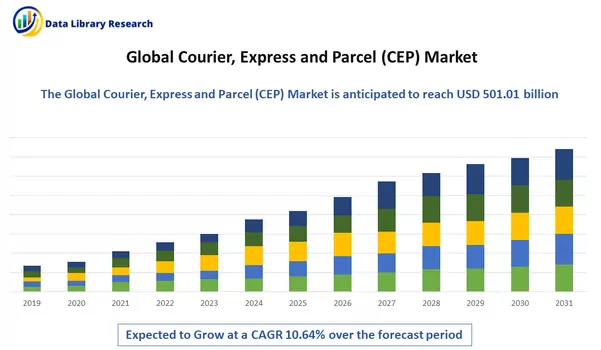

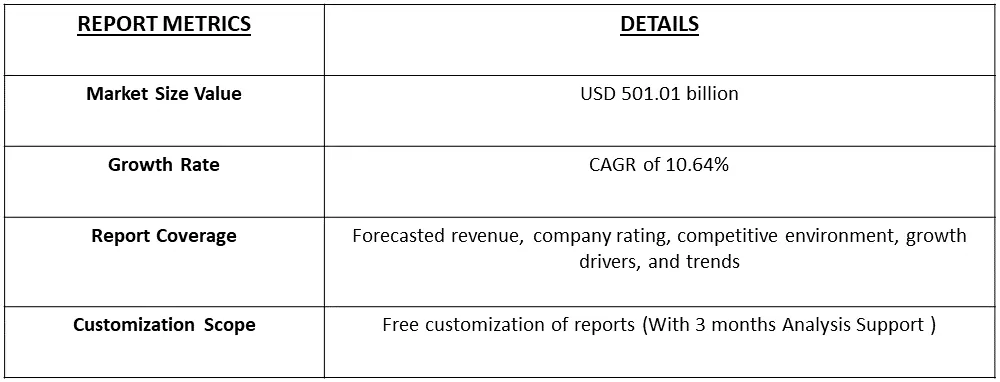

The Courier, Express and Parcel (CEP) Market are anticipated to reach an estimated value of around USD 501.01 billion in 2023, with a projected Compound Annual Growth Rate (CAGR) of 10.64% during the forecast period from 2023 to 2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

The Courier, Express and Parcel (CEP) Market encompasses services dedicated to the swift and reliable transportation and delivery of packages and parcels, often emphasizing tracking capabilities. These services cater to a diverse clientele, including businesses, e-commerce platforms, and individual consumers, encompassing both domestic and international shipping services.

A significant catalyst for the CEP market is the thriving e-commerce industry. The escalating trend of online shopping has led to an increased demand for efficient and punctual parcel deliveries. Additionally, the growth of cross-border trade and globalization has further fueled the need for international CEP services, with businesses actively seeking reliable and expedited shipping solutions to reach global markets.

The persistent expansion of e-commerce stands out as a prevailing trend, creating a heightened need for last-mile delivery services. CEP (Courier, Express, and Parcel) providers are actively adjusting their operations to cope with the substantial increase in parcel volumes, particularly in urban regions. The evolving preferences of consumers, who now anticipate swifter deliveries, have spurred the emergence of same-day and time-specific delivery options. To meet these changing demands, CEP providers are making strategic investments in both technology and operational frameworks. These initiatives aim to enhance efficiency and ensure that the evolving expectations for rapid and precise deliveries are met.

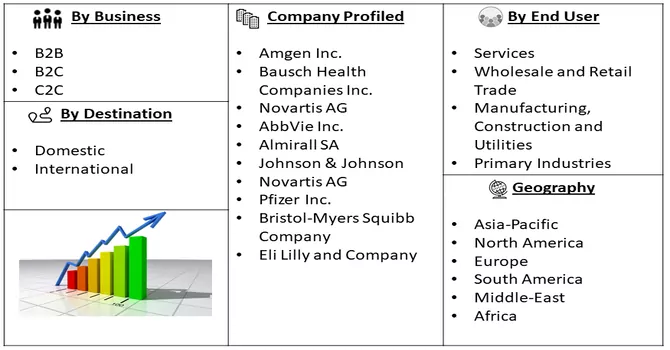

Market Segmentation:Courier, Express and Parcel (CEP) Industry Analysis is Segmented By Business (B2B, B2C and C2C), Destination (Domestic and International), By End User (Services, Wholesale and Retail Trade, Manufacturing, Construction and Utilities, and Primary Industries), and By Geography (North America, Europe, Asia-Pacific, and Rest of the World). The report offers the market size and forecasts in value (USD) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

E-commerce Growth

The persistent growth of the e-commerce industry stands out as a key driver for the CEP market. With consumers increasingly opting for online shopping, there is a surging demand for parcel deliveries that are both efficient and punctual. E-commerce entities heavily depend on CEP services to guarantee the swift and dependable delivery of products directly to customers' doorsteps. The ascent of online marketplaces, the adoption of direct-to-consumer models, and the overall expansion of digital retail all play substantial roles in the heightened parcel volumes managed by CEP providers.

