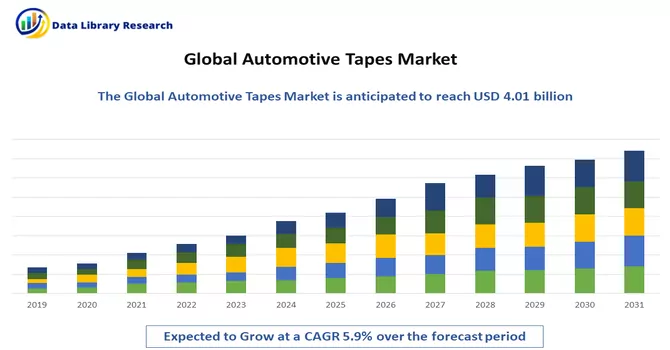

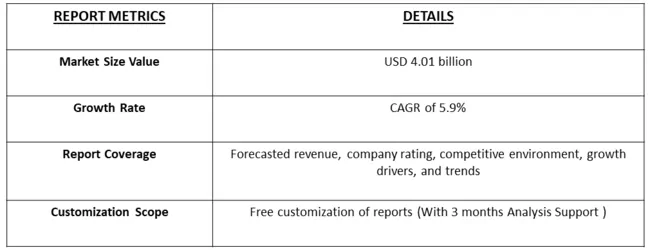

The global automotive adhesive tapes market size was estimated at USD 4.01 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.9% from 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Automotive tapes are specialized adhesive tapes used in the automotive industry for various applications such as bonding, masking, and insulating. These tapes are designed to meet the specific requirements of automotive manufacturing, including high temperature resistance, weather resistance, and durability. Automotive tapes are used for attaching trim, molding, and emblems, as well as for sealing and protecting components from moisture and corrosion. They play a crucial role in ensuring the integrity and longevity of automotive components and assemblies.

The automotive tapes market is expected to experience significant growth over the forecast period, driven by the rapid replacement of nut bolt fasteners to reduce vehicle weight and enhance aesthetics. This trend is particularly prominent in the automotive industry, where manufacturers are increasingly using tapes for bonding and joining components instead of traditional fasteners. The market is also expected to witness a growing demand from the aftermarket segment, as vehicle owners increasingly seek to modify and enhance the performance of their vehicles. Asian economies such as Japan, South Korea, China, and India are expected to lead the electric vehicle production market, supported by robust manufacturing industries, availability of resources, skilled labor, and low labor costs. These factors, coupled with the presence of prominent automakers in the region, are likely to drive the demand for automotive tapes in the coming years. In Europe and North America, major automobile manufacturers are focusing on technological developments to improve vehicle performance and efficiency. This is expected to create opportunities for automotive tape manufacturers, as these developments often require specialized tapes for bonding and sealing components. Thus, the automotive tapes market is poised for growth, driven by the shift towards lightweighting vehicles, increasing demand for electric vehicles, and advancements in vehicle technology

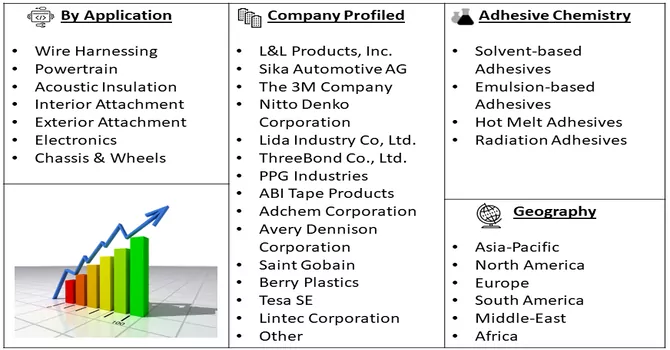

Market Segmentation: The automotive tapes market is Segmented by Application Outlook (Wire Harnessing, Powertrain, Acoustic Insulation, Interior Attachment, Exterior Attachment, Electronics, and Chassis & Wheels), Adhesive Chemistry ( Solvent-based Adhesives, Emulsion-based Adhesives, Hot Melt Adhesives and Radiation Adhesives) and Geography (North America, Europe, Asia-Pacific, South America, and Middle-East and Africa).

