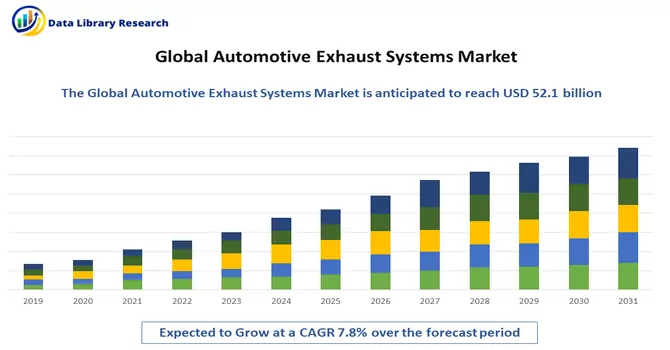

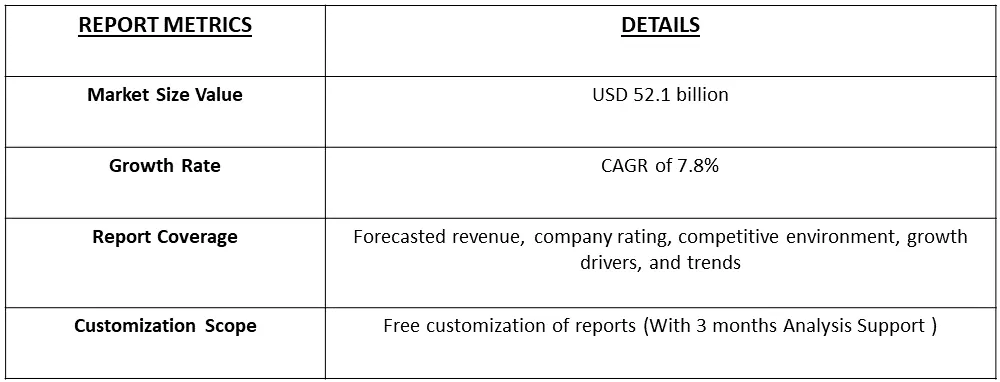

The global automotive exhaust systems market size was valued at USD 52.1 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Automotive exhaust systems are integral components of vehicles designed to manage and route the exhaust gases produced during the combustion process in an internal combustion engine. These systems play a crucial role in minimizing environmental impact by treating and expelling harmful emissions generated as byproducts of fuel combustion. The system collects and channels the hot and toxic gases produced during the combustion of fuel within the engine cylinders. Exhaust systems incorporate components, such as catalytic converters, to reduce and convert harmful pollutants, including carbon monoxide (CO), nitrogen oxides (NOx), and hydrocarbons, into less harmful substances before being released into the atmosphere.

The demand for automotive exhaust systems directly depends on production and sales units. Thus, the increasing sales of passenger cars and commercial vehicles across developed and emerging economies drive global demand for automotive exhaust systems. Moreover, stringent government standards associated with carbon emissions are expected to drive the market over the forecast period, as gasoline and diesel engines emit toxic gases and particles that are hazardous to the environment.

Several notable trends are shaping the automotive exhaust systems market, reflecting advancements in technology, regulatory changes, and evolving consumer preferences. Stringent emission standards worldwide are driving the development and adoption of advanced exhaust systems. Manufacturers are focusing on innovations, such as selective catalytic reduction (SCR) and lean NOx traps, to comply with emissions regulations and reduce the environmental impact of vehicles. The increasing shift toward electric vehicles has implications for exhaust systems. As the automotive industry embraces electrification, traditional internal combustion engines are being replaced by electric powertrains, eliminating the need for conventional exhaust systems. This trend poses challenges and opportunities for manufacturers to adapt their product portfolios. Collaboration between automotive manufacturers, exhaust system suppliers, and research institutions is gaining importance. Joint efforts facilitate the development of innovative technologies and solutions, ensuring compliance with evolving regulatory standards.

