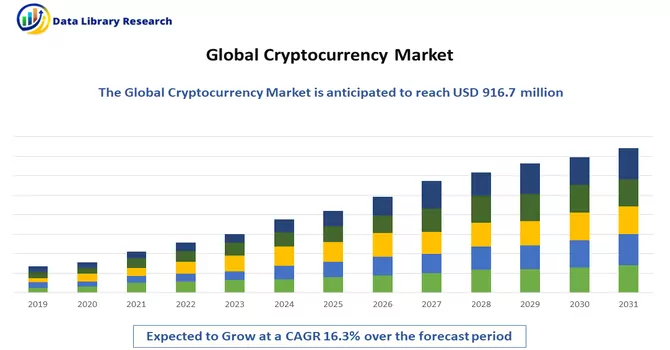

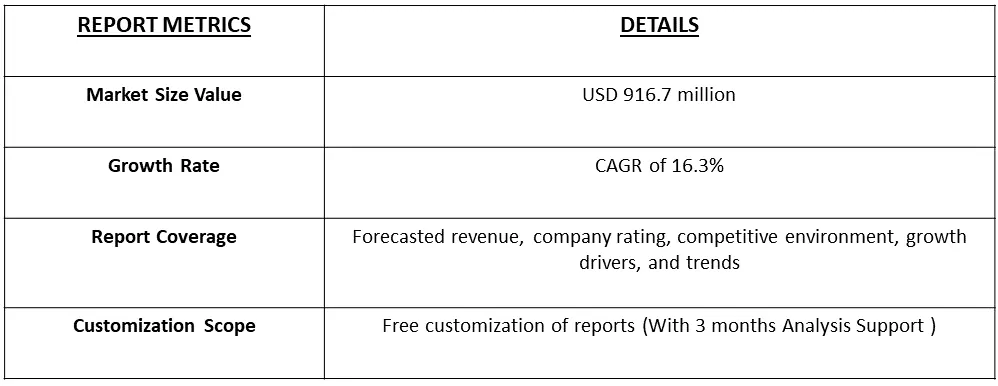

In 2022, the global cryptocurrency market reached a valuation of USD 916.7 million, and it is anticipated to exhibit a Compound Annual Growth Rate (CAGR) of 16.3% from 2023 to 2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

The cryptocurrency industry revolves around the conception, exchange, and utilization of digital or virtual currencies, relying on cryptographic principles and decentralized technologies, notably blockchain. This innovative technology ensures autonomy and transparency in financial transactions, operating independently of conventional banking systems.

Cryptocurrencies, underpinned by blockchain, offer a decentralized and transparent framework for conducting financial transactions, eliminating the necessity for intermediaries such as banks. The core of cryptocurrency functionality lies in blockchain, which facilitates secure and tamper-resistant recording of transactions. This, in turn, drives the development and widespread acceptance of cryptocurrencies. An essential aspect of cryptocurrencies is their ability to provide financial services to individuals who are either unbanked or underbanked, particularly in regions with limited access to traditional banking infrastructure. The decentralized nature of cryptocurrencies empowers individuals to participate in the global economy without the prerequisite of a traditional bank account. Overall, the growth and adoption of cryptocurrencies are significantly influenced by the transformative potential of blockchain technology, which ensures decentralization and transparency in the realm of financial transactions.

The rise of Decentralized Finance, abbreviated as DeFi, stands out as a significant trend within the cryptocurrency sector. DeFi platforms utilize blockchain technology to replicate conventional financial services like lending, borrowing, and trading, all without relying on traditional intermediaries. This surge in DeFi highlights a notable shift towards financial systems that are decentralized and permissionless. Another noteworthy development in the cryptocurrency space is the widespread attention garnered by Non-Fungible Tokens (NFTs). These tokens serve as unique digital assets, serving as proof of ownership or authenticity for both digital and physical items. NFTs find applications in diverse sectors such as art, gaming, and entertainment, underscoring the potential of blockchain technology in the creation and exchange of distinctive digital assets.

Market Segmentation: The Global Cryptocurrencies are segmented based on the market capitalization of cryptocurrencies (Bitcoin, Ethereum, Ripple, Bitcoin Cash, Cardano, and others) and by geography (Middle East & Africa, Americas, Europe, APAC). The report offers market size and forecast values for the Cryptocurrency Market in USD million for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Decentralization and Blockchain Technology

The cryptocurrency industry lies the fundamental concept of decentralization, a principle made possible through the innovative application of blockchain technology. Blockchain, serving as the foundational technology for the majority of cryptocurrencies, fundamentally transforms the way transactions are recorded and verified by eliminating the necessity for central authorities such as banks. Blockchain achieves decentralization by creating a distributed and decentralized ledger that securely records transactions across a network of nodes. Each transaction is cryptographically linked to the previous one, forming a chain of blocks that is resistant to tampering or unauthorized alterations. This decentralized ledger is maintained collectively by a network of participants, removing the need for a single central entity to oversee and validate transactions. The elimination of central authorities in the cryptocurrency ecosystem brings about several key benefits. First and foremost, it enhances security by reducing the vulnerability associated with a single point of failure. With no central server or authority to compromise, the decentralized nature of blockchain makes it highly resistant to hacking or malicious attacks. Moreover, the transparency inherent in blockchain technology ensures that all transactions are visible to the participants in the network. This transparency fosters trust among users as they can independently verify transactions without relying on a central authority. Each participant has access to a consistent and unalterable record of transactions, contributing to a higher level of accountability and integrity in the system. Thus, these factors are expected to drive the growth of the studied market.

