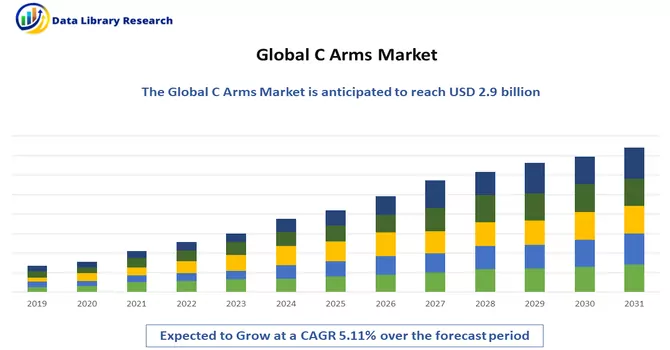

The C-Arms Market size is estimated at USD 2.9 billion in 2023 and is expected to register a CAGR of 5.11% during the forecast period (2024-2031).

Get Complete Analysis Of The Report - Download Free Sample PDF

A global C-arm is a vital medical imaging device featuring a C-shaped arm, extensively utilized in surgeries and interventional procedures across diverse medical specialities worldwide. This equipment, either mobile or fixed, facilitates real-time X-ray imaging during medical interventions, providing crucial visual guidance for physicians in procedures such as orthopaedic surgeries, fluoroscopy-guided interventions, and vascular examinations. The term "global" underscores the widespread adoption of C-arms, emphasizing their integral role in modern medical practices globally and their contribution to enhanced patient care through real-time imaging capabilities. The C-arm market is propelled by several key driving factors contributing to its sustained growth. Increasing demand for advanced medical imaging technologies in surgical and interventional procedures, coupled with rising prevalence of chronic diseases requiring diagnostic and treatment interventions, fuels the adoption of C-arms. Technological advancements, such as improved image quality, real-time imaging capabilities, and the integration of innovative features, drive the market forward. Additionally, the expanding geriatric population and the subsequent rise in orthopedic and cardiovascular procedures further stimulate the demand for C-arms. The growing number of ambulatory surgical centers (ASCs) and the trend toward minimally invasive procedures also contribute significantly to market growth. Furthermore, favorable reimbursement policies, investments in healthcare infrastructure, and increasing awareness among healthcare professionals about the benefits of C-arm technology contribute to a positive market outlook. Overall, these factors collectively contribute to the dynamic expansion of the C-arm market globally.

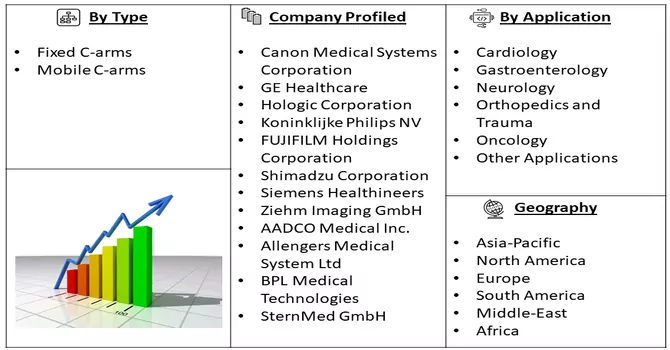

Market Segmentation: The Market Report Covers Global C-arm manufacturers and is Segmented by Type (Fixed C-arms and Mobile C-arms), Application (Cardiology, Gastroenterology, Neurology, Orthopedics and Trauma, Oncology, and Other Applications), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Value is provided in USD million for the Above Segments.

For Detailed Market Segmentation - Download Free Sample PDF

The C-arm market is witnessing notable trends that shape its trajectory and impact the landscape of medical imaging. Technological advancements, such as the integration of artificial intelligence (AI) for image enhancement and procedural guidance, are gaining prominence, offering improved precision and efficiency in surgical and interventional settings. The shift towards mobile C-arms is notable, providing flexibility and accessibility in various healthcare settings, including operating rooms and ambulatory surgery centers. Moreover, the increasing emphasis on dose reduction strategies and the development of low-dose imaging systems reflect a growing awareness of radiation safety. The trend towards hybrid operating rooms, combining C-arm technology with other imaging modalities, is on the rise, facilitating comprehensive patient care. Additionally, the market is witnessing a surge in demand for refurbished C-arm systems, driven by cost-effectiveness and sustainability considerations. These evolving trends collectively underscore the dynamic nature of the C-arm market, driven by technological innovations, patient-centric approaches, and the integration of advanced imaging solutions into contemporary healthcare practices.

