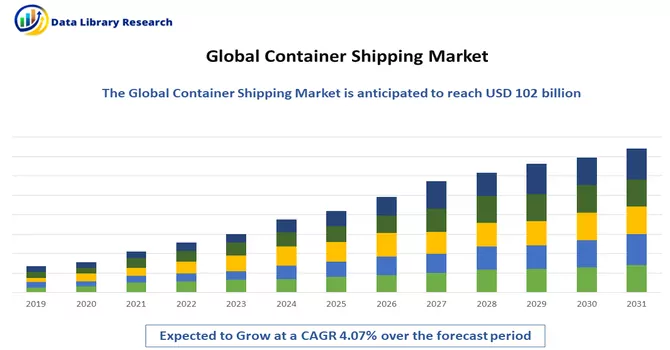

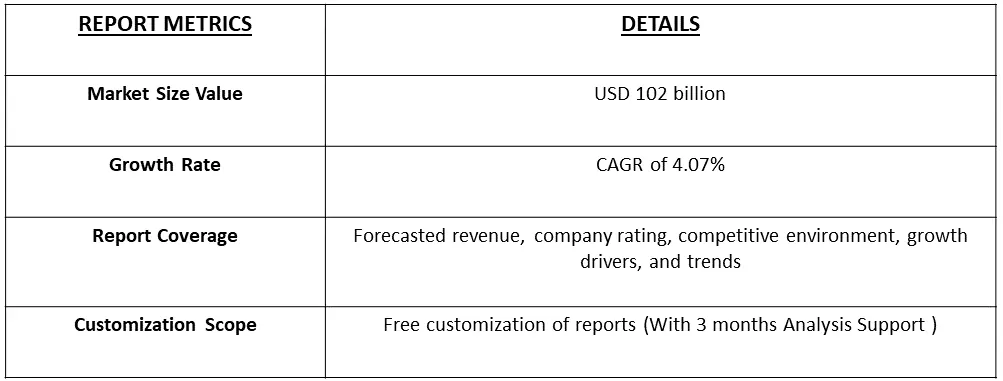

The Container Shipping Market is anticipated to reach a valuation of USD 102 billion in 2023, with a projected Compound Annual Growth Rate (CAGR) of 4.07% throughout the forecast period spanning from 2023 to 2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

This market encompasses the global sector dedicated to the conveyance of goods through standardized cargo containers, which are characterized by uniform size and design. This uniformity streamlines the handling and transportation processes across diverse modes, including ships, trains, and trucks. The container shipping industry holds a pivotal role in international trade, acting as a crucial link that connects manufacturers, producers, and consumers across different geographical regions.

At its core, the container shipping market is profoundly influenced by the volume of global trade. The expansion of international trade activities triggers a heightened demand for efficient and cost-effective means of transporting goods, thereby propelling the container shipping sector. Notably, economic growth, particularly in emerging markets, plays a significant role in stimulating production and trade. This, in turn, results in an increased need for container shipping services to facilitate the seamless movement of goods between nations. In essence, the container shipping market is intricately tied to the dynamics of global trade and economic growth. As international commerce flourishes and economies expand, the demand for streamlined and reliable container shipping services is expected to persist and contribute to the sustained growth of the industry.

The escalating integration of digital technologies is becoming increasingly evident in the container shipping industry. This includes the widespread adoption of IoT (Internet of Things) sensors, blockchain, and data analytics, all geared towards enhancing visibility, tracking, and overall cargo management. This technological evolution is poised to revolutionize the efficiency of operations within the industry.

Furthermore, there is a notable trend towards the implementation of automated and smart container terminals. These advanced terminals are designed to optimize various operational aspects, leading to more streamlined and efficient processes throughout the container shipping supply chain. The automation of terminals is expected to bring about significant improvements in overall operational efficiency. The container shipping sector is also experiencing a growing emphasis on sustainability and environmental responsibility. This involves a concerted effort to reduce emissions, invest in cleaner technologies, and explore alternative fuels. This shift towards eco-friendly practices aligns with a broader global commitment to environmental conservation and sustainable business practices.

Moreover, the industry is grappling with the pressure to comply with and adapt to international regulations aimed at mitigating the environmental impact of shipping. These regulations are geared towards setting standards for emissions reduction and fostering environmentally conscious practices within the container shipping domain. Adhering to these regulations not only meets global sustainability goals but also positions companies within the sector to navigate an evolving regulatory landscape.In summary, the container shipping industry is witnessing a transformative phase marked by the adoption of cutting-edge digital technologies, a move towards automated terminals, a heightened focus on sustainability, and a proactive response to international environmental regulations. These developments collectively signify a commitment to innovation, efficiency, and environmental stewardship within the dynamic landscape of global container shipping.

