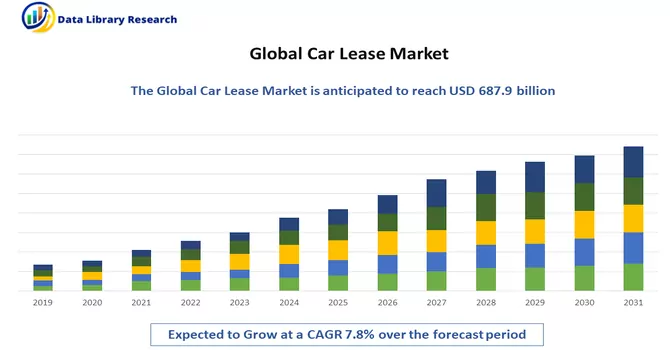

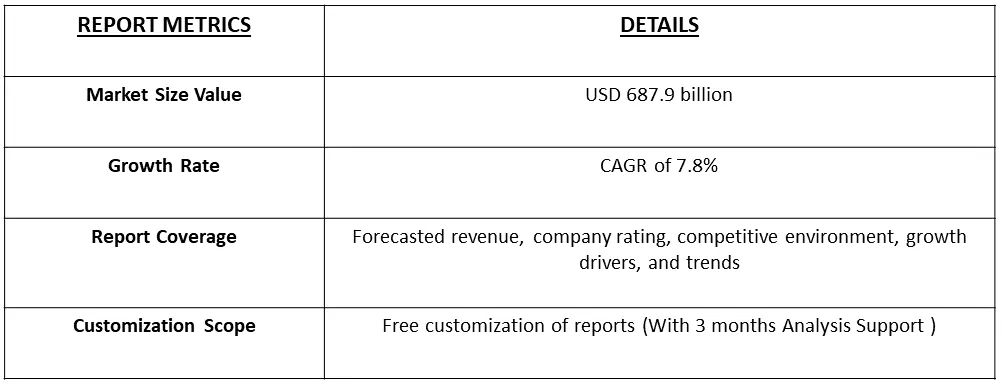

The Car Lease Market is USD 687.9 billion in the year 2023 and is expected to register a CAGR of 7.8% over the forecast period, 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

The car lease market refers to the segment of the automotive industry where vehicles are leased or rented rather than purchased outright. In a car lease arrangement, individuals or businesses make regular payments to use a vehicle for a specified period, typically two to three years. At the end of the lease term, the lessee usually has the option to either buy the vehicle or return it and lease a new one. Companies specializing in leasing services and automobile dealerships offer lease agreements to customers. These entities facilitate the leasing process, including negotiations, documentation, and maintenance services. Lessees make regular monthly payments throughout the lease term, covering the depreciation of the vehicle's value during that period. These payments are generally lower than the monthly payments in a traditional auto loan, making leasing an attractive option for some consumers.

The global car lease market is thriving due to several key factors. People are drawn to it because of its cost efficiency, offering lower monthly payments that appeal to those on a budget. The flexibility of leasing allows individuals and businesses to enjoy the experience of driving a new vehicle every few years without the commitment of long-term ownership. For businesses, leasing provides a cost-effective way to manage vehicle fleets. Reduced maintenance costs, coupled with manufacturer warranties, make leasing an attractive option. The market is also being driven by advancements in vehicle technology, such as electric and hybrid options, as well as the increasing trend of urbanization where car ownership may not be practical. Digital transformation in leasing processes enhances accessibility, and environmental concerns contribute to the rise in leasing eco-friendly vehicles. Economic factors and changing consumer preferences, favouring access over ownership, further contribute to the global growth of the car lease market.

