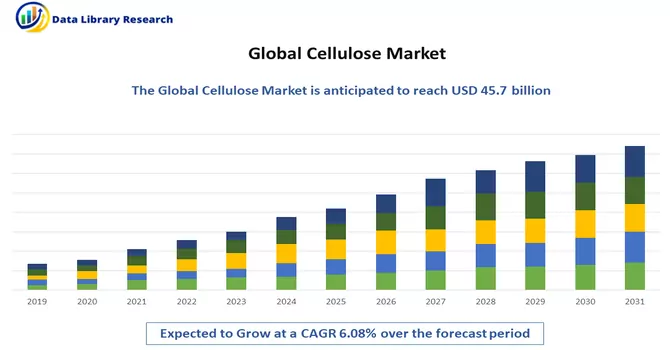

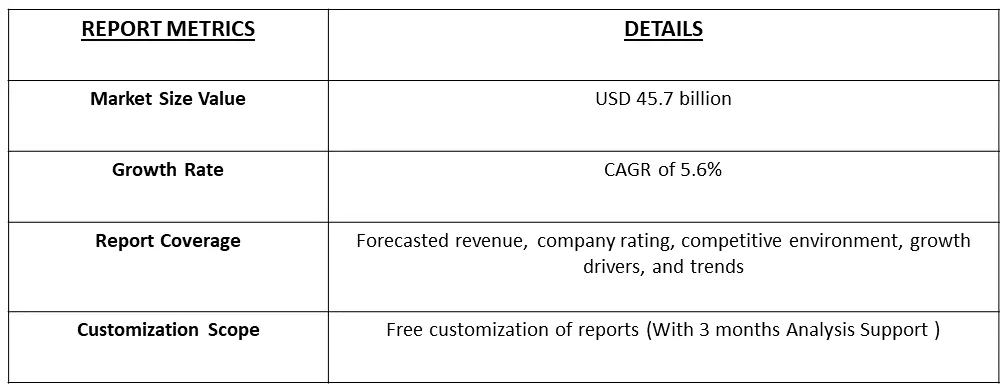

The Global Cellulose Market is currently valued at USD 45.7 billion in the year 2023 and is expected to register a CAGR of 5.6% over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

Cellulose, an intricate carbohydrate and a polysaccharide comprised of interconnected glucose units serves as a foundational structural element in plant cell walls, imparting robustness and resilience to plant cells. Its significance extends into the thriving paper and pulp industry, where it experiences heightened demand. Beyond this, cellulose derivatives such as cellulose acetate and carboxymethyl cellulose find versatile applications in pharmaceuticals, textiles, and food additives, diversifying their market influence.

The recent exploration of nanocellulose and its distinctive properties is fostering innovation in advanced materials and medical applications, notably within drug delivery systems due to cellulose's remarkable biocompatibility. Furthermore, cellulose-based materials are gaining prominence in sustainable packaging solutions, aligning seamlessly with the prevailing global shift towards eco-friendly practices. The escalating demand for cellulose is also propelled by government regulations emphasizing sustainable materials and increased awareness of environmentally friendly practices, collectively amplifying its pivotal role across diverse industries worldwide.

Market Segmentation: The Global Cellulose Market is Segmented by Source (Natural, Fruits, and Treewood), and geography (North America, Europe, Asia-Pacific, South America, and Africa). The report offers the market size and forecasts in terms of volume in metric tons and value in USD thousand for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The global cellulose market is witnessing several key trends that are shaping its trajectory and influencing various industries. One notable trend is the increasing demand for sustainable and eco-friendly materials, driven by a growing awareness of environmental issues. Cellulose, being a renewable and biodegradable resource, is gaining popularity in applications such as packaging, textiles, and pharmaceuticals, aligning with the global trend toward sustainability. The exploration and utilization of nanocellulose have emerged as a significant trend, opening avenues for innovation in advanced materials and medical applications, including drug delivery systems. In the paper and pulp industry, there is a continued demand for cellulose as a fundamental structural component. The market is also characterized by a surge in research and development activities, leading to the discovery of novel cellulose derivatives with applications in diverse sectors. As governments worldwide focus on promoting sustainable practices, cellulose is expected to play a crucial role in meeting the demand for eco-friendly alternatives across various industries. Moreover, collaborations and partnerships between industry players for geographical expansion and market penetration strategies are contributing to the overall growth and competitiveness of the global cellulose market.

