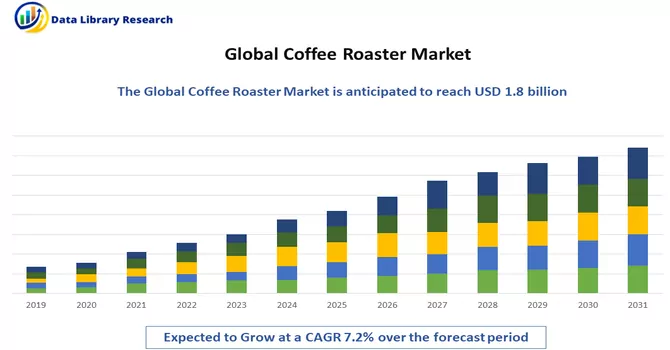

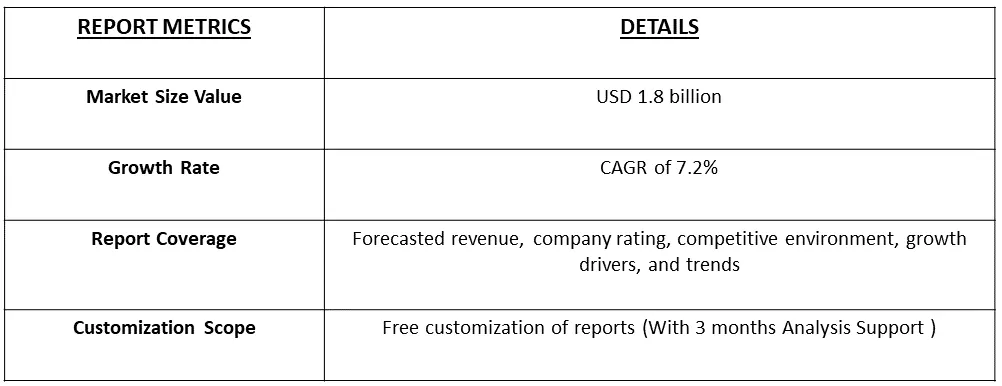

The global coffee roaster market size was valued at USD 1.8 billion in 2023 and is expected to grow at a CAGR of 7.2% from 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

A coffee roaster is a specialized device or facility used in the coffee industry to transform raw, green coffee beans into flavorful, aromatic beans that are suitable for brewing. This process involves heating the beans to a specific temperature, causing chemical changes that develop the characteristic taste and aroma of the coffee. Coffee roasters come in various sizes and types, from small-scale artisanal roasters to large industrial machines. Roasters play a crucial role in determining the final quality and profile of the coffee, as factors like roast time, temperature, and airflow influence the flavor, acidity, and body of the finished product. The art and science of coffee roasting contribute significantly to the diverse and nuanced world of coffee varieties and blends available to consumers.

The Coffee Roaster market is experiencing robust growth driven by several key factors. The escalating global demand for specialty and artisanal coffee, coupled with a burgeoning coffee culture, has led to an increased emphasis on unique flavor profiles and high-quality roasting methods. Additionally, the rising popularity of home brewing and independent coffee shops has fueled the demand for smaller, more versatile coffee roasters, contributing to market expansion. The advent of technology, particularly in precision roasting equipment and automation, has enhanced the efficiency and consistency of the roasting process, attracting both seasoned professionals and novice enthusiasts. Moreover, growing awareness of sustainability practices in the coffee industry has prompted the adoption of eco-friendly roasting technologies, appealing to environmentally conscious consumers. These converging factors create a favorable landscape for the Coffee Roaster market, fostering innovation and diversification in response to evolving consumer preferences and industry trends.

The coffee roaster market is experiencing notable trends driven by evolving consumer preferences and a growing emphasis on specialty coffee. There is a rising demand for customizable and automated roasting solutions, catering to both small-batch artisanal roasters and large-scale commercial operations. Sustainability is a key focus, with an increasing number of roasters adopting eco-friendly practices, such as energy-efficient roasting processes and ethically sourced beans. The surge in home brewing has led to a parallel trend in compact and user-friendly domestic roasters. Additionally, technological advancements, such as data analytics for precision roasting and smart roasting equipment, are gaining traction. Overall, the coffee roaster market is witnessing a dynamic shift towards innovation, sustainability, and enhanced user experiences.