Market Segmentation: The Global Car Leasing Market is Segmented by Lease (Open-Ended, and Close Ended), by Vehicle (Passenger Car, Light Commercial Vehicle, and Heavy Commercial Vehicle) and by End-user (Commercial Customers, and Non-commercial Customers) and geography (North America, Europe, Asia-Pacific, South America, and Africa). The report offers the market size and forecasts in terms of volume in metric tons and value in USD thousand for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The global car lease market is poised for significant growth, driven by various opportunities in response to shifting consumer preferences and industry trends. With the increasing demand for electric vehicles, there is a chance to capitalize on sustainability trends by offering attractive leasing options for electric and hybrid cars. Fleet management services represent another promising avenue, catering to businesses seeking flexible and cost-effective solutions. Embracing digital transformation, such as user-friendly online interfaces and automated processes, can enhance customer experiences and reach a broader audience. Customization and personalization of lease packages, subscription-based models, and integration of advanced technologies like telematics and connected features offer avenues for differentiation and market capture. Exploring opportunities in emerging markets and forming collaborations with manufacturers, dealerships, and technology providers can further expand the market's reach and innovative offerings. Additionally, focusing on flexible lease terms, especially in luxury and premium segments, provides avenues for attracting a diverse customer base and staying competitive in an evolving automotive landscape.

Market Drivers:

Increase in Demand for EV

The demand for electric vehicles in the automotive industry's increasing commitment to sustainability, and the surge in demand for electric vehicles presents a noteworthy opportunity. The car lease market is well-positioned to leverage this trend by providing enticing lease options tailored for electric and hybrid vehicles. In January 2024, as per recent sources, electric vehicle (EV) sales in India surpassed the 1 million milestone within just nine months of 2023, a notable achievement considering it took an entire year to reach this point in 2022. Information sourced from the Ministry of Road Transport and Highways’ Vahan Dashboard revealed that as of September 19 2023, a total of 1,037,011 EVs were officially registered with regional transport offices. This figure constitutes 6.4% of the overall automobile sales in the country for the year, underscoring the remarkable growth and increasing prominence of electric vehicles in the Indian automotive market. In taking such measures, the market has the capacity to play a proactive role in fostering environmental preservation, in line with the escalating concerns for ecological welfare. Furthermore, this thoughtful strategy not just meets the necessity of eco-consciousness but also accommodates the shifting inclinations of consumers who are progressively gravitating towards more eco-friendly and sustainable modes of transportation.

Flexible Lease Terms and Subscription Models

There is a noticeable upward trend favouring flexible lease terms that empower consumers to tailor contracts to their specific needs. Additionally, the increasing popularity of subscription-based models is significant, wherein customers opt for a monthly fee for access to a diverse range of vehicles. This evolving preference underscores a shift towards enhanced flexibility and convenience, presenting consumers with more options and a streamlined experience in fulfilling their transportation requirements. Hyundai Motor America, in collaboration with Hyundai Capital America, introduced the Evolve+ electric vehicle subscription service at the 2023 Chicago Auto Show in February. Positioned as a month-to-month subscription covering 1,000 miles, insurance, maintenance, registration, and roadside assistance, Evolve+ is priced at USD 699 per month for the Kona Electric and USD 899 per month for the IONIQ 5.i. What sets Evolve+ apart is its no-commitment cancellation option, distinguishing it from services that necessitate a 3- to 5-month minimum term. Currently accessible in select dealerships across six states, Hyundai aims to expand the Evolve+ service to additional locations by year-end. This initiative aligns with Hyundai's dedication to delivering accessible and convenient electric vehicle experiences. As a result, the proliferation of such adaptable lease terms and subscription models is anticipated to propel growth in the studied market.

Market Restraints:

Long-Term Cost and Market Depreciation Risk

The monthly lease payments are generally lower than loan payments, the long-term cost of leasing multiple vehicles can be higher than owning a car outright. For individuals who plan to keep a vehicle for an extended period, leasing may not be the most cost-effective option. Thus, long term cost may slow down the growth of the studied market.

The COVID-19 pandemic has profoundly impacted the car lease market, witnessing a notable shift in consumer behavior and preferences. With economic uncertainties and lockdowns curbing consumer spending, the demand for new vehicles declined, prompting individuals to reconsider traditional car ownership or leasing, particularly in urban areas where remote work and alternative transportation gained traction. Supply chain disruptions in the automotive industry further hindered new vehicle availability, influencing the choices for potential lease customers. Financial challenges, including job losses, led some consumers to opt for extending existing leases rather than committing to new ones. Leasing companies responded by introducing more flexible lease terms, such as shorter durations and reduced upfront costs, to accommodate the evolving needs of consumers during uncertain times. Digitalization and online transactions gained prominence, while government stimulus programs and financial incentives played a role in shaping leasing decisions. As the situation continues to evolve, the car lease market adapts to changing dynamics influenced by economic recovery, shifts in transportation preferences, and ongoing developments related to the pandemic.

