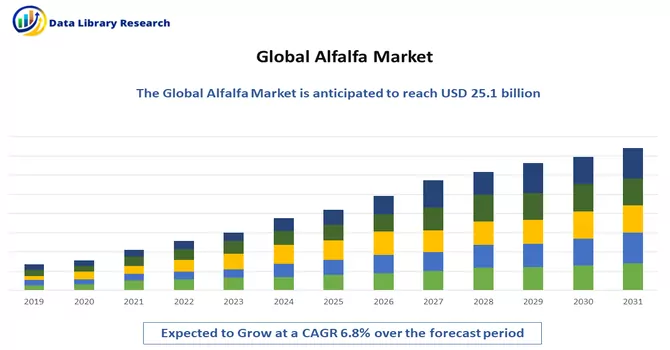

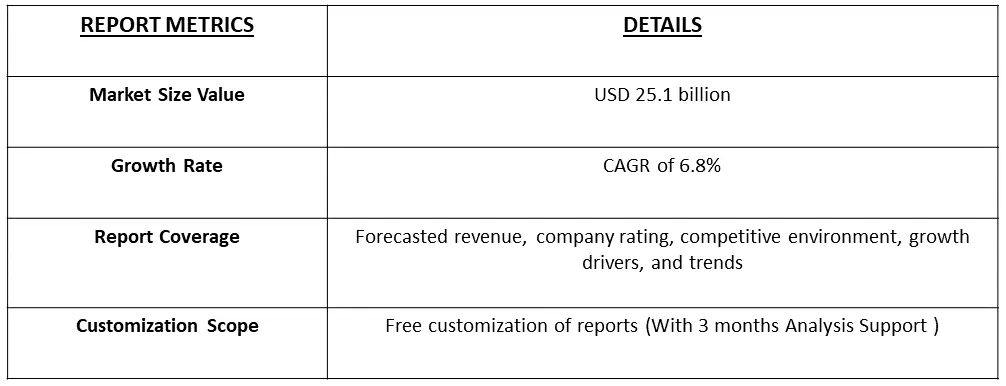

The Alfalfa Market size is estimated at USD 25.1 billion in 2022 and is expected to register a CAGR of 6.8% during the forecast period 2023-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Alfalfa is commonly grown as a forage crop for livestock, providing a rich source of nutrients. Its trifoliate leaves and clusters of small purple flowers make it recognizable. Often used in crop rotation for its nitrogen-fixing properties, alfalfa is valued for its role in improving soil fertility. Additionally, it is consumed by humans in the form of alfalfa sprouts, which are popular in salads and sandwiches.

The primary driver is the demand for alfalfa as a high-quality forage crop in livestock feed. Alfalfa is rich in nutrients, making it a preferred choice for dairy and beef cattle, horses, goats, and other livestock. Also, the expansion of the livestock industry globally fuels the demand for alfalfa. As the population grows, so does the demand for meat and dairy products, driving the need for high-quality feed. Furthermore, the increasing focus on dairy production, particularly in regions with a growing dairy industry, stimulates the demand for nutrient-dense feed like alfalfa to enhance milk production and quality.

Market Segmentation: The Global Alfalfa Market is Segmented by Products (Hay, Pellets, and Cubes or sprouts), Applications (Food and beverage and Pharmaceuticals and nutraceuticals), and Geography (North America, Europe, Asia Pacific, South America, and Middle-East and Africa).

For Detailed Market Segmentation - Download Free Sample PDF

There is a growing trend toward organic and natural products, and this extends to alfalfa. Increasing consumer awareness of the benefits of organic farming practices has led to a rising demand for organic alfalfa, driven by health-conscious consumers. Also, the adoption of advanced farming technologies, including precision farming and innovative irrigation methods, is becoming more prevalent in alfalfa cultivation. These technologies aim to enhance productivity and optimize resource utilization. Moreover, there is an increasing emphasis on sustainable and environmentally friendly farming practices. Alfalfa's nitrogen-fixing properties make it a valuable component in crop rotation systems, aligning with sustainable agriculture trends.