For Detailed Market Segmentation - Download Free Sample PDF

The automotive tapes market is witnessing several key trends that are shaping its growth trajectory. One of the prominent trends is the increasing demand for lightweighting solutions in vehicles, leading to the rapid replacement of traditional fasteners with tapes to reduce weight and improve fuel efficiency. Additionally, there is a growing trend towards using tapes for aesthetic purposes, such as bonding trims and emblems, to enhance the overall appearance of vehicles. Another significant trend is the rising demand for automotive tapes in the aftermarket segment, driven by vehicle modifications and performance enhancements. Moreover, the market is experiencing a shift towards electric vehicles, particularly in Asian economies like Japan, South Korea, China, and India, which are expected to drive significant growth in the automotive tapes market.

Market Drivers:

Increasing demand for lightweighting solutions in the automotive industry

The automotive industry is increasingly focused on lightweighting solutions to improve fuel efficiency and reduce emissions. This trend has led to a growing demand for automotive tapes, which are used as alternatives to traditional fasteners for bonding and joining lightweight materials. Automotive tapes offer several advantages over traditional fasteners, including reduced weight, improved aesthetics, and enhanced durability. They also provide better resistance to vibration and corrosion, making them ideal for use in various automotive applications. Furthermore, automotive tapes enable manufacturers to achieve design flexibility and cost savings, as they can be easily applied and do not require additional drilling or welding. This makes them particularly attractive for use in lightweight vehicle components such as interior trim, exterior panels, and structural components. Thus, the increasing demand for lightweighting solutions in the automotive industry is driving the growth of the automotive tapes market, as manufacturers seek innovative ways to reduce vehicle weight while maintaining performance and safety standards.

Growing trend towards vehicle customization and personalization

The automotive industry is experiencing a growing trend towards vehicle customization and personalization, driven by consumer preferences for unique and personalized vehicles. This trend has created a significant opportunity for the automotive tapes market, as tapes are increasingly used for aesthetic applications in vehicle customization. Automotive tapes are used to bond and attach various decorative elements such as trims, emblems, decals, and stripes, allowing consumers to personalize their vehicles according to their tastes and preferences. These tapes offer several advantages over traditional bonding methods, including ease of application, flexibility, and the ability to create intricate designs. Moreover, automotive tapes are available in a wide range of colors, finishes, and textures, making them ideal for creating customized looks that stand out on the road. This has made automotive tapes a popular choice among consumers looking to differentiate their vehicles from others and make a statement with their automotive styling. Thus, the growing trend towards vehicle customization and personalization is driving the demand for automotive tapes, as consumers seek innovative and creative ways to personalize their vehicles and express their individuality. This trend is expected to continue driving growth in the automotive tapes market, particularly in the aftermarket segment.

Market Restraints:

The challenge of achieving strong and durable bonds on certain automotive surfaces poses a significant restraint for the automotive tapes market. Surfaces with low surface energy, such as plastics or certain coatings, can be inherently difficult for tapes to adhere to effectively. Additionally, textured surfaces or surfaces that are exposed to harsh environmental conditions, such as extreme temperatures or moisture, can further hinder the performance of adhesive tapes. To address these challenges, manufacturers may need to undertake additional surface preparation steps, such as cleaning or priming, to improve the adhesion of tapes. In some cases, alternative bonding methods, such as mechanical fasteners or liquid adhesives, may be required, which can increase complexity and cost in the manufacturing process. Moreover, the performance of adhesive tapes can vary depending on the specific application and environmental conditions, which can further limit their effectiveness in certain automotive applications. Overall, while adhesive tapes offer many advantages in terms of flexibility, ease of use, and design possibilities, the challenges associated with achieving strong and durable bonds on certain surfaces can be a significant restraint for the automotive tapes market.

The COVID-19 pandemic had a mixed impact on the automotive tapes market. Initially, the market experienced a slowdown due to disruptions in manufacturing and supply chains caused by lockdowns and restrictions. However, as the automotive industry began to recover and adapt to the new normal, the demand for automotive tapes picked up, driven by the need for lightweighting solutions and increased focus on vehicle customization and personalization. The pandemic also highlighted the importance of hygiene and cleanliness, leading to a surge in demand for tapes used in interior applications such as antimicrobial films and protective coatings. Overall, while the pandemic posed challenges for the automotive tapes market, it also created new opportunities for growth and innovation.

