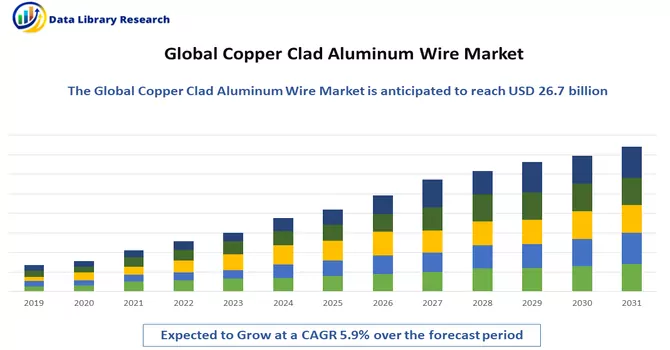

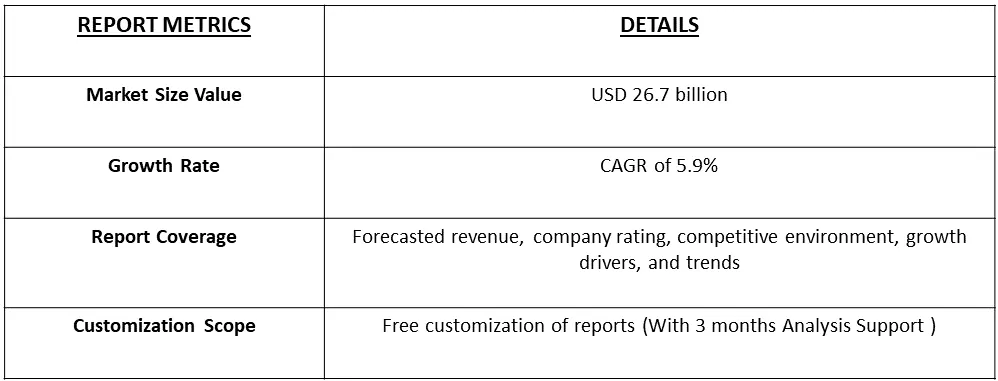

The Copper Clad Aluminum (CCA) cable market is currently valued at USD 26.7 billion in the year 2023 and is expected to register a CAGR of 5.9% over the forecast period, 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Copper Clad Aluminum (CCA) cable is a type of electrical cable that has an aluminum core coated with a layer of copper. The idea behind this design is to combine the good conductivity of copper with the lighter weight of aluminum, aiming to save costs without sacrificing electrical performance too much. In CCA cables, the aluminum core provides structural support and reduces the overall weight of the cable, while the copper coating ensures that it maintains good electrical conductivity. These cables are commonly used in various applications such as power transmission, telecommunications, and audio/video systems. It's important to be aware that while CCA cables can be more economical, they may have certain limitations compared to cables made entirely of copper. Aluminum's electrical conductivity is not as high as copper, and aluminum can be more prone to corrosion. Therefore, the choice between copper and copper-clad aluminum cables depends on specific needs and budget considerations in a given application.

The Copper Clad Aluminum (CCA) cable market is thriving due to cost efficiency, as the lower cost of aluminum makes these cables an economical choice for infrastructure projects. The lightweight nature of aluminum provides significant weight savings, particularly advantageous in aerospace and automotive applications. Despite slightly lower conductivity, CCA cables find diverse applications in power transmission, telecommunications, and audio/video systems. Ongoing advancements in coating technologies, such as polyolefin coatings, enhance corrosion resistance and overall performance. Innovations in manufacturing processes and customization options contribute to the development of high-quality CCA cables. The environmental benefits, including reduced transportation costs and environmental impact, align with sustainability goals. As global infrastructure projects expand, offering opportunities for reliable and cost-effective wiring solutions, the CCA cable market is set for continued growth.

The market for Copper Clad Aluminum (CCA) wire is dynamic and driven by several key factors. The cost-effectiveness of CCA wire, attributed to the lower price of aluminum compared to copper, makes it an attractive choice for various industries. The wire's reduced weight, owing to the lightweight nature of aluminum, is particularly advantageous in applications where weight is a critical consideration. Despite slightly lower conductivity than pure copper, CCA wire is widely used in power transmission, telecommunications, and electrical applications. Ongoing advancements in coating technologies, such as the use of polyolefin coatings, enhance the corrosion resistance and durability of CCA wire. Innovations in manufacturing processes and the ability to customize CCA wire solutions contribute to its popularity. As global infrastructure development continues, creating demand for reliable and cost-efficient wiring solutions, the CCA wire market is expected to grow steadily.

