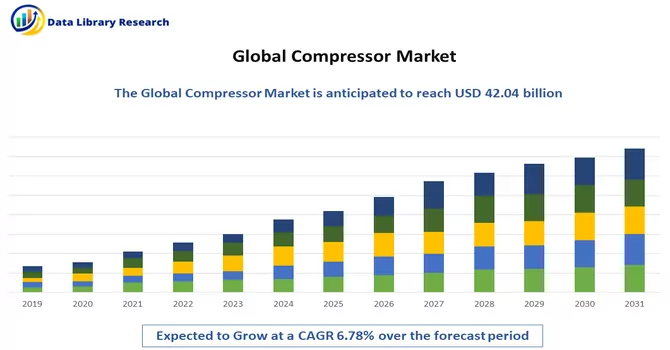

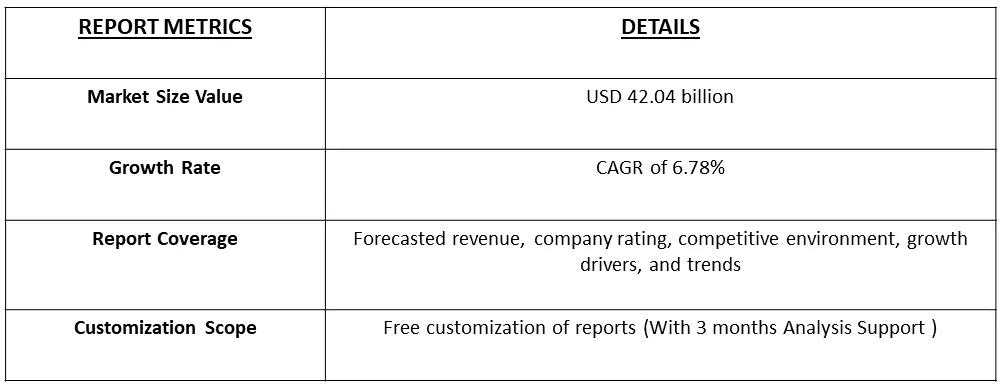

The Compressor Market is currently estimated at USD 42.04 billion in 2023 and is expected to register a CAGR of 6.78% during the forecast period (2024-2031).

Get Complete Analysis Of The Report - Download Free Sample PDF

Compressors are mechanical devices designed to increase the pressure of a gas or air by reducing its volume. They play a crucial role in various industrial, commercial, and residential applications where the compression of gases is required. Compressors are widely used in systems that involve the transportation, processing, and storage of gases, providing a versatile and efficient means of manipulating gas properties. These devices come in different types and sizes, ranging from small, portable units for household applications to large, industrial-scale compressors used in manufacturing, energy production, and other sectors. The primary purpose of a compressor is to compress and pressurize gases, enabling them to be transported or used in various processes such as refrigeration, air conditioning, pneumatic tools, and power generation.

The increasing industrialization and growth of manufacturing sectors, including automotive, chemical, petrochemical, and food processing, drive the demand for compressors. Compressors are essential for various processes within these industries, such as air compression for pneumatic tools and gas compression for chemical processing. Also, the Heating, Ventilation, Air Conditioning, and Refrigeration (HVACR) industry is a significant consumer of compressors. The global demand for air conditioning and refrigeration systems in residential, commercial, and industrial applications fuels the need for compressors, particularly in emerging economies experiencing urbanization and rising temperatures. Thus, these market factors are expected to witness significant growth over the forecast period.

Market Segmentation: The Global Compressors Market is segmented by End User (Oil and Gas Industry, Power Sector, Manufacturing Sector, Chemicals, and Petrochemical Industry, and Other End Users), Type (Positive Displacement and Dynamic), and Geography (North America, Europe, Asia-Pacific, South America, and Middle-East and Africa). The report offers the market size and forecasts for non-stick coatings in revenue (USD) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Ongoing technological advancements, such as the development of oil-free compressors, smart compressor systems, and digital control technologies, enhance the efficiency and performance of compressors. Innovations contribute to market growth as industries seek more reliable and advanced compressor solutions. Moreover, infrastructure development initiatives, including construction projects, transportation networks, and power generation plants, drive the demand for compressors. These projects often require compressors for tasks such as pneumatic tools, concrete pumping, and air separation. Thus, these market trends are expected to witness significant growth over the forecast period.

