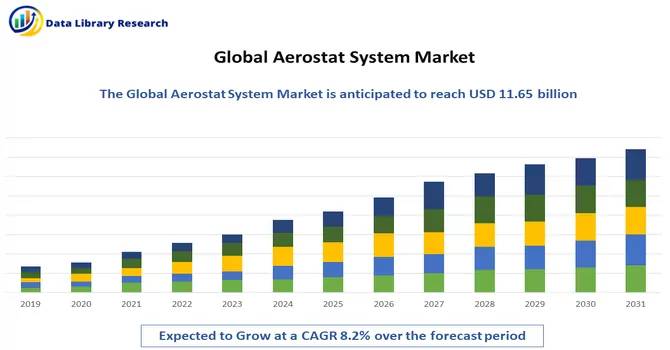

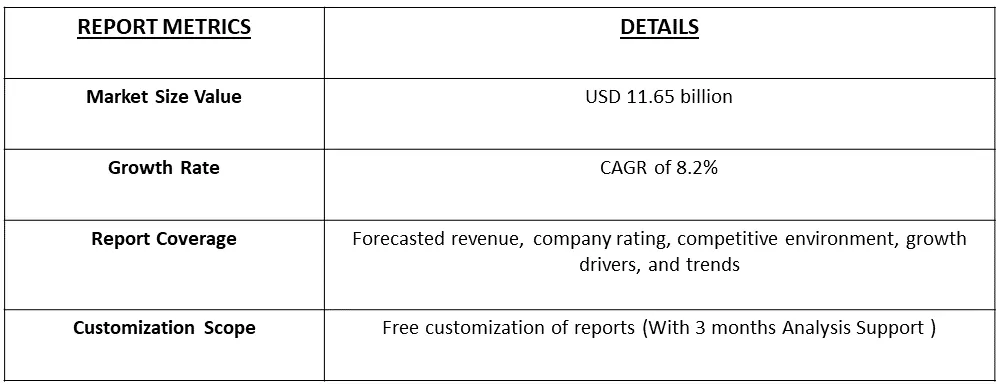

The Aerostat Systems Market Size is currently valued at USD 11.65 billion in 2023 and is expected to register a CAGR of 8.2% over the forecast period, 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

An aerostat system represents a specialized type of aircraft that remains airborne by utilizing helium or other buoyant gases. These systems serve a range of purposes, including surveillance, communication relay, border monitoring, and environmental observation. The key component is a large balloon-like structure tethered to the ground, housing equipment such as cameras, radars, or communication devices. Growing concerns related to national security, border surveillance, and counter-terrorism have fueled a heightened demand for aerostat systems. These systems provide persistent and wide-area surveillance capabilities, making them valuable assets for both military and civilian applications.

As nations globally embark on military modernization programs, there is a specific focus on enhancing intelligence surveillance, and reconnaissance (ISR) capabilities. Aerostat systems are increasingly viewed as cost-effective solutions to meet these evolving requirements. Their ability to offer reliable and enduring surveillance in a cost-efficient manner positions them as essential elements in modern defence strategies. Thus, the adoption of aerostat systems aligns with the trend of integrating advanced technologies into military operations. The tethered aerostats, filled with helium, offer a stable and enduring platform for various critical missions, making them integral to contemporary defence systems.

A notable shift is underway in the direction of incorporating advanced sensors and payloads onto aerostat systems, encompassing high-resolution cameras, synthetic aperture radar (SAR), electronic warfare (EW) systems, and communication relays. This trajectory significantly augments the capabilities of aerostats, particularly in the realm of intelligence, surveillance, and reconnaissance (ISR) missions. Furthermore, these enhanced systems find application in diverse fields such as environmental monitoring and disaster response. Manufacturers are directing their efforts toward the development of smaller and more agile aerostat systems, including micro and mini aerostats. The rationale behind this focus lies in the benefits these compact platforms offer, including heightened agility, easier transportability, and reduced operational costs when compared to their larger counterparts. This downsizing trend opens up new possibilities for applications such as urban surveillance, convoy protection, and rapid deployment scenarios. The integration of advanced technologies and the pursuit of miniaturization in aerostat systems signify a strategic response to emerging operational needs. By equipping these aerial platforms with sophisticated sensors and making them more maneuverable, manufacturers aim to enhance their versatility and address a broader range of mission requirements. This shift not only amplifies the efficacy of aerostats in traditional ISR roles but also expands their utility in dynamic and rapidly evolving scenarios, showcasing their adaptability across various operational domains.

