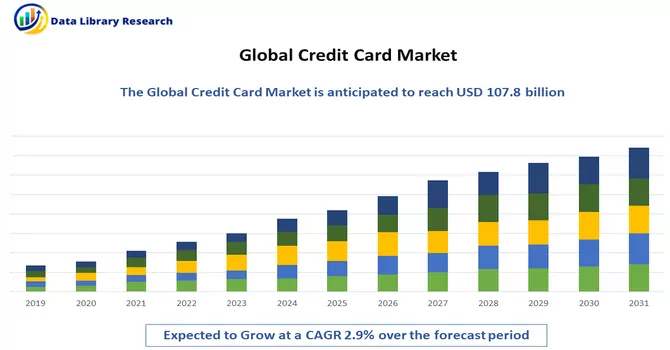

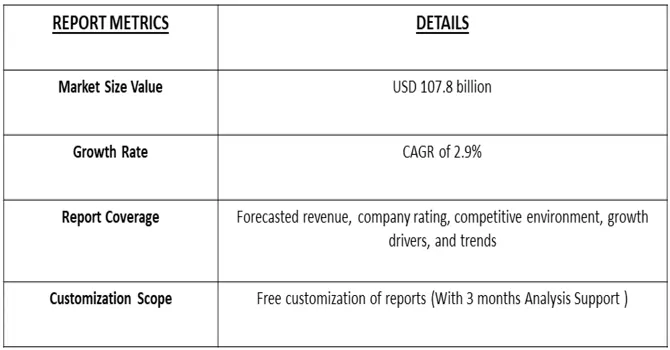

The credit card market is currently valued at USD 107.8 billion in 2023 and is expected to register a CAGR of 2.9% over the forecast period, 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

The credit card market encompasses the issuance, utilization, and management of credit cards, involving various stakeholders such as financial institutions, card networks, merchants, and consumers. Credit cards, issued by banks or credit card companies, provide cardholders with the ability to borrow funds for purchases, with an agreement to repay the borrowed amount at a later date, often with interest. A key driving force behind the credit card market is the spending behaviour of consumers. When consumer confidence is on the rise and disposable incomes increase, there tends to be a corresponding uptick in credit card usage. Consumers utilize credit cards not only for discretionary spending but also for everyday expenses and significant purchases. Moreover, the credit card market is heavily influenced by consumer preferences, lifestyle choices, and spending patterns. The demand for credit cards is shaped by features such as rewards, cashback options, travel benefits, and promotional offers, reflecting the evolving needs and desires of consumers in the financial landscape.

The credit card market experiences growth driven by various factors, including the expanding consumer base facilitated by increased financial inclusion, economic stability fostering consumer confidence and spending, and ongoing innovations in payment systems and credit card functionalities. The market is further influenced by consumer preferences, with the demand for cards offering rewards, cashback, travel benefits, and promotional offers shaping product offerings. Regulatory changes and government initiatives can impact market dynamics, while strategic partnerships between financial institutions, merchants, and technology companies contribute to the overall growth and competitiveness of the credit card sector. Together, these multifaceted drivers underscore the evolving landscape of the credit card market within the broader financial services industry.

The credit card market is experiencing a rapid surge in the adoption of contactless payment technology, propelled by consumer preferences for swift, convenient, and hygienic payment solutions. Credit cards equipped with contactless functionality empower cardholders to simply tap their cards or use mobile devices at terminals designed for contactless transactions, eliminating the necessity for physical contact or inserting the card into the terminal. The ongoing COVID-19 pandemic has played a pivotal role in expediting the adoption of contactless payments, as consumers increasingly prioritize touch-free transactions for both safety and enhanced convenience. This surge underscores a significant shift in payment habits, emphasizing the importance of seamless, secure, and contactless options in the contemporary credit card landscape.