In a historic milestone, online retail sales, excluding travel, surpassed USD 1 trillion in 2022 for the first time ever. Online non-travel sales reached a total of USD 1.09 trillion, with e-commerce sales in the fourth quarter hitting an all-time high at USD 332.2 billion. The 2022 holiday season witnessed record-breaking e-commerce spending, as consumers spent USD 211.7 billion online from November 1 to December 31, reflecting a 3.5% year-over-year increase. Notable product categories during the holiday period included robust sales in toys, video games, and apparel and accessories. Thus, such instances are expected to contribute towards the growth of the studied market.

Growing Globalization

The escalating trend of globalization and the surge in cross-border trade have emerged as pivotal drivers for the rising demand in the international Courier, Express, and Parcel (CEP) services market. Businesses operating on a global scale are actively seeking reliable and expeditious shipping solutions to effectively navigate the complexities of reaching diverse and distant markets. In the contemporary landscape of interconnected economies, businesses are capitalizing on the opportunities presented by cross-border trade. To capitalize on these opportunities, companies are increasingly relying on international CEP services to ensure the swift and secure transportation of goods across borders. The dynamics of international trade require a seamless and efficient logistics infrastructure, and CEP services play a crucial role in meeting these demands.

Moreover, the Courier, Express, and Parcel (CEP) Market have evolved to cater specifically to the demands of international commerce. These services go beyond traditional parcel delivery and often include comprehensive solutions such as real-time tracking, customs clearance assistance, and adherence to international shipping regulations. This adaptability positions CEP providers as strategic partners for businesses navigating the intricacies of global supply chains. In essence, as businesses continue to embrace the opportunities presented by globalization and cross-border trade, the demand for international CEP services is poised for sustained growth. The ability of CEP providers to offer reliable, fast, and comprehensive shipping solutions aligns seamlessly with the needs of businesses seeking to establish and expand their presence in global markets. Thus, such factors are expected to drive the growth of the studied market over the forecast period.

Market Restraints:

Last-Mile Delivery Challenges

The crucial element propelling the CEP market is last-mile delivery, signifying the final segment of the delivery process from a distribution center to the ultimate destination at the customer's location. The complexity of efficiently maneuvering and delivering parcels, especially in densely populated urban areas, has become more pronounced with the expansion of e-commerce. To tackle the challenges associated with last-mile delivery, CEP providers are making strategic investments in inventive solutions. This includes the implementation of route optimization algorithms, the establishment of alternative delivery points, and the utilization of smart lockers. These initiatives aim to address last-mile complexities and ensure the prompt and successful delivery of parcels to customers' residences or their preferred locations. Thus, these factors are expected to slow down the growth of the studied market.

The pandemic expedited the transition to online shopping, driven by lockdowns, social distancing measures, and heightened safety concerns that prompted consumers to favor e-commerce for their retail needs. Courier, Express, and Parcel (CEP) providers experienced a notable upswing in parcel volumes as the demand for home deliveries skyrocketed. This increased reliance on e-commerce is expected to leave a lasting imprint on the CEP market. Throughout the pandemic, there was a notable surge in the demand for the delivery of essential goods, including groceries, medications, and healthcare products. CEP providers played a pivotal role in ensuring the timely delivery of these critical items to households, thereby showcasing the adaptability, flexibility, and resilience of the industry. The heightened demand for essential goods during the pandemic prompted CEP companies to adjust their services to meet this surge, underscoring the industry's ability to respond effectively to evolving market needs.

