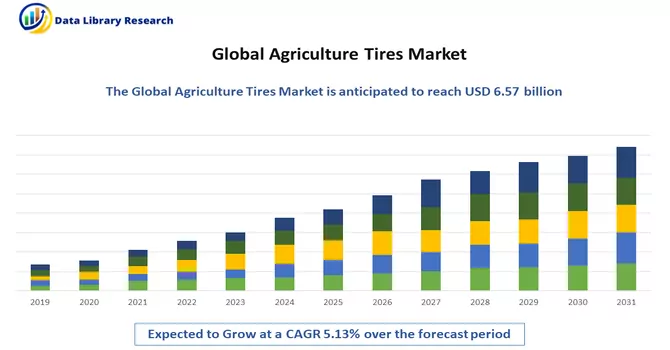

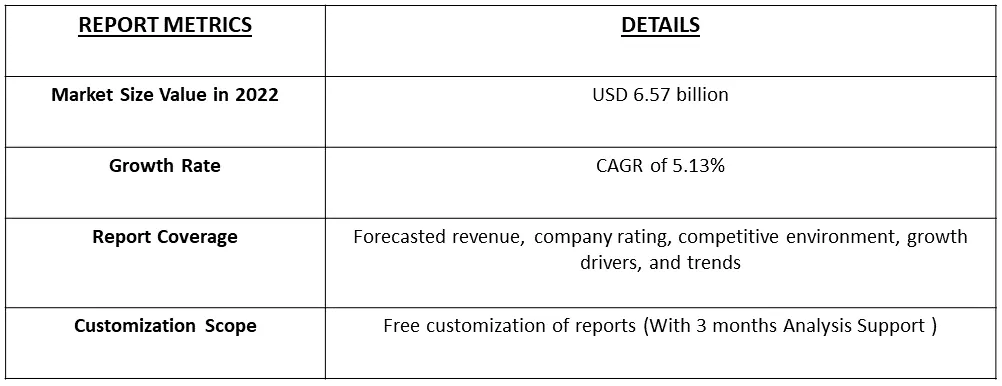

The agricultural tires market is valued at USD 6.57 billion in the year 2022, registering a CAGR above 5.13% during the forecast period, 2023-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Agricultural tires, often referred to as farm tires or ag tires, are specialized types of tires designed for use on various agricultural vehicles and machinery used in farming and agricultural operations. These tires are specifically engineered to withstand the demands and challenges of the agricultural environment, which often includes rough and uneven terrain, heavy loads, and a variety of weather conditions.

The continuously increasing global population necessitates higher agricultural productivity. Agricultural tires help in improving the efficiency of farming machinery, which is crucial for meeting the growing demand for food. The shift towards mechanized farming practices, especially in emerging economies, is driving the demand for agricultural tires. These tires enable better traction and reduce soil compaction, resulting in higher crop yields. Moreover, innovations in tire technology have led to the development of high-performance agricultural tires with longer durability and enhanced load-bearing capacity, attracting more farmers towards their adoption.

The market is witnessing a growing trend toward eco-friendly agricultural tires that minimize soil compaction and reduce fuel consumption. These tires are gaining popularity due to their sustainability and reduced environmental impact. The integration of digital technologies and IoT in the agriculture sector is leading to the development of smart tires that can monitor tire pressure, temperature, and wear. This trend is gaining traction due to the benefits it offers in terms of efficiency and maintenance.

Market Segmentation: The Global Agricultural Tires Market is Segmented by Sales Channel Type (OEM and Replacement/Aftermarket), Application Type (Tractors, Combine Harvesters, Sprayers, Trailers, Loaders, and Other Application Types), Tire Type (Bias Tires and Radial Tires), and Geography (North America, Europe, Asia-Pacific, and Rest of the World). The market size are provided in terms of value (USD million) for all the mentioned segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Agriculture Tires Market Growing Global Population

The world's population is steadily growing, and this demographic shift has profound implications for global food production and, consequently, the demand for agricultural tires. The 2022 UN Report stated that world's population is on an upward trajectory, with estimates suggesting that it will reach 9.7 billion by 2050. This population growth is driven by factors such as increased life expectancy and fertility rates in some regions. As farms expand to meet the needs of a larger population, the use of larger and more robust farming equipment becomes common. These machines require specialized agricultural tires to maintain traction and reduce soil compaction. Thus, the market is expected to witness significant growth over the forecast period.

Agriculture Tires Market Technological Advancement and Mechanization of Agriculture

The agricultural industry is undergoing a significant transformation due to technological advancements and the increasing mechanization of farming practices. The adoption of advanced machinery and technology in agriculture has led to increased mechanization. Farming equipment, such as tractors, combines, and harvesters, are now equipped with cutting-edge technology, enhancing efficiency and productivity. The agricultural sector has seen remarkable technological advancements, including precision farming, autonomous machinery, and digital tools. These innovations require specialized tires that can complement these advanced farming practices. Thus, owing to such advantages the market is expected to witness significant growth over the forecast period.

