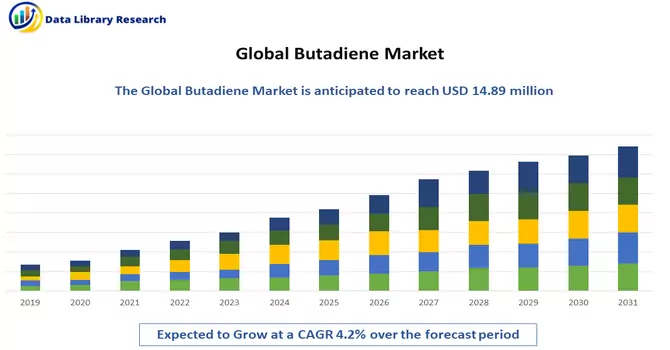

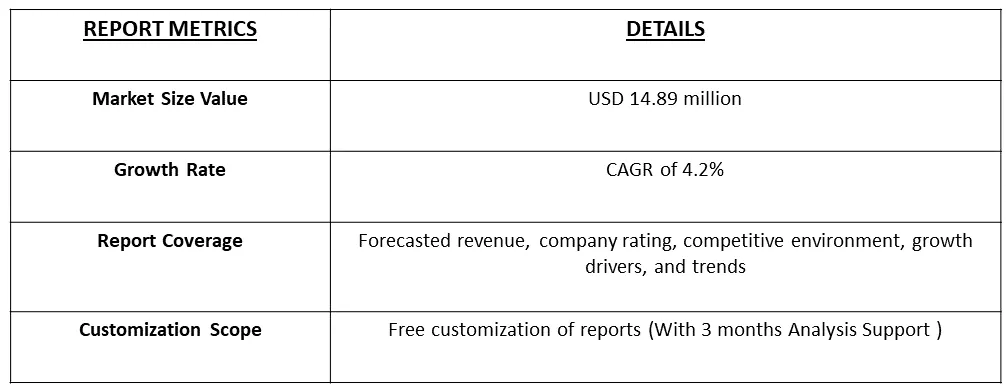

The Butadiene Market size is estimated at 14.89 million tons in 2023 and is expected to register a CAGR of 4.2% during the forecast period (2024-2031).

Get Complete Analysis Of The Report - Download Free Sample PDF

Butadiene is a hydrocarbon compound with the chemical formula C4H6, consisting of four carbon atoms arranged in a chain and containing two carbon-carbon double bonds. It is a colorless gas with a mild, gasoline-like odor and is a crucial monomer in the production of synthetic rubber, particularly styrene-butadiene rubber (SBR) and polybutadiene rubber (PBR). Apart from its role in the rubber industry, butadiene serves as a versatile chemical intermediate, participating in the synthesis of various polymers and resins. It is primarily obtained as a byproduct of the steam cracking process in the petrochemical industry, and its production and applications make it a key component in the global chemical manufacturing landscape.

The Butadiene market is driven by several key factors contributing to its growth and stability. The escalating demand for synthetic rubber, a major application of Butadiene, fueled by the automotive industry's expansion and tire manufacturing, acts as a primary driver. Additionally, the increasing use of Butadiene in the production of various polymers and plastics, particularly in the manufacturing of consumer goods, appliances, and packaging materials, further propels market growth. As a crucial raw material in the petrochemical sector, the growing demand for Butadiene in the production of styrene-butadiene rubber and latex emphasizes its indispensable role, reinforcing its market position and fostering continuous development in diverse industrial applications.

The butadiene market is experiencing notable trends reflecting shifts in global demand and industry dynamics. One significant trend is the growing focus on sustainability and environmental concerns, leading to increased interest in bio-based sources of butadiene as alternatives to traditional petrochemical-derived routes. Technological advancements and investments in bio-based butadiene production processes are driving this trend, aiming to reduce carbon footprint and dependence on fossil fuels. Moreover, the demand for butadiene derivatives, particularly synthetic rubber for tire manufacturing, remains a key driver in the market. With the automotive industry's transition towards electric vehicles and increased focus on fuel efficiency, the demand for high-performance rubber compounds, such as styrene-butadiene rubber (SBR) and polybutadiene rubber (PBR), is expected to rise. Regional shifts in butadiene production and consumption patterns, influenced by factors like economic growth, industrialization, and regulatory policies, also shape market dynamics. Additionally, the integration of butadiene in various downstream applications, including plastics, adhesives, and coatings, underscores its versatility and importance across diverse industries, driving innovation and market growth in the butadiene sector.