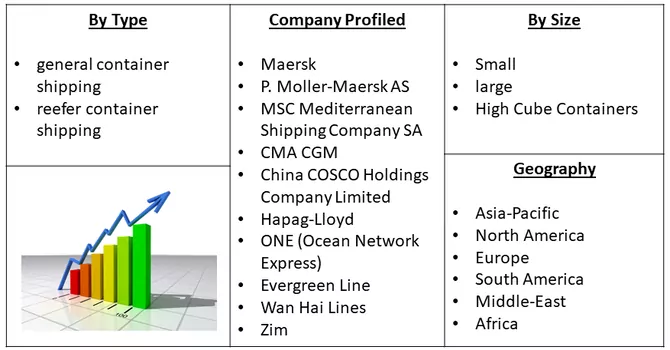

Market Segmentation: The Container Shipping Market is segmented by size (small, large, and high cube containers), type (general container shipping and reefer container shipping), and geography (North America, Europe, Asia-Pacific, Middle-East and Africa, and South America). The report offers market size and forecasts for the container shipping market in value (USD) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Global Trade Expansion:

The container shipping market is notably shaped by the expanding landscape of global trade. As economies undergo growth and international trade surges, there emerges an elevated need for the efficient conveyance of goods across borders. Container shipping emerges as a standardized and economically viable solution for the seamless transport of a diverse array of products, playing a pivotal role in facilitating global commerce. The surge in global trade volumes directly translates into heightened utilization of container shipping services, thereby propelling the demand for container vessels and the necessary logistics infrastructure. Essential drivers of this trend include economic expansion, the establishment of trade agreements, and the liberalization of markets. Also, an article published in June 2023, reported that Toronto-based startup Boxhub, which offers an online marketplace for shipping containers, has raised a USD 12.4-million Series A round. The shipping industry has experienced a dynamic market in recent years. Thus, these factors collectively contribute to the expansion of global trade, consequently influencing the trajectory of the container shipping market. In essence, the market's vitality is intricately linked to the dynamics of economic growth, international trade agreements, and the broader trend of market liberalization.

Technological Advancements and Innovation:

The ongoing progression of technology plays a pivotal role in shaping the landscape of the container shipping market. Groundbreaking innovations, including IoT (Internet of Things) sensors, blockchain, data analytics, and automation, have been seamlessly integrated to bring about improvements in operational efficiency, elevate cargo visibility, and streamline various aspects of the supply chain. These technological advancements contribute significantly to the enhancement of tracking, monitoring, and overall management of containers throughout their shipping journey. The adoption of technology-driven solutions not only fosters increased efficiency but also results in reduced operational costs and heightened levels of customer satisfaction. Noteworthy implementations include automated container terminals, intelligent logistics solutions, and digital platforms, empowering stakeholders to optimize routes, manage inventory with greater precision, and respond to market dynamics in real-time. Furthermore, technology is a driving force behind environmental initiatives within the industry, facilitating the transition toward more sustainable practices. These advancements support the container shipping sector in embracing eco-friendly approaches, aligning with global efforts to promote sustainability. In essence, the integration of technology in the container shipping market not only revolutionizes operational processes but also contributes to the industry's responsiveness, cost-effectiveness, and commitment to environmentally conscious practices.

Market Restraints:

Overcapacity and Freight Rate Volatility and Geopolitical Uncertainties and Trade Barriers:

The excess capacity in the container shipping market occurs when there is a surplus of container vessels in comparison to the demand for transporting cargo. This surplus triggers heightened competition among shipping lines, resulting in unpredictable fluctuations in freight rates and exerting pressure on pricing structures. Various factors contribute to overcapacity, including the introduction of larger vessels, speculative ordering of new ships, and economic downturns that negatively impact trade volumes. The container shipping market is susceptible to significant disruptions influenced by geopolitical tensions, trade disputes, and the imposition of trade barriers such as tariffs and sanctions. These factors can have profound effects on the market dynamics, leading to uncertainties related to international relations, political stability, and regulatory changes. Consequently, established trade routes may be disrupted, influencing the flow of goods between different regions. Trade tensions between major economies have the potential to cause shifts in shipping patterns and impact container volumes, contributing to an unpredictable operating environment for container shipping companies. Thus, these factors are expected to slow down the growth of the studied market.

The global supply chain experienced widespread disruptions during the pandemic, leading to delays and interruptions in the manufacturing, distribution, and transportation of goods. Lockdowns, restrictions, and a decrease in workforce availability hindered the smooth movement of goods, impacting the operational efficiency of container shipping. Container shortages and imbalances were further exacerbated by the pandemic. Initially, there was a mismatch in container availability due to reduced imports and disruptions in the repositioning of empty containers. This imbalance led to a scarcity of containers in certain regions and an oversupply in others. The adoption of digital technologies within the container shipping industry saw accelerated growth during the pandemic. Remote work, contactless transactions, and the utilization of digital platforms became essential for sustaining operations and ensuring the continuity of business processes. This shift towards digitalization became a critical aspect of adapting to the challenges posed by the global health crisis in the container shipping sector.

