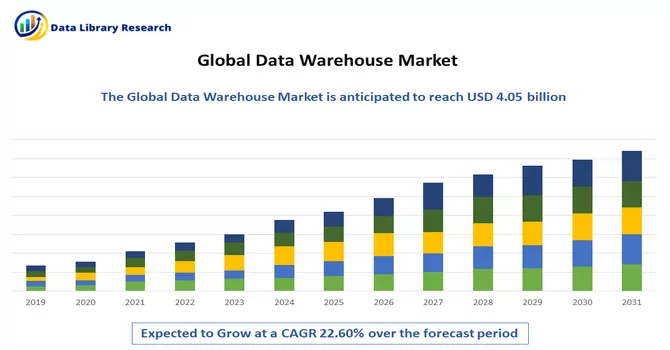

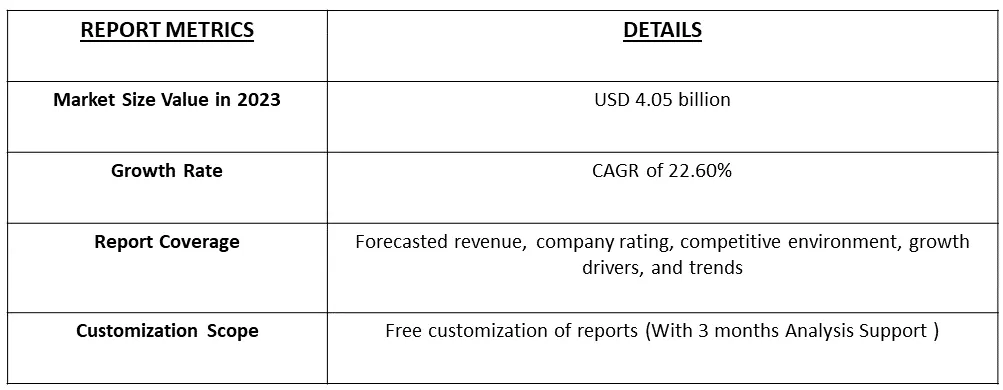

The Data Warehouse as a Service Market size is expected to grow from USD 4.05 billion in 2023 registering a CAGR of 22.60% during the forecast period (2023-2030).

Get Complete Analysis Of The Report - Download Free Sample PDF

Data warehouse as a service (DWaaS) is an outsourcing model in which a cloud service provider configures and manages the hardware and software resources a data warehouse requires, and the customer provides the data and pays for the managed service.

With the rising concerns about data manageability and increasing complexity in recent years, data warehousing has attracted significant interest in real-life applications, especially in finance, business, healthcare, and other industries contributing to the growth of the studied market.

Segmentation:

The Report Covers Data Warehouse Service Providers' Growth and it is segmented by

Organization Size

End-user Verticals

Geography

The market sizes and forecasts are provided in terms of value (USD million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The integration of AI and ML into data warehousing enhances analytics capabilities, while multi-cloud data warehousing offers scalability, redundancy, and flexibility. These trends represent the future of data warehousing, enabling organizations to extract greater value from their data and adapt to evolving business demands.

Drivers:

The market demand is poised to surge due to the increasing need for low latency and high-speed analytics, as well as the growing significance of business intelligence in enterprise-wide management. However, expanding the scope of the market study may be necessary to address the escalating challenges of data quality control and enhancement.

Furthermore, the demand for data warehouse services, especially in cloud-based deployments, is expected to soar. This is primarily driven by the exponential growth in structured and unstructured data across various industries such as BFSI, retail and e-commerce, government, public sector, and manufacturing. As an example, Tencent Holdings' plan to establish a third data center in Japan to cater to the robust demand for cloud services in online gaming and live streaming systems highlights this trend.

Additionally, the increasing adoption of data warehousing for advanced analytics, the rapid surge in data volumes, heightened regulatory compliance requirements, and the emergence of multi-cloud architectures present abundant opportunities for the adoption of cloud-based data warehouse solutions.

Enterprises are leveraging reports, dashboards, and analytics tools to extract valuable insights from datasets, facilitating real-time monitoring of business performance to support decision-making. These tools are an integral part of data warehouses, which efficiently store data and deliver query results rapidly to multiple users simultaneously, thus driving the adoption of Data Warehouse as a Service (DWaaS) in emerging economies. Thus, due to the above-mentioned reasons the market is expected to witness significant growth over the forecast period.

