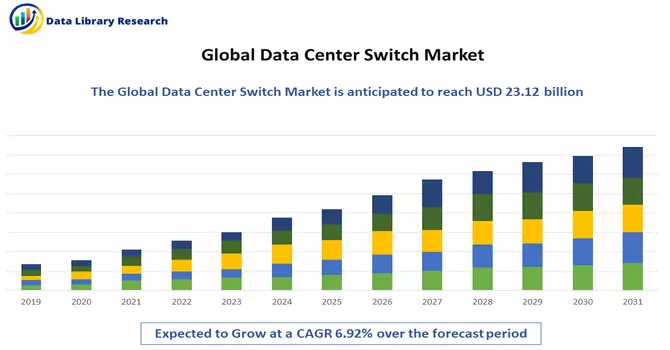

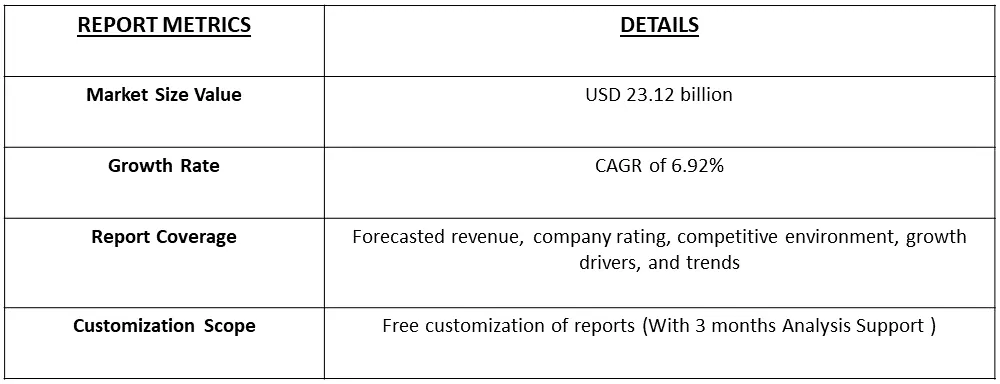

The global data centre switch market size was valued at USD 23.12 billion in 2023 and is expected to a CAGR of 6.92% over the forecast period, 2023-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

A data center switch refers to a network switch specifically designed and optimized for use within data center environments. It plays a crucial role in managing the flow of data between servers, storage systems, and other networking devices within a data center infrastructure. Data center switches are integral components of the network architecture, providing high-speed connectivity and efficient data transmission to ensure seamless communication between various components of the data center. These switches are designed to handle the unique demands of data centers, which typically involve high volumes of traffic, low-latency requirements, and the need for scalability. Data center switches often support features such as high port density, low-latency switching, Quality of Service (QoS) capabilities, and energy-efficient designs. They are crucial for supporting the networking needs of virtualized environments, cloud computing, and other modern data center technologies.

The data center switch market experiences robust growth driven by several key factors. The escalating volume of data traffic, fueled by digital content, cloud computing, streaming services, and the Internet of Things (IoT), necessitates high-speed and efficient data transmission within data centers. The widespread adoption of cloud computing services, coupled with ongoing data center modernization efforts, amplifies the demand for advanced and scalable data center switches. The prevalence of server virtualization and software-defined networking (SDN), along with the rise of edge computing and bandwidth-intensive applications like artificial intelligence and data analytics, underscores the need for switches that are flexible, programmable, and capable of supporting dynamic environments.

The data center switch market is undergoing dynamic changes with several notable trends shaping its trajectory. A significant trend is the proliferation of Intent-Based Networking (IBN), which automates network operations based on business policies, enhancing efficiency and management capabilities. Another key development is the increased adoption of 400G Ethernet switches, driven by the growing demand for higher bandwidth and faster data transmission speeds, particularly in applications with intensive data processing needs. The rise of multi-cloud architectures is influencing data center switches to provide seamless connectivity between on-premises data centers and diverse cloud environments. Edge computing's ascendancy is impacting switch requirements, with a focus on supporting applications such as IoT devices and real-time data processing at the edge. Thus, these market trends are expected to drive the growth of the market over the forecast period.