Market Drivers :

Rise in Industrial growth Globally

The demand for compressors is propelled by the expanding industrialization and the flourishing growth of manufacturing sectors, encompassing automotive, chemical, petrochemical, and food processing industries. Compressors play a vital role in these sectors, serving as indispensable components for a myriad of processes. They are crucial for tasks like air compression, powering pneumatic tools, and gas compression essential for chemical processing. In automotive applications, compressors contribute to pneumatic systems, while in the chemical and petrochemical domains, they are instrumental in compressing gases integral to various manufacturing processes. Similarly, in the food processing industry, compressors play a pivotal role in ensuring efficient operations and maintaining the quality of processed products. The versatile applications of compressors across these industries highlight their indispensable role in supporting key manufacturing processes and contributing to overall industrial growth.

Rising Demand for Energy-Efficient Solutions

With an increasing emphasis on sustainability and energy conservation within industries, there is a rising need for compressor systems that prioritize energy efficiency. The market is witnessing a surge in demand for systems incorporating innovative technologies geared towards optimizing energy consumption. Notably, variable speed compressors are gaining prominence as they offer a dynamic and adaptive approach to energy efficiency. This heightened focus on energy-efficient solutions is particularly pronounced in regions where the imperative of enhancing energy efficiency holds significant importance. As industries align their practices with environmentally conscious initiatives, the adoption of these advanced compressor technologies becomes integral to the overall market growth, representing a pivotal shift towards more sustainable industrial operations.

Market Restraints :

High Initial Cost

The upfront investment for acquiring and installing compressors, especially advanced and high-capacity systems, can be substantial. This cost may act as a barrier for small and medium-sized enterprises (SMEs) or businesses with budget constraints, hindering widespread adoption. Also, compressors require regular maintenance to ensure optimal performance and longevity. The associated maintenance costs, including replacement of parts, lubricants, and energy consumption, can contribute to the overall operational expenses, impacting the cost-effectiveness of compressor systems. Thus, these factors are expected to slow down the growth of the studied market over the forecast period.

The global compressor market experienced significant impacts as a result of the COVID-19 pandemic, leading to disruptions in production, supply chains, and demand dynamics. The pandemic led to widespread disruptions in global supply chains. Manufacturing facilities faced closures or operational restrictions, affecting the production of compressor components and finished products. Delays in the supply chain contributed to challenges in meeting demand and fulfilling orders. The pandemic triggered changes in consumer behaviour, impacting industries such as HVACR (Heating, Ventilation, Air Conditioning, and Refrigeration). With lockdowns and remote working, there was a temporary decline in installations and upgrades of air conditioning systems in commercial spaces and offices, affecting the demand for compressors. Thus, the pandemic accelerated the adoption of digital technologies and Industry 4.0 solutions. While this shift created opportunities for smart and connected compressors, it also highlighted the need for adaptability and innovation within the compressor market.

Segmental Analysis:

Oil and Gas Industry Segment is Expected to Witness Significant Growth Over the Forecast Period

The oil and gas industry plays a pivotal role in driving demand and shaping the dynamics of the global compressor market. Compressors are indispensable components within the oil and gas sector, serving a multitude of critical functions across various stages of exploration, production, refining, and transportation. In upstream operations, compressors are extensively used for gas lift applications to enhance the production of oil from reservoirs. Additionally, compressors play a crucial role in gas gathering and processing facilities, where they are employed to compress raw natural gas for transportation through pipelines. Compressors play a fundamental role in pipeline transportation, where they are strategically placed along the pipeline to boost the pressure of the transported natural gas. This ensures a continuous and efficient flow of gas over long distances, supporting the intricate network of pipelines in the oil and gas infrastructure. Thus, owing to such advantages, the segment is expected to witness significant growth over the forecast period.

Positive displacement Segment is Expected to witness Significant Growth Over the Forecast Period

Positive displacement compressors are a category of compressors that operate by trapping a fixed volume of gas and mechanically reducing its volume to increase its pressure. Unlike dynamic compressors, which achieve compression through the dynamic action of rotating elements, positive displacement compressors use reciprocating or rotating mechanisms to physically displace the gas.