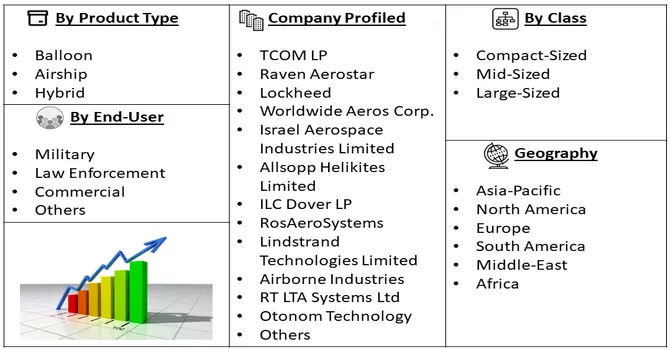

Market Segmentation:

The Global Aerostat Radar Systems Market is Segmented by Application (Military and Law Enforcement, and Commercial and Research) and by Geography (North America, Europe, Asia-Pacific, Latin America, and Middle East & and Africa). The market size and forecasts for all the above segments are provided in terms of value (USD Billion) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Growing Demand for Persistent Surveillance

The escalating demand for persistent surveillance capabilities, crucial in monitoring borders, coastlines, and critical infrastructure for security purposes, underscores the strategic importance of innovative solutions. In this landscape, aerostat systems have emerged as a compelling choice, offering a cost-effective means to achieve continuous aerial surveillance over vast areas for extended periods. The key advantage lies in their capacity to operate without the frequent need for refuelling or extensive maintenance, making them highly efficient in sustaining prolonged vigilance. Aerostats, characterized by their tethered, helium-filled structures, provide a stable platform for carrying surveillance payloads such as cameras and sensors. This stability allows for enhanced and prolonged observation, facilitating real-time monitoring of potential security threats. The cost-effectiveness of aerostat systems is particularly noteworthy, as they eliminate the need for frequent operational interruptions, contributing to a more streamlined and economically viable surveillance strategy. Whether safeguarding national borders, monitoring coastlines, or protecting critical infrastructure, aerostat systems stand out as a reliable and practical solution. Their ability to offer continuous and uninterrupted surveillance contributes significantly to bolstering security measures, meeting the evolving challenges of modern threat landscapes while optimizing operational efficiency and resource utilization.

Rising Threats and Security Challenges

In the face of escalating security threats, ranging from terrorism and transnational crime to geopolitical tensions, the imperative for advanced surveillance and reconnaissance capabilities has become increasingly paramount. Aerostat systems, buoyed by helium and tethered to the ground, have emerged as instrumental assets in addressing these challenges. Their ability to elevate surveillance to new heights, quite literally, equips governments and defense organizations with a strategic advantage in detecting, tracking, and responding to potential threats in real-time. Aerostats provide an elevated and persistent vantage point, allowing for comprehensive monitoring of vast areas. Equipped with advanced sensors, including high-resolution cameras and radar systems, these platforms deliver enhanced situational awareness. This heightened awareness proves invaluable in rapidly identifying and assessing potential security risks, enabling timely and effective responses. The real-time data and intelligence gathered by aerostat systems empower decision-makers to implement proactive measures, fortifying the overall security posture. The versatility of aerostat systems extends across various scenarios, from border surveillance to monitoring critical infrastructure. Their role in maintaining continuous vigilance contributes significantly to national and global security efforts, offering a proactive and effective response to the evolving and multifaceted nature of contemporary security threats.

Market Restraints:

Weather Dependency and Limited Payload Capacity:

Aerostat systems face vulnerability to adverse weather conditions, including high winds, thunderstorms, and extreme temperatures. Unfavorable weather not only diminishes the operational effectiveness of aerostats but also introduces disruptions to surveillance missions, presenting potential safety risks to both personnel and equipment. While there have been notable advancements in payload technologies, aerostat systems still contend with limited payload capacity when compared to alternative aerial platforms like manned aircraft or drones. This limitation constrains the range of sensors, cameras, and other payloads that can be integrated into aerostat systems, curbing their overall versatility and application potential. The constrained payload capacity of aerostats poses challenges in adapting to diverse mission requirements and may restrict their ability to accommodate larger or more advanced surveillance equipment. Despite their unique advantages, such as prolonged endurance and stability, these constraints underscore the need for continued innovation to enhance the payload capabilities of aerostat systems and expand their operational adaptability in varied environmental conditions.

The global pandemic wrought havoc on the seamless flow of supply chains, resulting in significant disruptions to the production, delivery, and procurement of components and systems essential for aerostats. Manufacturing facilities grappled with temporary closures, a scarcity of labor, and limitations in transportation, collectively leading to extensive disruptions in the supply chain and a slowdown in production. The imposition of travel restrictions, lockdown measures, and adherence to social distancing protocols, implemented to curb the spread of the virus, further compounded challenges for operators and maintenance crews of aerostat systems. The restrictive measures presented operational hurdles, impacting the deployment of aerostats for critical functions such as surveillance and reconnaissance. Movement restrictions and limited access to operational sites may have hindered the timely and efficient deployment of aerostat systems, underscoring the profound and far-reaching impacts of the pandemic on the operational landscape of these aerial platforms. Thus, the pandemic-induced disruptions not only reverberated across manufacturing processes but also intricately affected the operational aspects of aerostat systems, highlighting the vulnerability of global supply chains and the intricate interdependencies within the aerospace industry.