Market Drivers:

Rising Geriatric Population and Increasing Incidence of Chronic Diseases

The rising geriatric population and the increasing incidence of chronic diseases have become pivotal factors influencing the utilization of C-arms in medical imaging. As the elderly demographic grows, there is a higher prevalence of health conditions, such as cardiovascular diseases and orthopedic issues, necessitating advanced diagnostic and interventional procedures. C-arms play a crucial role in these medical interventions, offering real-time imaging guidance during surgeries and minimally invasive procedures. The technology's versatility and effectiveness in providing detailed and immediate visual information contribute significantly to improved patient outcomes, particularly in the context of complex surgeries often associated with age-related health concerns. The integration of C-arms in healthcare settings aligns with the growing demand for innovative solutions to address the diagnostic and treatment needs of an aging population facing a higher risk of chronic illnesses. Consequently, the intersection of the rising geriatric demographic and the prevalence of chronic diseases underscores the instrumental role of C-arms in enhancing the quality of care for these vulnerable patient populations.

Advancements in Maneuverability and Imaging Capabilities

Advancements in maneuverability and imaging capabilities have been transformative in shaping the landscape of C-arms, contributing to enhanced precision and efficiency in medical imaging. The evolution of C-arm technology includes improvements in maneuverability, allowing for increased flexibility and optimal positioning during various medical procedures. These advancements are particularly crucial in complex surgeries and interventions, where real-time imaging precision is paramount. In terms of imaging capabilities, technological innovations have led to improved image quality, offering clearer and more detailed visuals for healthcare professionals. High-resolution imaging, three-dimensional reconstructions, and the integration of advanced software contribute to more accurate diagnostics and streamlined procedures. The advent of flat-panel detectors has replaced traditional image intensifiers, providing higher sensitivity and enabling dynamic imaging modalities. Additionally, the incorporation of fluoroscopy and cone-beam computed tomography (CBCT) features has further expanded the diagnostic capabilities of C-arms. These features allow for real-time visualization of anatomical structures and guide interventions with unparalleled accuracy. The dynamic integration of artificial intelligence (AI) has also played a role in automating certain aspects of image analysis, reducing operator workload, and potentially improving diagnostic accuracy. Overall, the continuous advancements in maneuverability and imaging capabilities of C-arms represent a paradigm shift in medical imaging technology, empowering healthcare professionals with state-of-the-art tools to achieve optimal outcomes in surgeries, interventional procedures, and diagnostics. As technology continues to evolve, these innovations contribute to the ongoing improvement of patient care and treatment outcomes in diverse medical specialties.

Market Restraints:

High Procedural and Equipment Costs

The high procedural and equipment costs stand as potential impediments that could decelerate the growth of the C-arms market. While C-arms offer advanced imaging capabilities and real-time visualization during medical procedures, the associated expenses, both in terms of acquiring the equipment and conducting procedures, pose challenges for healthcare providers. The significant initial investment required for purchasing C-arm systems, coupled with the costs associated with maintenance, training, and upgrades, may deter some healthcare facilities, particularly those with limited financial resources, from adopting this advanced imaging technology. Moreover, the high procedural costs attributed to the utilization of C-arms in various interventions can be a limiting factor, impacting their widespread adoption. Reimbursement challenges and the need for skilled operators further contribute to the overall economic burden associated with C-arm procedures. This financial barrier may be particularly pronounced in regions or healthcare systems with budgetary constraints.

The C-arms market is anticipated to experience the repercussions of the COVID-19 pandemic, primarily due to its impact on elective image-guided procedures that faced postponements during the health crisis. Hospitals, focusing on critical COVID-19 treatment support equipment like ventilators, deferred investments in high-cost capital equipment, including C-arms, leading to a temporary slowdown. A study published in the British Journal of Surgery highlighted that approximately 28.4 million elective surgeries worldwide were cancelled or postponed during the peak 12-week disruption in hospital services in 2020. In India alone, over 580,000 planned surgeries were affected. However, as healthcare guidelines evolve, especially in managing COVID-19-positive patients requiring surgery, the need for specially equipped operating rooms with mobile C-arm fluoroscopic X-ray systems becomes crucial. This demand, coupled with the gradual recovery of elective procedures, is expected to contribute to a steady growth trajectory for the C-arms market during the forecast period, despite the initial pandemic-induced challenges.

