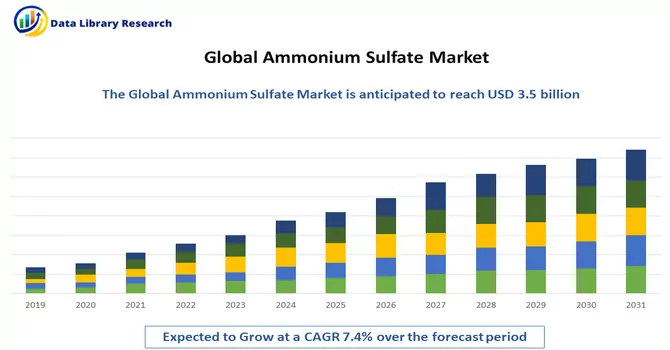

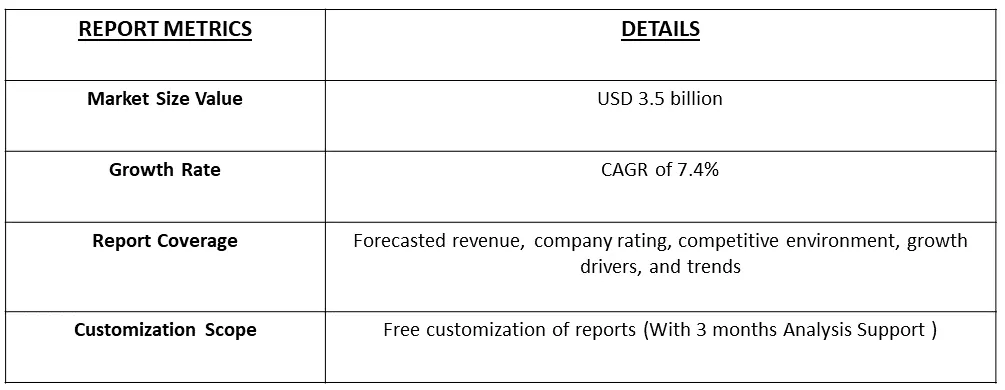

The global ammonium sulfate market size was estimated at USD 3.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.4% from 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Ammonium sulfate is an inorganic salt with the chemical formula (NH₄)₂SO₄. It consists of two ammonium ions (NH₄⁺) and one sulfate ion (SO₄²⁻). The compound is commonly used in various industrial and agricultural applications. It is a white, crystalline solid that is highly soluble in water. In agriculture, ammonium sulfate is often employed as a fertilizer, providing a source of both nitrogen and sulfur for plants. The nitrogen in ammonium sulfate is in the ammonium form, which is less prone to leaching compared to other nitrogen sources like nitrates, making it useful for certain soil conditions. In industry, ammonium sulfate is utilized in the production of certain chemicals, as a flame retardant for textiles and plastics, and in water treatment processes. Additionally, it is sometimes used in laboratories for protein precipitation and purification.

The expansion of the market for ammonium sulfate is primarily fueled by the growing need for this compound in the formulation of nitrogenous fertilizers, which find extensive application in the agricultural sector. The market is strongly influenced by the widespread consumption of solid ammonium sulfate. Nevertheless, there is an anticipated surge in demand for the liquid form, driven by the increasing need for water treatment applications. This shift in demand is reflective of the versatile applications of ammonium sulfate across different industries, with its solid form dominating in agriculture and the liquid counterpart gaining traction in water treatment processes.

The Ammonium Sulfate market is experiencing robust growth, primarily driven by the escalating demand for nitrogenous fertilizers in the agricultural sector. Solid ammonium sulfate remains the preferred choice due to its ease of handling, storage, and application in agriculture. However, there is a notable trend towards increased demand for the liquid form, fueled by its applications in water treatment processes. Technological advancements in production processes, a focus on sustainable agriculture, and global economic and agricultural trends significantly influence market dynamics. Regulatory considerations, particularly in relation to environmental standards, play a crucial role. Additionally, ongoing investments in research and development contribute to innovation and competitiveness within the market. Regional variations in agricultural practices and regulatory frameworks further impact market trends, highlighting the importance of a nuanced understanding for stakeholders to navigate opportunities and challenges effectively.