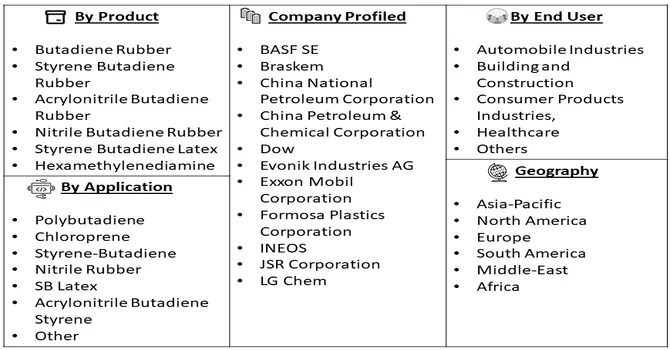

Market Segmentation: The Global Butadiene Market Manufacturers and Segmented by Application (Polybutadiene (PBR), Chloroprene, Styrene-butadiene (SBR), Nitrile Rubber (Acrylonitrile Butadiene NBR), Acrylonitrile Butadiene Styrene (ABS), Adiponitrile, Sulfolane, Ethylidene Norbornene, Styrene Butadiene Latex, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The report offers the market size and forecasts for butadiene in terms of volume (kilo ton) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Robust demand for synthetic rubber and the increasing utilization of butadiene

The robust demand for synthetic rubber and the increasing utilization of Butadiene are pivotal factors driving the growth of the Butadiene market. As a primary building block for synthetic rubber, Butadiene is in high demand, particularly in the automotive industry for tire manufacturing. The expansion of the automotive sector globally, coupled with the rising need for durable and high-performance tires, has led to a sustained and growing demand for synthetic rubber, thus driving the demand for Butadiene. Moreover, the versatility of Butadiene in the production of various polymers and plastics further enhances its significance, finding applications in a wide range of industries, including consumer goods, packaging, and appliances. This dual demand from the synthetic rubber and polymer sectors underscores Butadiene's integral role in key industrial applications, fostering its market prominence.

The automotive industry's expanding footprint

The expanding footprint of the automotive industry and its significant reliance on butadiene underscore a crucial relationship driving market dynamics. Butadiene plays a pivotal role in the production of synthetic rubber, a key component in tire manufacturing for the automotive sector. As the automotive industry continues to grow globally, especially with increasing vehicle production and demand for high-performance tires, the demand for butadiene remains robust. This dependency on butadiene highlights its indispensability in meeting the stringent quality and durability requirements of modern tires, emphasizing its integral role in supporting the automotive industry's expansion and sustained performance.

Market Restraints:

The butadiene market faces several restraints that impact its dynamics. One significant challenge is the volatility in feedstock prices, particularly from crude oil and natural gas, as butadiene is predominantly derived from the steam cracking process in petrochemical production. This volatility can lead to fluctuating production costs and affect the overall pricing of butadiene-based products. Environmental concerns and increasing regulations related to emissions and sustainability pose challenges for the traditional petrochemical-based butadiene production processes, driving the need for more eco-friendly alternatives. Additionally, the cyclicality of end-use industries, such as the automotive sector, which heavily influences the demand for butadiene-derived rubber, can lead to market instability during economic downturns. Geopolitical factors, trade tensions, and global economic uncertainties further contribute to market restraints by influencing supply chains and trade dynamics. Successfully navigating these challenges requires strategic investments in sustainable production methods, adaptation to changing regulatory landscapes, and diversification of applications to mitigate risks associated with market fluctuations and industry-specific downturns.

The COVID-19 pandemic has had a multifaceted impact on the butadiene market. Disruptions in global supply chains, reduced industrial activities, and lockdown measures initially led to a decline in demand for butadiene, particularly in sectors such as automotive manufacturing that heavily rely on synthetic rubber production. The slowdown in economic activities and uncertainties surrounding the duration of the pandemic affected investment decisions and project expansions within the petrochemical industry, influencing butadiene production. Additionally, shifts in consumer behavior, such as reduced travel and changing purchasing patterns, influenced the demand for butadiene-containing products. However, as economies gradually recover, especially with the resurgence of manufacturing and construction activities, the demand for butadiene is expected to rebound. The long-term impact will depend on the speed of global economic recovery, ongoing changes in consumer behavior, and the industry's ability to adapt to evolving market conditions in the post-pandemic landscape.

Segmental Analysis:

Styrene-Butadiene (SBR) Segment is Expected to Witness Significant Growth Over the Forecast Period

Styrene-Butadiene (SBR) is a versatile synthetic rubber with a wide range of applications across various industries. One of its primary uses is in the manufacturing of tires, where it serves as a key component in tire treads due to its excellent abrasion resistance, grip, and durability. This makes SBR a crucial material in the automotive industry, contributing to the production of high-performance and all-season tires. Beyond the automotive sector, SBR finds extensive application in the production of conveyor belts, footwear, and gaskets, benefiting from its resilience and cost-effectiveness. In the construction industry, SBR is employed in adhesives and sealants for its adhesive properties and resistance to weathering. Additionally, its water resistance makes it a valuable component in roofing materials and coatings. In the realm of consumer goods, SBR is used in the fabrication of various products such as shoe soles, sports equipment, and foam materials. Its versatility extends to the textile industry, where it is utilized in coated fabrics and as a binder in non-woven textiles. Moreover, SBR plays a crucial role in the production of latex for paints and coatings, providing excellent stability and durability. With its wide-ranging applications, Styrene-Butadiene remains a fundamental material, contributing to the performance, longevity, and functionality of diverse products across industries.