Segmental analysis:

Fixed C-arms Segment is Expected to Witness Significant Growth over the Forecast Period

The fixed C-arms segment holds a pivotal position in the medical imaging equipment market, representing stationary imaging devices permanently installed in specific locations within healthcare facilities. Renowned for their stability and consistent imaging quality, fixed C-arms feature advanced technologies like high-resolution image intensifiers and flat-panel detectors, catering to diverse medical specialities, including orthopaedics, cardiology, and vascular surgery. Their versatility allows real-time imaging guidance during various procedures, such as orthopaedic surgeries and angiography. While fixed C-arms lack the mobility of their counterparts, their dedicated presence in specific medical environments ensures continuous access to advanced imaging capabilities, contributing to improved patient care. Ongoing technological advancements in this segment focus on refining imaging modalities, optimizing workflow, and incorporating artificial intelligence for enhanced diagnostic accuracy, underscoring the integral role of fixed C-arms in providing reliable and advanced medical imaging solutions.

Cardiology Segment is Expected to Witness Significant Growth Over the Forecast Period

Cardiology and C-arms are intricately connected in the realm of medical imaging, playing a crucial role in diagnosing and treating cardiovascular conditions. C-arms, whether fixed or mobile, are instrumental in providing real-time, high-quality fluoroscopic imaging during a range of cardiac procedures. In interventional cardiology, C-arms aid in visualizing the heart and blood vessels, guiding catheter-based treatments such as angioplasty, stent placement, and cardiac catheterization. The dynamic imaging capabilities of C-arms enable cardiologists to navigate through complex vascular structures, assess blood flow, and precisely deploy medical devices. Moreover, the integration of advanced features like flat-panel detectors enhances image clarity and facilitates detailed visualization of cardiac anatomy. C-arms have become indispensable tools in the cardiac catheterization lab, offering a combination of flexibility and imaging prowess to enhance diagnostic accuracy and therapeutic interventions in the field of cardiology. As technology continues to evolve, the synergy between cardiology and C-arms contributes to improved patient outcomes, making them pivotal components in the comprehensive management of cardiovascular diseases.

North America Region is Expected to Witness Significant Growth over the Forecast Period

North America is poised to experience significant growth in the C-arms market, driven by several factors contributing to the region's dynamic healthcare landscape. The United States, in particular, boasts high standards of healthcare infrastructure, fostering a conducive environment for the market's expansion. The region witnesses a heightened frequency of diagnostic examinations, propelled by the rising prevalence of chronic diseases and an aging population. The World Health Organization's observation that cardiovascular diseases are a leading cause of global mortality in 2021 underscores the critical need for advanced imaging procedures, such as those facilitated by C-arms, to diagnose and treat cardiovascular conditions. The substantial growth in the geriatric population, as estimated by the Census Bureau, further amplifies the demand for C-arm technology. With projections indicating that the geriatric population in the United States will reach 94 million by 2060, there is an anticipated surge in the number of surgeries, particularly those addressing age-related health concerns. This demographic trend becomes a key driver for the overall market growth, given the integral role of C-arms in surgeries and interventional procedures. Additionally, the C-arms market in North America is propelled by the continuous trend of new product approvals and launches, coupled with advancements in technology. A noteworthy example is MINICARM.COM's expansion of its United States warehouse in December 2022, emphasizing the refurbishment of high-quality Mini C-Arms. These devices play a crucial role in fluoroscopic imaging during orthopaedic surgery and digital diagnostic imaging, contributing to the overall growth and technological advancement of the C-arms market in the region.

Get Complete Analysis Of The Report - Download Free Sample PDF

The C-arms market exhibits a consolidated structure characterized by the participation of numerous companies with a global and regional presence. The competitive landscape entails an examination of both international and local entities, each holding significant market shares and enjoying recognition. This market structure emphasizes the competitive dynamics shaped by well-established players operating on both global and regional scales. Some of the market players working in this segment are:

Recent Development:

1) In July 2022, Siemens Healthineers announced FDA clearance for its Artis icono Ceiling Angiography system. The ARTIS icono ceiling system offers a blend of design flexibility, precise positioning, and intelligent workflows. Notably, its C-arm features enhanced rotational capabilities and simplified cabling, enabling cone beam CT data acquisitions.

2) In July 2022, Fujifilm Healthcare Americas Corporation introduced the FDR Cross, an inventive hybrid c-arm and portable x-ray solution specifically designed for hospitals and ambulatory surgery centers (ASC).

Q1. What was the C- Arms Market size in 2023?

As per Data Library Research the C-Arms Market size is estimated at USD 2.9 billion in 2023.

Q2. At what CAGR is the C-Arms market projected to grow within the forecast period?

C-Arms market is expected to register a CAGR of 5.11% during the forecast period.

Q3. What segments are covered in the C-Arms Market Report?

By Type, By Application, End-User and Geography these segments are covered in the C-Arms Market Report.

Q4. What are the factors driving the C-Arms market?

Key factors that are driving the growth include the Rising Geriatric Population and Increasing Incidence of Chronic Diseases and Advancements in Maneuverability and Imaging Capabilities.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model