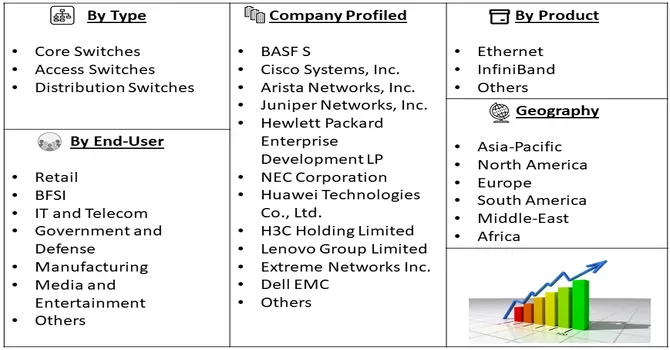

Market Segmentation: The Data Center Switch Market is Segmented by Switch Type (Core Switches, Access Switches, Distribution Switches) and Geography (North America (United States, Canada), Europe (United Kingdom, Germany, France, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Rest of Asia Pacific), Rest of the World). The Market Sizes and Forecasts are Provided in Terms of Value (USD) for all the Above Segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

The Increasing Demand for Cloud & Edge Computing Services

The escalating demand for cloud and edge computing services is reshaping the landscape of data management, and data center switches play a critical role in facilitating this transformation. As businesses increasingly adopt cloud services to enhance scalability, flexibility, and cost efficiency, the need for robust data center switches becomes paramount.

With the growing prominence of cloud and edge computing services, the demand for data center switches is further intensified. These switches are integral in creating agile, scalable, and responsive network infrastructures that can handle the dynamic requirements of modern computing architectures. As businesses continue to leverage cloud and edge computing to meet their evolving operational needs, the data center switch market is poised for sustained growth, driven by the indispensable role these switches play in supporting the expanding scope of cloud and edge services.

Government Regulations Regarding Localization of Data Centers

Government regulations regarding the localization of data centers have become a focal point in the evolving landscape of data governance and security. Various countries are implementing stringent measures to ensure that sensitive data generated within their borders is stored and processed locally. These regulations aim to address concerns related to data privacy, security, and sovereignty. Thus, the growing trend of government regulations regarding the localization of data centers reflects an increasing awareness of the importance of data sovereignty and security. As governments worldwide continue to refine and enact such regulations, businesses and data center operators must stay abreast of the evolving legal landscape to ensure compliance and secure their data assets effectively.

Market Restraints:

Presence of self-reliant enhanced servers

The data center switches market faces a potential shift in its growth trajectory with the emergence and acceptance of self-reliant enhanced servers. These servers, characterized by advanced processing capabilities and integrated functionalities, seek to diminish reliance on conventional networking infrastructure, including data center switches. The adoption of such servers poses a challenging dynamic as organizations explore alternatives that offer comprehensive and self-contained solutions, potentially impacting the demand for traditional data center switches. This trend reflects a growing emphasis on self-sufficiency within server technology, prompting a reevaluation of the role and necessity of conventional networking components in the evolving landscape of data center architecture.

The COVID-19 pandemic has brought about notable impacts on the Data Center Switch market, influencing both short-term disruptions and long-term trends. In the initial phase of the pandemic, widespread lockdowns, supply chain disruptions, and uncertainties in the business environment led to delays in data center infrastructure projects, affecting the demand for Data Center Switches. Many organizations faced budget constraints and deferred or reevaluated their IT spending, impacting the adoption of data center networking solutions. However, the pandemic also accelerated certain trends that have implications for the Data Center Switch market. The sudden surge in remote work and increased reliance on digital services highlighted the importance of robust and scalable data center infrastructure. This has prompted organizations to reassess and reinforce their data center capabilities, potentially driving demand for Data Center Switches in the long run. Furthermore, the growing significance of cloud computing and the adoption of hybrid and multi-cloud strategies gained traction during the pandemic, impacting the dynamics of data center architectures. Data Center Switches, as integral components of networking within these environments, witnessed shifts in demand patterns. The emphasis on business continuity and the need for resilient IT infrastructure have underscored the importance of data center technologies, including switches, that can ensure high availability and performance. Security concerns, heightened during the pandemic, have also influenced the choice of data center networking solutions, with a focus on robust features in switches to safeguard sensitive data. As organizations continue to adapt to the post-pandemic landscape, the Data Center Switch market is expected to rebound, driven by renewed investments in digital transformation, cloud infrastructure, and the overall modernization of data center facilities. The evolving trends in remote work, digital services, and the increasing data-centric nature of businesses are likely to shape the trajectory of the Data Center Switch market in the foreseeable future.

Segmental Analysis:

Distribution Switches Segment is Expected to Witness Significant Growth Over the Forecast Period

