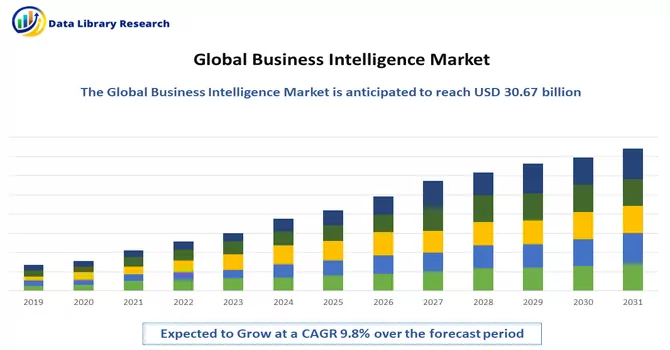

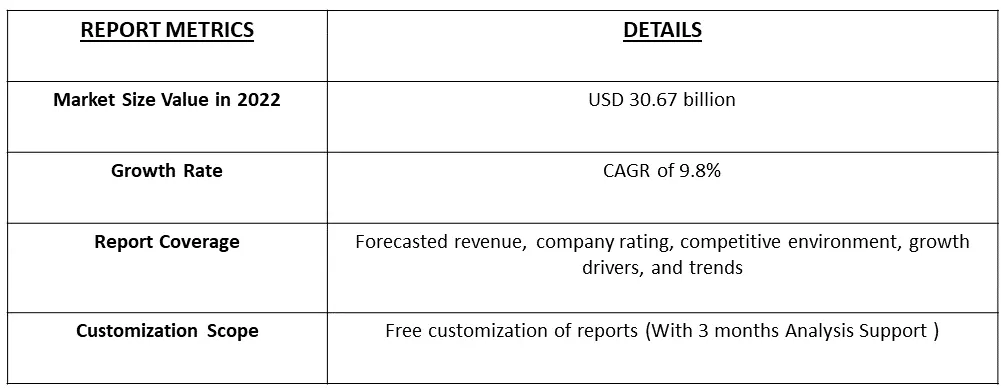

The Global Business Intelligence Market is currently valued at USD 30.67 billion in the year 2022 and is expected to register a CAGR of 9.8% over the forecast period, 2023-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Business intelligence (BI) refers to the procedural and technical infrastructure that collects, saves, and analyses data generated by a company's activities. BI is a broad phrase that includes data mining, process analysis, performance benchmarking, and descriptive analytics. BI analyses a company's data and presents it in easy-to-understand reports, performance metrics, and trends that help management make choices.

The technological advancements and developments in Business Intelligence and the growing use of big data and cloud computing are driving the growth of the studied market.

Businesses use BI tools to make data-driven decisions for more efficient business operations in this fast-changing technology world. Organizations must balance physical and digital competencies to establish new business models. Real-time data from smart devices and the Internet of Things (IoT) paired with historical data, big data analytics, and artificial intelligence are projected to drive demand for data analytics software across companies.

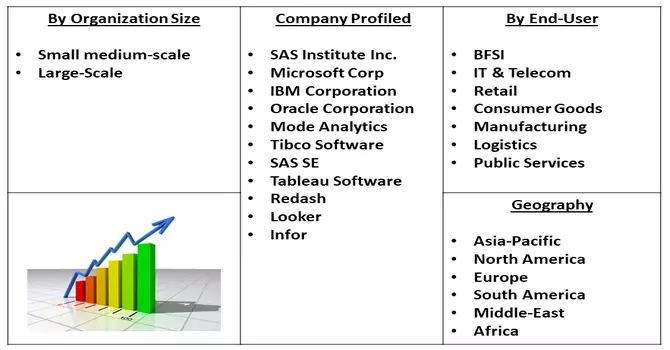

Segmentation:

The United Kingdom Business Intelligence Market is segmented

By Organization Size :

End-User

Geography :

The report offers market size and forecasts in value (in USD million) for all the above-mentioned segments.

For Detailed Market Segmentation - Download Free Sample PDF

Drivers :

Growing Adoption of IoT-Enabled Technologies and Advanced Analytics Tools

The continuous research and innovation directed by tech giants are driving the adoption of advanced technologies in industry verticals, such as automotive, healthcare, retail, finance, and manufacturing. For instance, in November 2020, Intel Corporation acquired Cnvrg.io, an Israeli company that develops and operates a platform for data scientists to build and run machine learning models, to boost its artificial intelligence business.

Migration To The Cloud Has Enabled SMEs To Leverage Data To Support Their Decision-Making Process

Cloud-based business intelligence, or cloud BI, describes the process of transforming data into actionable insights either partially or fully within a cloud environment. Cloud BI gives organizations the information they need to make data-driven decisions without the cost or hassle of physical hardware. For instance, in August 2019, IBM announced to launch of the IBM Cloud Multizone Region to deploy applications across cloud infrastructure. These factors are foreseen to drive the BI market. Thus, such developments are expected to drive the growth of the studied market.