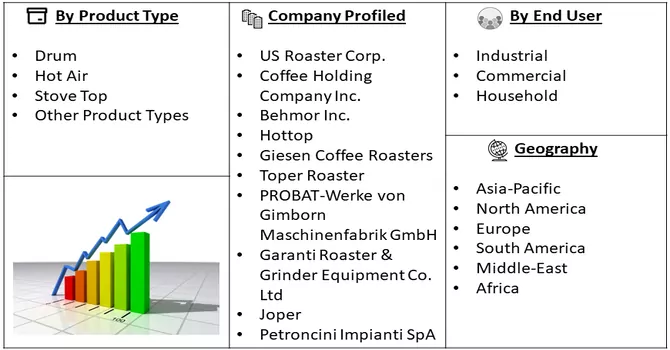

Market Segmentation: The Global Coffee Roaster Market Research is segmented by Product Type (Drum, Hot Air, Stove Top, and Other Product Types); by End User (Industrial, Commercial, and Household); and by Geography (North America, Europe, Asia-Pacific, South America, and Middle East & Africa). The report offers market size and values in (USD million) during the forecasted years for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Rising Demand for Specialty Coffee

The coffee roaster market is experiencing a notable upswing driven by the expanding consumer inclination toward premium and high-quality specialty coffee. As coffee enthusiasts increasingly seek distinctive and refined flavor profiles, the demand for sophisticated roasting equipment has surged. This elevated interest in specialty coffees, characterized by unique and nuanced taste experiences, necessitates advanced roasting technologies capable of accommodating a diverse range of coffee bean varieties. Roasters are now under greater pressure to invest in cutting-edge equipment that ensures precise and meticulous roasting processes to accentuate the distinctive characteristics of specialty coffees. This trend is reflective of a broader shift in consumer preferences, where discerning coffee drinkers are not merely satisfied with conventional options but actively seek out elevated and unique flavor experiences. The call for precision in roasting techniques highlights the importance of equipment that can cater to the intricacies of different bean types, ensuring optimal development of flavors and aromas. Consequently, the coffee roaster market is witnessing a robust demand for innovative and technologically advanced solutions that align with the evolving expectations of coffee connoisseurs seeking a more refined and personalized coffee-drinking experience.

Focus on Sustainable Practices

A pervasive global movement toward sustainability is propelling the coffee roaster market to embrace eco-conscious practices. There is a noticeable trend among roasters to prioritize sustainability by incorporating energy-efficient technologies, opting for sustainable energy sources, and championing the ethical sourcing of coffee beans. This heightened emphasis on environmental responsibility not only resonates with the values of conscientious consumers but also underscores the broader industry's dedication to fostering sustainable business practices. The surge in demand for sustainability within the coffee roaster market signifies a collective awareness of the environmental impact associated with coffee production. Roasters are increasingly investing in innovations that minimize energy consumption during the roasting process, reflecting a commitment to reducing carbon footprints. Moreover, the conscientious selection of sustainable energy sources, such as solar or wind power, is gaining prominence as roasters actively seek alternatives that align with eco-friendly objectives. Furthermore, ethical sourcing practices are becoming integral to the identity of coffee roasters, as they recognize the importance of supporting fair trade and environmentally responsible coffee cultivation. By embracing these principles, roasters not only align themselves with consumer preferences but also contribute to the broader industry's transformation toward more sustainable and socially responsible operations. In essence, the adoption of eco-friendly practices in the coffee roaster market signifies a pivotal step towards a more sustainable and ethically-driven coffee industry.

Market Restraints:

High Initial Investment Costs

A key hurdle confronting businesses aiming to enter or expand in the coffee roaster market lies in the substantial initial investment necessary for acquiring top-notch roasting equipment. The adoption of advanced roasting technologies, incorporation of automation features, and integration of eco-friendly systems typically entail elevated costs, creating a formidable barrier for small and emerging roasters. The considerable upfront financial outlay can impede market entry and hinder growth prospects, particularly for startups and smaller enterprises aspiring to compete in the dynamically evolving coffee industry. The formidable challenge emanates from the premium pricing associated with state-of-the-art roasting equipment, a factor that places a strain on the financial resources of burgeoning businesses. The incorporation of advanced technologies is often deemed essential for staying competitive and meeting consumer demands for quality and sustainability. However, for smaller players in the market, the initial investment acts as a deterrent, limiting their ability to leverage cutting-edge equipment and potentially hindering their capacity to offer diverse and high-quality coffee products. In essence, the financial constraints posed by the substantial upfront costs present a critical barrier for aspiring entrants and smaller roasters, underscoring the need for strategic financial planning and potential industry initiatives to facilitate more accessible entry points for businesses aiming to thrive in the coffee roaster market.

The COVID-19 pandemic has had a profound impact on the coffee roaster industry, causing disruptions across the supply chain and altering consumer behavior. One of the immediate challenges faced by coffee roasters was the disruption in the global supply of green coffee beans due to transportation restrictions and logistical challenges. Lockdowns and restrictions on movement further impacted the workforce, leading to labor shortages and operational bottlenecks for many roasting facilities. On the demand side, the closure of cafes, restaurants, and other foodservice establishments during lockdowns significantly reduced the out-of-home consumption of coffee, affecting bulk orders from these sectors. While there was a surge in home coffee consumption as people adapted to remote work, the shift was not sufficient to offset the losses from the commercial sector. Furthermore, the economic downturn and uncertainties prompted many consumers to reassess their spending habits, leading to potential shifts in preferences toward more affordable coffee options. This impacted premium and specialty coffee segments, forcing some roasters to adjust their product offerings to cater to changing consumer dynamics. Despite these challenges, the pandemic also prompted innovation within the industry. Some coffee roasters pivoted towards e-commerce, subscription models, and direct-to-consumer channels to reach customers at home. Additionally, the crisis underscored the importance of agility and resilience in supply chain management for coffee roasters, encouraging the adoption of technology and sustainable practices to navigate future uncertainties. As the industry continues to recover, adaptation to evolving consumer trends and a focus on operational resilience are crucial for coffee roasters to thrive in the post-pandemic landscape.

