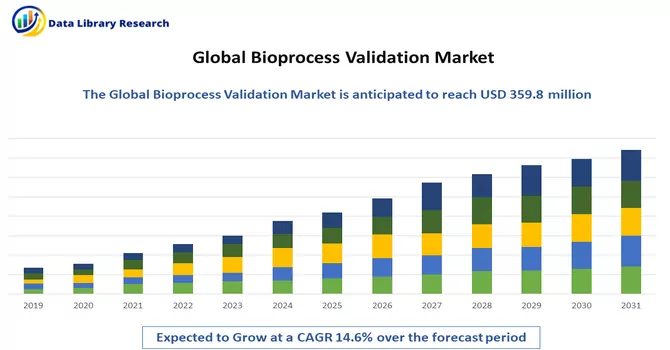

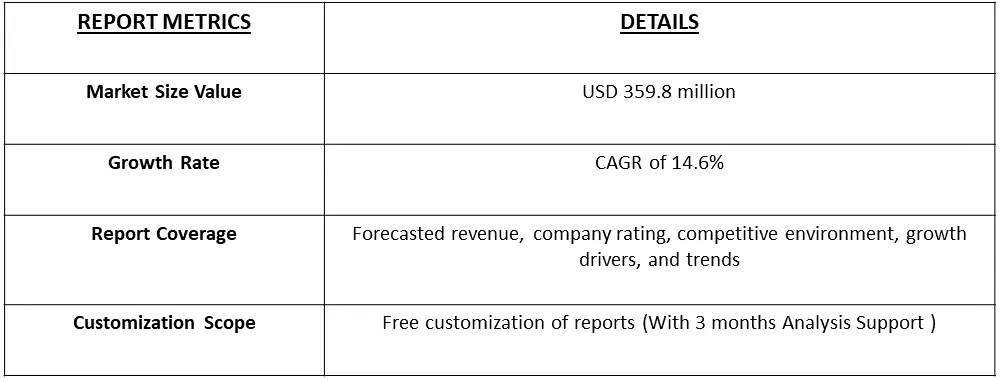

The global bioprocess validation market size is projected to reach USD 359.8 million by 2023 and register a CAGR of 14.6% over the forecast period, 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Bioprocess validation is a critical aspect of the pharmaceutical and biotechnology industries that involves demonstrating, through documented evidence, that a specific process is capable of consistently producing a product meeting predetermined specifications and quality attributes. This validation process is designed to ensure the reliability, repeatability, and compliance of bioprocessing methods used in the production of biopharmaceuticals, vaccines, and other biological products. It encompasses a series of activities, including process qualification, equipment validation, and facility validation, to confirm that the entire production process consistently produces the desired product within established quality parameters. Bioprocess validation aims to assure the safety, efficacy, and quality of biopharmaceutical products and is an essential component of regulatory compliance in the biopharmaceutical industry. It involves a combination of in-depth documentation, testing, and monitoring to establish the integrity and reliability of the bioprocessing methods employed.

The expansion of the market is propelled by a robust demand for bioprocess validation services. This heightened demand is attributed to stringent safety and quality regulations that extend beyond the pharmaceutical and biopharmaceutical sectors, encompassing product certifications and testing. Additionally, there is a rising trend in outsourcing bioprocess validation activities, further fueled by an increase in research and development expenditure. The convergence of these factors contributes to the overall growth and vitality of the bioprocess validation market.