Segmental Analysis:

High Cube Container Segment is Expected to Witness Significant Growth Over the Forecast Period

High-cube containers, also known as high-cube or HC containers, are a specific type of intermodal container used in container shipping. These containers share the standard dimensions of traditional containers but have an increased height. The most common high cube container dimensions are 9.5 feet (2.89 meters) in height, compared to the standard height of 8.5 feet (2.59 meters) for standard containers. Thus, high-cube containers play a crucial role in container shipping by offering increased cargo capacity and versatility. Their standardized design ensures compatibility with existing infrastructure, contributing to the overall efficiency of the container shipping industry.

General Container Shipping Segment is Expected to Witness Significant Growth Over the Forecast Period

Container shipping is a fundamental component of global trade and logistics, facilitating the efficient movement of goods across the world. Containers used in shipping follow standardized dimensions regulated by the International Organization for Standardization (ISO). The two primary sizes are 20 feet (TEU - Twenty-Foot Equivalent Unit) and 40 feet (FEU). This standardization ensures compatibility across various modes of transportation, including ships, trains, and trucks. Freight forwarders coordinate the shipment of goods, managing the logistics and documentation involved in container shipping. Shipping lines operate the vessels and offer services for the transportation of containers between ports. Thus, the container shipping is a linchpin of the global economy, providing a reliable and standardized means of transporting goods across borders. It is a dynamic industry shaped by technological advancements, market forces, and the ongoing pursuit of more sustainable practices.

Asia-Pacific Region is Expected to Witness Significant Growth Over the Forecast Period

In 2021, Asia maintained its status as the predominant global maritime cargo handling hub, overseeing 42% of exports and commanding 64% of imports. Approximately 40% of the total containerized trade during the year occurred along the major East-West routes connecting Asia, Europe, and the United States. Notably, non-mainland East-West routes, such as South Asia-Mediterranean, constituted 12.9% of this trade. The performance across container shipping lanes displayed variability based on the direction of trade, whether head haul or backhaul. Volumes on the Transpacific route surged by 15%, reflecting a substantial 20% growth on the peak East Asia to North America route. Conversely, trade on the backhaul journey experienced a slight decline of 1.6%. The Asia-Europe route saw a 10% increase in trade, buoyed by rising volumes from East Asia to Europe, which witnessed a robust growth of 14.7%.

Moreover, in 2021, Asian container exporters, including China, Vietnam, the Republic of Korea, and Japan, collectively accounted for nearly half of the global traffic. Notably, trade in iron ore, heavily influenced by developments in China, saw marginal growth of 1%, with China continuing to represent about 73% of global iron ore imports, surpassing pre-pandemic levels. Projections indicate that the Asia-Pacific region will maintain its position as the fastest-growing region for contract logistics, with the market expected to grow from EUR 95 billion in 2021 to EUR 135 billion in 2026, according to a report by Transport Intelligence. During this period, Asia Pacific's share of the contract logistics market is forecasted to increase from 39.8% in 2021 to 44.8% in 2026, while Europe and North America are anticipated to experience a contraction in market share. Thus, the region is expected to witness significant growth over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The container shipping market exhibits a fragmented landscape, characterized by the presence of numerous international companies. The industry faces high barriers to entry, primarily driven by the substantial cost associated with acquiring vessels and the increasing significance of economies of scale, which significantly influences the competitive dynamics. The structure of the industry is further shaped by stringent international government regulations and the inherent cyclicality of demand. Shipping firms are strategically investing in new assets to ensure reliability and efficiency in their services, aiming to deliver superior returns on their investments. The challenging conditions brought about by the COVID-19 pandemic highlighted the advantages of consolidation for shipping companies, particularly in terms of cost reduction and sustainability.Looking ahead, the industry anticipates a trend towards automation in marine transportation. Simultaneously, the elevation of marine safety norms is poised to present opportunities for market players in the coming years. These advancements signal a shift towards more streamlined and technologically advanced operations within the container shipping market, offering prospects for companies to enhance their efficiency and meet evolving industry standards.

Key players in this sector include

Recent Development:

1) In January 2023, A.P. Moller-Maersk (Maersk) completed the acquisition of Martin Bencher Group, a Danish expert in Project Logistics renowned for its premium capabilities in non-containerized project logistics and global operations. This strategic move enhances Maersk's capacity to provide top-notch project logistics services to its global clientele, offering a more comprehensive range of solutions across various industries.

2) In October 2022, the CMA CGM Group, a prominent global shipping entity, proudly reported the completion of its acquisition of Containerships, a company specializing in container transportation and logistics. This transaction received approval from the European Commission on October 22nd. Containerships, with its focus on the intra-European market, become a valuable addition to CMA CGM’s service portfolio, further enriching the group's offering in the logistics sector.

Q1. What was the Container Shipping Market size in 2023?

As per Data Library Research the Container Shipping Market is anticipated to reach a valuation of USD 102 billion in 2023

Q2. At what CAGR is the Container Shipping market projected to grow within the forecast period?

Container Shipping market is projected to grow Compound Annual Growth Rate (CAGR) of 4.07% over the forecast period.

Q3. What are the factors driving the Container Shipping market?

Key factors that are driving the growth include the Global Trade Expansion and Technological Advancements and Innovation.

Q4. Which region has the largest share of the Container Shipping market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model