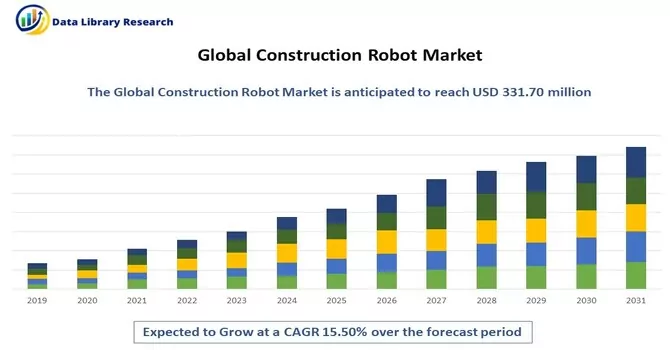

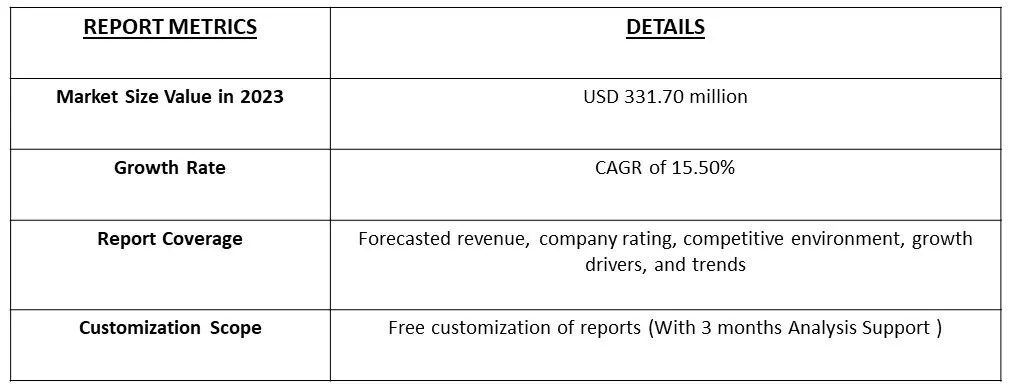

The Construction Robots Market size is currently valued at USD 331.70 million in 2023 a CAGR of 15.50% during the forecast period (2023-2030).

Get Complete Analysis Of The Report - Download Free Sample PDF

The construction industry is undergoing a significant transformation with the adoption of robotics and automation technologies. Construction robotics, encompassing autonomous vehicles, drones, exoskeletons, and robotic arms, are increasingly being employed to enhance productivity, efficiency, and safety in construction projects. This report delves into the global construction robotics market to analyze its growth prospects and challenges.

The increasing focus of construction organizations on reducing building materials' resources and material waste during construction will drive the adoption of the construction robot market.

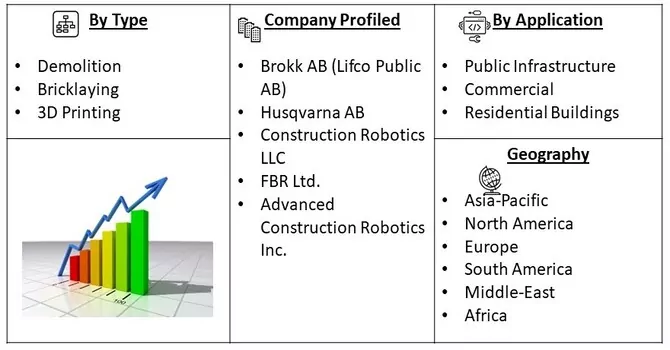

Segmentation:

The Global Construction Robotics Market Analysis is segmented

By Type :

Application :

Geography

The market sizes and forecasts are in terms of value in USD million for all the segments.

For Detailed Market Segmentation - Download Free Sample PDF

The deployment of 5G networks enables real-time communication and remote operation of construction robots. The incorporation of AI algorithms allows robots to learn from past tasks and improve performance over time. Also, the development of modular robotic systems allows for greater flexibility and scalability on construction sites. Also, robotics can contribute to sustainable construction practices by reducing waste and energy consumption.

Drivers:

Enhanced Workplace Safety and Improved Cost Efficiency

Construction robotics play a pivotal role in the construction industry by mitigating safety risks associated with hazardous tasks, reducing accidents and injuries, and offering substantial cost-related benefits. The adoption of these technologies not only promotes a safer working environment but also contributes to improved cost management, shorter project timelines, and enhanced competitiveness in the construction sector.

Technological Advancements

Robots offer unparalleled precision in tasks such as bricklaying, concrete pouring, and welding, ensuring high-quality construction. For instance, in August 2022, Husqvarna Construction entered into a strategic partnership with AABTools, the region's leading industrial tools and equipment supplier. Husqvarna Construction's organic products were to be distributed by AABTools, including heavy-duty and high-frequency concrete coring machines, wall saws designed for brick and reinforced concrete, remote-controlled demolition robots, and twenty-plus models of handheld power cutters, dust extractors, and floor saws. Thus, such partnerships are leading to the development of better industrial products, thereby driving the growth of the studied market.

Restraints :

High Initial Investment and Technological Challenges

The cost of implementing robotics systems in construction can be a barrier for small and medium-sized companies. Also, developing robotics solutions that can adapt to diverse construction environments remains a technical challenge.