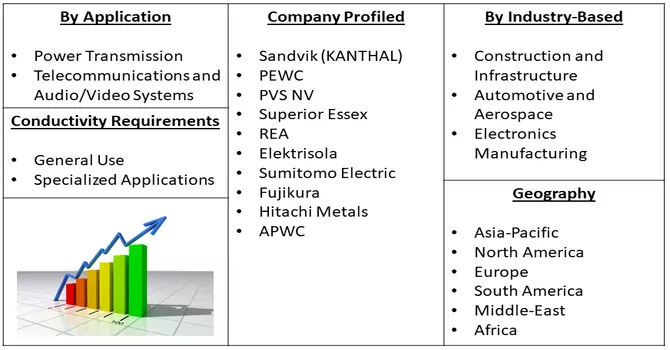

Market Segmentation: The market for Copper-Clad Aluminum (CCA) is Segmented by Application Type (Power Transmission, Telecommunications and Audio/Video Systems), Industry-Based (Construction and Infrastructure, Automotive and Aerospace and Electronics Manufacturing), Conductivity Requirements (General Use and Specialized Applications), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The market provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

High Corrosion Resistance

CCA cables, when coated appropriately, demonstrate commendable resistance to corrosion. This robust corrosion resistance not only contributes to their longevity but also enhances their reliability when deployed in diverse environmental settings, particularly in outdoor installations. The protective coating serves as a barrier, shielding the aluminum core from environmental elements that may lead to corrosion over time. This attribute is crucial in ensuring the sustained performance and durability of CCA cables, making them well-suited for applications where exposure to varying weather conditions or outdoor environments is a key consideration. The coating acts as a safeguard, fortifying the cables against the potential detrimental effects of moisture, humidity, and other corrosive factors, thereby bolstering their overall reliability and resilience. For an instance, in December 2022, a research published by Japaense Scientist in Tokyo University reported that the resistance of CCA conductors is 55-60% higher than copper. Also, the source reported that the copper cladding of the copper clad aluminum wire provides good corrosion resistance and can resist some common corrosive media. This makes copper clad aluminum wire more reliable in some specific environments, such as outdoors and humid environments. Thus, such instances are expected to drive the growth of the studied market over the forecast period.

Increased Flexibility in Applications

CCA cables are utilized across a spectrum of industries, encompassing power transmission, telecommunications, and audio/video systems. The market growth of CCA cables is propelled by their inherent versatility and adaptability to diverse environments. These cables exhibit a remarkable capacity to seamlessly integrate into different industry applications, showcasing their flexibility in meeting varied requirements. The adaptability of CCA cables ensures their efficacy in addressing the unique demands of power transmission systems, telecommunication networks, and audio/video setups. This adaptability factor not only broadens the scope of their applications but also positions CCA cables as a preferred choice across industries seeking reliable and efficient wiring solutions. The ability of CCA cables to navigate through and perform optimally in distinct environments contributes significantly to their sustained market growth and widespread adoption. For instance, in 2022, an article published reported that CCA10% copper clad aluminum is used in telecommunication systems. Thus, such wide spectrum use of CCA is expected to drive the growth of the studied market over the forecast period.

Market Restraints:

Lower Electrical Conductivity

Copper Clad Aluminum (CCA) wire has comparatively lower electrical conductivity compared to pure copper. While CCA wire offers a cost-effective alternative, the inherent conductivity limitations may pose challenges in applications where optimal electrical performance is critical. This limitation becomes more pronounced in scenarios requiring high conductivity, potentially limiting the use of CCA wire in certain specialized applications. Industries or projects that prioritize superior electrical conductivity over cost savings may find CCA wire less suitable, thereby constraining its market potential in specific niches where maximum electrical efficiency is paramount. Despite its advantages, this conductivity restraint underscores the importance of carefully considering the specific requirements of an application before choosing CCA wire, particularly in contexts where uncompromised conductivity is a primary consideration. Thus, such factors are expected to slow down the growth of the studied market over the forecast period.

