As the COVID-19 pandemic continuing its effect around the world, many defense and aerospace companies are facing its impact during this time around the world. For instance, commercial aviation companies in the U.S., France, Germany, and Canada are facing disruption in the production process and reduced demand as workforces staying at home, passengers stop traveling, and delay in delivery of new aircraft. Analysts expecting a drop from 3,000 to 4,000 aircraft during the pandemic period. On the defense side, contractors operating in the sector are in a better position, hence the impact of the pandemic is likely low in the short to mid-term. However, low demand due to budget constraints affecting the production as in aircraft manufacturing.

Market Overview

In latest years, there has been increase in use of unmanned aerial systems (UAS) for the electronic attacks (EA), suppression of enemy air defense (SEAD), destruction of enemy air defense (DEAD), communication transfer, surveillance, intelligence, reconnaissance (ISR) and combat search and rescue (CSAR), operations.

UAVs are next generation of the aerial platforms deployed by the defense forces around world. The demand for these unmanned systems and the payloads has been fuelled by the successful deployment in the combat missions against the terrorism, particularly in countries such as Afghanistan and Iraq. Furthermore, defense forces around world are investing in the systems to counter-terrorism and also reduce troop casualties. The stratospheric UAV payload technology is reasonable and is principally used in the ISR missions; therefore, demand for the systems is estimated to be important in countries with the limited military budgets.

Segment Overview

This segment covers market for the UAV payload technology used in defense sector. In defense sector, the UAV payload technologies are used for the surveillance, intelligence, and reconnaissance (ISR) missions. They can be deployed for border and maritime surveillance, missile detection, environmental surveillance, navigation, and other applications. The UAVs can stay in stratosphere for hours or even days at time, and payloads including high-tech cameras can scan wide geographic area required for the surveillance. Such UAVs are obtained by defense forces of countries for observing national and the sea borders. For instance, UK’s Ministry of Defense has ordered the Zephyr S high-altitude pseudo-satellite from the Airbus SAS for communication and surveillance.

Regional Overview

North America accounted for largest market share in 2019. Increasing military spending and technological advancements in the North America has led to high demand for UAVs, with U.S. being the larger market. In U.S., the presence of noticeable defense companies such as the Lockheed Martin Corporation and the aircraft manufacturers such as the Boeing are increasing the market growth. Invention, launches by these companies are bolstering market growth in country. For instance, in 2018, Lockheed Martin Corporation introduced unmanned vehicle control software VCSi which can simultaneously control the multiple UAV types.

Companies such as the Boeing are launching new unmanned systems for the defense forces, which is motivating the market growth. For instance, in February 2019, Boeing launched Boeing Airpower Teaming System, unmanned system that can achieve rapid reconfiguration and the various types of assignments in tandem with the other aircraft. Thus, stratospheric UAV payload technology in North America is projected to register considerable CAGR during the forecast period.

Competitor overview

In Nov 2018, Boeing Company's Aurora Flight Services introduced its HAPS called Odysseus, that is solar-powered autonomous aircraft.

In Sept 2018, the Thales Alenia Space, joint venture between the Thales Group and the Leonardo SpA, is preparing stratospheric balloon demonstration for the 4G/5G telecom applications with the Hispasat, Spanish satellite communications operator. Demonstration will test 4G/5G applications by letting direct communications between the smartphones and HAPS with communication payloads.

In Nov 2017, Boeing Company acquired the Aurora Flight Sciences to manufacture advanced aerospace platforms and the autonomous systems.

Key Players

- 1Airbus SAS

- The Boeing Company

- Lockheed Martin Corporation

- QinetiQ Group PLC

- Thales Group

- Arca Space Corp.

- Near Space Systems, Inc.

- OpenStratosphere SA

Market Segmentation

By Type

- Signal Intelligence (SIGINT)

- Electronic Intelligence (ELINT)

- Communication Intelligence (COMINT)

- Telemetry Intelligence (TELINT)

- Persistent Communication

- Imagery and Sensing

- Direct Broadcast TV

- Radio

- Military

- Commercial

- Scientific

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- UAE

- Rest of LAMEA

Request for TOC

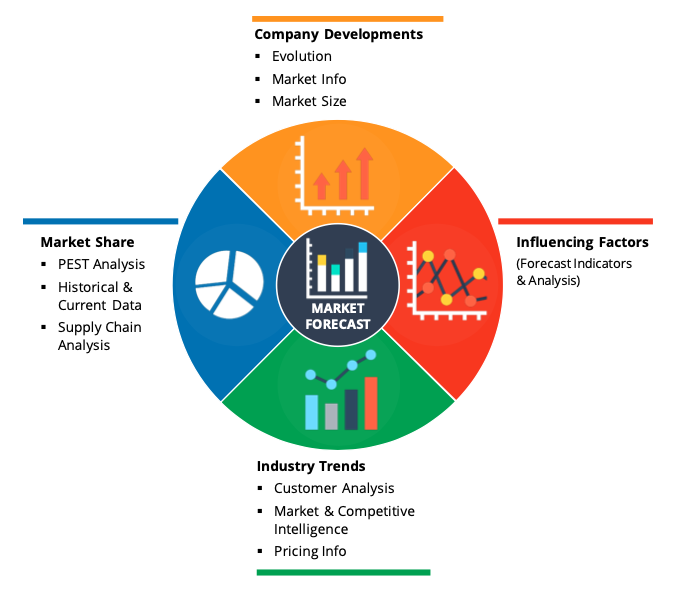

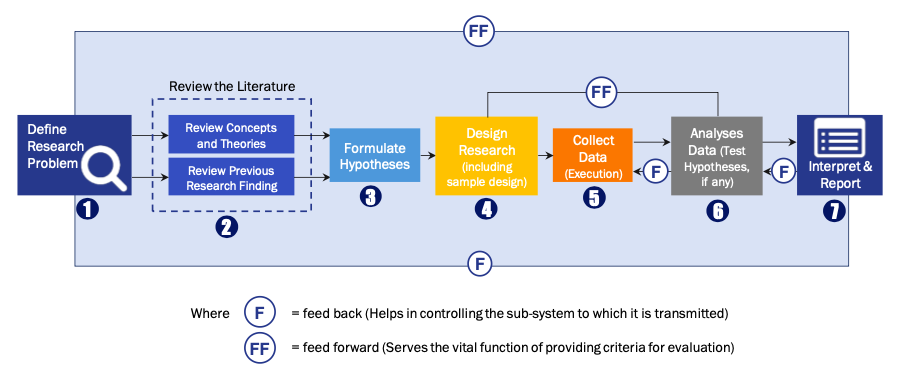

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model