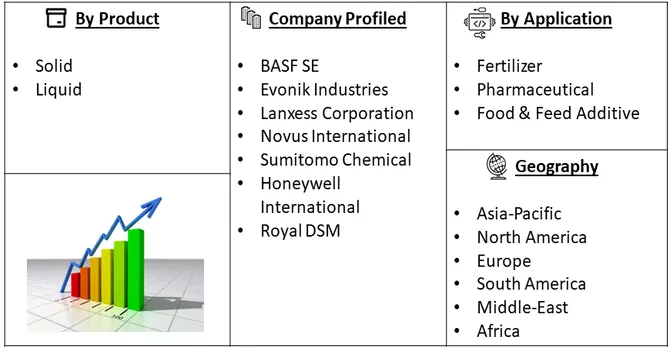

Market Segmentation: Ammonium Sulfate Market Size, Share & Trends Analysis Report By Product (Solid, Liquid), By Application (Fertilizer, Pharmaceutical, Food & Feed Additive) and geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The report offers the market size and forecasts for revenue (USD million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Growing Population and Shrinking Arable Land

The growing population and shrinking arable land pose significant challenges to global food security and agricultural productivity, directly impacting the demand for fertilizers such as ammonium sulfate. As the world's population continues to expand, the pressure to increase food production rises, necessitating the optimization of available arable land. However, the availability of arable land is diminishing due to urbanization, soil degradation, and other environmental factors. In this context, fertilizers play a crucial role in maximizing crop yields and ensuring food supply adequacy. Ammonium sulfate, a widely used nitrogen fertilizer, provides essential nutrients to crops, promoting healthy growth and enhancing yield potential. Its popularity stems from its ability to deliver readily available nitrogen to plants, supporting their development and improving overall productivity. In regions with limited arable land, the efficient utilization of fertilizers becomes paramount for achieving sustainable agricultural practices and mitigating food scarcity risks. Ammonium sulfate offers a viable solution by enhancing soil fertility and nutrient availability, thereby optimizing the productivity of existing agricultural areas.

However, the sustainable use of ammonium sulfate and other fertilizers is critical to mitigate adverse environmental impacts. Excessive application of nitrogen-based fertilizers can lead to nutrient runoff, soil degradation, and water pollution, exacerbating environmental challenges. To address these concerns, agricultural practices need to evolve towards more efficient and environmentally sustainable approaches. This includes adopting precision agriculture techniques, optimizing fertilizer application rates, and integrating organic farming methods. Furthermore, research and innovation in fertilizer technology aim to develop eco-friendly formulations and minimize environmental footprints while maintaining agricultural productivity. In summary, the interplay between the growing population, shrinking arable land, and the demand for fertilizers like ammonium sulfate underscores the importance of sustainable agricultural practices and innovative solutions to ensure food security while safeguarding the environment for future generations.

Robust Growth Of The Overall Fertilizer Industry

The flourishing fertilizer industry, driven by the imperative to address the growing global population's food requirements, significantly influences the demand for ammonium sulfate. As a pivotal nitrogen fertilizer, ammonium sulfate plays a crucial role in enhancing agricultural productivity by providing readily available nutrients for plant growth. Its versatility extends to specialty markets such as horticulture and greenkeeping, reflecting its diverse applications. However, the industry's robust growth faces environmental challenges, prompting a shift towards sustainable practices and innovative solutions. Regulatory scrutiny and the need for eco-friendly approaches underscore the evolving landscape, requiring a delicate balance between agricultural expansion and environmental responsibility to ensure long-term viability and resilience.

Market Restraints:

High Environmental Impact

The high environmental impact associated with the production and use of ammonium sulfate has the potential to impede its growth in various applications. The manufacturing process often involves the use of energy-intensive methods and may contribute to greenhouse gas emissions. Additionally, the runoff of ammonium sulfate from agricultural fields can lead to nitrogen pollution in water bodies, negatively impacting aquatic ecosystems. The environmental concerns related to these aspects may result in increased scrutiny and regulations, compelling industries to adopt more sustainable practices or explore alternative fertilizers with lower environmental footprints. As sustainability becomes a more significant focus globally, the potential for stricter regulations and a shift towards eco-friendly alternatives could pose challenges to the continued growth of ammonium sulfate, prompting industries to prioritize environmentally responsible practices and seek innovative solutions to mitigate its environmental impact.

The COVID-19 pandemic has had a substantial impact on the ammonium sulfate market, disrupting both supply and demand dynamics. While the agricultural sector, a primary consumer of ammonium sulfate, faced fluctuations due to labor shortages and distribution challenges, other industries experienced decreased demand amid economic uncertainties and supply chain disruptions. Transportation restrictions and logistical hurdles further hindered the timely availability of raw materials and distribution of finished products, leading to market uncertainties and potential price fluctuations. The economic downturn also influenced investment decisions, affecting expansion plans and new projects within the industry. As the world continues to navigate the pandemic, adaptability and strategic planning will be crucial for stakeholders to mitigate the effects and position themselves for recovery and future growth in the ammonium sulfate market.

