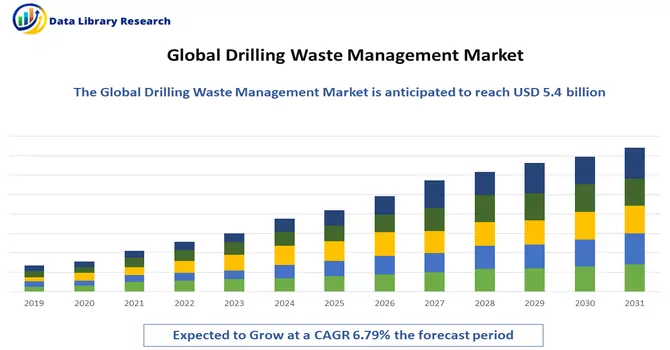

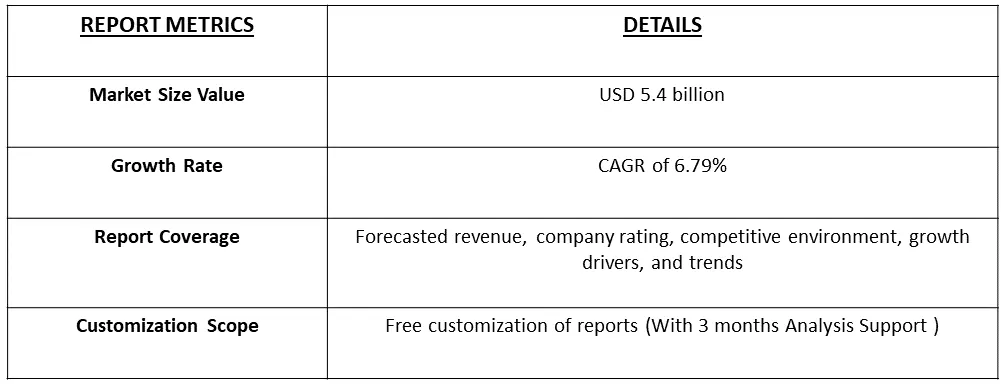

The drilling waste management market was estimated at USD 5.4 billion in 2023 and is likely to grow at a CAGR of 6.79% during 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Drilling waste management services refer to a set of specialized solutions and processes designed to handle and mitigate the environmental impact of waste generated during drilling activities in the oil and gas industry. The drilling process generates various types of waste, including drill cuttings, mud, fluids, and other by-products that can contain hazardous materials. Drilling waste management services involve the collection, treatment, and disposal or recycling of these waste materials in an environmentally responsible and regulatory-compliant manner. The goal is to minimize the ecological footprint of drilling operations, prevent soil and water contamination, and adhere to legal and environmental standards. These services often include technologies such as solids control, waste transportation, treatment, and disposal methods, contributing to sustainable and responsible practices in the energy exploration and production sector.

The market for drilling waste management services is driven by several key factors that reflect the increasing awareness of environmental responsibility and the regulatory landscape within the oil and gas industry. Stringent environmental regulations and guidelines aimed at minimizing the impact of drilling activities on ecosystems and communities propel the demand for effective drilling waste management services. Companies operating in the sector are compelled to adhere to these regulations, fostering the need for advanced waste treatment and disposal solutions. Additionally, the growing emphasis on sustainable practices and corporate social responsibility has led to a heightened focus on environmentally friendly drilling operations, further boosting the demand for efficient waste management services. The continuous expansion of oil and gas exploration activities globally, coupled with the increasing volume of drilling waste generated, contributes to the market's growth. Moreover, advancements in waste management technologies, including innovative treatment methods and recycling options, drive the adoption of these services among drilling companies seeking to enhance their environmental performance and ensure compliance with evolving industry standards.

The drilling waste management services market is witnessing significant trends that reflect the industry's commitment to sustainability and technological advancements. One key trend involves the increasing adoption of cutting-edge technologies for waste treatment and disposal, such as thermal desorption units and bioremediation processes, enhancing efficiency and environmental friendliness. There is a notable shift towards on-site waste management solutions, with companies investing in mobile and modular systems for real-time waste handling, reducing transportation costs, and ensuring compliance with stringent environmental regulations. Recycling and reuse of drilling waste materials are gaining prominence, aligning with broader sustainability goals and minimizing the environmental impact of drilling activities. Additionally, the market is influenced by a trend towards stricter regulatory standards, driving companies to invest in advanced technologies and adhere to higher environmental compliance requirements. These trends collectively highlight a transformative shift towards more sustainable, technologically advanced, and on-site solutions in the drilling waste management services sector.