The Copper Clad market experienced notable disruptions due to the COVID-19 pandemic, with supply chain interruptions and workforce challenges affecting manufacturing and distribution. The uncertainty in the global economy impacted investment decisions, particularly in construction and infrastructure projects, key sectors for Copper Clad applications. However, the increased reliance on robust communication networks during the pandemic has driven demand for telecommunications infrastructure, creating opportunities for Copper Clad Aluminum (CCA) cables, given their adaptability and cost-effectiveness. Furthermore, the continued emphasis on renewable energy and electric vehicles has the potential to stimulate demand for CCA cables in power transmission and automotive applications. While challenges persist, evolving market dynamics and emerging opportunities may shape the recovery and growth of the Copper Clad market in the post-pandemic landscape.

Segmental Analysis:

Telecommunications Segment is Expected to Witness Significant Growth Over The Forecast Period

Telecommunications is a crucial sector where Copper-Clad Aluminum (CCA) wire plays a significant role. CCA cables are employed extensively in telecommunications infrastructure for their unique combination of cost-effectiveness and acceptable conductivity. As the industry continues to evolve and demand for high-speed data transmission increases, CCA wire provides a practical solution. Its lightweight nature makes it easier to handle and install, contributing to operational efficiency. The adaptability of CCA wire is particularly advantageous in telecommunications applications where the balance between performance and cost efficiency is essential. Despite the slightly lower electrical conductivity compared to pure copper, CCA wire meets the demands of many telecommunications networks. The cables are used for various applications, including backbone installations, local area networks (LANs), and connectivity within buildings. Moreover, as the telecommunications industry undergoes expansions and upgrades, the demand for reliable and cost-effective wiring solutions is on the rise. CCA wire's versatility positions it as a preferred choice in the construction and enhancement of communication networks, meeting the industry's evolving connectivity requirements. Thus, the integration of Copper Clad Aluminum wire in telecommunications infrastructure underscores its pivotal role in enabling efficient and cost-conscious solutions for high-performance data transmission.

Electronics Manufacturing Segment is Expected to Witness Significant Growth Over The Forecast Period

Copper Clad Wire finds significant utility in electronics manufacturing, where its unique characteristics make it a valuable choice for various applications. One of the primary advantages is cost-effectiveness, as the aluminum core of the Copper Clad Aluminum (CCA) wire provides a more economical alternative to pure copper. In electronics manufacturing, where precision and cost efficiency are crucial considerations, CCA wire strikes a balance between performance and affordability. The lightweight nature of CCA wire is particularly advantageous in the production of electronic devices, contributing to reduced overall weight and enhancing the portability of electronics. This is especially relevant in applications such as consumer electronics, where weight considerations play a pivotal role in product design.

Additionally, the adaptability of CCA wire allows for seamless integration into the intricate circuitry of electronic devices. Its flexibility and malleability facilitate intricate manufacturing processes, contributing to the production of compact and efficient electronic components. CCA wire is utilized in various applications, including the production of printed circuit boards (PCBs), connectors, and internal wiring within electronic devices. As the electronics manufacturing industry continues to demand cost-effective solutions without compromising performance, Copper Clad Wire emerges as a reliable and versatile option. Its role in enhancing the efficiency, affordability, and design flexibility of electronic products underscores its significance in this rapidly evolving sector.

Specialized Applications Segment is Expected to Witness Significant Growth Over The Forecast Period

Copper Clad Wire finds application in a variety of specialized contexts where its distinct characteristics address specific industry requirements. One notable area is in specialized electrical applications, where the balance between cost-effectiveness and acceptable conductivity is crucial. Industries such as automotive and aerospace leverage Copper Clad Aluminum (CCA) wire due to its lightweight nature, contributing to weight reduction in vehicles and aircraft, thus enhancing fuel efficiency and overall performance. Moreover, specialized applications in high-frequency signal transmission benefit from CCA wire's properties. The adaptability of CCA wire makes it suitable for use in radio frequency (RF) cables and coaxial cables, where its unique combination of materials allows for efficient signal transmission while maintaining cost efficiency. In the realm of renewable energy, CCA wire plays a role in solar power applications. The cables are utilized in photovoltaic systems, balancing the need for conductivity with the economic considerations of large-scale solar installations. Additionally, CCA wire is employed in the manufacturing of high-performance speakers and audio equipment. The cables' properties, including their electrical conductivity and lightweight design, make them well-suited for audio systems where optimal signal transmission is paramount. Thus, specialized applications, Copper Clad Wire emerges as a versatile solution, offering a tailored balance of performance attributes to meet the distinctive demands of various industries. The adaptability and cost-effectiveness of CCA wire make it an integral component in the successful execution of specialized projects across diverse sectors.