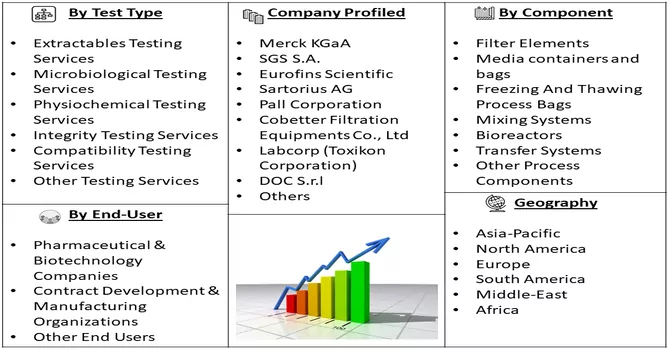

Market Segmentation: The Bioprocess Validation Market is Segmented by Test Type (Extractables Testing Services, Microbiological Testing Services, Physiochemical Testing Services, Integrity Testing Services, Compatibility Testing Services, and Other Testing Services), Process Component (Filter Elements, Media containers and bags, Freezing And Thawing Process Bags, Mixing Systems, Bioreactors, Transfer Systems, and Other Process Components), End-User (Pharmaceutical & Biotechnology Companies, Contract Development & Manufacturing Organizations, Other End Users), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The bioprocess validation market is experiencing notable trends, including a surge in biopharmaceutical R&D activities, driven by the increasing development of biologics and biosimilars. Stringent regulatory requirements, particularly in regions like North America and Europe, are shaping validation practices to ensure compliance and market approval. Outsourcing of validation services to specialized CDMOs is on the rise due to the need for expertise and cost-efficiency. The adoption of advanced analytical technologies, such as high-throughput analytics and Process Analytical Technology (PAT), is enhancing the efficiency of validation processes. Single-use technologies are gaining prominence for their flexibility and reduced risk of contamination, influencing validation strategies. Quality by Design (QbD) principles are being emphasized for a proactive and science-based approach to validation. The trend towards continuous bioprocessing is impacting validation approaches, offering advantages like improved productivity and reduced costs.

Market Drivers:

Increasing Demand for Biopharmaceuticals and Increasing Demand for Outsourcing Bioprocess Validation

The bioprocess validation market is witnessing a substantial increase in demand, primarily fueled by the rising global demand for biopharmaceuticals. As the biopharmaceutical industry continues to grow, with an expanding pipeline of biologics and biosimilars, there is a heightened need for robust validation processes to ensure the safety, efficacy, and quality of these complex therapeutic products. Concurrently, there is a significant trend toward outsourcing bioprocess validation services. Biopharmaceutical companies are increasingly relying on specialized Contract Development and Manufacturing Organizations (CDMOs) and validation service providers to meet the growing complexity and regulatory requirements associated with bioprocessing. Outsourcing offers advantages such as access to specialized expertise, cost-efficiency, and streamlined validation processes. This dual trend of increasing demand for biopharmaceuticals and the outsourcing of bioprocess validation underscores the industry's recognition of the importance of rigorous validation practices in ensuring the success and compliance of biopharmaceutical manufacturing.

Rising Life Science R&D Expenditure

The bioprocess validation market is significantly influenced by the upward trajectory of life science Research and Development (R&D) expenditure. The increasing investment in R&D within the life science sector, particularly in biopharmaceuticals and biotechnology, is driving the demand for robust bioprocess validation. As companies allocate substantial resources to advance their understanding of complex biological processes and develop innovative therapies, the need for thorough validation processes becomes imperative. This trend is particularly evident in the development of biologics, biosimilars, and other advanced therapeutic products. The rising R&D expenditure reflects a commitment to scientific innovation and the exploration of novel treatment modalities, necessitating stringent validation practices to ensure the safety, quality, and efficacy of these advanced biological products. Bioprocess validation, with its focus on ensuring the reproducibility and reliability of biomanufacturing processes, plays a crucial role in supporting the outcomes of increased R&D investments in the life sciences.

Notably, data from the Pharmaceutical Research and Manufacturers of America (PhRMA) as of September 2021 indicates a substantial investment in the pursuit of new treatments and cures by PhRMA member companies. Since the year 2000, these companies have collectively invested over USD 1.1 trillion in research and development endeavours, with a noteworthy allocation of USD 102.3 billion in 2021 alone. The trajectory of such investments is projected to continue increasing in the forecast period. This escalating research and development expenditure is anticipated to be a significant driver for the bioprocess validation market.

Market Restraints:

Issues Related to Extractables & Leachables

The growth of the bioprocess validation market may encounter challenges due to issues related to extractables and leachables. Extractables refer to chemical substances that can be extracted from processing equipment or container closure systems under exaggerated conditions, while leachables are compounds that migrate into the product under normal conditions of use. The presence of extractables and leachables poses a potential risk to the quality and safety of biopharmaceutical products, requiring thorough assessment and validation procedures. The identification and characterization of these compounds, often originating from materials used in bioprocessing equipment, can be complex and time-consuming. Stringent regulatory requirements for evaluating and controlling extractable and leachables add an additional layer of complexity to bioprocess validation. Addressing these challenges necessitates comprehensive strategies, including analytical testing, risk assessment, and the implementation of suitable materials to mitigate potential impacts on product quality. The intricate nature of managing extractables and leachables poses a potential restraint on the pace of growth in the bioprocess validation market.

