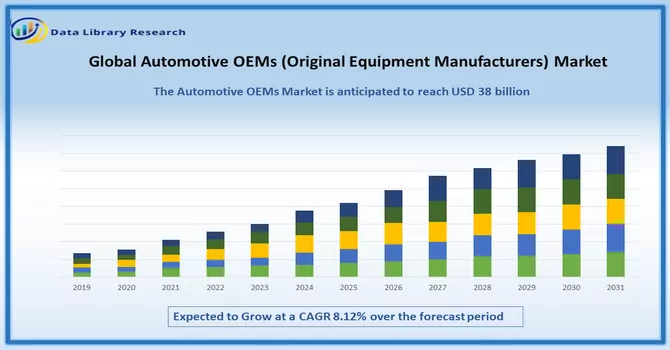

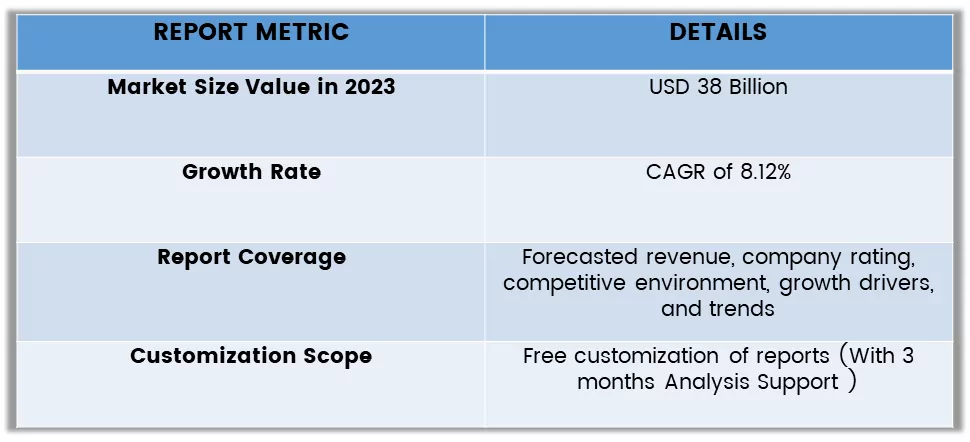

The Global Automotive OEM Market has valued at USD 38 billion in 2023 and is anticipated to project robust growth of a CAGR of 8.12% over a forecast period, 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

The global automotive OEMs (Original Equipment Manufacturers) market plays a central role in the automotive industry's ecosystem. These companies are responsible for designing, engineering, and manufacturing the original components and systems used in vehicles. Covering a wide range of products, including engines, transmissions, chassis, and electronic components, automotive OEMs are vital contributors to the innovation and production of vehicles. As the automotive sector undergoes transformative changes driven by electrification, connectivity, and autonomous technologies, OEMs are at the forefront of integrating these advancements into their products. The market is characterized by intense competition, technological collaborations, and a continuous focus on sustainability. OEMs also play a crucial role in meeting regulatory standards and addressing consumer preferences for safety, efficiency, and cutting-edge features.

The global automotive OEMs market is dynamic, responding to shifts in consumer demands, regulatory landscapes, and the broader automotive industry's evolution. The global automotive OEMs market is poised for significant growth, driven by several key factors. First and foremost, the increasing demand for electric vehicles (EVs) and the global push towards sustainable transportation solutions are compelling OEMs to invest heavily in research, development, and production of electric drivetrains and components. Moreover, the advent of autonomous vehicles is prompting OEMs to integrate advanced sensor technologies, artificial intelligence, and connectivity features, creating new revenue streams. Additionally, the growing consumer emphasis on safety and regulatory requirements for enhanced safety features are stimulating innovation in vehicle design and manufacturing. Furthermore, the globalization of automotive supply chains and the rise of emerging markets contribute to the expansion of OEM operations, catering to diverse customer needs. Collaborations and partnerships between OEMs and technology firms are fostering innovation and accelerating the adoption of cutting-edge technologies in vehicles. These driving factors collectively position the global automotive OEMs market for sustained growth and evolution in the coming years.