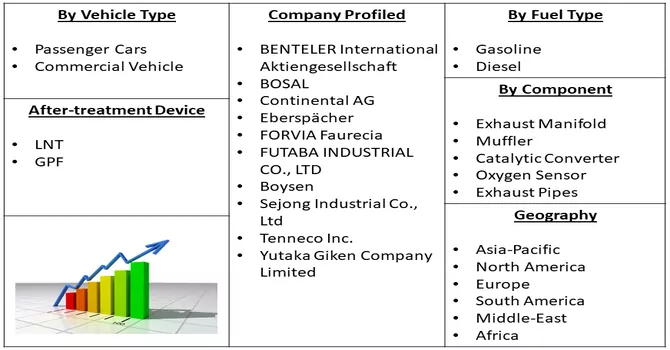

Market Segmentation: The Automotive Exhaust Systems Market is Segmented By Vehicle Type (Passenger Cars and Commercial Vehicle) Fuel Type (Gasoline and Diesel) After-treatment Device (LNT, and GPF), Component (Exhaust Manifold, Muffler, Catalytic Converter, Oxygen Sensor, and Exhaust Pipes) and Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa).

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Increasing Use of Combined After-Treatment Equipment

The increasing stringency of global emission standards has heightened the demand for reductions in exhaust stream emissions in terms of both details and quantities. To comply with these evolving standards, original equipment suppliers for automobiles and manufacturers of performance exhaust systems are employing various after-treatment systems. Among these, the combination of Selective Catalytic Reduction (SCR) and Diesel Particulate Filter (DPF) stands out as one of the most prevalent. This combination effectively addresses emissions concerns by eliminating over 70% of particulate and gaseous pollutants. While the DPF is responsible for filtering particulates, the SCR system converts nitrogen oxides (NOx) into nitrogen (N2) and liquid in the presence of a reduction agent. Consequently, the market for exhaust systems, especially those equipped with after-treatment technologies, is experiencing significant growth.

Technology For Exhaust Systems Is Developing Quickly

Rapid advancements in technology for particulate filters, driven by stringent governmental pollution regulations, have become pivotal in the automotive industry. Emission after-treatment solutions and Exhaust Gas Recirculation (EGR) mechanisms, aimed at enhancing exhaust stream regeneration, have evolved swiftly in response to these regulatory mandates. The anticipated growth of the industry is closely tied to the widespread adoption of these technologies. Thus, with upcoming vehicle quality regulations, automobile manufacturers are actively engaged in developing innovative technologies for gasoline exhaust systems. The primary objective is to reduce Nitrogen Oxide (NOx) emissions, aligning with the impending regulatory standards. The collective impact of these efforts, particularly in the creation and enhancement of automotive catalytic converters, is expected to drive an increased adoption of advanced particulate filters for vehicles.

Market Restraints :

Real-World Vehicle Emission Testing and Increasing Electrical Vehicle Demand

Utilizing portable emissions measuring devices, the Real Driving Emissions (RDE) test is designed to monitor hazardous pollutants, such as Nitrogen Oxides (NOx), emitted by vehicles while they are in actual operation on the road. The significance of RDE lies in its ability to address the disparity between approved emission values obtained through laboratory testing and the real-world performance of vehicles. According to the European Federation for Transportation and Environmental AISBL, there has been an uncontrollable increase in the gap between officially sanctioned laboratory test results and the actual efficiency of automobiles. This gap has expanded from 9% in 2001 to 28% in 2012 and further to 42% in 2015. RDE regulations aim to mitigate this growing divide by mandating that car manufacturers integrate pollution control systems into their engines and undertake additional measures to achieve optimal carbon reduction during real-world driving conditions. As a result, RDE rules are anticipated to have a positive impact on improving air quality in European nations by compelling manufacturers to take actions that contribute to a reduction in harmful emissions and enhance overall environmental standards.

The pandemic led to widespread disruptions in global supply chains. Lockdowns, restrictions, and reduced workforce availability affected the production and supply of automotive components, including exhaust systems. Delays in manufacturing and delivery timelines created challenges for both OEMs and aftermarket suppliers. Automotive manufacturing plants around the world faced temporary closures or reduced production capacities to comply with lockdown measures and ensure worker safety. This resulted in a decline in the production of vehicles, directly impacting the demand for automotive exhaust systems. Economic uncertainties arising from the pandemic, including job losses and financial strains, led to a decline in consumer confidence and spending. As a result, the demand for new vehicles, replacement parts, and aftermarket exhaust systems experienced fluctuations, affecting market dynamics.