The bioprocess validation market felt the profound impact of the COVID-19 pandemic, witnessing substantial disruptions in manufacturing and supply chain operations due to global lockdowns and government-imposed restrictions. Amid these challenges, the demand for bioprocess validation surged as it became a crucial aspect of drug development, ensuring precision, efficiency, and safety at every stage. The heightened need for validation was particularly evident in the development of biosimilars, combination molecules, and innovative vaccines and medicines prompted by the escalating cases of COVID-19. However, as the pandemic gradually wanes, the market has experienced a slight deceleration. Despite this, a period of stable growth is anticipated during the forecast period as the industry adapts to the post-pandemic landscape.

Segmental Analysis:

Microbiological Testing Service Segment to Hold a Significant Market Share Over the Forecast Period

Microbiological testing services play a critical role in the broader spectrum of bioprocess validation, ensuring the safety and integrity of biopharmaceutical products. Bioprocess validation involves a series of activities to confirm and document that a specific process consistently produces a result or product meeting predefined quality attributes. Microbiological testing services within this context focus on assessing microbial contamination risks and ensuring compliance with regulatory standards. These services encompass various microbiological analyses, including sterility testing, environmental monitoring, and detection of microorganisms such as bacteria, yeast, and mould. Sterility testing is vital to ascertain that a biopharmaceutical product is free from viable microorganisms that could compromise its safety. Environmental monitoring involves regularly testing the air, surfaces, and water in the manufacturing environment to identify and mitigate potential sources of contamination. Microbiological testing also plays a crucial role in supporting process validation by assessing the effectiveness of bioburden controls and sanitation procedures. This comprehensive approach helps in preventing microbial contamination during the bioprocessing stages, from raw materials to the final product. Thus, microbiological testing services are an integral component of bioprocess validation, providing assurance of the microbiological quality and safety of biopharmaceutical products throughout their production lifecycle. These services contribute to meeting stringent regulatory requirements and ensuring the reliability and consistency of bioprocessing operations.

Bioreactors Segment to Hold a Significant Market Share Over the Forecast Period

Bioreactors play a crucial role in the pharmaceutical sector, serving as essential tools for the production of medicines, vaccines, and components critical for various treatments. Particularly, bioreactors are instrumental in the manufacturing of monoclonal antibodies used in the treatment of conditions like cancer and rheumatoid arthritis. These versatile devices have found applications in diverse industrial and research areas, facilitating the transition from 2D cultures to 3D constructs, closely resembling the natural physiological state.

In pharmaceutical settings, bioreactors act as controlled environments for fostering the natural biochemical processes of microorganisms. Batch bioreactors follow a closed system where all components are added at once, allowing biochemical reactions to progress before extraction or further processing. Continuous flow bioreactors, on the other hand, enable a constant flow of materials through the system, ensuring a steady and efficient production process. The importance of bioreactors is underscored by the significant investment in research and development (R&D) activities, with countries like Germany, France, Austria, Sweden, and Norway allocating substantial portions of their gross domestic expenditure toward R&D, as reported by the OECD in 2021. This heightened focus on R&D activities is driving the adoption of bioprocess validation devices, including bioreactors, contributing to the growth of this segment in the pharmaceutical industry.

Pharmaceutical & Biotechnological Companies Segment to Hold a Significant Market Share Over the Forecast Period

Pharmaceutical and biotechnological companies play a pivotal role in the field of bioprocess validation, as they are at the forefront of developing and manufacturing biopharmaceutical products. Bioprocess validation is a systematic approach employed by these companies to ensure the reproducibility and consistency of critical manufacturing processes, ultimately guaranteeing the quality, safety, and efficacy of their products.

