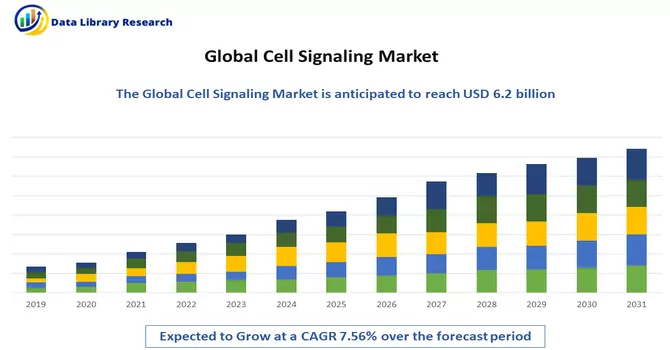

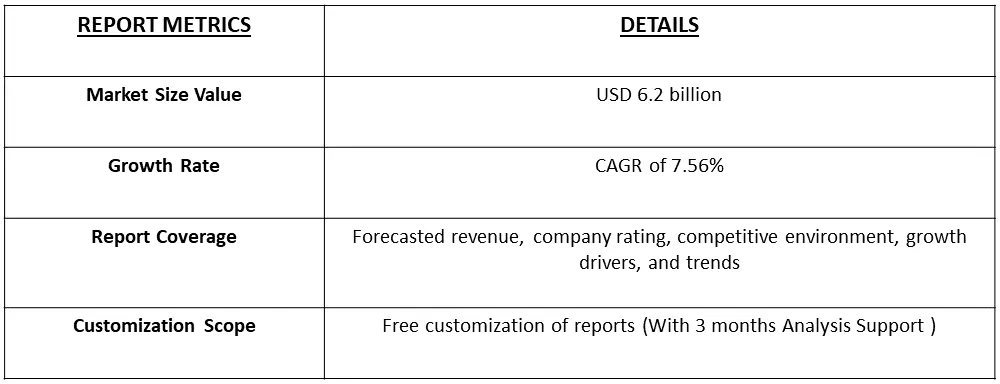

The global cell signalling market size was valued at USD 6.2 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.56% during the forecast period, 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Cell signalling, also known as cellular communication or cell signalling pathways, refers to the complex process by which cells communicate with each other to coordinate various physiological activities and responses. Cells use signalling mechanisms to transmit information about their internal state or external environment, allowing them to regulate processes such as growth, differentiation, metabolism, and response to environmental stimuli. Cell signaling involves the transmission of signals, often in the form of molecules like hormones, neurotransmitters, or growth factors, from one cell to another. These signals are recognized by specific receptors on the target cell's surface or inside the cell, initiating a series of molecular events known as signal transduction. The ultimate outcome of cell signaling can include changes in gene expression, alterations in cell behavior, activation of specific cellular responses, or adaptation to environmental conditions. Cell signaling is a fundamental aspect of cellular function and plays a crucial role in development, immune responses, tissue repair, and maintaining homeostasis in multicellular organisms.

The growth of cell signaling marker research is propelled by a confluence of factors. Technological advancements, including high-throughput screening and advanced imaging, facilitate the identification and characterization of novel markers. Increasing insights into disease mechanisms, especially in cancer research, drive the quest for specific markers for diagnostics and targeted therapies. The shift towards personalized medicine accentuates the need for a nuanced understanding of cell signaling pathways, fostering a focus on individualized treatment strategies. Ongoing efforts in drug development and validation rely heavily on comprehending cell signaling, with markers serving as crucial indicators for efficacy and safety. The expanding applications in cancer research, coupled with the rising interest in immunotherapy, underscore the significance of cell signaling markers in optimizing therapeutic approaches. Additionally, the availability of technological platforms for biomarker discovery, increased funding for life sciences research, and collaborative initiatives accelerate progress in the field. The integration of advanced technologies in diagnostics, particularly in molecular and companion diagnostics, further emphasizes the importance of identifying specific cell signaling markers for enhancing diagnostic accuracy and guiding treatment decisions. Collectively, these factors drive the dynamic landscape of cell signaling marker research, promising advancements in precision medicine, targeted therapies, and improved patient outcomes.