Restraints:

Data security remains a paramount concern within the rapidly growing DWaaS market. As organizations increasingly rely on DWaaS to manage and analyze their critical data, they are faced with several significant security challenges that need to be addressed effectively. Data breaches represent a significant threat to organizations utilizing DWaaS. If not properly secured, sensitive and valuable data stored in data warehouses can be compromised, leading to financial losses, reputational damage, and legal consequences. Moreover, Controlling access to data is essential to prevent unauthorized users from accessing sensitive information. Implementing robust access control measures and authentication protocols is crucial to mitigate this risk. Thus, the growth of the market may slow down over the forecast period.

The global economic recession triggered by the COVID-19 outbreak and the subsequent lockdown measures had a significant impact on capital investments and industrial operations worldwide. However, the Data Warehouse as a Service (DWaaS) market experienced growth during the initial stages of the pandemic as a result of an expedited digital transformation process. Many enterprises, particularly those in end-user industries like manufacturing and automotive, were compelled to temporarily halt their production facilities due to the enforced lockdown restrictions.

Segmental Analysis:

Large Enterprises Segment is Expected to Witness Significant Growth over the Forecast Period

Large enterprises leverage DWaaS to efficiently manage and analyze their extensive data assets. These solutions offer scalability, cost efficiency, real-time insights, compliance, and security, addressing the specific needs and challenges faced by large organizations in the data-driven business landscape. Large enterprises generate and accumulate vast amounts of data across various departments and operations. DWaaS platforms provide the scalability required to efficiently handle and store this data, ensuring it is readily accessible for analysis. Moreover, large enterprises rely on advanced analytics to gain insights into their operations, customer behavior, and market trends. DWaaS solutions offer the computational power and tools necessary for complex data analysis, predictive modeling, and business intelligence. Thus, the segment is expected to witness significant growth over the forecast period.

E-Commerce and Retail Segment is Expected to Witness Significant Growth over the Forecast Period

The E-commerce and Retail sectors are increasingly turning to Data Warehouse as a Service (DWaaS) to gain a competitive edge and optimize their operations. E-commerce and retail companies rely heavily on customer data for personalized marketing and product recommendations. DWaaS helps consolidate and analyze customer data from various sources to provide insights that drive targeted marketing campaigns and improve customer experiences.

Also, Retailers deal with vast inventories, and DWaaS enables them to monitor stock levels, track product demand, and manage supply chains efficiently. Real-time data analytics through DWaaS aids in optimizing inventory management and reducing costs. Thus, DWaaS empowers e-commerce and retail businesses with data-driven decision-making capabilities, enabling them to enhance customer experiences, optimize operations, improve inventory management, and stay competitive in dynamic markets.

North America is Expected to Witness Significant Growth Over the Forecast Period

North America's prominence in the data warehousing market is driven by its technological infrastructure, leading adoption trends, growth in cloud computing, strategic alliances, and the need to effectively manage the vast amounts of data generated. This region is likely to continue driving innovations and advancements in data warehousing solutions.

The availability of highly advanced data warehouse infrastructure in North America is a key driver of its market position. This technological edge enables organizations to adopt analytics solutions across various industries effectively. For instance, in June 2022 - HCL Technologies partnered with Amazon Web Services. AWS allows HCL to offer scalable, cost-effective, secure, and high-performing enterprise data warehouse solutions. Amazon Redshift provides data-driven business insights enabled by modern AI/ML capabilities to improve operational efficiency, decision-making, and faster time to market to HCL Technologies.

Moreover, US-based organizations are at the forefront of adopting analytics solutions across diverse verticals. The country's leadership in the market is fueled by a significant demand for operational data management and the increasing presence of cloud solution providers. Thus, the region is expected to witness significant growth over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The Data Warehouse as a Service Market is competitive and consists of several significant players. Some of the players currently dominate the market in terms of market share. The competitive landscape is consolidated with the presence of some of the prominent players across the region, such as:

Recent Developments:

1. May 2022 - Dell partnered with Snowflake Inc. to ease access to on-premises data. The partnership between Snowflake Inc. and Dell Technologies brings Snowflake Data Cloud's tools to on-premises object storage.

2. January 2022 - Firebolt, a data warehouse startup, raised USD100 million at a USD1.4 billion valuation to provide quicker, cheaper analytics on massive data sets. It intended to utilize the funds to continue investing in its technological stack, increase business development, and add more expertise to its team to meet the data warehousing market.

Q1. What is the current Data Warehouse Market size?

The Data Warehouse as a Service Market size is expected to grow USD 4.05 billion.

Q2. What is the Growth Rate of the Data Warehouse Market?

Data Warehouse Market registering a CAGR of 22.60% during the forecast period.

Q3. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share

Q4. Which are the major companies in the Data Warehouse Market?

Google LLC, Teradata Corp, SAP SE and IBM Corp are some of the major companies in the Data Warehouse Market

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model