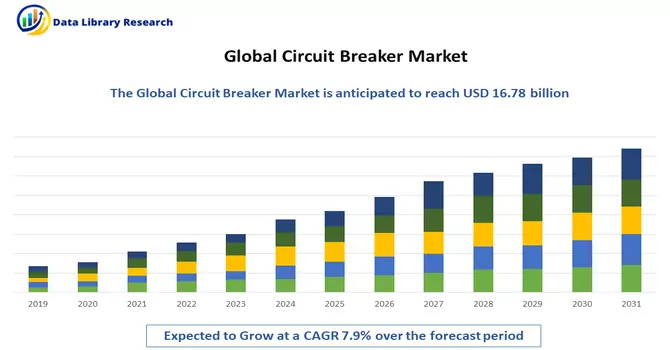

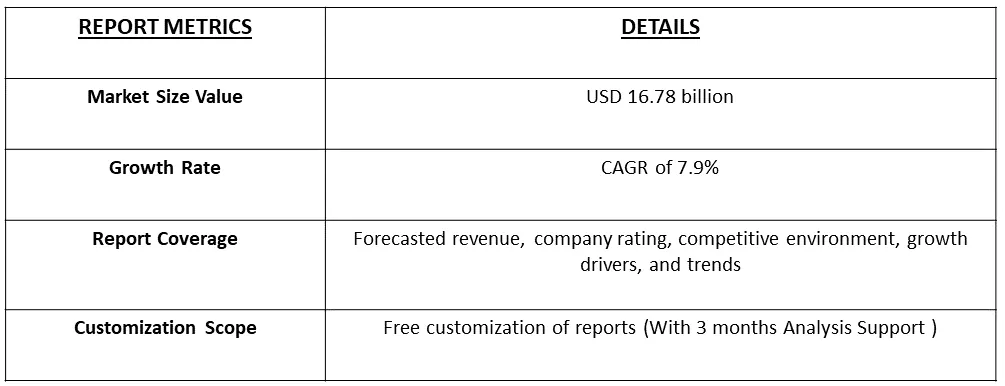

The global circuit breaker and fuse market size was valued at USD 16.78 billion in 2023 and is expected to advance at a compound annual growth rate (CAGR) of 7.9% from 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

A circuit breaker is an electrical switching device designed to protect electrical circuits from damage caused by overcurrents, short circuits, and other electrical faults. It serves as a crucial safety component by interrupting the flow of electric current when a fault is detected, preventing potential damage to connected devices and ensuring the overall stability of the electrical system. Circuit breakers are pivotal in various applications, ranging from residential and commercial buildings to industrial settings, providing a reliable means to manage and control electrical power and enhance safety by swiftly disconnecting the circuit in case of abnormalities.

The anticipated expansion in the domain is attributed to factors such as the increasing demand for access to efficient networks and renewable energy sources. This growth is particularly significant for industries like electronics, automotive, and telecommunications, where the necessity for innovative equipment has escalated due to heightened concerns about short circuits and damage caused by power fluctuations. Over the projected period, circuit breakers and fuses are poised to experience substantial growth. This surge in demand is directly linked to the imperative role these devices play in safeguarding against unplanned power fluctuations stemming from issues like overvoltage, overloads, and short circuits. Such fluctuations have the potential to adversely impact a wide range of equipment, spanning from industrial machinery and residential appliances to IT products and electric tools. Furthermore, the deployment of circuit breakers and fuses is not merely reactive but also proactive. Beyond mitigating the impact of power disturbances, these devices contribute to the optimization of energy consumption by minimizing and controlling the electric load on equipment. Consequently, the increasing adoption of these gadgets is expected to drive up demand throughout the forecast period, aligning with the broader trends in energy efficiency and equipment protection across various industries.

The circuit breaker market is witnessing significant growth, driven by increasing demand for access to efficient networks and renewable energy sources. Industries such as electronics, automotive, and telecommunications are experiencing a surge in demand for innovative equipment due to growing concerns about short circuits and damage caused by power fluctuations. Circuit breakers are essential components in mitigating these risks, offering protection against overvoltage, overloads, and short circuits that can impact various equipment, from industrial machinery to residential appliances and IT products. The market is expected to continue expanding as the adoption of circuit breakers rises, driven not only by reactive safety measures but also by the proactive role these devices play in optimizing energy consumption through load control. This trend aligns with the broader industry focus on energy efficiency and equipment protection across diverse sectors.