Market Segmentation: The Drilling Waste Management Services Market is segmented by Service (Solid Control, Containment & Handling, and Others), Location of Deployment (Onshore and Offshore) and Geography (North America, Europe, Asia-Pacific, South America, and Middle-East and Africa).

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Growing Production and Exploratory Operations in the Oil and Gas Industry

The surge in oil and gas production, particularly in regions like North America and the Middle East, is a direct response to the escalating global demand for energy. This heightened demand has spurred increased exploration and production activities in these regions. In the oil and gas exploration and production process, drilling plays a pivotal role. With the uptick in drilling activities, there is a concurrent increase in drilling waste, encompassing materials like drilling mud and cuttings. Managing this drilling waste appropriately becomes imperative to safeguard the environment. The expansion of production and exploratory operations creates opportunities for effective drilling waste management solutions.

Growing Offshore Exploration Activities

In recent decades, there has been a substantial expansion in offshore oil and gas exploration and production activities worldwide. Presently, offshore production constitutes one-third of the global crude oil output and one-fourth of the global gas production. The discovery of a significant portion of hydrocarbon reserves in recent years has predominantly occurred in offshore locations, underscoring the increasing importance of the maritime sector in extraction processes. Technological advancements have played a pivotal role in facilitating offshore drilling to extend into deep and ultra-deep oceans, further amplifying its significance in the energy industry.

Market Restraints:

Stringent Regulatory Framework

Several market restraints impact the drilling waste management sector, influencing its growth and operational dynamics. One significant challenge is the stringent regulatory framework governing waste management practices in the oil and gas industry. Adhering to complex environmental regulations requires substantial investments in advanced technologies and compliance measures, which can increase operational costs for companies operating in this sector. Additionally, the high initial costs associated with implementing advanced waste management technologies and infrastructure pose a restraint, particularly for smaller or emerging players in the market. The fluctuating prices of oil and gas commodities can also impact the financial stability of companies, influencing their spending on waste management initiatives. Furthermore, public opposition and community concerns regarding the environmental impact of drilling activities and waste management processes can create regulatory hurdles and slow down project approvals. These restraints collectively underscore the challenges faced by the drilling waste management market in achieving sustainable and cost-effective solutions while navigating a complex regulatory landscape and addressing public concerns.

The COVID-19 pandemic has significantly impacted the drilling waste management services market, creating a complex landscape of challenges and opportunities. The global economic slowdown and disruptions in the oil and gas industry resulted in reduced drilling operations and exploration activities, leading to a decline in the demand for drilling waste management services. Project delays, cancellations, and budget constraints affected many companies, influencing market dynamics. However, the pandemic also underscored the importance of environmental sustainability and regulatory compliance, prompting a renewed focus on efficient waste management solutions. As the industry gradually rebounds, there is an increasing emphasis on adopting advanced technologies and digital solutions, such as remote monitoring software, to enhance operational efficiency and safety. Despite the initial setbacks, the ongoing recovery and heightened awareness of environmental responsibility are expected to drive innovation and growth in the drilling waste management services market.

Segmental Analysis:

Solid Control Segment is Expected to Witness Significant Growth Over the Forecast Period

Solid control is a crucial aspect of drilling operations within the oil and gas industry, playing a pivotal role in managing drilling waste. Solid control systems are designed to remove and process drilling solids, such as cuttings and mud, from the drilling fluid before it is circulated back into the wellbore. This process helps maintain the integrity of the drilling fluid, ensuring its proper functionality for efficient drilling. The effective implementation of solid control not only enhances drilling performance but also contributes to environmental protection by reducing the discharge of contaminated drilling waste into the surroundings. Drilling waste management services play a complementary role in handling the waste generated during drilling operations. These services encompass a range of solutions, from collection and containment to treatment and disposal of drilling waste. By integrating solid control systems with drilling waste management services, companies can optimize their operations, minimize environmental impact, and adhere to regulatory requirements. The synergy between solid control and drilling waste management is crucial for sustainable and responsible drilling practices. It not only enhances the efficiency of drilling operations but also addresses environmental concerns associated with the oil and gas exploration and production process. As the industry continues to focus on environmental stewardship and regulatory compliance, the integration of solid control and drilling waste management services becomes instrumental in achieving operational excellence and minimizing the ecological footprint of drilling activities.

