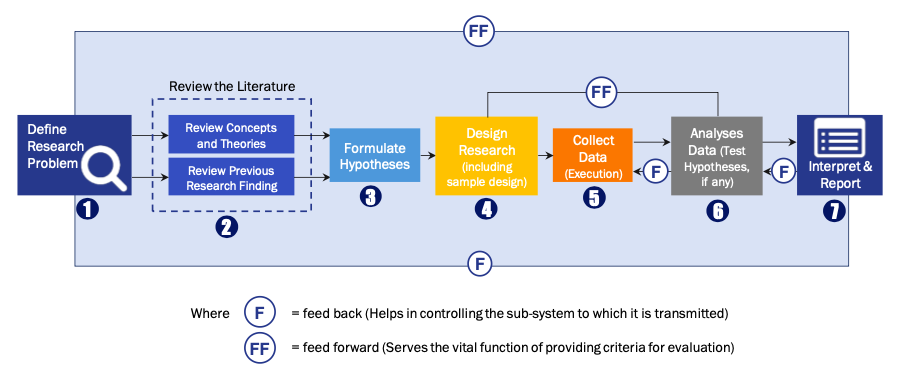

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model