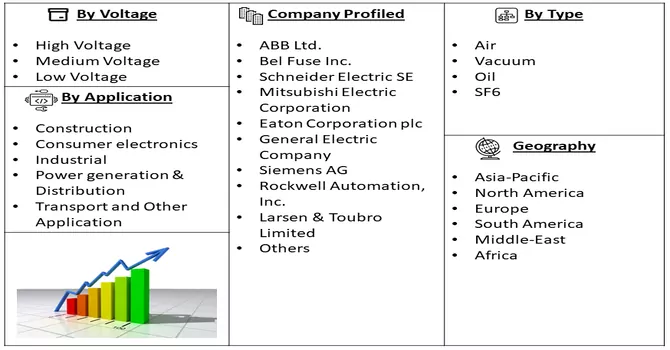

Market Segmentation: The Circuit Breaker and Fuse Market is Segmented by Voltage (High Voltage, Medium Voltage, and Low Voltage), Type (Air, Vacuum, Oil, and SF6), Application (Construction, Consumer electronics, Industrial, Power generation & Distribution, Transport and Other Application), and Geography (North America, Europe, Asia-Pacific, Middle-East and Africa, and South America). The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Increasing demand for access to efficient networks and renewable energy sources

The Electric Circuit Market is witnessing a surge in demand fueled by the increasing need for efficient networks and the global emphasis on renewable energy sources. Industries across the board, including telecommunications, electronics, and automotive sectors, are seeking advanced electric circuit solutions to ensure seamless connectivity and safeguard against disruptions. Concurrently, the growing adoption of renewable energy, such as solar and wind power, is driving the market as robust circuit protection becomes essential for efficient energy distribution. Companies are actively responding to these trends by developing circuits that not only meet current demands but also align with sustainability goals, positioning the industry for continuous expansion and innovation.

Strategic alliances, mergers, partnerships, and acquisitions among industry players

The electric circuit market is witnessing a notable surge in strategic alliances, mergers, partnerships, and acquisitions among industry players. Recognizing the dynamic nature of the sector, companies are increasingly leveraging these collaborative strategies to bolster their competitive positions, drive innovation, and capitalize on synergies. Strategic alliances play a pivotal role as companies join forces to combine their expertise and resources, leading to the development of cutting-edge technologies and solutions. Mergers are facilitating the consolidation of market players, creating larger entities with broader market reach and enhanced capabilities. Partnerships are fostering collaboration on specific projects or ventures, allowing companies to pool their strengths for mutual benefit. Meanwhile, acquisitions are enabling firms to expand their product portfolios, enter new markets, or acquire specialized skills and technologies. For instance, in April 2023, Havells India announced on Tuesday that it had forged a commercial agreement with the Swedish tech start-up, Blixt Tech AB, to bring Solid State Circuit Breaker (SSCB) technology to the domestic market. The incorporation of SSCB technology marked a strategic move by Havells to enhance its standing in the switchgear segment, underlining the company's commitment to pioneering and future-oriented solutions, as stated in a joint announcement. This collaboration reflects Havells' proactive approach in embracing innovative technologies and its dedication to providing advanced solutions to meet the evolving needs of the market. Thus, such strategic developments are fuelling the studied market growth over the forecast period.

Market Restraints:

Geopolitical tensions and raw material shortages pose significant challenges to manufacturers

Geopolitical tensions and raw material shortages emerge as formidable challenges for manufacturers in the Electric Circuit Market, potentially impeding its growth trajectory. Ongoing geopolitical uncertainties can disrupt the global supply chain, affecting the procurement of essential components for electric circuits. Tensions between nations may lead to trade restrictions, impacting the availability and cost of materials. Simultaneously, raw material shortages, driven by factors such as increased demand, supply chain disruptions, or geopolitical events, pose a significant risk to manufacturing operations. The interplay of these challenges may result in delayed production, increased costs, and a potential slowdown in the overall growth of the electric circuit market, highlighting the intricate connections between global dynamics and the industry's resilience in navigating complex geopolitical landscapes.