Market Restraints :

Agriculture Tires Market High Initial Cost and Environmental Concerns

The challenges of high initial costs and environmental concerns are indeed slowing down the growth of the agriculture tire market. For instance, the use of heavy machinery with conventional tires can lead to soil compaction, which negatively affects soil health, crop yield, and the environment. This issue has raised concerns among farmers, regulators, and environmentalists. Apart from this the primary challenges faced by farmers and agricultural businesses is the high initial cost associated with purchasing agricultural tires. These tires, especially the specialized and technologically advanced ones, can be relatively expensive, posing a financial hurdle for many potential buyers. Thus, due to this the studied market is expected to witness significant growth over the forecast period.

The outbreak of the COVID-19 pandemic in 2019 had far-reaching consequences across various industries, and the agriculture tire market was no exception. During the early stages of the pandemic, lockdowns, restrictions, and labor shortages disrupted the manufacturing processes of agriculture tire companies, leading to reduced production capacity. Moreover, global supply chains were severely impacted, causing delays in the transportation of raw materials and finished products, affecting the availability of agriculture tires. Thus, the COVID-19 pandemic brought significant challenges to the agriculture tire market, disrupting supply chains, reducing agricultural activities, and causing economic uncertainty. However, it also accelerated the adoption of technology in agriculture, fostered resilience, and emphasized the importance of essential services and innovative solutions.

Segmental Analysis:

OEM is Expected to Witness significant Growth Over the Forecast Period

Original Equipment Manufacturers (OEMs) play a pivotal role in the agriculture tire market, as their products are integrated directly into agricultural machinery and vehicles. OEMs manufacture a wide range of agricultural equipment, including tractors, combines, and harvesters. These machines often require specialized tires, creating essential partnerships with tire manufacturers. OEMs provide a stable demand base for agricultural tire manufacturers. Large-scale orders from OEMs ensure consistent production, which benefits both tire manufacturers and farmers. Thus, owing to such advantages the segment is expected to witness significant growth over the forecast period.

Combine Harvesters is Expected to Witness significant Growth Over the Forecast Period

Combine harvesters are essential agricultural machinery used for the efficient harvesting of various crops. Combine harvesters are versatile machines designed to harvest a wide range of crops, from grains to oilseeds and more. They play a central role in modern farming by significantly increasing harvesting efficiency. Moreover, combine harvesters operate under heavy workloads, as they must cut, thresh, and clean crops. To handle these tasks efficiently, they require robust tires that can withstand the weight and stress. Thus, the segment is expected to witness significant growth over the forecast period.

Bias Tires is Expected to Witness significant Growth Over the Forecast Period

Bias tires are a type of tire construction that plays a unique role in the agriculture tire market. Bias tires are constructed with multiple overlapping piles or layers of fabric cords arranged at different angles. This construction provides durability and strength, making them well-suited for demanding agricultural applications. Moreover, bias tires are known for their robust construction, which allows them to handle heavy loads, making them a preferred choice for equipment used in agriculture, where load-bearing capacity is essential. Thus, the segment is expected to witness significant growth over the forecast period.

North America Region is Expected to Witness significant Growth Over the Forecast Period

North America boasts a diverse agricultural landscape, with a wide variety of crops, from grains and oilseeds to fruits and vegetables. This diversity creates unique demands on agricultural tires. The region is home to extensive agricultural operations, characterized by large-scale farms and modern farming equipment. This trend drives the need for high-performance and specialized agricultural tires.

The adoption of mechanized farming practices, including the use of tractors, harvesters, and other machinery, creates substantial demand for agriculture tires to support these equipment. For instance, in January 2022, Magna Tyres acquired Industra Ltd in a step toward global expansion. Industra Ltd holds a robust presence in the Polish market, with three tire segments, including Agricultural Tires. Earthmoving and Industrial Tires will aid Magna in marking its presence in the Polish market.

North America is at the forefront of technological innovation in agriculture, leading to a higher demand for smart and high-tech agricultural tires equipped with features like tire pressure monitoring systems (TPMS). Thus, region is expected to witness significant growth over the forecast period.

For Detailed Market Segmentation - Download Free Sample PDF

The agricultural tire market is moderately concentrated. In order to maintain market dominance, the major companies are focusing on product up-gradation and customization to expand the overall product line, with robust offerings in the agricultural tires market. The major players in the agricultural tires market are:

Recent Developments:

1. February 2023: Continental introduced its largest-ever tractor tire designed for high-horsepower tractors, offering enhanced load-carrying capacity, improved traction, and reduced soil compaction. With its robust construction and advanced tread design, the tire aims to meet the demands of modern agriculture, providing increased efficiency and productivity in the field.

2. May 2022: Apollo Tyres launched a new range of agricultural tires specifically designed for tractors. These tires are aimed at improving traction, fuel efficiency, and load-carrying capacity while also reducing soil compaction. With their durable construction and innovative tread patterns, the tires are expected to enhance the performance and productivity of tractors in agricultural operations.

Q1. What was the Agriculture Tires Market size in 2022?

As per Data Library Research Market agricultural tires market is valued at USD 6.57 billion in the year 2022.

Q2. At what CAGR is the Agriculture Tires Market projected to grow within the forecast period?

Agriculture Tires Market is registering a CAGR above 5.13% during the forecast period.

Q3. What are the factors on which the Agriculture Tires Market research is based on?

By Sales Channel Type, By Application Type, Tire Type and Geography are the factors on which the Agriculture Tires Market research is based

Q4. Who are the key players in Agriculture Tires Market?

Some key players operating in the market include:

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model