Segmental Analysis:

Business Segment is Expected to Witness Significant growth over the Forecast Period

B2B transactions in the CEP market involve the shipment and delivery of parcels between businesses. This includes the movement of goods, components, and supplies between manufacturers, wholesalers, retailers, and other entities within the business ecosystem.B2C transactions in the CEP market involve the delivery of parcels directly from businesses to individual consumers. This model is closely associated with the rise of e-commerce and the increasing trend of consumers purchasing goods online.C2C transactions in the CEP market involve individuals shipping parcels to other individuals. This model is often associated with peer-to-peer selling, online marketplaces, and platforms facilitating the exchange of goods between consumers. Thus, such factors are expected to drive the growth of the studied market over the forecast period.

Services Whole Trade and Retail Segment is Expected to Witness Significant growth over the Forecast Period

CEP services refer to the specialized logistics and transportation services provided by courier and delivery companies. These companies offer a range of services, including the pickup, sorting, transportation, and final delivery of parcels. CEP services cater to various segments, including businesses, e-commerce platforms, and individual consumers. Wholesale trade in the CEP market involves the bulk purchase and distribution of courier and parcel services to businesses or entities that act as resellers or intermediaries. Wholesale trade can occur at various stages of the supply chain, with wholesalers providing CEP services to retailers, e-commerce platforms, or other businesses. Retail in the CEP market refers to the direct provision of courier and parcel services to individual consumers, businesses, and e-commerce customers. Retailers in this context may include brick-and-mortar shipping centers, online platforms, and CEP service points accessible to the general public. Thus, such factors are expected to drive the growth of the studied market over the forecast period.

North America Region is Expected to Witness Significant growth over the Forecast Period

CEP providers in North America have been early adopters of advanced technologies to improve operational efficiency. This includes the use of route optimization algorithms, real-time tracking systems, and automation in sorting facilities.The North American CEP market is influenced by cross-border e-commerce, particularly between the United States and Canada. CEP providers facilitate the movement of parcels across borders, and the North American Free Trade Agreement (NAFTA) has played a role in shaping cross-border logistics.

The technological advancements in the region including the utilization of digital technologies with crowd-sourced delivery models, are also creating a positive outlook for the market. These technologies aid the service providers in increasing their overall operational efficiency and meeting the requirements of the customers effectively. Other factors, including rapid urbanization, rising consumer expenditure capacities, and significant growth in the manufacturing sector, are projected to drive the market further toward growth during the forecast period. Automated package and freight shipping solutions are available to improve efficiency for the entire shipping process of retail vendors. Thus, due to the above-mentioned reasons, the region is expected to witness significant growth over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The Courier, Express, and Parcel (CEP) Market is fragmented and highly competitive. The global express and small parcels market continues to be driven forward by e-commerce. Companies are trying to grow organically or inorganically to improve their product offerings, services, and geographical reach. The international players are making strategic investments to establish a regional logistics network, such as opening new distribution centres, smart warehouses, etc. Local companies face high competition with multinational companies with comparatively well-developed infrastructure. In the regional context, domestic companies still have an edge. Some of the key players being

Recent Developments:

1) November 2022- The real estate experts of DHL Supply Chain, the world’s leading contract logistics provider, have developed a carbon-neutral real estate portfolio of 400,000 sqm to support customers’ growth requirements across six European Tier 1 markets. Located in central logistics areas all sites will benefit from excellent multi-modal transport connectivity, designed to serve customers across different sectors.

2) June 2022- FedEx Corp. announced it has received its first 150 electric delivery vehicles from BrightDrop, the technology startup from General Motors (GM) decarbonizing last-mile delivery. This marks a critical milestone for FedEx as the company plans to transform its entire parcel pickup and delivery (PUD) fleet to all-electric, zero tailpipe emissions by 2040 and comes just months after BrightDrop’scommercialization of the Zevo600 as the fastest vehicle to market in GM’s history.

Q1. What was the Courier, Express and Parcel (CEP) Market size in 2023?

As per Data Library Research the Courier, Express and Parcel (CEP) Market estimated value of around USD 501.01 billion in 2023.

Q2. At what CAGR is the Courier, Express and Parcel (CEP) Market projected to grow within the forecast period?

Courier, Express and Parcel (CEP) Market is projected Compound Annual Growth Rate (CAGR) of 10.64% during the forecast period.

Q3. Which region has the largest share of the Courier, Express and Parcel (CEP) Market? What are the largest region's market size and growth rate?

North America has the largest share of the market . For detailed insights on the largest region's market size and growth rate request a sample here.

Q4. What are the factors driving the Courier, Express and Parcel (CEP) Market?

Key factors that are driving the growth include the E-commerce Growth and Growing Globalization.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model