Financial Inclusion

Cryptocurrencies play a crucial role in advancing financial inclusion by extending access to financial services to individuals who are either unbanked or underbanked. Particularly in areas where traditional banking infrastructure is lacking, cryptocurrencies emerge as a decentralized alternative, empowering users to engage in global economic activities, facilitate transactions, and avail financial services without relying on a conventional bank account. The pursuit of financial inclusion stands out as a foundational catalyst driving the widespread acceptance and integration of cryptocurrencies.

Moreover, in regions where traditional banking services are sparse, cryptocurrencies offer a transformative solution. They serve as a decentralized financial avenue, enabling individuals to seamlessly participate in the global economy. Users can conduct various transactions and access a spectrum of financial services without being tethered to the constraints of a traditional bank account. This shift towards decentralized financial solutions not only addresses the limitations imposed by inadequate banking infrastructure but also ensures that a broader segment of the population can actively engage in economic activities. Thus, such factors are propelling the growth of the studied market over the studied period.

Market Restraints:

Regulatory Uncertainty and Security Concerns and Hacking Risks

One significant restraint in the cryptocurrency industry is the lack of clear and consistent regulatory frameworks across different jurisdictions. Regulatory uncertainty creates challenges for businesses and investors, as varying or ambiguous regulations can lead to legal and compliance risks. The evolving nature of regulations can impact market confidence and hinder mainstream adoption. Also, security remains a critical concern in the cryptocurrency industry. While blockchain technology is known for its security features, cryptocurrency exchanges and wallets are susceptible to hacking attempts. High-profile security breaches and the loss of funds from hacking incidents can erode trust in the industry and deter potential investors and users. Thus, such factors are expected to contribute to the studied market growth.

During the early stages of the COVID-19 pandemic, the cryptocurrency market experienced significant volatility. The uncertainty and panic in traditional financial markets spilled over into the crypto market, leading to sharp declines in the prices of major cryptocurrencies like Bitcoin. As traditional markets faced uncertainties, some investors viewed cryptocurrencies, particularly Bitcoin, as a potential safe-haven asset. The narrative of Bitcoin as "digital gold" gained traction, with some seeking an alternative store of value amid economic uncertainties. Thus, in the current scenario, the market is expected to witness significant growth over the next few years.

Segmental Analysis:

Bitcoin Segment is Expected to Witness Significant growth Over the Studied Period

Bitcoin was introduced in 2009 by an unknown person or group using the pseudonym Satoshi Nakamoto. It is the pioneering cryptocurrency and laid the groundwork for the entire ecosystem. Bitcoin introduced the concept of decentralized, peer-to-peer digital currency and blockchain technology. Bitcoin is often referred to as "digital gold" due to its limited supply and perceived store of value characteristics. Like precious metals, Bitcoin is seen by some investors as a hedge against inflation and a long-term store of wealth. This narrative has contributed to Bitcoin's adoption as a digital asset for investment purposes. Moreover, bitcoin operates on a decentralized network of computers (nodes) that collectively validate and record transactions on a public ledger called the blockchain. This decentralization eliminates the need for a central authority, such as a government or financial institution, providing users with more control over their funds. Thus, due to the such advantages offered by bitcoin, the segment is expected to witness significant growth over the forecast period.

North America Region is Expected to Witness Significant growth over the Studied Period

The United States, as a major player in North America, has witnessed significant Bitcoin adoption. Cryptocurrency exchanges, Bitcoin ATMs, and businesses accepting Bitcoin payments are prevalent, contributing to its mainstream visibility.The regulatory environment in North America, particularly in the United States and Canada, has been crucial in shaping the cryptocurrency industry. Regulatory agencies provide guidelines for cryptocurrency exchanges, initial coin offerings (ICOs), and other crypto-related activities. Regulatory clarity is an ongoing focus to provide legal frameworks for industry participants.

Canada has generally been more proactive in embracing cryptocurrency. The regulatory approach has been characterized by a balance between fostering innovation and ensuring consumer protection. The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) oversees anti-money laundering (AML) regulations for cryptocurrency exchanges.

Moreover, beyond cryptocurrencies, there is significant interest and investment in blockchain technology. Numerous startups and established companies in North America are exploring blockchain applications in various industries, including finance, healthcare, and supply chain. Thus, owing to such advantages, the region is expected to witness significant growth over the studied period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The report includes different segments like coin product developers, mining services, cryptocurrency exchanges, wallet companies, etc., along with a note on recent mergers and acquisitions that shaped the ecosystem. some of the major players are:

Bitfinex

Recent Development:

1) In August 2023, Securitize Agrees to Buy Crypto Wealth Manager Onramp to Expand RIA Services. With this acquisition Asset tokenization firm Securitize aims to extend its offering to registered investment advisors (RIAs) and Onramp will be operating as a subsidiary of Securitize to integrate Securitize products into its existing service.

2) In September 2022, Ethereum underwent a significant transition known as "the Merge" which changed its technology to cut carbon emissions by more than 99.9 percent. The first phase of merge so-called "hard fork" will convert Ethereum from a proof-of-work (PoW) to a proof-of-stake (PoS) base

Q1. What was the Cryptocurrency Market size in 2022?

As per Data Library Research the global cryptocurrency market reached a valuation of USD 916.7 million in 2022.

Q2. What is the market size of the Cryptocurrency Market?

Cryptocurrency Market it is anticipated to exhibit a Compound Annual Growth Rate (CAGR) of 16.3% over the forecast period.

Q3. What are the factors driving the Cryptocurrency Market?

Key factors that are driving the growth include the Decentralization and Blockchain Technology and Financial Inclusion.

Q4. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model