The COVID-19 pandemic has had a mixed impact on the construction robotics market. While it disrupted supply chains and led to project delays in the short term, it also accelerated the adoption of automation and contactless construction methods to ensure business continuity and reduce reliance on on-site labor. In the current scenario, with the resumption of supply chain services, the market is expected to witness significant growth over the forecast period.

Segmental Analysis:

Commercial and Residential Buildings Segment is Expected to Witness Significant Growth Over the Forecast period

With the increasing demand for new commercial and residential infrastructure, automated construction solutions are poised to gain significant traction in the coming years, positively impacting the market. According to Redshift, the construction industry will need to erect approximately 13,000 buildings daily between now and 2050 to accommodate an anticipated urban population of seven billion.

Furthermore, urbanization is experiencing exponential growth, with World Bank data indicating that around 55% of the global population, equivalent to 4.2 billion people, currently resides in cities. This trend is expected to persist, with the urban population projected to double by 2050, meaning nearly seven out of every ten individuals will live in urban areas. This rapid urbanization is driving the adoption of transformative technologies like automation and artificial intelligence, including robotics, to address various urban challenges.

Moreover, according to the World Population Data Sheet 2021 from the Population Reference Bureau, North America leads as the most urbanized continent globally, with 82% of its population residing in cities. In Latin America and the Caribbean, urbanization rates stand at 79%. The global trend indicates that the proportion of people living in urban areas will rise from 56% in 2020 to an estimated 70% by 2050. The pressing need for urbanization is accompanied by challenges, including the need to meet the surging demand for affordable housing, efficient transportation systems, and other essential urban infrastructure. The World Bank reports that nearly one billion urban poor individuals living in informal settlements are in close proximity to opportunities but often face conflicts, leading to the forced displacement of approximately 60% of this population within urban areas. The growing construction of residential properties such as homes and apartments is set to drive the demand for construction robots in the foreseeable future, as the industry adapts to meet the challenges and opportunities presented by urbanization.

3D Printing Segment is Expected to Witness Significant Growth Over the Forecast Period.

3D printing in construction, often referred to as construction 3D printing or 3D construction printing, represents a groundbreaking technology that utilizes robotics and additive manufacturing techniques to construct buildings and structures layer by layer. 3D printing robots can construct buildings and structures significantly faster compared to traditional construction methods. They work around the clock without rest, making it possible to complete projects in a fraction of the time it would take using conventional techniques. This speed is particularly valuable in addressing housing shortages and disaster recovery efforts.

Also, construction 3D printing can lead to substantial cost savings. By reducing labor requirements, minimizing material waste, and optimizing construction processes, the overall cost of building projects can be significantly lower. This makes housing more affordable and can improve the cost-effectiveness of infrastructure development. Thus, the segment is expected to witness significant growth over the forecast period.

Asia-Pacific Region is Expected to Witness Significant Growth Over the Forecast period

The Asia-Pacific region stands out as a key market for construction robotics, with India, China, and Japan being its major players. Notably, the increasing adoption of 3D-printed housing in this region is poised to drive market expansion.

Furthermore, international companies are keen on expanding their presence in the region due to the growing demand for 3D printing technology. For instance, in June 2022, COBOD International, a Danish developer specializing in 3D construction printing technology, entered into a distribution agreement with Fortex, an Australian company. This move aligns with COBOD's strategy to introduce advanced concrete 3D printing technology in Australia and bolster the 3D construction printing sector across the Asia-Pacific region. The ongoing trend of urbanization in the region is also set to drive demand for construction robotics. According to data from the National Bureau of Statistics of China, in 2022, approximately 65.2% of China's population resided in urban areas, marking a significant increase in urbanization rates over recent decades.

While the outlook for the construction industry in the Asia-Pacific region remains optimistic, with a sustained demand for labor, the industry faces the challenge of efficiently managing a continuous and substantial workload. To meet these demands effectively and ensure both worker safety and site efficiency, the industry is turning to robotics and automation, ultimately enhancing overall productivity and cost-effectiveness. These evolving trends are expected to generate positive growth for the construction robotics market in the foreseeable future.

Get Complete Analysis Of The Report - Download Free Sample PDF

The construction robots market is fragmented with the presence of major players. Players in the market are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain a sustainable competitive advantage. Some of the key market players working in this segment are:

Recent Developments:

1. In December 2022, Ekso Bionics, an industry leader in exoskeleton technology for medical and industrial use, announced the acquisition of the Human Motion and Control ("HMC") Business Unit from Parker Hannifin Corporation ("Parker"), a global leader in motion and control technologies. The acquisition included the Indegolower limb exoskeleton line of products as well as the planned development of robotic-assisted orthotic and prosthetic devices.

2. In October 2022, Brokk, the world's leading manufacturer of remote-controlled demolition robots, announced the addition of the BROKK SURFACE GRINDER 530 (BSG 530) attachment for material removal, such as paint and asbestos, surface preparation, and polishing on walls, floors, and ceilings in renovation and restoration applications.

Q1. What is the current Construction Robot Market size?

The Construction Robots Market size is currently valued at USD 331.70 million.

Q2. At what CAGR is the market projected to grow within the forecast period?

Construction Robot Market is expected to grow at a CAGR of 15.50% during the forecast period.

Q3. What are the factors driving the Construction Robot Market?

Key factors that are driving the Construction Robot Market growth include the Enhanced Workplace Safety and Improved Cost Efficiency and Technological Advancements.

Q4. What segments are covered in the Construction Robot Market Report?

By Type, By Application & Geography are the segments covered in the Construction Robot Market Report.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model