The Electric Circuit Market faced notable disruptions due to the COVID-19 pandemic, with supply chain challenges, labor shortages, and project delays affecting the industry. The initial slowdown in manufacturing and construction activities, coupled with uncertainties in global markets, led to a temporary decline in demand for electric circuits. However, as the world adapted to the new normal, the market demonstrated resilience, driven by increased digitization, remote work trends, and a renewed focus on sustainable energy solutions. The pandemic underscored the importance of robust electrical infrastructure, accelerating the adoption of advanced circuit technologies to support the evolving needs of a rapidly changing world, thus shaping the market's trajectory toward recovery and adaptation to the post-pandemic landscape.

Segmental Analysis:

Medium Voltage Segment is Expected to Witness Significant Growth Over the Forecast Period

Medium Voltage (MV) refers to electrical voltage levels typically ranging from 1,000 volts to 69,000 volts, falling between Low Voltage (LV) and High Voltage (HV) classifications. In the context of Electric Circuits, medium voltage systems play a crucial role in power distribution networks, providing an optimal balance between safety considerations and efficient energy transmission. Electric circuits designed for medium voltage applications are engineered to handle the specific challenges posed by voltage levels within this range. Medium Voltage Electric Circuits are commonly used in a variety of applications, including industrial facilities, commercial buildings, and utility networks. These circuits facilitate the safe and reliable transmission of electrical power over moderate distances, ensuring the delivery of electricity to end-users with minimal power loss. The components within medium voltage circuits, such as switches, circuit breakers, and protective devices, are designed to manage the unique characteristics of medium voltage systems, providing effective control and protection. As industries and infrastructure continue to evolve, the demand for efficient and reliable medium voltage electric circuits remains significant. Advancements in technology and the integration of smart grid solutions further contribute to the optimization of medium voltage power distribution, emphasizing the critical role these circuits play in supporting a resilient and sustainable electrical infrastructure.

SF6 Segment is Expected to Witness Significant Growth Over the Forecast Period

Sulfur hexafluoride (SF6) plays a vital role in Electric Circuits, particularly in the context of circuit breakers. SF6 is a colorless, odorless, and non-flammable gas known for its excellent insulating properties, making it widely utilized in medium and high-voltage electrical applications. In the field of circuit breakers, SF6 is often employed as the insulating and arc-quenching medium. Circuit breakers are crucial components in electrical systems, designed to interrupt or break the flow of electric current in the event of a fault or overload. SF6 circuit breakers utilize the gas's high dielectric strength and efficient arc-quenching capabilities to extinguish electrical arcs quickly and safely, preventing damage to the circuit and connected devices. The use of SF6 in circuit breakers enables compact design and efficient interruption of electrical currents, making it a preferred choice for applications where space is a critical consideration. However, it is important to note that SF6 is a potent greenhouse gas with a high global warming potential. Efforts are underway to explore alternative gases or technologies to mitigate the environmental impact of SF6 usage. Nonetheless, SF6-based circuit breakers remain prevalent in various industries due to their reliable performance and effectiveness in ensuring the stability and safety of electric circuits. Ongoing advancements and research in the field aim to strike a balance between the operational benefits of SF6 and the environmental concerns associated with its usage.

Power Distribution and Storage Segment is Expected to Witness Significant Growth Over the Forecast Period