Tire and Rubber Segment is Expected to Witness Significant Growth Over the Forecast Period

Tire and rubber industries are major consumers of butadiene, a key monomer derived from the petrochemical industry. Butadiene is a critical component in the production of synthetic rubber, particularly styrene-butadiene rubber (SBR) and polybutadiene rubber (PBR). These synthetic rubbers are essential for tire manufacturing, contributing to the formulation of tire treads, sidewalls, and other components. In tire production, butadiene-based rubbers enhance key characteristics such as abrasion resistance, durability, and traction. SBR, in particular, is widely used in the creation of all-season and high-performance tires, providing optimal grip on roads and ensuring longevity under various driving conditions. The versatility of butadiene-derived rubbers allows tire manufacturers to tailor the properties of the rubber compounds to meet specific performance requirements, making them suitable for a wide range of vehicles and applications. Beyond tires, butadiene also plays a crucial role in the production of various rubber products, including conveyor belts, hoses, seals, and gaskets. Its resilience, flexibility, and resistance to wear make it an ideal material for these applications in industries such as automotive, construction, and manufacturing. Thus, butadiene serves as a cornerstone in the tire and rubber industries, providing the necessary building blocks for the creation of high-performance rubber materials that contribute to the safety, efficiency, and longevity of a wide array of products, particularly in the transportation sector.

Asia-Pacific Region is Expected to Witness Significant Growth Over the Forecast Period

The Asia-Pacific region is a pivotal player in the global butadiene market, reflecting its robust industrial growth and increasing demand for synthetic rubber and polymer products. As a key monomer derived from the petrochemical sector, butadiene finds extensive applications in the manufacturing of synthetic rubbers, particularly styrene-butadiene rubber (SBR) and polybutadiene rubber (PBR), which are integral components in tire production. The burgeoning automotive industry in countries like China and India has been a primary driver for the escalating demand for butadiene. With the increasing production and sales of vehicles in the region, there is a consistent need for high-performance tires, thus fueling the demand for butadiene-based rubber compounds. Moreover, the Asia-Pacific region has witnessed a surge in construction and infrastructure development, contributing to the demand for butadiene in various rubber applications such as conveyor belts, hoses, and seals. The versatility of butadiene allows manufacturers to cater to diverse industries, from automotive to construction, meeting the growing requirements of a dynamic and expanding market. Given the region's economic growth, industrialization, and increasing urbanization, the Asia-Pacific butadiene market is anticipated to remain a key hub in the global landscape, contributing significantly to the production and innovation within the synthetic rubber and polymer sectors.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding company presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. Some of the key market players working in this domain are:

Recent Development:

1) In July 2022, Sinopec and INEOS Group revealed collaborative agreements to address the escalating demand in China's market by expanding petrochemical production. INEOS acquired a 50% stake in Sinopec subsidiary SECCO Petrochemical Co. Ltd., a significant producer of butadiene. The collaboration will establish a new 50-50 joint venture, focusing on enhancing China's acrylonitrile butadiene styrene (ABS) production capacity by constructing two 300,000-tpy ABS plants, thereby contributing up to 1.2 million tons per year. This strategic partnership aligns with the growing demand for petrochemicals in China.

2 In June 2022, BASF extended its Licity anode binders for Li-ion battery manufacturing. The second-generation styrene-butadiene rubber (SBR) binder, Licity 2698 X F, facilitates the incorporation of silicon contents exceeding 20%, offering improved capacity, increased charge/discharge cycles, and reduced charging times. This advancement reflects BASF's commitment to enhancing battery technology for electric vehicles.

Q1. What was the Butadiene Market size in 2023?

As per Data Library Research the Butadiene Market size is estimated at 14.89 million tons in 2023.

Q2. At what CAGR is the Butadiene market projected to grow within the forecast period?

Butadiene market is expected to register a CAGR of 4.2% during the forecast period.

Q3. What are the factors driving the Butadiene market?

Key factors that are driving the growth include the Robust demand for synthetic rubber and the increasing utilization of butadiene and The automotive industry's expanding footprint.

Q4. Which region has the largest share of the Butadiene market? What are the largest region's market size and growth rate?

Asia-Pacific region has the largest share of the market . For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model