Close Ended Lease Segment is Expected to Witness Significant Growth Over The Forecast Period

A Close Ended Car Lease, also known as a "closed-end" or "walk-away" lease, is a specific type of car lease agreement that comes with predetermined terms and conditions regarding the vehicle's usage, mileage, and maintenance. In a close-ended lease, the lessee agrees to lease the vehicle for a fixed period, usually two to three years, and commits to a maximum mileage limit. At the end of the lease term, the lessee has the option to return the vehicle without any further financial obligation, assuming the car is within the agreed-upon mileage and is in good condition, allowing for normal wear and tear. This type of lease provides lessees with a clear understanding of their financial obligations over the lease period, making it a popular choice for individuals who prefer a structured and predictable arrangement. However, exceeding the agreed-upon mileage or excessive wear and tear on the vehicle may result in additional charges at the end of the lease term. Close Ended Car Leases are common in consumer auto leasing and are often contrasted with Open Ended Leases, where the lessee may be responsible for the vehicle's residual value at the end of the lease. Thus, owing to such benefit the segment is expected to witness significant growth over the forecast period.

Passenger Car Segment is Expected to Witness Significant Growth Over The Forecast Period

A passenger car, commonly referred to as an automobile, is a motor vehicle designed primarily for the transportation of passengers. It typically accommodates four or more individuals and is characterized by features such as comfort, safety, and ease of use. Passenger cars come in various body styles, including sedans, hatchbacks, SUVs (sport utility vehicles), and coupes, catering to diverse consumer preferences. Car leasing, on the other hand, is a financial arrangement where an individual or business can use a vehicle for a specified period, typically two to three years, by making regular monthly payments. Unlike an outright purchase, leasing allows individuals to enjoy the benefits of driving a new car without the long-term commitment of ownership. Car lease agreements come in two primary forms: open-ended and closed-ended leases. In an open-ended lease, the lessee may be responsible for the vehicle's residual value at the end of the lease term, while a closed-ended lease, also known as a "walk-away" lease, offers predetermined terms, including mileage limits and lease duration. At the end of a closed-ended lease, the lessee can return the vehicle without further financial obligations if it meets the agreed-upon conditions. Car leasing is popular for its flexibility, lower monthly payments compared to traditional auto loans, and the ability to drive a new vehicle every few years. It is a widely utilized option in the automotive industry, offering consumers an alternative to vehicle ownership while enjoying the convenience and features of a passenger car. Thus, owing to such benefit the segment is expected to witness significant growth over the forecast period.

Commercial Vehicle Segment is Expected to Witness Significant Growth Over The Forecast Period

A commercial vehicle is a motor vehicle primarily used for transporting goods or paying passengers for profit. These vehicles play a crucial role in various industries, including transportation, logistics, construction, and delivery services. Commercial vehicles encompass a wide range of types, such as trucks, vans, buses, and specialized vehicles designed to meet the diverse needs of businesses. Car leasing in the context of commercial vehicles follows a similar principle to passenger car leasing but is tailored to the specific requirements of businesses. Commercial vehicle leases are structured agreements where a business or individual can use a vehicle for a predetermined period by making regular lease payments. This arrangement provides businesses with the flexibility to access the necessary vehicles without the financial commitment of ownership. Commercial vehicle leases often come with terms that suit the unique demands of businesses, allowing for customized lease durations, mileage limits, and additional features tailored to specific commercial needs. Leasing commercial vehicles offers advantages such as predictable monthly expenses, the ability to upgrade to newer models regularly, and potential tax benefits for businesses. One common type of commercial vehicle lease is the closed-end lease, where the lessee returns the vehicle at the end of the lease term without further financial obligations, assuming the vehicle meets the predetermined conditions. This can be advantageous for businesses seeking cost-effective and flexible solutions for their transportation needs. Thus, commercial vehicles are essential for various business operations, and commercial vehicle leasing provides a practical and flexible means for businesses to access and manage their fleet. It allows businesses to utilize the latest vehicles without the long-term commitment of ownership, contributing to operational efficiency and financial flexibility.