Power Distribution and Storage are integral components of modern electrical systems, and Circuit Breakers play a crucial role in ensuring the safe and efficient operation of these systems. Power distribution involves the transmission of electricity from the source, such as power plants or renewable energy installations, to end-users through a network of transformers, switchgear, and distribution lines. Circuit breakers act as protective devices within this distribution network, interrupting the flow of electric current in case of faults, overloads, or short circuits. In power distribution systems, Circuit Breakers contribute to grid reliability by preventing damage to equipment and minimizing the impact of electrical faults. They are strategically placed at various points in the network to isolate faulty sections and maintain the overall integrity of the power supply. Additionally, Circuit Breakers enable routine maintenance and repairs by providing a means to disconnect specific portions of the grid without affecting the entire distribution system. Power storage is becoming increasingly crucial with the integration of renewable energy sources and the need for grid stability. Energy storage systems, such as batteries, store excess energy during periods of low demand and release it during peak demand, helping to balance the grid and enhance overall efficiency. Circuit breakers play a critical role in these storage systems by ensuring the safety and protection of the stored energy. They are employed to disconnect or isolate the battery systems during maintenance, emergencies, or when necessary to prevent electrical hazards. Thus, Circuit Breakers are fundamental components in both power distribution and storage systems, contributing to the reliability, safety, and efficiency of modern electrical networks. As the energy landscape continues to evolve, the role of Circuit Breakers in safeguarding power distribution and storage systems becomes even more crucial for maintaining a resilient and sustainable energy infrastructure.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America, as a significant player in the global electrical infrastructure landscape, plays a pivotal role in the adoption and evolution of Circuit Breakers. The region's electrical systems, spanning the United States, Canada, and Mexico, are characterized by diverse industries, extensive urbanization, and a growing emphasis on sustainability, all of which contribute to the demand for reliable and efficient circuit protection mechanisms. In North America, Circuit Breakers find extensive use in various sectors, including residential, commercial, and industrial applications. As industries in the region, such as manufacturing, automotive, and telecommunications, continue to expand, the need for advanced circuit protection technologies becomes increasingly critical. Circuit Breakers play a key role in safeguarding equipment, preventing damage from overloads, short circuits, and other electrical faults. Moreover, the growing awareness of energy efficiency and the integration of renewable energy sources in North America contribute to the demand for advanced Circuit Breakers. These devices not only protect electrical systems but also support the integration of sustainable energy practices, aligning with the region's commitment to reducing environmental impact. The market in North America is marked by ongoing technological advancements in Circuit Breaker design, including innovations in smart grid technologies and digital monitoring capabilities. The region's stringent safety standards and regulatory frameworks further drive the adoption of advanced circuit protection solutions. Thus, North America's robust and dynamic electrical infrastructure landscape, combined with the evolving energy landscape and sustainability goals, positions Circuit Breakers as crucial components for ensuring the reliability and safety of electrical systems across various applications in the region.

Get Complete Analysis Of The Report - Download Free Sample PDF

Anticipated trends in the industry indicate a strong inclination towards innovation, with market players increasingly relying on strategic alliances, mergers, partnerships, and acquisitions as pivotal strategies to bolster their presence in the sector. This strategic landscape emphasizes the proactive pursuit of collaborations and consolidations, showcasing a dynamic approach among industry participants to foster growth and maintain a competitive edge. By fostering such partnerships and engaging in strategic manoeuvres, companies aim to harness synergies, share resources, and capitalize on complementary strengths, ultimately positioning themselves for sustained success in the evolving market landscape. Some of the prominent players in the global circuit breaker and fuse market include:

Recent Development:

1) In May 2023, Schneider Electric, a prominent player in the digital transformation of energy management and automation worldwide, has unveiled its latest offering, the EvoPacT medium voltage circuit breaker, specifically tailored for the Canadian market. This advanced solution has undergone significant enhancements to cater to the diverse requirements of infrastructure, large-scale industrial and commercial buildings, electro-intensive processes, as well as cloud and service providers. The launch of EvoPacT underscores Schneider Electric's commitment to delivering innovative solutions that align with the unique demands of the Canadian market, further solidifying its position as a global leader in energy management and automation.

2) In November 2022, Siemens is enhancing its generator circuit-breaker portfolio with the introduction of the HB1-Compact (HB1-C), a new compact version. This adaptable and highly customizable solution incorporates maintenance-free vacuum switching technology to address even the most challenging constraints. With options available in L-shape and I-shape designs, the HB1-C is versatile, allowing both vertical and horizontal mounting, and can be easily adjusted to align with existing busbar connection points. Furthermore, the generator circuit-breaker, along with its integrated main disconnector, offers enhanced flexibility by accommodating earthing switches on either the generator side or the transformer side. This expansion underscores Siemens' commitment to providing innovative and tailored solutions to meet the evolving needs of the industry.

Q1. What was the Circuit Breaker Market size in 2023?

As per Data Library Research the global circuit breaker and fuse market size was valued at USD 16.78 billion in 2023.

Q2. At what CAGR is the Circuit Breaker market projected to grow within the forecast period?

Circuit Breaker market is expected to advance at a compound annual growth rate (CAGR) of 7.9% over the forecast period.

Q3. What are the Growth Drivers of the Circuit Breaker Market?

Increasing demand for access to efficient networks and renewable energy sources and Strategic alliances, mergers, partnerships, and acquisitions among industry players are the Growth Drivers of the Circuit Breaker Market.

Q4. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model