Segmentation Analysis:

Military and Law Enforcement Segment is Expected to Witness Significant Growth Over the Forecast Period

Globally, military forces heavily rely on aerostat systems to conduct Intelligence, Surveillance, and Reconnaissance (ISR) missions. Outfitted with an array of sensors, cameras, radars, and communication payloads, aerostats offer sustained aerial surveillance across expansive territories. This capability empowers military commanders to acquire real-time intelligence, observe enemy activities, and assess the dynamic landscape of the battlefield. The persistent presence of aerostats proves invaluable in enhancing situational awareness and decision-making on the part of military strategists. Law enforcement agencies also leverage aerostat systems for critical tasks such as border security and immigration control. Equipped with advanced features like cameras, thermal imaging sensors, and ground surveillance radars, these aerostats become indispensable tools for border patrol agents. They enable continuous monitoring of border areas, facilitating the detection of illegal crossings and providing crucial support in efforts to apprehend smugglers, human traffickers, and undocumented migrants. The adaptability and versatility of aerostat systems make them pivotal assets in ensuring both military and law enforcement objectives are met effectively and with heightened efficiency.

Commercial and Research Segment is Expected to Witness Significant Growth Over the Forecast Period

Aerostat systems support environmental monitoring and research initiatives by providing aerial platforms for collecting environmental data, conducting atmospheric research, and monitoring natural resources. Aerostats equipped with sensors, sampling devices, and scientific instruments enable researchers to study air quality, weather patterns, pollution levels, and ecological changes in terrestrial and marine environments. Researchers use aerostat systems for geological surveys, mineral exploration, and terrain mapping applications. Aerostats equipped with remote sensing payloads, LiDAR scanners, and magnetometers provide aerial platforms for conducting geological surveys, identifying mineral deposits, mapping geological formations, and assessing terrain characteristics in remote or inaccessible areas.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America’s , aerostat systems play a crucial role in advancing environmental monitoring and research endeavors by serving as aerial platforms for the collection of data pertaining to air quality, weather patterns, and overall environmental conditions. Researchers harness the capabilities of aerostats, integrating them with specialized scientific instruments and sensors to conduct comprehensive atmospheric research. These aerial platforms prove instrumental in monitoring pollution levels and assessing ecological shifts in both terrestrial and marine environments. Aerostats, equipped with state-of-the-art scientific instrumentation, provide a versatile and reliable means for researchers to gather valuable insights into the intricacies of the environment. Their elevated vantage points enable a broader scope of observation, facilitating a more comprehensive understanding of atmospheric dynamics and environmental changes. This innovative use of aerostat systems contributes significantly to ongoing initiatives aimed at promoting environmental sustainability and addressing critical issues related to climate change and pollution. Thus, the integration of aerostat technology into environmental research not only enhances data collection capabilities but also underscores the adaptability of these aerial platforms in supporting scientific endeavors. The insights gained through aerostat-enabled research initiatives contribute to a more informed and proactive approach to environmental management and conservation in the North American region.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding the company presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. These strategies include investments in research and development to stay at the forefront of technological advancements, mergers and acquisitions to consolidate market share, strategic partnerships for synergies, and innovation to differentiate products and services. The adoption of such multifaceted strategies reflects the competitive nature of the market, with participants continually seeking avenues for growth and sustainability. In essence, the high fragmentation in the studied market not only signifies the diversity of players but also underscores the dynamism and competitiveness that drive ongoing strategic maneuvers. As companies explore various avenues for expansion, the market continues to evolve, presenting both challenges and opportunities for industry stakeholders. Some of the market players working in this domain are:

Recent Developments:

1) In May 2022, Spire Global secured a multi-million-dollar, five-year contract to deliver weather forecasts for TCOM, a United States-based intelligence, surveillance, and reconnaissance (ISR) firm. This subcontract specifically involves providing weather forecasts for ten locations where TCOM operates aerostats, emphasizing the critical role of accurate weather information in supporting ISR activities.

2) During November 2021, the Israeli Ministry of Defense (MoD) unveiled a significant development involving the Israel Missile Defense Organization (IMDO) testing a cutting-edge aerostat. Manufactured by the U.S. company TCOM, the High Availability Aerostat System (HAAS) was equipped with a state-of-the-art radar capable of detecting long-range threats. This collaborative effort included the expertise of the U.S. Missile Defense Agency and Elta, a subsidiary of Israel Aerospace Industries' primary contractor. The successful testing of the HAAS aerostat with advanced radar technology underscores the global collaboration and technological advancements shaping the landscape of aerostat systems in defense and security applications.

Q1. What is the current Aerostat System Market size?

The Aerostat Systems Market Size is currently valued at USD 11.65 billion,

Q2. What is the Growth Rate of the Aerostat System Market?

Aerostat System Market is expected to register a CAGR of 8.2% over the forecast period.

Q3. Which is the leading Component Segment in the Aerostat System Market?

Military and Law Enforcement Segment and Commercial and Research Segment is the leading Component in the Aerostat System Market.

Q4. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model