Market Drivers:

Rise in Organic and Sustainable Livestock Farming Practices

The increasing adoption of organic and sustainable practices in livestock farming is a key driver for the growing demand for organic alfalfa. Organic farming emphasizes environmentally friendly and sustainable agricultural methods that avoid synthetic pesticides and fertilizers. In this context, alfalfa becomes a valuable asset due to its inherent ability to fix nitrogen in the soil. Organic alfalfa plays a pivotal role in supporting the principles of organic farming systems. As a nitrogen-fixing legume, alfalfa forms a symbiotic relationship with nitrogen-fixing bacteria in its root nodules. This process enriches the soil with nitrogen, enhancing its fertility without the need for synthetic fertilizers. This is particularly advantageous for organic farming, where maintaining soil health and fertility through natural means is a fundamental principle. The demand for organic alfalfa is driven not only by its nutritional benefits for livestock but also by its role in promoting sustainable and regenerative agricultural practices. By incorporating organic alfalfa into crop rotations, farmers can improve soil structure, enhance water retention, and foster a more balanced ecosystem. Thus, such factors are expected to drive the growth of the studied market.

Growing Consumer Awareness of the Health Benefits

The increasing recognition among consumers of the positive health attributes associated with organic and natural products, particularly those derived from animals fed with alfalfa, is a significant driver for the expansion of the market. As consumers become more health conscious and environmentally aware, there is a growing preference for food items produced through sustainable and organic farming practices. In this context, alfalfa plays a crucial role as a nutritious feed for livestock, contributing to the overall well-being of the animals. Livestock, such as cattle and dairy cows, that are fed with alfalfa yield meat and dairy products that are perceived as healthier alternatives. This is attributed to the rich nutritional profile of alfalfa, which includes essential vitamins, minerals, and proteins. Thus, consumers are increasingly seeking transparency in food production and are drawn to products that align with their values of health, sustainability, and naturalness. The understanding that animals raised on alfalfa-based diets receive a nutrient-rich and natural feed further boosts the appeal of meat and dairy sourced from such practices.

Market Restraints:

Water Scarcity and Drought Conditions

Alfalfa, being a crop with high water requirements, presents challenges in regions grappling with water scarcity or intermittent drought conditions. The limited availability of water poses significant obstacles to the sustainable cultivation of alfalfa, placing constraints on production levels. In such environments, the demand for water-intensive crops like alfalfa necessitates careful consideration and resource management to ensure the viability and productivity of alfalfa cultivation amidst the challenges posed by inadequate water supplies. Thus, such factors are expected to slow down the growth of the studied market over the forecast period.

The pandemic disrupted global supply chains, affecting the availability and distribution of agricultural inputs, including alfalfa seeds and fertilizers. Transportation restrictions and logistical challenges impeded the smooth flow of goods, impacting alfalfa production. Lockdowns, social distancing measures, and health concerns led to labour shortages on farms, affecting planting, harvesting, and other critical agricultural activities. The reduced workforce posed challenges in maintaining regular cultivation practices. The pandemic underscored the importance of food security, prompting governments and stakeholders to reassess strategies for sustaining essential food production, including forage crops like alfalfa. The pandemic accelerated the adoption of technology in agriculture, including remote monitoring, precision farming, and digital platforms. This trend could have long-term implications for the efficiency and resilience of alfalfa cultivation practices. Thus, post-pandemic the market is expected to witness significant growth over the forecast period.

Segmental Analysis:

Hay Product Type Segment is Expected to Witness Significant Growth Over the Forecast Period

The hay bales segment emerged as the market leader, commanding a substantial revenue share due to the dominance that can be attributed to the inherent advantages they offer, providing a more natural and unprocessed form of forage. Particularly beneficial for the psychological and physical well-being of certain livestock, such as horses and cows, hay bales have gained preference. Also, one of the key factors contributing to the growth of hay bales is their extended shelf life compared to other forage types. Their durability ensures a longer preservation period, making them an optimal choice for storage. Unlike some alternatives, hay bales exhibit resilience to moisture exposure, mitigating the risk of spoilage. This inherent quality not only enhances their convenience for storage but also reduces the likelihood of wastage due to unfavourable environmental conditions.