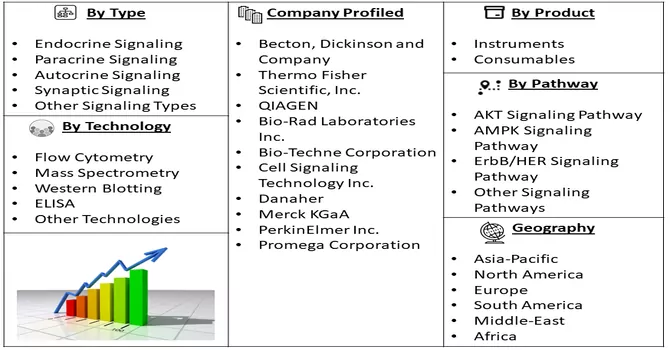

Market Segmentation: The Global Cell Signaling Market is Segmented by Signaling Type (Endocrine Signaling, Paracrine Signaling, Autocrine Signaling, Synaptic Signaling, and Other Signaling Types), Product (Instruments and Consumables), Technology (Flow Cytometry, Mass Spectrometry, Western Blotting, ELISA, and Other Technologies), Pathway (AKT Signaling Pathway, AMPK Signaling Pathway, ErbB/HER Signaling Pathway, and Other Signaling Pathways), and Geography (North America, Europe, Asia-Pacific, Middle-East and Africa, and South America). The market provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The cell signaling market is undergoing dynamic changes marked by a surge in precision medicine applications, driven by an increased understanding of individualized treatment approaches. Advances in omics technologies, including genomics and proteomics, play a pivotal role, offering comprehensive insights into intricate cell signaling pathways. With a pronounced focus on cancer research, there is an expansion of applications in oncology, influencing the development of targeted therapies and companion diagnostics. The integration of advanced technologies, such as molecular diagnostics and companion diagnostics, underscores the importance of cell signaling markers in diagnostic platforms. Immunotherapy's rising prominence fuels research on cell signaling markers associated with immune responses. Biomarker discovery, facilitated by collaborative initiatives and high-throughput screening, gains significance for early disease detection and monitoring. Additionally, the application of artificial intelligence and machine learning enhances data analysis, contributing to more efficient research. Regulatory support for biomarker development further encourages investment in the identification of novel cell signaling markers, shaping a dynamic and evolving landscape for the cell signaling market.

Market Drivers:

Growing Applications in Cancer Research

Extensive research in oncology, underscored by the pivotal role of cell signaling in cancer progression and treatment, is a driving force behind the burgeoning cell signaling market. The increasing prevalence of chronic diseases on a global scale, particularly cancer, cardiovascular diseases, and neurological disorders, further amplifies the demand for advanced cell signaling research. The surge in new cancer cases, as reported by the American Cancer Society with approximately 1.9 million in 2022, along with 609,360 cancer-related deaths in the U.S., underscores the urgent need for innovative approaches. This pressing health challenge fuels the development of targeted therapies and companion diagnostics, as researchers strive to unravel the intricate signaling pathways involved in disease mechanisms. The growing pool of patients afflicted by these diseases intensifies the quest for a deeper understanding of cell signaling, positioning it as a crucial field for identifying potential therapeutic targets and advancing personalized treatment strategies. As the prevalence of chronic diseases continues to rise, the dynamic landscape of cell signaling research is poised for sustained growth, driven by the imperative to address the evolving healthcare needs of a global population.

Increasing Demand for Biomarkers

The surge in demand for biomarkers is intricately linked to the burgeoning field of cell signaling research, particularly driven by the paradigm shift towards precision medicine. Biomarkers derived from cell signaling pathways play a pivotal role in disease diagnosis, prognosis, and therapeutic target identification. They serve as essential indicators in drug development, guiding clinical trials and optimizing treatment outcomes. The integration of cell signaling biomarkers into companion diagnostics contributes to personalized medicine, aiding in patient stratification and ensuring tailored interventions. With a specific emphasis on oncology, these biomarkers inform cancer research, facilitating early detection, subtype classification, and the monitoring of disease progression. Technological advancements further accelerate biomarker discovery, fostering a dynamic interplay between cell signaling and the growing demand for precise, personalized healthcare solutions.