There are two main types of positive displacement compressors: reciprocating compressors and rotary compressors. Reciprocating compressors use a piston-cylinder arrangement to compress the gas. The piston moves back and forth within a cylinder, creating suction on one stroke and compression on the other. Rotary compressors, on the other hand, use rotating elements to compress gas. Examples include screw compressors and vane compressors. In screw compressors, two rotating helical screws trap and compress the gas, while vane compressors use rotating blades (vanes) to achieve compression. They are known for their continuous and smooth operation, compact design, and suitability for applications with a relatively constant demand. Thus, owing to such advantages, the segment is expected to witness significant growth over the forecast period.

Asia-Pacific Region is Expected to witness Significant Growth Over the Forecast Period

The Asia-Pacific region stands as a significant global hub with some of the largest consumers and importers of natural gas. Despite a historical reliance on oil and coal for energy needs, there is a discernible shift in recent trends towards increased adoption of natural gas. This transition is largely propelled by escalating concerns over air pollution, prompting a move towards cleaner energy sources. The primary beneficiaries of natural gas consumption in the region are the power generation and manufacturing industries. The unprecedented growth in demand for electricity, particularly in populous nations like India and China, is poised to be a key driver for the increased use of natural gas. As urbanization progresses and the middle class expands across Asia-Pacific countries, a parallel surge in residential gas consumption is anticipated.

This growing appetite for natural gas is expected to have a cascading effect on the demand for gas compressors, particularly in the midstream gas industry and the power and manufacturing sectors. The need for compressors becomes paramount in facilitating the efficient transportation and utilization of natural gas in various applications. Notably, India is actively investing in its petrochemical sector, further contributing to the rising demand for compressors. A pertinent example is the Indian Oil Corporation's (IOC) strategic move in June 2021, wherein they inked a memorandum of understanding (MoU) with the Gujarat government. This collaboration encompasses the establishment of diverse projects, including the LuPech project for petrochemicals and the Acrylics-Oxo Alcohol project at Dumad near Vadodara. Additionally, the creation of a hydrogen dispensing facility around Vadodara is part of this ambitious initiative, collectively requiring a substantial investment of USD 3.25 billion. Thus, the evolving energy landscape in the Asia-Pacific region, driven by a shift towards cleaner fuels and burgeoning industrial activities, is poised to significantly influence the demand for compressors, especially in the context of natural gas utilization in key sectors.

Get Complete Analysis Of The Report - Download Free Sample PDF

The market for compressors exhibits a fragmented landscape. This fragmentation is characterized by the presence of numerous diverse players and competitors, each contributing to the market with their unique offerings and solutions. The absence of a dominant single entity underscores the varied dynamics within the compressor market, where multiple companies, often of varying sizes and specialities, coexist and compete. This fragmentation fosters a competitive environment marked by a range of product portfolios, technological innovations, and strategic approaches, providing customers with a diverse array of options and driving continual advancements in the field of compressor technology. Some of the key players in this market are:

Recent Development:

1) In March 2023, Sapphire Gas Solutions and Bauer Compressors Inc. revealed a nationwide collaboration, marking a significant partnership between the two entities. Under this alliance, Sapphire has gained the authority to undertake the installation, construction, and maintenance of a cutting-edge series of gas compressors manufactured by Bauer. The partnership extends to providing original equipment manufacturer (OEM) parts and services across crucial industries spanning the United States, Canada, and Mexico.

2) In December 2022, ELGi Compressors USA, Inc. made a strategic announcement regarding the rebranding of its portable air compressor line within North America. Formerly identified as Rotair, the company opted for a strategic shift by rebranding the product line under the established name of ELGi. This decision leverages the well-established credibility associated with the ELGi brand, signifying a noteworthy move in enhancing brand recognition and market presence.

Q1. What was the Compressor Market size in 2023?

As per Data Library Research the Compressor Market is currently estimated at USD 42.04 billion in 2023.

Q2. What is the Growth Rate of the Compressor Market?

Compressor Market is expected to register a CAGR of 6.78% during the forecast period.

Q3. What are the Growth Drivers of the Compressor Market?

Rise in Industrial growth Globally and Rising Demand for Energy-Efficient Solutions are the Growth Drivers of the Compressor Market

Q4. Which Region is expected to hold the highest Market share?

Asia-Pacific region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model