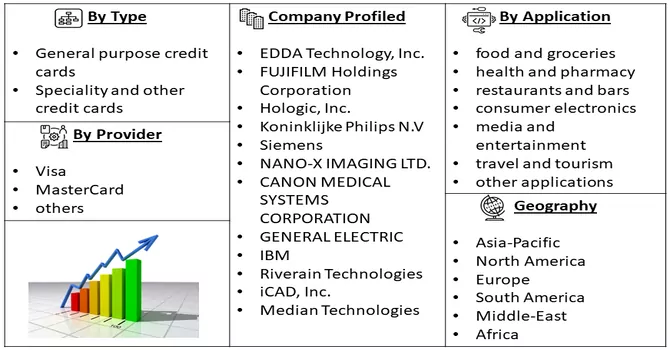

Market Segmentation: The global credit card market is segmented by card type (general purpose credit cards and speciality and other credit cards), by application (food and groceries, health and pharmacy, restaurants and bars, consumer electronics, media and entertainment, travel, and tourism, and other applications), by provider (Visa, MasterCard, and others), and by geography (North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa). The report offers market size and forecasts for the global credit card market in value (USD billion) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Consumer Spending Habits

The dynamics of the credit card market are substantially influenced by consumer spending habits. A pivotal factor in this relationship is the correlation between growing consumer confidence and an increase in discretionary income, which tends to elevate the propensity of individuals to utilize credit cards. This heightened confidence prompts consumers to turn to credit cards not only for everyday expenditures but also for substantial purchases and online transactions. The nexus between consumer spending patterns and credit card usage is integral, impacting transaction volumes and serving as a primary driver for revenue generation among credit card issuers. As consumers exhibit a greater inclination toward using credit cards across various spending categories, the market responds to and evolves with these changing dynamics.

Convenience and Payment Flexibility

The widespread adoption and usage of credit cards can be attributed to the convenience and payment flexibility they offer consumers. Credit cards empower cardholders to make immediate purchases with the option to defer payment until a later date, presenting a valuable combination of financial flexibility and convenience. This feature is particularly appealing to consumers who appreciate the ability to access a line of credit for various scenarios, including emergencies, unforeseen expenses, or planned purchases. The inherent flexibility of credit cards aligns with the evolving financial needs of consumers, providing a versatile and accessible means of managing transactions and payments in a way that suits their individual preferences and circumstances.

Market Restraints:

Consumer Debt Levels and Interest Rates and Fees

Elevated levels of consumer debt pose a potential constraint on the expansion of the credit card market. When consumers carry excessive credit card debt, they grapple with the financial burden of interest payments and repayment obligations, thereby limiting their capacity to engage in additional spending or borrow further. Economic downturns or shifts in interest rates can exacerbate challenges related to debt repayment, prompting consumers to curtail credit card usage or prioritize reducing existing debt over new expenditures. The presence of high-interest rates, annual fees, and additional charges associated with credit cards may act as deterrents, dissuading consumers from obtaining or actively using credit cards. The reluctance to incur substantial fees or interest rates becomes particularly pronounced when consumers have access to alternative payment methods or more cost-effective credit alternatives. Regulatory alterations or shifts in market conditions that lead to heightened fees or interest rates can further discourage credit card utilization among consumers. The intricate interplay of these factors underscores the delicate balance between consumer debt levels and the sustained growth of the credit card market.

The imposition of travel restrictions, border closures, and the widespread cancellation of events and entertainment venues has precipitated a significant downturn in travel-related and entertainment spending. As a consequence, consumers have been compelled to either defer or altogether cancel their travel plans, resulting in a marked decrease in the utilization of travel rewards credit cards and co-branded airline or hotel cards. Recognizing the shift in consumer behaviour, credit card issuers have proactively adapted their rewards programs and promotional offerings to align with changing preferences and constrained opportunities for travel. This strategic realignment reflects the industry's responsiveness to the evolving landscape, ensuring that credit card incentives remain relevant and appealing to consumers despite the limitations imposed by global circumstances.

General-purpose Segment is Expected to Witness is Expected to Witness Significant Growth Over the Forecast Period

General-purpose credit cards serve as versatile payment tools, enabling users to make purchases across a broad spectrum of categories such as retail, dining, travel, entertainment, and beyond. This flexibility allows cardholders the convenience of utilizing their credit cards at a myriad of locations globally, wherever credit cards are accepted. With the ability to seamlessly transact at millions of establishments worldwide, these credit cards provide users with unparalleled convenience and accessibility, catering to diverse spending needs and preferences across various sectors. The widespread acceptance of general-purpose credit cards underscores their ubiquity in the modern financial landscape, offering cardholders a universally recognized and convenient method of payment across an extensive array of goods and services.