Market Restraints:

High Costs of Research and Development

The extensive research and development required for understanding cell signalling pathways and developing novel drugs can be cost-prohibitive. High costs associated with sophisticated technologies, equipment, and clinical trials may limit the number of players entering the market and hinder innovation. Thus, such factors are expected to slow the growth of the studied market.

The COVID-19 pandemic has brought about a multifaceted impact on the cell signalling market, initially disrupting research activities with laboratory closures and supply chain interruptions. A shift in research priorities towards understanding the cellular responses to SARS-CoV-2 has been observed, impacting timelines for non-COVID-19-related studies. Clinical trials investigating cell signaling-based therapies faced delays, and remote work presented challenges for laboratory-based research. However, there was a surge in demand for diagnostic technologies related to cell signaling markers for COVID-19 monitoring. The pandemic accelerated the adoption of virtual technologies for scientific collaboration, while also fostering increased interest in antiviral drug development. Supply chain disruptions affected the availability of research reagents, emphasizing the need for resilient supply chains. Despite challenges, the pandemic heightened global awareness of public health, potentially influencing future investments and research initiatives in cell signaling, particularly related to immune responses and infectious diseases.

Segmental Analysis:

Consumables Segment is Expected to Witness Significant Growth Over the Forecast Period

In 2023, the life sciences industry saw a surprising champion: consumables. While flashier technologies may have grabbed headlines, it was the constant need for replenishing these workhorses that drove them to the top of the revenue chain. Unlike expensive equipment, consumables like specialized reagents and cell culture plates are used and repurchased frequently, creating a reliable income stream.

But hold on, the story gets even more exciting! The rise of personalized medicine and targeted therapies, fueled by genomics and proteomics breakthroughs, is creating a perfect storm for consumable growth. These therapies require specialized tools tailor-made for individual patients, consumables play a crucial role. This surge in demand is further amplified by burgeoning investments from both governments and private sectors. Just look at the cell signaling industry, heavily reliant on consumables: massive funding, like the USD 45 billion poured into stem cell research by the NIH in 2021, is propelling its growth forward. Similar funding trends for embryonic and induced pluripotent stem cell research paint a clear picture – consumables are no longer just supporting actors, they're the driving force in this scientific revolution.

Microscopy Segment is Expected to Witness Significant growth Over the Forecast Period

In 2023, the microscopy segment took center stage, dominating the life sciences market. But it's not just about static snapshots anymore. Fluorescence microscopy shines a light on the dynamic world of cellular signaling. It's not limited to simply observing protein location; it now reveals the fascinating dance of protein interactions happening in real-time. Researchers can witness how signals zip around the cell, get amplified, and ultimately translate into cellular responses. This unlocks a deeper understanding of the intricate signaling networks that govern life processes.

But microscopy doesn't stop there. It dives even deeper, peering into the unique world of individual cells. By tracking how proteins express themselves in different cells, we gain insight into the remarkable variability within living organisms. This single-cell analysis unveils how cells respond differently to stimuli, revealing nuances that traditional population-based studies might miss.

This shift towards studying the dynamic and individual aspects of signaling wouldn't be possible without technological advancements. Microscopy is undergoing a renaissance, fueled by breakthroughs in light sources, detectors, and computational analysis. These innovations are pushing the boundaries of resolution, speed, and sensitivity, allowing researchers to see what was previously invisible. As a result, demand for microscopes is booming, with the light microscopy segment experiencing significant growth. This isn't just about peering into the microscopic world; it's about unlocking the secrets of how life works at its most fundamental level.

AKT signaling pathway Segment is Expected to Witness Significant Growth Over the Forecast Period