Segmental Analysis:

Wire Harnessing Segment is Expected to Witness Significant Growth Over the Forecast Period

Wire harnessing is a critical process in automotive manufacturing, and automotive tapes play a crucial role in securing and protecting wire harnesses. These tapes provide insulation, abrasion resistance, and protection against environmental factors, ensuring the reliability and longevity of the wire harnesses. As the automotive industry continues to advance technologically, the demand for high-performance automotive tapes for wire harnessing is expected to grow, driven by the need for efficient and durable solutions in vehicle wiring systems.

Solvent-based Adhesives Segment is Expected to Witness Significant Growth Over the Forecast Period

Solvent-based adhesives have been traditionally used in automotive tapes for their strong bonding properties and versatility. However, with increasing regulations on volatile organic compound (VOC) emissions, there is a shift towards solvent-free adhesives in the automotive tapes market. This transition is driven by the automotive industry's commitment to sustainability and environmental responsibility. Manufacturers are developing innovative solvent-free adhesive tapes that offer comparable performance to solvent-based adhesives while meeting stringent environmental regulations. As a result, the demand for solvent-based adhesives in automotive tapes is expected to decline, with solvent-free alternatives gaining traction in the market.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America is a key region in the automotive tapes market, driven by the presence of major automotive manufacturers and a strong focus on technological advancements. The region's stringent safety and quality standards require high-performance tapes for various automotive applications, including wire harnessing, bonding, and surface protection. Additionally, the growing demand for lightweight vehicles and electric vehicles in North America is expected to further boost the demand for automotive tapes, particularly those that offer strong adhesion, durability, and resistance to environmental factors. In 2023, L&L Products, Inc.'s expansion in the Village of Romeo, Michigan, is a significant development that is driving the growth of the North America automotive tapes market. By expanding its production footprint, L&L Products, Inc. is increasing its capacity to manufacture automotive tapes and accommodate the automobile industry's demand for finished goods. This expansion allows L&L Products, Inc. to better serve its customers in the automotive industry, providing them with high-quality tapes for various applications such as wire harnessing, bonding, and surface protection. The increased production capacity also enables the company to meet the growing demand for automotive tapes in North America, driven by the region's focus on technological advancements and stringent safety standards. Furthermore, L&L Products, Inc.'s expansion in Michigan confirms its commitment to the region and its recognition of the business growth opportunities available. This development is expected to have a positive impact on the North America automotive tapes market, driving innovation, competition, and ultimately, market growth.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding the company presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. These strategies include investments in research and development to stay at the forefront of technological advancements, mergers and acquisitions to consolidate market share, strategic partnerships for synergies, and innovation to differentiate products and services. The adoption of such multifaceted strategies reflects the competitive nature of the market, with participants continually seeking avenues for growth and sustainability. In essence, the high fragmentation in the studied market not only signifies the diversity of players but also underscores the dynamism and competitiveness that drive ongoing strategic maneuvers. As companies explore various avenues for expansion, the market continues to evolve, presenting both challenges and opportunities for industry stakeholders. The automotive adhesive tapes market is dominated by several key players who hold a significant market share and influence industry trends. These companies are at the forefront of innovation and their financials, strategies, and product offerings are analyzed to understand the supply network of the market.

Some of the key market players are:

Recent Developments:

1) In July 2023, Berry Global introduced an upgraded version of its premier Formifor insulation compression films, featuring a blend of recycled materials comprising over 30% of the total composition. This innovation is expected to make a substantial contribution to the automotive manufacturing sector's sustainability efforts.

2) In April 2023, Berry Global Group, Inc. initiated the expansion of one of its key manufacturing facilities specializing in stretch films located in Lewisburg, Tennessee. The expansion project is slated for completion by early 2024 and aims to cater to the rising demand for the company's environmentally friendly and high-performance stretch films. These films are designed to meet the needs of various industries and also include adhesive tapes.

Q1. What was the Automotive Tapes Market size in 2023?

As per Data Library Research the global automotive adhesive tapes market size was estimated at USD 4.01 billion in 2023.

Q2. At what CAGR is the Automotive Tapes Market projected to grow within the forecast period?

Automotive Tapes Market is expected to grow at a compound annual growth rate (CAGR) of 5.9% over the forecast period.

Q3. What are the factors driving the Automotive Tapes market?

Key factors that are driving the growth include the Increasing demand for lightweighting solutions in the automotive industry and Growing trend towards vehicle customization and personalization.

Q4. Who are the key players in Automotive Tapes market?

Some key players operating in the market include

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model