Market Drivers:

Growing Demand for Sustainable Resources

Derived primarily from renewable sources like wood pulp and cotton, cellulose stands out as a sustainable substitute for synthetic materials, gaining significant traction across industries. The rising emphasis on sustainability and heightened environmental consciousness are key drivers behind the escalating demand for cellulose. This natural polymer's appeal lies in its eco-friendly attributes, offering a viable solution to reduce reliance on non-renewable resources. Furthermore, technological advancements play a pivotal role in propelling market growth by facilitating the creation of cutting-edge cellulose-based products. The intersection of sustainability goals and innovation is giving rise to a diverse range of applications for cellulose, spanning textiles, packaging, pharmaceuticals, and more. As industries increasingly prioritize eco-friendly alternatives, cellulose continues to emerge as a versatile and sustainable material that aligns with the global drive towards a greener and more environmentally responsible future.

Rising Demand from the Textile Industry

Cellulose fibres play a pivotal role in the textile industry, serving as a prominent material for the production of fabrics and garments. The surging growth in the fashion sector, coupled with evolving consumer preferences that lean towards comfortable and natural fabrics, is a key catalyst propelling the demand for cellulose fibres. The inherent qualities of cellulose, derived from renewable sources like wood pulp, align with the increasing focus on sustainability in the textile and apparel industry. As consumers seek eco-friendly and breathable materials, cellulose fibres, with their natural origin and versatility, become a preferred choice. The ongoing expansion of the textile and apparel industry on a global scale further contributes to the robust growth of the cellulose market, as manufacturers seek sustainable and innovative solutions to meet the demands of the evolving fashion landscape.

Market Restraints:

Availability of Alternative Materials

While cellulose is renowned for its sustainability advantages, it encounters stiff competition from both synthetic materials and other natural fibres in the market. The challenge lies in the availability of alternative materials that possess comparable properties but come with lower production costs, thereby restricting the growth of the cellulose market in certain applications. The competition from synthetic materials often revolves around factors such as cost-effectiveness and specific performance attributes, leading industries to explore alternatives. In navigating this landscape, the cellulose market faces the task of overcoming these challenges to secure its position, requiring continuous innovation and strategic positioning to emphasize its unique ecological benefits and appeal to consumers seeking sustainable alternatives in various industries.

The cellulose market experienced significant disruptions in the wake of the COVID-19 pandemic, with supply chain challenges, reduced demand in key industries, and shifts in consumer behaviour shaping its trajectory. Lockdowns and restrictions on transportation impacted the supply chain, leading to production delays and distribution challenges for cellulose-based products. Industries heavily reliant on cellulose, such as textiles, automotive, and construction, faced reduced demand due to economic uncertainties and lockdown measures. Conversely, there was an increased demand for certain cellulose-based products in sectors prioritizing hygiene and health, notably in pharmaceuticals and healthcare applications. The cellulose market also witnessed supply-demand disparities, with some segments facing oversupply while others experienced shortages, contributing to market volatility. The shift to remote work resulted in a decline in commercial activities, impacting paper consumption and, consequently, the demand for cellulose in the paper and pulp industry. Amid these challenges, there emerged a renewed focus on sustainability, positioning cellulose as a viable and eco-friendly material. As the industry navigates these dynamics, its recovery and future growth will depend on its adaptability, innovation, and broader economic revival.

Segmental Analysis:

Treewood Segment is Expected to Witness Significant Growth Over The Forecast Period

Cellulose, a complex carbohydrate essential for plant structure, is sourced from a variety of natural materials. Wood pulp, obtained from both softwood and hardwood trees, is a primary source extensively used in the paper and textile industries. Cotton, a widely cultivated crop, provides pure cellulose fibers, making it a key natural source for textiles and apparel. Hemp, flax, and jute plants contribute cellulose-rich fibers used in textiles, ropes, and coarse materials. Bamboo, known for its rapid growth, contains cellulose in its fibers and is utilized in textiles and paper production. Agricultural residues like straw from grains contain cellulose and find applications in paper and composite materials. Additionally, cellulose is present in varying amounts in fruits and vegetables, contributing to dietary fiber. The diverse range of natural sources of cellulose underscores its versatility and sustainability, supporting industries aligned with eco-friendly practices.