The landscape of medical advancements in 2023, the AKT signaling pathway took center stage, asserting its dominance in the market. Widely acknowledged as the "survival route," this signaling pathway assumes a critical role in the intricate orchestration of cellular processes, including the regulation of cell development, apoptotic signals (programmed cell death), and proliferation.What sets the AKT signaling pathway apart is its pervasive dysregulation in the most prevalent types of c ancer. Across a spectrum of common cancer types, this pathway emerges as the frequently disturbed mechanism, highlighting its crucial involvement in the onset and progression of these diseases. One notable projection for the future revolves around the development of commercial diagnostic tests. These tests are anticipated to leverage the nuances of the AKT pathway, particularly its down-regulation, to provide accurate and insightful diagnostic information. This development is poised to be a catalyst for significant growth within the broader cell signaling sector. The implications are profound, suggesting that the strategic targeting and understanding of the AKT signaling pathway could pave the way for innovative diagnostic tools. These tools have the potential not only to enhance our understanding of cancer but also to usher in a new era of personalized and targeted therapies. This underscores the dynamic and promising nature of ongoing research and development efforts within the realm of cell signaling, offering hope for more effective approaches to cancer diagnosis and treatment in the foreseeable future.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America emerged as the primary force in steering the cell signalling market. This dominance can be attributed to several factors, most notably the significant presence of key industry players like Thermo Fisher Scientific, Merck KGaA, and Cell Signaling Technology Inc. within the region. The local concentration of these major players has created a robust ecosystem for the advancement and proliferation of cell signaling technologies. An essential driver behind North America's prominence in the cell signaling industry is the substantial increase in research and development investments by key stakeholders. This heightened focus on R&D is geared towards the creation of innovative and advanced products, further propelling the growth of the regional cell signaling sector. The collaborative efforts and investments made by these industry giants contribute to the continuous evolution and sophistication of cell signaling technologies in North America. The region's ascendancy in the market is not only a testament to the presence of established industry leaders but also reflects the proactive approach adopted by these entities to foster cutting-edge developments. The convergence of technological expertise, strategic collaborations, and a dedication to pioneering research positions North America at the forefront of the global cell signaling landscape, emphasizing its role as a pivotal hub for advancements in this crucial field.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding the company presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. These strategies include investments in research and development to stay at the forefront of technological advancements, mergers and acquisitions to consolidate market share, strategic partnerships for synergies, and innovation to differentiate products and services. The adoption of such multifaceted strategies reflects the competitive nature of the market, with participants continually seeking avenues for growth and sustainability. In essence, the high fragmentation in the studied market not only signifies the diversity of players but also underscores the dynamism and competitiveness that drive ongoing strategic maneuvers. As companies explore various avenues for expansion, the market continues to evolve, presenting both challenges and opportunities for industry stakeholders. Some of the market players working in this segment are:

Recent Development:

1) In June 2021, Thermo Fisher Scientific forged a collaborative partnership with the University of Sheffield to enhance end-to-end processes for characterizing and monitoring complex oligonucleotide and mRNA products. This synergistic collaboration leverages Thermo Fisher's state-of-the-art technologies, including sample preparation, liquid chromatography (LC), high-resolution accurate-mass (HRAM) mass spectrometry (MS), and advanced data interpretation software. By integrating these capabilities with the University of Sheffield's profound research expertise, the collaboration aims to streamline analytical workflows and establish robust fit-for-purpose processes. This strategic alliance is anticipated to contribute significantly to the development of more efficient and reliable methodologies for the analysis of intricate genetic materials.

2) In June 2021, Thermo Fisher Scientific Inc., a global leader in scientific services, introduced the Invitrogen Attune CytPix Flow Cytometer. This innovative cytometer integrates acoustic focusing flow cytometry technology with a high-speed camera, allowing users to capture high-resolution bright-field images concurrently with high-performance fluorescent flow cytometry data from cells. The Attune CytPix offers a unique capability for users to correlate images with corresponding flow cytometry data, providing valuable insights into cell morphology and quality. This technological advancement represents a noteworthy contribution to the field of flow cytometry, enabling researchers to achieve a more comprehensive understanding of cellular characteristics through the combination of imaging and flow cytometry techniques.

Q1. What was the Cell Signaling Market size in 2023?

As per Data Library Research Market size was valued at USD 6.2 billion in 2023.

Q2. At what CAGR is the market projected to grow within the forecast period?

Cell Signaling Market is anticipated to grow at a compound annual growth rate (CAGR) of 7.56% during the forecast period.

Q3. What are the factors on which the Cell Signaling Market research is based on?

By Signaling Type, By product, By Technology , Pathway and Geography are the factors on which the Cell Signaling Market research is based.

Q4. Which region has the largest share of the Cell Signaling Market ? What are the largest region's market size and growth rate?

North America has the largest share of the market . For detailed insights on the largest region's market size and growth rate request a sample here

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model