Restraints :

The High-Cost IT Infrastructure Investment in Business Intelligence Market.

The high cost of IT infrastructure investment is expected to hamper the growth of the business intelligence market during the forecast period. The cost of installing business intelligence infrastructure is a major concern for various firms. Also, adequate factors such as consulting analysts skilled IT experts, and professional data science experts are hindering the BI market growth. The high-cost software such as cloud computing, big data, Tableau, SQL server express, QLIK, and Power BI are expensive to install and maintain in small and medium-sized businesses which impacts the BI market.

The COVID-19 pandemic considerably slowed down AI investments for most enterprises. Although AI is still one of the critical technology areas, organizations require an efficient way to scale their AI practices and use AI in business to accelerate ROI in AI investment. As organizations face more significant pressure to optimize their workflows, more companies will ask BI teams to manage and develop AI/ML models. The two critical factors that will drive this boost of a new BI-based AI developer class: First, enabling BI teams with tools such as automation platforms is more scalable and more sustainable than hiring dedicated data scientists; second, because BI teams are significantly closer to the business use-cases compared to data scientists, the lifecycle from the working model's requirement will be accelerated.

Business Intelligence Market Segmental Analysis.

BFSI Segment is Expected to Hold a Significant Share of the Market.

Owing to the internet and the proliferation of mobile devices and apps, financial institutions today face changing client demands, mounting competition, and the need for strict control and risk management in a highly dynamic market. In such scenarios, business intelligence solutions enable financial organizations to analyze immense amounts of customer data to gain insights about their customer's needs and sentiments regarding banking that can be used to improve products and services.

Growing adoption of IoT-enabled technologies and Advanced Analytics tools.

Analytics and BI will allow businesses to drill down to individual transactions to get answers to revenue opportunities and cost concerns. By examining the incoming and outgoing finances of the present and past, a business can make decisions based on its future financial status. Breaking down revenue by location calculates the strength of product lines by branch. For instance, an enterprise could remove a specialty item from one place and increase its promotion in another. Customizing the dashboard allows enterprise executives to track key performance indicators (KPIs) to enable effective financial management and oversight.

North America Region is Expected to Witness Significant Growth Over the Forecast Period.

North America dominated the Business Intelligence market due to the high growth credited to rapid development and emerging technology and the presence of major industry players in the region such as IBM Corporation, Microsoft Corporation, Tableau Software, Oracle Corporation, and others are anticipated to drive the growth across the region. For instance, in June 2020, Microsoft collaborated with SAS in order to form an extensive technology and strategic platform that is likely to migrate SAS analytical products, pushing the sales of business intelligence systems.

Similarly, in June 2020- IBM introduced Watson Works which helps companies in letting employees return to their workplaces, focusing on navigating many aspects that counter the impacts of coronavirus, fueling the sales of business intelligence platforms.

Thus, the above developments are contributing to the growth of the studied market in the region.

Get Complete Analysis Of The Report - Download Free Sample PDF

Competitive Intelligence:

The business intelligence market concentration is medium due to the presence of many small and medium-sized companies competing with each other and with large enterprises. Large enterprises hold a prominent market share and give tough competition to the new entrance players through innovations. Some key players in the market include:

Key Players :

Recent Developments:

1) December 2022: Snowflake has enabled organizations in various industries to deploy data and analytical workloads to meet their mission-critical requirements. With actual multi-cloud availability across three major public clouds, businesses may deploy Snowflake's unique data capabilities for workloads, including region-to-region and cross-cloud data replication, across their preferred cloud service providers.

2) August 2022: Pyramid Analytics (Pyramid), a pioneering provider of decision intelligence platforms reported a new division that will offer the transformative power of augmented analytics to government departments, agencies, and bodies. AI and machine learning-enabled decision intelligence help revolutionize the delivery of vital public services such as healthcare, electricity, and transportation in Europe's largest public sector market.

Q1. What is the current Business Intelligence Market size?

The Global Business Intelligence Market is currently valued at USD 30.67 billion.

Q2. What is the Growth Rate of the Business Intelligence Market?

Business Intelligence Market is expected to register a CAGR of 9.8% over the forecast period.

Q3. What are the factors on which the Business Intelligence Market research is based on?

By Organization Size, End User & Geography are the factors on which the Business Intelligence Market research is based.

Q4. Which region has the largest share of the Business Intelligence Market? What are the largest region's market size and growth rate?

North America was the largest region in the Business Intelligence Market in 2022. For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model