Asia-Pacific Region is Expected to Witness Significant Growth in the Forecast Period

The Asia Pacific car leasing market has experienced substantial growth fueled by economic expansion, urbanization, and changing consumer preferences. The region’s rising middle class increased disposable income, and growing corporate sectors have driven demand for flexible and cost-effective mobility solutions, leading to a surge in car leasing. Shifting attitudes toward access over ownership, along with the adoption of advanced vehicle technologies like electric and hybrid options, contribute to the market's dynamism. Government initiatives supporting sustainable transportation and the digital transformation of leasing processes further enhance the accessibility and popularity of car leasing services in the region. This evolving landscape, coupled with a competitive market, positions car leasing as a significant player in providing flexible and sustainable transportation solutions across the Asia Pacific. In Feb 2023, Mitsubishi Corporation (MC), Mitsubishi HC Capital Inc., Mitsubishi Auto Leasing Corporation and Mitsubishi HC Capital Auto Lease Corporation are pleased to announce the merger of Mitsubishi Auto Leasing and Mitsubishi HC Capital Auto Lease. The merger, which is scheduled to take place on April 1, 2023, has already been agreed to by respective parent entities MC and Mitsubishi HC Capital and contractually confirmed by Mitsubishi Auto Leasing and Mitsubishi HC Capital Auto Lease. The newly merged entity shall retain the name Mitsubishi Auto Leasing, with MC and Mitsubishi HC Capital holding equal shareholder voting rights.

Get Complete Analysis Of The Report - Download Free Sample PDF

The major companies working in this segment are:

Recent Development:

1) In 2023, RCI Banque S.A., operating under the Mobilize Financial Services brand, has revealed that its subsidiary, RCI Bank UK Ltd, is set to acquire a 36.6% stake in SELECT CAR LEASING, a prominent independent broker in the UK. In a reciprocal move, SELECT CAR LEASING's shareholders, Mark Tongue and James O'Malley, will secure a 15% interest in Mobilize Lease&Co UK Ltd. This subsidiary of RCI Bank UK Ltd, established in May 2023, will soon introduce SELECT LEASE by MOBILIZE as a fresh commercial brand. This strategic collaboration aims to position Mobilize Lease&Co UK Ltd as a leading provider of multi-brand leasing contracts, catering to the diverse needs of private individuals, SMEs, and companies with a comprehensive range of products and services.

2) In Feb 2023, Hyundai Motor America in partnership with Hyundai Capital America today announced its new Evolve+ electric vehicle subscription service at the 2023 Chicago Auto Show. This new service provides flexibility and affordability to the consumer who wants to drive Hyundai's newest electric vehicles without committing to a purchase or longer-term lease. Evolve+ is a month-to-month subscription service that covers 1,000 miles, insurance, maintenance, registration, and road-side assistance at a starting price of USD 699 per month for a Kona Electric and USD 899 per month for an IONIQ 5.i The subscriber can cancel at any time during each subscription period and there is no long-term commitment required. Other subscription services require customers to lock into a 3- to 5-month minimum term. Evolve+ is currently available at select dealerships in six states with plans to add more by the year's end. Consumers can find available dealers within the app.

Q1. What was the Car Lease Market size in 2023?

As per Data Library Research the Car Lease Market is USD 687.9 billion in the year 2023.

Q2. What is the Growth Rate of the Car Lease Market ?

Car Lease Market is expected to register a CAGR of 7.8% over the forecast period.

Q3. What segments are covered in the Car Lease Market Report?

By Lease, By Vehicle, End-User and Geography these segments are covered in the Car Lease Market Report.

Q4. What are the Growth Drivers of the Car Lease Market?

Increase in Demand for EV and Flexible Lease Terms and Subscription Models are the Growth Drivers of the Car Lease Market.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model