Segmental Analysis:

Hot Air Segment is Expected to Witness Significant Growth Over the Forecast Period

The hot air coffee roaster, employing a fluidized bed to suspend beans in a stream of hot air, offers a unique and efficient alternative to traditional drum roasters. Renowned for its rapid roasting capability and even heat distribution, this method ensures consistency and precision in flavor development, providing a cleaner cup with distinctive taste profiles. The absence of a physical drum allows for greater control and adaptability, making it a preferred choice for artisanal roasters and coffee enthusiasts seeking a hands-on approach to achieve nuanced and customized roast profiles. While less prevalent than drum roasters, the hot air method stands out for its energy efficiency, flavor clarity, and flexibility, appealing to those exploring innovative techniques in the dynamic world of coffee roasting.

Commercial Segment is Expected to Witness Significant Growth Over the Forecast Period

In the commercial realm, the Coffee Roaster Market plays a pivotal role as a linchpin in the coffee supply chain, serving diverse businesses ranging from local cafes to large-scale coffee production facilities. The market caters to the evolving demands of commercial enterprises by providing advanced roasting equipment equipped with features such as automation, precision control, and sustainability measures. Coffee roasters are essential for achieving distinct flavor profiles, meeting the discerning preferences of consumers. The commercial sector's emphasis on efficiency, scalability, and consistency has driven the adoption of technologically advanced roasting solutions, facilitating businesses in maintaining high-quality standards. Furthermore, the market witnesses a surge in demand for roasters capable.

Europe Region is Expected to Witness Significant Growth Over the Forecast Period

The European coffee market is experiencing robust growth, fueled by two key trends: innovative flavor blends offered by an increasing number of outlets, and international events showcasing the latest industry developments. A surge in coffee shops offering unique, newly formulated blends is enticing consumers and driving sales. This trend caters to the evolving palates of European coffee enthusiasts, who increasingly seek out distinctive taste experiences.International events like the World of Coffee trade show in Berlin play a significant role in market expansion. Such gatherings, attracting hundreds of exhibitors across the coffee value chain, serve as launchpads for innovative products and foster collaboration among roasters, baristas, producers, and other industry professionals. The major players like Starbucks are capitalizing on these trends. By offering a diverse range of whole bean coffees across various roast profiles, all sourced from 100% Arabica beans, Starbucks caters to the preferences of European coffee connoisseurs. Arabica beans, known for their superior flavor and lower caffeine content (around 1%), align perfectly with the evolving demands of the European market. European coffee market thrives on flavor innovation and growing outlet diversification. International events like the World of Coffee stimulate market growth and collaboration. Major players like Starbucks adapt their offerings to European preferences with diverse roasts and 100% Arabica beans.

Get Complete Analysis Of The Report - Download Free Sample PDF

The coffee roaster market at a global scale is marked by intense competition, largely attributed to the significant presence of both prominent regional and domestic players across various countries. Consequently, industry leaders prioritize strategic initiatives such as mergers, expansions, acquisitions, and partnerships, coupled with continuous innovation in new product development, to enhance and solidify their brand presence. This competitive landscape underscores the dynamic nature of the market, as key players strategically align themselves to gain a competitive edge. Emphasizing strategic approaches allows these companies to not only strengthen their market positions but also respond effectively to evolving consumer preferences and market trends. As a result, the coffee roaster industry remains characterized by a constant pursuit of growth and innovation, with companies actively engaging in diverse strategies to navigate the competitive terrain and fortify their standing in the global market. Some of the market players working in this domain are:

Recent Development:

1) In August 2022, Up Coffee Roasters, based in Minneapolis, was purchased by FairWave, a group of speciality coffee brands based in Kansas City, Missouri, that work together to promote high-quality coffee in local communities.

2) In July 2022, Iron & Fire, a speciality coffee roaster, launched a brand-new website specifically for wholesale customers. Iron & Fire supplies coffee shops, bar chains, restaurants, garden centers, hotels, and other establishments and has experienced tremendous growth since its reopening.

Q1. What was the Coffee Roaster Market size in 2023?

As per Data Library Research the global coffee roaster market size was valued at USD 1.8 billion in 2023.

Q2. At what CAGR is the Coffee Roaster Market projected to grow within the forecast period?

Coffee Roaster Market is expected to grow at a CAGR of 7.2% over the forecast period.

Q3. What are the factors driving the Coffee Roaster market?

Key factors that are driving the growth include the Rising Demand for Specialty Coffee and Focus on Sustainable Practices.

Q4. Which region has the largest share of the Coffee Roaster market? What are the largest region's market size and growth rate?

Europe has the largest share of the market . For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model