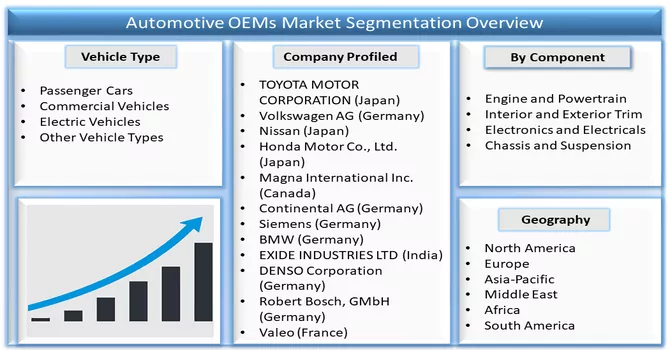

Market Segmentation: The Global Automotive OEMs market is Segmented by Vehicle Type (Passenger Cars, Commercial Vehicles, Electric Vehicles and Other Vehicle Types), Component (Engine and Powertrain, Interior and Exterior Trim, Electronics and Electricals, Chassis and Suspension and Others (e.g., Braking System, Steering System)) and Geography (North America, Europe, Asia Pacific, Latin America and Middle East and Africa).

For Detailed Market Segmentation - Download Free Sample PDF

The global automotive OEMs market is undergoing transformative trends that reflect the industry's evolution. One prominent trend is the increasing integration of digital technologies, such as advanced driver-assistance systems (ADAS) and in-vehicle infotainment, to enhance the overall driving experience. Another noteworthy development is the rising focus on sustainable practices, with OEMs actively investing in electric and hybrid vehicle technologies to address environmental concerns and comply with stringent emission norms. Furthermore, there is a growing shift towards flexible and modular vehicle architectures, allowing OEMs to streamline production processes and adapt to changing consumer preferences efficiently. Collaborations and partnerships between traditional OEMs and technology companies are becoming more common, fostering innovation in connectivity, autonomy, and shared mobility. Additionally, the trend of personalization and customization is gaining momentum, with OEMs offering a diverse range of features and options to cater to individual consumer preferences. These market trends collectively shape the trajectory of the global automotive OEMs market, emphasizing technological advancements, sustainability, and consumer-centric approaches.

Market Drivers:

Technological Advancements and Innovation

The automotive OEMs market is driven by continuous technological advancements and innovation. Original Equipment Manufacturers (OEMs) are investing heavily in research and development to integrate cutting-edge technologies into vehicles. The rise of electric and hybrid vehicles, advanced driver-assistance systems (ADAS), and connectivity features are key drivers. The push towards autonomous driving capabilities and the development of smart, connected vehicles are shaping the competitive landscape, with OEMs striving to stay at the forefront of technological innovation to meet consumer demands for safer, more efficient, and intelligent transportation solutions.

Global Shift Towards Electric Vehicles (EVs)

The increasing global emphasis on environmental sustainability and the need to reduce carbon emissions are significant drivers for the automotive OEMs market. Governments worldwide are implementing stringent regulations and incentives to promote the adoption of electric vehicles (EVs). As a result, OEMs are accelerating their efforts to design, manufacture, and market electric and hybrid vehicles. The growing awareness among consumers about the environmental impact of traditional combustion engines is fostering a shift towards EVs. This transition is compelling automotive OEMs to invest in the development of EV platforms, charging infrastructure, and battery technologies, driving the market towards a more sustainable and eco-friendly future.

Market Restraints:

The global automotive OEMs market faces several challenges that act as restraining factors, influencing the industry's dynamics. One significant restraint is the economic uncertainty and fluctuating consumer demand. The automotive sector is highly sensitive to economic downturns, and factors such as inflation, interest rates, and geopolitical tensions can impact consumer spending on new vehicles. Additionally, the ongoing semiconductor shortage has emerged as a critical constraint, disrupting the production schedules of automotive OEMs worldwide. This shortage has led to production delays, increased costs, and, in some cases, forced temporary closures of manufacturing facilities. Furthermore, the transition to electric vehicles (EVs) poses challenges related to the availability and affordability of advanced battery technologies. The high initial costs of electric vehicles and the need for a robust charging infrastructure present barriers to widespread EV adoption. These factors collectively contribute to the complexities faced by global automotive OEMs, requiring strategic adaptation to navigate through market restraints.

The global automotive OEMs market experienced significant disruptions due to the COVID-19 pandemic, which triggered widespread ramifications across the automotive industry. The initial outbreak led to factory closures, supply chain disruptions, and a sharp decline in consumer demand for new vehicles. Automakers faced challenges in maintaining production levels as lockdowns and restrictions hindered workforce availability and disrupted logistics. The pandemic-induced economic downturn further impacted purchasing power, causing a decline in vehicle sales. Additionally, the semiconductor shortage intensified during the pandemic, disrupting the production of vehicles globally and leading to increased lead times. The industry also witnessed shifts in consumer preferences, with a growing focus on contactless services and digital retail experiences. As the automotive OEMs market emerges from the pandemic, companies are recalibrating their strategies to adapt to the evolving market landscape, emphasizing resilience and agility in the face of unforeseen challenges.