Segmental Analysis:

Solid State Segment is Expected to Witness Significant Growth Over the Forecast Period

The solid-state use of ammonium sulfate spans various industries and applications. In agriculture, solid ammonium sulfate is a widely utilized nitrogen fertilizer, providing crops with a readily available source of nitrogen. Its granular form allows for easy application, making it a preferred choice among farmers for enhancing soil fertility and promoting plant growth. Additionally, the solid-state application of ammonium sulfate is common in the manufacturing of blended fertilizers, where it is combined with other essential nutrients. In the industrial sector, solid ammonium sulfate finds use in diverse applications. It is employed in the production of flame-retardant materials, as it can act as a fire inhibitor. Solid ammonium sulfate is also utilized in certain chemical processes and as a precipitating agent in laboratories for protein purification. Moreover, the solid form of ammonium sulfate is a key component in various water treatment applications. Its ability to effectively remove impurities, such as heavy metals, from water makes it valuable in wastewater treatment processes. Solid ammonium sulfate is used in conjunction with other chemicals to precipitate and remove pollutants, contributing to the purification of water for industrial and municipal purposes. Overall, the solid-state use of ammonium sulfate underscores its versatility and importance across agriculture, industry, and environmental applications, showcasing its significance in various processes and sectors.

Pharmaceutical Segment is Expected to Witness Significant Growth Over the Forecast Period

While ammonium sulfate is more commonly recognized for its applications in agriculture and industrial processes, it also finds use in the pharmaceutical sector. One significant application is in protein purification and crystallization. Ammonium sulfate is employed to fractionate and separate proteins based on their solubility characteristics. By adjusting the concentration of ammonium sulfate in a solution, proteins can be selectively precipitated, facilitating their isolation and purification from other components. In the pharmaceutical industry, where the purity of drugs and therapeutic proteins is paramount, ammonium sulfate precipitation is a well-established method for refining and concentrating biomolecules. This technique helps researchers and manufacturers achieve high levels of purity and specificity in the isolation of target proteins, ensuring the quality and efficacy of pharmaceutical products. Additionally, ammonium sulfate can be utilized in the stabilization of certain pharmaceutical formulations. In some cases, it is employed to enhance the stability and shelf life of protein-based drugs by preventing their denaturation or aggregation. Overall, the pharmaceutical sector leverages the unique properties of ammonium sulfate in protein purification processes, contributing to the production of high-quality drugs and therapeutic proteins with applications in medicine and healthcare.

Asia Pacific Segment is Expected to Witness Significant Growth Over the Forecast Period

As of 2023, the Asia Pacific region dominated the market with a substantial volume share due to the escalating demand for fertilizers within the agricultural sector in the region, consequently propelling the need for ammonium sulfate. The agriculture sector serves as a cornerstone in several economies, including India, Bangladesh, and Sri Lanka. Despite the relatively gradual growth of the agriculture sector, ongoing advancements in this domain are anticipated to create favorable opportunities for the increased utilization of fertilizers. The expanding agricultural activities in the Asia Pacific region underscore the significance of ammonium sulfate in meeting the evolving demands of the sector, contributing to the overall market dominance in terms of volume share.

Get Complete Analysis Of The Report - Download Free Sample PDF

Key Ammonium Sulfate Companies:

Recent Development:

1) In March 2023, Enva commenced the construction of a novel fertilizer pellet plant, focusing on utilizing ammonium sulfate derived from industrial liquid waste. The facility is slated to manufacture 4500 tons of pellets each year, targeting applications in agriculture, horticulture, and greenkeeping.

2) In July 2022, Evonik achieved the successful completion of a strategic agreement for the provision of blueSulfate®, an advanced nitrogen fertilizer designed to meet the specific needs of U.S. farmers. This collaborative venture positions Evonik to effectively address market demands, contributing to heightened agricultural productivity in the United States.

Q1. What was the Ammonium Sulfate Market size in 2023?

As per Data Library Research the global ammonium sulfate market size was estimated at USD 3.5 billion in 2023.

Q2. At what CAGR is the Ammonium Sulfate market projected to grow within the forecast period?

Ammonium Sulfate Market is expected to grow at a compound annual growth rate (CAGR) of 7.4% over the forecast period.

Q3. What are the factors driving the Ammonium Sulfate Market?

Key factors that are driving the growth include the Growing Population and Shrinking Arable Land and Robust Growth Of The Overall Fertilizer Industry.

Q4. Which region has the largest share of the Ammonium Sulfate market? What are the largest region's market size and growth rate?

Asia Pacific region has the largest share of the market . For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model