On-Shore Segment is Expected to Witness Significant Growth Over the Forecast Period

On-shore drilling operations within the oil and gas industry generate substantial amounts of drilling waste, necessitating effective waste management solutions. Drilling waste management services play a crucial role in mitigating the environmental impact of on-shore drilling activities. These services encompass a range of processes, including the collection, containment, treatment, and disposal of drilling waste materials such as cuttings, mud, and other by-products. On-shore drilling waste management involves the deployment of advanced technologies and systems to optimize the handling and treatment of waste materials. The goal is to minimize the ecological footprint, adhere to regulatory standards, and ensure the sustainable execution of drilling operations. Key components of on-shore drilling waste management include the implementation of solid control systems, waste separation, and the use of specialized equipment for containment and disposal. The market for on-shore drilling waste management services is driven by the increasing emphasis on environmental sustainability, stringent regulatory requirements, and the growing demand for responsible waste disposal practices in the oil and gas sector. Companies operating in this space are continually innovating to develop comprehensive solutions that address both the operational and environmental aspects of on-shore drilling waste management. As the industry evolves, the integration of advanced technologies and best practices in on-shore drilling waste management services becomes pivotal for achieving efficient, compliant, and environmentally conscious drilling operations.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America plays a significant role in shaping the dynamics of the drilling waste management services market, driven by the region's prominent position in the oil and gas industry. The United States and Canada, in particular, have witnessed extensive on-shore and offshore drilling activities, resulting in the generation of substantial drilling waste. The demand for effective waste management solutions has surged in response to environmental regulations, heightened awareness of sustainability, and the need for responsible waste disposal practices. In North America, the drilling waste management services market is characterized by the adoption of advanced technologies and innovative solutions to handle various waste materials produced during drilling operations. Stringent environmental regulations set by authorities contribute to the development and implementation of state-of-the-art waste management practices. The market encompasses a spectrum of services, including waste collection, containment, treatment, and disposal, with an emphasis on minimizing the environmental impact. The region's commitment to environmental stewardship, coupled with advancements in waste management technologies, propels the growth of the drilling waste management services market in North America. Companies operating in this sector continually invest in research and development to offer comprehensive solutions that align with both regulatory requirements and industry best practices. As the focus on sustainable drilling practices intensifies, North America remains a pivotal market for driving innovation and shaping the future of drilling waste management services.

Get Complete Analysis Of The Report - Download Free Sample PDF

The market for drilling waste management services exhibits a consolidated structure, indicating a scenario where a limited number of major players dominate the industry. In this consolidated market, a handful of key companies play significant roles and wield considerable influence over the overall dynamics. The consolidation may result from factors such as strategic mergers, acquisitions, or collaborations among major industry players. This scenario suggests a landscape where a select few companies hold substantial market share, emphasizing the competitive strength and market presence of these key players. The consolidated nature of the drilling waste management services market often implies a higher level of competition among the established industry leaders, contributing to a more focused and controlled market environment. The key market players are:

Recent Development:

1) In December 2023, Bjorn Haaland, the General Manager of Risavika Gjenvinning, stated that the company would be developing new processes for treating drilling waste from offshore companies and various industries. Haaland, who also serves as the director of hazardous waste at Geminor, is overseeing the development of Risavika Gjenvinning AS, a company established in collaboration with R&D Manager Henry Magne Haakstad. This initiative forms a significant part of the Geminor group's investment in handling hazardous waste and contaminated materials. Haaland expressed the intention to develop environmental technology specifically for treating oil-related waste like drill cuttings. The primary objective is to assist the oil and gas industry in elevating the treatment of this specialized waste in the waste hierarchy, with a focus on the potential for reusing these contaminated materials

2) In September 2023, TWMA, a specialist drilling waste management company, has unveiled the latest version of its award-winning RotoMill technology, known as RotoMill 2.0. This advanced iteration is hailed as the most energy-efficient RotoMill, offering operators an environmentally sustainable wellsite processing solution. Notably, RotoMill 2.0 incorporates TWMA's XLink™ remote monitoring software, providing enhanced operational insights and automating the wellsite processing system. The technology aims to deliver cost savings, heightened safety measures, and reduced carbon emissions for operators. Featuring a state-of-the-art control scheme, it enables advanced condition monitoring, adopting a predictive maintenance approach.

Q1. What was the Drilling Waste Management Market size in 2023?

As per Data Library Research the drilling waste management market was estimated at USD 5.4 billion in 2023.

Q2. What is the Growth Rate of the Drilling Waste Management Market?

Drilling Waste Management Market is poised to grow at a CAGR of 6.79% over the forecast period.

Q3. What segments are covered in the Drilling Waste Management Market Report?

By Service, By Location and Deployment and Geography these segments are covered in the Drilling Waste Management Market Report.

Q4. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model