Asia- Pacific Region Segment is Expected to Witness Significant Growth Over The Forecast Period

The demand for Copper Clad Wire in the Asia-Pacific region is on the rise, driven by substantial growth in the construction, telecommunications, automotive, and electronics manufacturing industries. Countries like China, India, Japan, and South Korea are witnessing significant infrastructure development, and the lightweight and cost-effective attributes of Copper Clad Aluminum (CCA) wire make it a preferred choice for wiring applications in the construction sector. As telecommunications networks expand rapidly, CCA wire plays a crucial role in establishing efficient communication infrastructure. In the automotive and electronics manufacturing sectors, where lightweight design and cost-effectiveness are paramount, CCA wire is gaining prominence. The region's leading position in automotive production and electronic device manufacturing contributes to the escalating demand for this versatile wiring solution. Moreover, the Asia-Pacific region's focus on renewable energy projects, particularly in solar power, aligns well with the characteristics of CCA wire. Its adaptability to specialized applications and economic advantages position it as a key component in the region's pursuit of sustainable and efficient solutions. Thus, the Asia-Pacific market for Copper Clad Wire is witnessing a surge in demand, driven by diverse industries and infrastructure developments. The adaptability and cost-effectiveness of CCA wire make it a crucial element in the region's technological and infrastructural advancements.

Get Complete Analysis Of The Report - Download Free Sample PDF

Major market players actively pursue strategies such as expanding their production capabilities, engaging in mergers and acquisitions, and conducting research and development initiatives to maintain a competitive edge in the industry. This involves increasing their capacity for manufacturing, acquiring other companies or merging with them to strengthen their market position, and investing in innovative research and development efforts. These strategic moves are crucial for staying ahead of competitors, enhancing market share, and ensuring sustained growth in the dynamic business environment. The commitment to these initiatives underscores the players' proactive approach in adapting to market trends, meeting evolving customer demands, and securing a prominent position in the competitive landscape. Key Players are :

Recent Developments:

1) In May 2023: NKT has announced the introduction of AX PRO, which is described as an aluminum ground wire featuring an attractive total cost of ownership and excellent corrosion protection properties, ensuring high reliability and performance. According to the company, AX PRO comprises seven individually coated aluminum wires, all bundled into a unified product without requiring additional materials to maintain its integrity. In the event that the wires separate, it is considered advantageous as it enhances the contact surface with the ground, thereby improving the electrical connection to the ground. The corrosion protection of AX PRO involves the use of a unique polyolefin that exhibits high conductivity and mechanical strength. The company suggests that by eliminating bare aluminum in the ground and in conjunction with electric current, corrosion and interruptions in the current path can be avoided. Additionally, NKT claims that AX PRO is the sole earth system that provides the possibility of status diagnosis to predict its lifetime.

2) In December 2023, CERN's Experimental Physics department has developed a high-temperature superconducting (HTS) demonstration coil, building on prior work with aluminium-stabilized HTS conductors. The magnet, featuring five turns and a 230 mm open bore diameter, demonstrated full superconductivity at 4.4 kA and 0.113 T across four central turns up to 30 K. Utilizing a 3D-printed aluminum mixed with copper alloy cylinder (Al10SiMg) as a stabilizer and support, the coil showcased stable performance even when intentionally disrupted. Soldering ReBCO tapes to the Al10SiMg stabilizer using tin-lead solder at 188°C was successfully demonstrated. Despite voids in the solder joint, the magnet showed no degradation after 12 thermal cycles, validating the feasibility of using aluminum-stabilized HTS magnets.

Q1. What is the current Copper Clad Aluminum Wire Market size?

The Copper Clad Aluminum Wire market is currently valued at USD 26.7 billion.

Q2. What is the Growth Rate of the Copper Clad Aluminum Wire Market ?

Copper Clad Aluminum Wire Market is expected to register a CAGR of 5.9% over the forecast period.

Q3. What are the factors driving the Copper Clad Aluminum Wire market?

Key factors that are driving the growth include the High Corrosion Resistance and Increased Flexibility in Applications.

Q4. Who are the key players in Copper Clad Aluminum Wire Market?

Some key players operating in the market include

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model