Segmental Analysis:

Passenger Cars Segment is Expected to Witness Significant Growth Over the Forecast Period

Passenger cars are a key segment in the automotive OEM market, representing vehicles designed for personal use. As consumer preferences evolve towards more fuel-efficient, technologically advanced, and environmentally friendly vehicles, automotive OEMs are focusing on developing innovative solutions for passenger cars. This includes advancements in electric and hybrid vehicles, safety features, connectivity, and autonomous driving technology. The passenger car segment presents significant opportunities for OEMs to differentiate their offerings, meet evolving customer demands, and drive growth in the competitive automotive market.

Engine and Powertrain Segment is Expected to Witness Significant Growth Over the Forecast Period

The engine and powertrain segment is a crucial component of the automotive OEM market, encompassing the engine, transmission, and drivetrain systems that power vehicles. As automotive technology advances, OEMs are focusing on developing more efficient, eco-friendly, and high-performance engine and powertrain solutions. This includes the development of hybrid and electric powertrains, lightweight materials for improved fuel efficiency, and advanced transmission systems for smoother acceleration. The engine and powertrain segment presents significant opportunities for OEMs to innovate and differentiate their offerings, catering to evolving consumer preferences and regulatory requirements for cleaner and more sustainable vehicles.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America is a key region in the automotive OEM market, characterized by a strong automotive industry and a large consumer base. Automotive OEMs in North America are focused on developing cutting-edge technologies for vehicles, including electric and autonomous vehicles, to meet evolving consumer demands and regulatory requirements. The region's robust manufacturing infrastructure and skilled workforce make it a hub for automotive production, driving innovation and competitiveness in the market. Additionally, North America's strong emphasis on safety and quality standards further accelerates the development of advanced automotive technologies. Overall, North America plays a significant role in shaping the future of the automotive OEM market with its focus on innovation, quality, and sustainability.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding the company presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. These strategies include investments in research and development to stay at the forefront of technological advancements, mergers and acquisitions to consolidate market share, strategic partnerships for synergies, and innovation to differentiate products and services. The adoption of such multifaceted strategies reflects the competitive nature of the market, with participants continually seeking avenues for growth and sustainability. In essence, the high fragmentation in the studied market not only signifies the diversity of players but also underscores the dynamism and competitiveness that drive ongoing strategic maneuvers. As companies explore various avenues for expansion, the market continues to evolve, presenting both challenges and opportunities for industry stakeholders.

Some of the key market players are:

Recent Developments:

1) In December 2023, EKA Mobility, a leading electric vehicle and technology company in India, unveiled a strategic partnership with Mitsui & Co., Ltd. of Japan and VDL Groep from the Netherlands. This collaboration is set to revolutionize the automotive OEM market by creating innovative global Original Equipment Manufacturers (OEMs) in the region. By combining EKA Mobility's expertise in electric vehicles and technology with Mitsui & Co.'s global reach and VDL Groep's advanced manufacturing capabilities, the alliance aims to drive significant growth in the automotive OEM sector. This partnership will enable the development of cutting-edge electric vehicles and technology solutions, further establishing India as a key player in the global automotive market.

2) In January 2023, the partnership between Baraja, the innovator behind the groundbreaking Spectrum-Scan™ LiDAR technology, and Veoneer, a global leader in automotive safety, has been expanded with an investment by Veoneer in Baraja. This expansion comes on the heels of a recent announcement regarding an advanced development agreement with a major automotive original equipment manufacturer (OEM). Baraja is making substantial strides in its development of the next-generation Spectrum HD25 LiDAR product, tailored specifically for seamless integration into automotive systems. This progress is expected to drive significant growth in the automotive OEM market by offering cutting-edge LiDAR technology that enhances vehicle safety and autonomous driving capabilities. The collaboration between Baraja and Veoneer is poised to accelerate the adoption of LiDAR technology in the automotive industry, further solidifying their position as leaders in automotive safety and innovation.

Q1. What was the Automotive OEMs Market size in 2023?

As per Data Library Research the Global Automotive OEM Market has valued at USD 38 billion in 2023.

Q2. At what CAGR is the Automotive OEM market projected to grow within the forecast period?

Automotive OEM Market is anticipated to project robust growth of a CAGR of 8.12% over a forecast period.

Q3. What are the factors driving the Automotive OEM market?

Key factors that are driving the growth include the Technological Advancements and Innovation and Global Shift Towards Electric Vehicles (EVs).

Q4. Which region has the largest share of the Automotive OEM market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here,

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model