Food and Groceries Segment is Expected to Witness is Expected to Witness Significant Growth Over the Forecast Period

A multitude of credit cards entice users with rewards or cashback incentives specifically tailored for transactions conducted at grocery stores and supermarkets. This enticement allows cardholders to accrue a designated percentage of cashback or rewards points for every dollar spent on essential groceries, presenting a compelling incentive to opt for credit card payments in their routine food purchases. By aligning these benefits with a ubiquitous and necessary expense like grocery shopping, credit card issuers aim to encourage users to leverage their cards for such transactions, thereby fostering loyalty and providing tangible rewards for everyday spending on essential items. This strategy not only enhances the attractiveness of the credit card but also establishes it as a valuable tool for managing routine expenses while concurrently enjoying financial perks.

Media and Entertainment Segment is Expected to Witness is Expected to Witness Significant Growth Over the Forecast Period

Credit cards established through collaborations with media companies, entertainment venues, or streaming services, commonly known as co-branded credit cards, present cardholders with exclusive benefits and rewards. These specialized cards often feature accelerated rewards programs, discounts, or VIP access privileges when used for transactions at affiliated entertainment outlets. In addition to financial perks, co-branded credit cards may extend unique advantages, including access to exclusive content, early ticket availability for events, or opportunities for meet-and-greet sessions with celebrities or performers. This synergistic partnership between credit card issuers and entertainment entities not only enhances the value proposition for cardholders but also fosters brand loyalty by providing distinctive and sought-after experiences beyond traditional financial incentives.

North America Region is Expected to Witness is Expected to Witness Significant Growth Over the Forecast Period

In North America, credit card issuers frequently collaborate with prominent media and entertainment enterprises, establishing partnerships that extend exclusive rewards, benefits, and experiences to cardholders. These collaborations often manifest in the form of co-branded credit cards associated with renowned entertainment brands, including major movie studios, streaming platforms, sports leagues, and music labels. Through these affiliations, cardholders gain the opportunity to accumulate rewards points or avail themselves of discounts when making entertainment-related purchases, spanning movie and concert tickets, streaming subscriptions, and merchandise. These strategic alliances not only enhance the appeal of credit cards but also empower consumers to access unique and tailored perks within the realm of entertainment, thereby fostering customer loyalty through a distinctive array of benefits.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding the company presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. These strategies include investments in research and development to stay at the forefront of technological advancements, mergers and acquisitions to consolidate market share, strategic partnerships for synergies, and innovation to differentiate products and services. The adoption of such multifaceted strategies reflects the competitive nature of the market, with participants continually seeking avenues for growth and sustainability. In essence, the high fragmentation in the studied market not only signifies the diversity of players but also underscores the dynamism and competitiveness that drive ongoing strategic maneuvers. As companies explore various avenues for expansion, the market continues to evolve, presenting both challenges and opportunities for industry stakeholders. Some of the major players operating in the computer aided detection (CAD) market are:

Recent Developments:

1) In May 2023, DBS Bank in Singapore aims to enhance its retail product portfolio by introducing a super-premium credit card, expecting to finalize the addition this week. This strategic move comes as DBS seeks to solidify its market position, following the acquisition of Lakshmi Vilas Bank (LVB) two-and-a-half years ago.

2) In May 2023, the National Payments Corporation of India (NPCI) relies on collaborative efforts with banks to promote the adoption of RuPay credit cards. This approach reflects NPCI's strategy to leverage partnerships with various banks to drive the acceptance and usage of RuPay credit cards in the market.

Q1. What is the current Credit Card Market size?

The credit card market is currently valued at USD 107.8 billion.

Q2. What is the Growth Rate of the Credit Card Market?

Credit Card Market is expected to register a CAGR of 2.9% over the forecast period.

Q3. Which are the major companies in the Credit Card Market?

EDDA Technology, Inc., FUJIFILM Holdings Corporation, Hologic, Inc. and iCAD Inc. are some of the major companies in the Credit Card Market.

Q4. Which region has the largest share of the Credit Card Market? What are the largest region's market size and growth rate??

North America has the largest share of the market . For detailed insights on the largest region's market size and growth rate request a sample here

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model