Asia Pacific Region is Expected to Witness Significant Growth Over The Forecast Period

The Asia-Pacific region stands as a central hub in the global cellulose market, both in terms of production and consumption. Countries like China, India, and Indonesia serve as major production centres, leveraging their well-established manufacturing facilities for processing cellulose from diverse sources, including wood pulp and cotton. The region's dominance in the textile and apparel industry, fueled by cellulose-based fibres like cotton and viscose, significantly contributes to the cellulose market. Moreover, the growing population and industrialization in the Asia Pacific drive a heightened demand for paper and packaging materials, emphasizing the critical role of cellulose in the paper and pulp industry. With abundant renewable resources such as wood, bamboo, and agricultural residues, Asia Pacific supports sustainable cellulose production practices. The region's economic growth propels the consumption of cellulose-based products in construction, packaging, and various industrial applications. As environmental awareness increases, there is a notable shift towards sustainability in the Asia Pacific, aligning with cellulose as a renewable and biodegradable material. Additionally, significant investments in research and development foster innovations in cellulose-based technologies and products, solidifying the region's pivotal position in shaping the trajectory of the cellulose market.

Furthermore, the developments in the region is expected to fuel the studied market growth. For instance, In February 2023, Asahi Kasei, a Japanese multinational company, successfully concluded the construction of its second plant dedicated to Ceolus™ microcrystalline cellulose (MCC) at the Mizushima Works in Japan. This new facility has been strategically developed to address the increasing demand for MCC, with a specific focus on its application in pharmaceutical tablets. The completion of this plant underscores Asahi Kasei's commitment to meeting the rising market needs for microcrystalline cellulose, particularly in the pharmaceutical sector.

The competitive landscape of the global cellulose market offers a comprehensive overview of key players, encompassing crucial details such as company profiles, financial performance, revenue generation, market potential, research and development investments, new market strategies, global presence, production sites, capacities, strengths, weaknesses, product launches, and application dominance. This detailed information specifically pertains to the companies' activities and strategies within the cellulose market. It provides stakeholders with valuable insights into the competitive dynamics, allowing for a nuanced understanding of each player's positioning, strengths, and areas for potential growth. The focus on crucial elements such as research and development, market initiatives, and production capacities offers a holistic view of the cellulose market's competitive ecosystem, aiding stakeholders in making informed decisions and staying abreast of the evolving industry landscape. Some of the Key Market Players are:

Recent Developments:

1) In September 2022, Scientists in South Korea have created an environmentally friendly binder material based on cellulose for anode electrodes in all-solid-state secondary batteries. The uncomplicated and eco-friendly manufacturing process of this high-energy-density binder is well-suited for large-scale production. This is particularly advantageous as it can be seamlessly integrated into existing manufacturing facilities designed for lithium-ion batteries utilizing liquid electrolytes.

2) In August 2022, Syzygy Plasmonics, LOTTE Chemical, LOTTE Fine Chemical and Sumitomo Corporation of Americas (SCOA) jointly revealed a collaborative agreement to explore a fully electric chemical reactor tailored for clean hydrogen production. It was announced that the reactor is scheduled for installation and activation at LOTTE Chemical HQ facilities in Ulsan, South Korea, during the latter half of 2023. This collaboration has been positioned as a demonstration of LOTTE Chemical HQ and SCOA's early adoption of disruptive technology, reinforcing their role as leaders in the endeavor to decarbonize Korea. It was also highlighted that LOTTE Fine Chemical is a crucial supplier of fine chemicals, such as chlorine, ammonia relatives, and cellulose ether, to global markets.

Q1. What was the Cellulose Market size in 2023?

As per Data Library Research the Global Cellulose Market is currently valued at USD 45.7 billion in the year 2023.

Q2. At what CAGR is the Cellulose market projected to grow within the forecast period?

Cellulose Market is expected to register a CAGR of 5.6% over the forecast period.

Q3. What are the factors driving the Cellulose market?

Key factors that are driving the growth include the Growing Demand for Sustainable Resources and Rising Demand from the Textile Industry.

Q4. Which region has the largest share of the Cellulose market? What are the largest region's market size and growth rate?

Asia-Pacific has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model