Distribution switches are commonly employed in local area networks (LANs) to efficiently manage and direct network traffic between various devices, such as computers, servers, and access points. Positioned between access switches (connecting end-user devices) and core switches or routers (connecting different parts of the network), distribution switches play a crucial role in aggregating and distributing data traffic. They facilitate the implementation of network policies, perform VLAN (Virtual Local Area Network) segmentation, and contribute to the overall scalability and efficiency of the network. Data center switches, on the other hand, are specialized switches designed to meet the unique demands of data center environments. These switches are optimized for high-performance computing, large-scale data processing, and the dynamic nature of modern data centers. In a data center, switches connect servers, storage systems, and other networking devices to enable efficient data exchange. Key features of data center switches include high port density, low latency, high bandwidth, and support for virtualization technologies. With the rise of cloud computing, virtualization, and the need for scalable and agile infrastructure, data center switches play a crucial role in ensuring the seamless operation of applications and services hosted in data centers. While distribution switches primarily focus on managing traffic within a local network, data center switches are tailored to the specific demands of large-scale data processing and storage within centralized data center facilities. Both types of switches contribute to the overall efficiency, performance, and reliability of modern network infrastructures, addressing the unique requirements of their respective domains.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America stands as a key influencer and major player in the Data Center Switch market, playing a pivotal role in shaping the trends and dynamics of this rapidly evolving industry. The region's robust technological infrastructure, coupled with the widespread adoption of digital technologies across various sectors, contributes significantly to the demand for advanced data center networking solutions, including switches. The Data Center Switch market in North America is characterized by a high level of competitiveness, with several established players vying for market share. Major technology hubs and business centers in the United States and Canada drive innovation and foster the deployment of cutting-edge data center technologies. The demand for scalable, high-performance data center switches is propelled by the growing reliance on cloud computing, big data analytics, and the increasing digitization of businesses. The COVID-19 pandemic has further underscored the importance of resilient and efficient data center infrastructure, driving organizations to invest in technologies that enhance business continuity and support remote work. This shift has implications for the Data Center Switch market in North America, as the need for robust networking solutions to facilitate seamless data flow and connectivity becomes increasingly critical. The region has been witnessing trends such as the adoption of higher-speed Ethernet switches (such as 100G and 400G), increased focus on security features to address rising cyber threats, and a growing interest in intent-based networking for more automated and efficient operations. Additionally, the sustainability agenda is gaining prominence, prompting organizations to consider energy-efficient and environmentally friendly data center switch solutions. Strategic initiatives such as mergers, acquisitions, partnerships, and collaborations among key market players in North America contribute to the competitive landscape. These endeavors aim to enhance product portfolios, expand market reach, and stay at the forefront of technological advancements. Thus, North America's role in the Data Center Switch market extends beyond being a major consumer; it actively shapes industry trends, fosters innovation, and sets the pace for the adoption of advanced networking solutions in data center infrastructures. As organizations in the region continue to prioritize digital transformation and modernize their IT environments, the Data Center Switch market in North America is poised for ongoing growth and evolution.

Get Complete Analysis Of The Report - Download Free Sample PDF

The landscape of the Data Centre Switch market is characterized by intense competition and the presence of several key players. However, a handful of major companies currently wield significant influence, dominating the market in terms of market share. These industry leaders employ a range of strategic initiatives to fortify their positions, such as expansions, mergers and acquisitions, joint ventures, collaborations, and partnerships. Through these strategic moves, these market players have not only solidified their standing within the business but have also strategically positioned themselves to navigate the dynamic challenges and opportunities in the highly competitive Data Centre Switch market.

Recent Developments:

1) In May 2022, PLDT, the Philippines' leading operator, joined forces with Cisco to introduce a 5G standalone service platform in Manila. This deployment was slated for implementation at PLDT's 5G TechnoLab located in Makati City. Fueled by Cisco's 5G SA service, the TechnoLab was anticipated to serve as a cutting-edge facility, offering a network sandbox featuring the latest private 5G standalone service architecture. The initiative represents a significant step forward in promoting network automation and embracing Software-Defined Networking (SDN) in the Philippines, as the advanced 5G infrastructure lays the foundation for more agile, programmable, and responsive network environments, catering to the evolving needs of enterprises in the region. Thus, such market opportunities are fueling the market growth.

2) In May 2022, 5TONIC collaborated with Telefónica. The collaboration between 5TONIC, Telefónica, and key technology partners in integrating a 5G Standalone (5G SA) network with a multi-access edge computing (MEC) platform signifies a significant step toward the evolution of network-as-a-service (NaaS). The growth of network-as-a-service models often brings scalability challenges. Data center switches that can scale seamlessly to accommodate the increasing demands of 5G networks, edge computing, and the evolving NaaS landscape become critical for the success of such initiatives. Thus, the integration of a 5G SA network and MEC platform by 5TONIC and its partners represents a progressive step toward network-as-a-service. This development is likely to stimulate the demand for advanced data center switches that can effectively support the requirements of 5G technologies, edge computing, and dynamic network configurations, contributing to the overall growth of the data center switches market.

Q1. What was the Data Center Switch Market size in 2023?

As per Data Library Research the global data centre switch market size was valued at USD 23.12 billion in 2023.

Q2. At what CAGR is the Data Center Switch market projected to grow within the forecast period?

Data Center Switch Market is expected to a CAGR of 6.92% over the forecast period.

Q3. What are the factors driving the Data Center Switch market?

Key factors that are driving the growth include theThe Increasing Demand for Cloud & Edge Computing Services and Government Regulations Regarding Localization of Data Centers.

Q4. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model