In the context of pharmaceutical and biotechnological companies, bioprocess validation covers a spectrum of activities, including the validation of upstream processes involving cell culture and fermentation, downstream processes for purification, and formulation processes. This meticulous validation process aims to confirm that each stage of production consistently meets predefined specifications and adheres to regulatory standards. Pharmaceutical and biotechnological companies leverage bioprocess validation to mitigate risks associated with microbial contamination, cross-contamination, and variations in critical process parameters. This systematic validation approach is crucial in complying with regulatory requirements set forth by health authorities such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). Thus, such factors are expected to slow down the growth of the studied market.

North America Region to Hold a Significant Market Share Over the Forecast Period

North America commands a substantial share in the bioprocess validation market, driven by a surge in research and development (R&D) activities, increased investments, and a growing demand for biopharmaceuticals. Notably, a report from the Pharmaceutical Research and Manufacturers of America (PhRMA) in September 2021 revealed that biopharmaceutical companies invested over USD 1 trillion in R&D over the past decade, with a record-breaking investment of about USD 91 billion in 2020 alone. Outsourcing drug development has become a strategic move for biotechnology firms, enabling efficient resource utilization and risk mitigation. The region witnessed a significant boost in biomanufacturing initiatives, with the US government investing over USD 2 billion in September 2022 to enhance manufacturing capacity and bolster pandemic preparedness. A portion of this investment, approximately USD 20.6 million, was allocated to the Manufacturing Innovation Institute BioMADE, supporting tech and innovation projects. This substantial funding is poised to catalyze the growth of clinical research institutes, contributing to the overall expansion of the bioprocess validation market in the region. The confluence of these factors positions the market for noteworthy growth in the foreseeable future.

Get Complete Analysis Of The Report - Download Free Sample PDF

Major market players actively pursue strategies such as expanding their production capabilities, engaging in mergers and acquisitions, and conducting research and development initiatives to maintain a competitive edge in the industry. This involves increasing their capacity for manufacturing, acquiring other companies or merging with them to strengthen their market position, and investing in innovative research and development efforts. These strategic moves are crucial for staying ahead of competitors, enhancing market share, and ensuring sustained growth in the dynamic business environment. The commitment to these initiatives underscores the players' proactive approach in adapting to market trends, meeting evolving customer demands, and securing a prominent position in the competitive landscape. Key market players in the studied market are:

Recent Developments:

1) In November 2023, Aragen, a Contract Development and Manufacturing Organization (CDMO) based in India, is in the process of establishing a biologics manufacturing facility in Bengaluru to enhance its bioproduction capabilities. Encompassing an expansive area of 160,000 square feet, the facility is designed to house process development laboratories and multiple manufacturing suites, complemented by quality control labs dedicated to analytical and microbiological functions. The decision to construct this biologics manufacturing facility was initially announced at CPHI Frankfurt in 2022. Once operational, the Bengaluru facility is poised to offer comprehensive solutions, covering large-scale drug substance manufacturing, analytical development, pilot production, process development and validation, stability services, and pilot production.

2) In October 2023, Cytiva has inaugurated a new manufacturing facility and experience center spanning 33,000 square feet in Pune, India. This facility marks an expansion for the bioprocess vendor, focusing on the increased production of equipment such as tangential flow, virus filtration, and inactivation systems. Situated at Hinjewadi Rajiv Gandhi Infotech Park, approximately 100 kilometers southwest of Mumbai, the establishment includes an 'Experience Center' designed to offer immersive training programs for both upstream and downstream technologies, complemented by digital and automation software. Additionally, the center serves as a showcase for Cytiva's proprietary products, featuring displays of ÄKTA, Allegro, iCELLis, and Sepax. Cytiva's development in Pune supports the bioprocess validation ecosystem by addressing production needs, providing training resources, showcasing innovative products, promoting technological advancements, and enhancing geographic accessibility. These factors collectively contribute to strengthening and advancing bioprocess validation efforts.

Q1. What was the Bioprocess Validation Market size in 2023?

As per Data Library Research the global bioprocess validation market size is projected to reach USD 359.8 million by 2023.

Q2. At what CAGR is the Bioprocess Validation market projected to grow within the forecast period?

Bioprocess Validation Market is register a CAGR of 14.6% over the forecast period.

Q3. What segments are covered in the Bioprocess Validation Market Report?

By Test Type, By Process Component, end-User and Geography these segmnets are covered in the Bioprocess Validation Market Report.

Q4. Which region has the largest share of the Bioprocess Validation market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model