Segmental Analysis :

Commercial Vehicle Segment is Expected to Witness Significant Growth Over the Forecast Period

The pivotal role of the commercial vehicle segment is evident in the automotive exhaust systems market, exerting a substantial influence on the demand for exhaust components and systems. Trucks and buses, encompassed within the realm of commercial vehicles, face rigorous emission standards mandated globally by governments and regulatory bodies. These standards are implemented to mitigate air pollution and foster environmental sustainability. Consequently, manufacturers of commercial vehicles are compelled to integrate sophisticated exhaust systems, ensuring adherence to stringent emission regulations. Sustainability in commercial vehicle exhaust systems is further propelled by ongoing innovations in materials, design methodologies, and manufacturing processes. Manufacturers actively explore the integration of lightweight materials and advanced coatings to bolster durability, concurrently reducing the overall weight of exhaust components.

Diesel Segment is Expected to Witness Significant Growth Over the Forecast Period

The diesel segment is a significant driver within the automotive exhaust systems market, playing a crucial role in shaping demand for exhaust components and systems. Diesel engines are prevalent in various vehicle types, including passenger cars, trucks, and commercial vehicles. Diesel engines emit pollutants such as nitrogen oxides (NOx) and particulate matter, necessitating effective emissions control mechanisms.

The automotive exhaust systems designed for diesel engines incorporate advanced technologies to minimize harmful emissions and comply with stringent environmental regulations. The global market trends in diesel vehicles, influenced by factors such as fuel prices, consumer preferences, and regulatory landscapes, impact the demand for exhaust systems. Shifts in market preferences, including the rise of alternative powertrains, may influence the future trajectory of the diesel segment. Thus, the diesel segment is a vital component of the automotive exhaust systems market, with a focus on emissions control, compliance with regulations, and the optimization of diesel engine performance. Technological advancements and market dynamics continue to shape the evolution of exhaust systems for diesel vehicles.

LNT Segment is Expected to Witness Significant Growth Over the Forecast Period

The Lean NOx Trap (LNT) segment is a noteworthy aspect within the automotive exhaust systems market, contributing significantly to the advancement of emission control technologies. The LNT system is designed to mitigate nitrogen oxide (NOx) emissions from internal combustion engines, particularly in gasoline and some diesel-powered vehicles. The Lean NOx Trap (LNT) is an after-treatment device that operates during lean-burn conditions in the engine. It utilizes a catalyst to temporarily store NOx emissions during lean air-to-fuel ratios and subsequently releases and reduces them under rich conditions. The LNT segment is influenced by market dynamics such as fuel efficiency demands, consumer preferences, and regulatory landscapes. Future trends may involve further refinement of LNT technology, its integration with hybrid powertrains, and its adaptation to emerging propulsion systems. Thus, the Lean NOx Trap (LNT) segment is instrumental in addressing NOx emissions from gasoline engines, contributing to regulatory compliance and environmental sustainability. As emission standards evolve, the role of LNT technology is likely to expand, shaping the trajectory of the automotive exhaust systems market.

Exhaust Pipes Segment is Expected to Witness Significant Growth Over the Forecast Period

Exhaust pipes are integral components of automotive exhaust systems, playing a vital role in the efficient and safe expulsion of combustion byproducts from internal combustion engines. These pipes are crucial elements that contribute to the overall performance, emissions control, and sound characteristics of a vehicle. Exhaust pipes serve as conduits for the passage of hot and potentially harmful gases generated during the combustion process within the engine. These pipes facilitate the safe transfer of exhaust gases from the engine to the rear of the vehicle, where they are released into the atmosphere. Exhaust pipes are typically constructed from durable and heat-resistant materials to withstand the high temperatures of exhaust gases. Common materials include stainless steel, aluminium, and aluminized steel. The choice of materials is crucial for ensuring longevity and resistance to corrosion. Thus, exhaust pipes play a multifaceted role in the automotive exhaust systems market, contributing to emissions control, durability, sound management, and overall vehicle performance. The market is dynamic, driven by regulatory compliance and consumer demand for both functional and aesthetic enhancements in exhaust systems.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America plays a pivotal role in the automotive exhaust systems market, contributing significantly to the demand for exhaust components and systems. North America is known for its stringent emission standards, driven by environmental regulations aimed at curbing air pollution and promoting sustainable practices. The automotive industry in the region adheres to these standards, necessitating the integration of advanced exhaust systems to meet emission requirements.