The appeal of hay bales extends beyond their practical attributes. The unprocessed nature of this forage aligns with the nutritional needs and preferences of certain livestock. As a result, hay bales have become a favoured choice among farmers and livestock owners seeking a reliable, durable, and nutritionally sound forage option. This dominance in the market underscores the importance of hay bales in catering to the well-being and nutritional requirements of livestock, positioning them as a cornerstone in the forage market landscape.

The Pharmaceutical & Nutraceutical Segment is Expected to Witness Significant Growth Over the Forecast Period

Pharmaceuticals and nutraceuticals derived from alfalfa showcase the plant's versatility in contributing to human health. Alfalfa (Medicago sativa) contains bioactive compounds, including phytoestrogens and antioxidants, that have potential therapeutic properties. Research explores its use in traditional medicine for various ailments. Some studies suggest that compounds in alfalfa may contribute to cholesterol regulation, making it a subject of interest in pharmaceutical research related to cardiovascular health. Also, Alfalfa has been investigated for its anti-inflammatory effects, with studies exploring its potential to mitigate inflammation-related conditions. This property makes it relevant to pharmaceutical research in inflammatory disorders. Thus, the segment is expected to witness significant growth over the forecast period.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North American region, alfalfa serves diverse agricultural purposes and contributes significantly to various sectors. Alfalfa is primarily cultivated as a high-quality forage crop for livestock, including dairy and beef cattle, horses, sheep, and goats. Its nutritional profile, rich in proteins, vitamins, and minerals, makes it a preferred choice for animal feed. North America, particularly the United States, is a significant exporter of alfalfa. Alfalfa products, including hay and pellets, are exported to various countries to meet the demand for high-quality forage in the global market. Thus, the versatile uses of alfalfa in North America underscore its significance in the agricultural landscape, playing a pivotal role in animal nutrition, soil health, and sustainable farming practices across the region.

Get Complete Analysis Of The Report - Download Free Sample PDF

Numerous manufacturers are embracing sustainable agricultural methodologies, incorporating practices such as crop rotation, decreased reliance on chemical inputs, and water conservation, to mitigate the environmental footprint associated with alfalfa production. A subset of market participants is channelling investments into research and development initiatives, specifically geared towards enhancing various facets of alfalfa cultivation techniques. This encompasses advancements in crop management, irrigation practices, pest control mechanisms, and disease prevention strategies. Key Alfalfa Companies:

Recent Development:

1) In September 2023, DLF announced the acquisition of Corteva Agriscience’s alfalfa breeding program. This strategic move provides DLF with access to top-tier alfalfa genetics and a robust brand portfolio.

2) In October 2021, Forage Genetics International, a subsidiary of Land O' Lakes, successfully secured patent approval for a natural DNA sequence conferring resistance to anthracnose race 5 in alfalfa. This breakthrough is poised to deliver substantial advantages to farmers, as it has the potential to mitigate defoliation, ultimately preventing yield losses estimated at 25-30%.

Q1. What was the Alfalfa Market size in 2022?

As per Data Library Research the Alfalfa Market size is estimated at USD 25.1 billion in 2022.

Q2. What is the Growth Rate of the Alfalfa Market ?

Alfalfa Market is expected to register a CAGR of 6.8% during the forecast period.

Q3. What are the factors driving the Alfalfa Market?

Key factors that are driving the growth include the Rise in Organic and Sustainable Livestock Farming Practices and Growing Consumer Awareness of the Health Benefits.

Q4. What are the factors on which the Alfalfa market research is based on?

By Product, By Application and Geography are the factors on which the Alfalfa market research is based.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model