Federal agencies such as the Environmental Protection Agency (EPA) in the United States and corresponding authorities in Canada set emissions standards that mandate automakers to deploy effective exhaust systems. Compliance with these regulations shapes the design and technology incorporated into exhaust systems in North America. For instance, in February 2020, Tenneco Inc.'s Walker Emissions Control announced the launch of a new replacement catalytic converter called Walker CalCat and a muffler called Walker Ultra in North America.

Similarly, in March 2023, Milltek Sport Ltd launched a new lineup of upgraded performance exhaust systems for the BMW M3 Touring. These exhaust systems are meticulously designed, developed, and manufactured at Milltek Sport's state-of-the-art advanced facility. Furthermore, additional testing has been conducted at Milltek Sport's German R&D Centre, where the standard production BMW M3 Touring achieved the fastest lap time for an estate car in 2022, clocking in at 7 minutes and 35.06 seconds.

Government incentives and initiatives to promote sustainable transportation, reduce greenhouse gas emissions, and boost the adoption of cleaner technologies have an impact on the automotive exhaust systems market in North America. Thus, North America serves as a dynamic and influential market for automotive exhaust systems, driven by regulatory frameworks, technological advancements, and the region's commitment to environmental sustainability. The ongoing evolution of the automotive industry and the pursuit of cleaner and more efficient transportation solutions shape the trajectory of the exhaust systems market in North America.

Get Complete Analysis Of The Report - Download Free Sample PDF

Market participants are implementing various strategies, including the introduction of new products, acquisitions, and collaborative ventures, with the aim of expanding their presence on a global scale. These strategic initiatives are designed to enhance their market position, foster growth, and capitalize on emerging opportunities in the industry. Through product launches, acquisitions, and collaborations, industry players are actively engaging in efforts to strengthen their foothold, drive innovation, and meet the evolving demands of the market. Key Automotive Exhaust Systems Companies:

Recent Development :

1) In May 2021, Futaba Industrial Co., Ltd. announced its participation in the Department of Mechanical Engineering Exhibition 2021 Online, where the company showcased its products focusing on emissions and systems within vehicle body components. The showcased products aimed to reduce pollutant emissions, enhance fuel efficiency, and contribute to the overall lightweighting of vehicles in alignment with the Sustainable Development Goals.

2 ) In April 2021, Faurecia disclosed details about its Clean Transportation Department's manufacturing hub, the Koriyama Factory in Koriyama Municipal, Fukushima Prefecture. The factory was set to commence operations in the second quarter of 2021. Originally scheduled to start operations in September 2020, the launch was postponed due to a temporary reduction in output by the automaker it supplied components to, as a response to the challenges posed by the COVID-19 outbreak.

Q1. What was the Automotive Exhaust Systems Market size in 2022?

As per Data Library Research the global automotive exhaust systems market size was valued at USD 52.1 billion in 2022

Q2. At what CAGR is the Automotive Exhaust Systems market projected to grow within the forecast period?

Automotive Exhaust Systems Market is expected to expand at a compound annual growth rate (CAGR) of 7.8% over the forecast period.

Q3. What are the factors driving the Automotive Exhaust Systems Market?

Key factors that are driving the growth include the Increasing Use of Combined After-Treatment Equipment and Technology For Exhaust Systems Is Developing Quickly

Q4. What segments are covered in the Automotive Exhaust Systems Market Report?

By Vehicle Type, By fuel Type, Component, End-User and Geography are the segments covered in the Automotive Exhaust Systems Market Report.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model