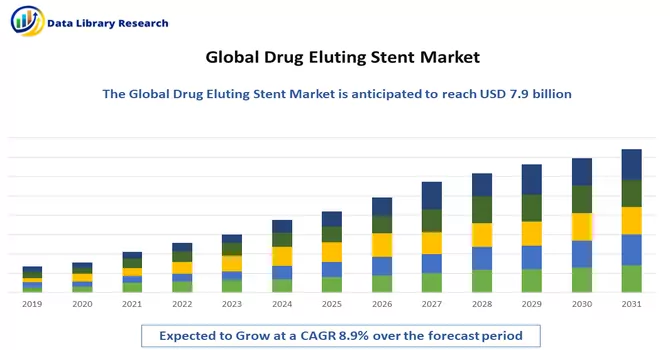

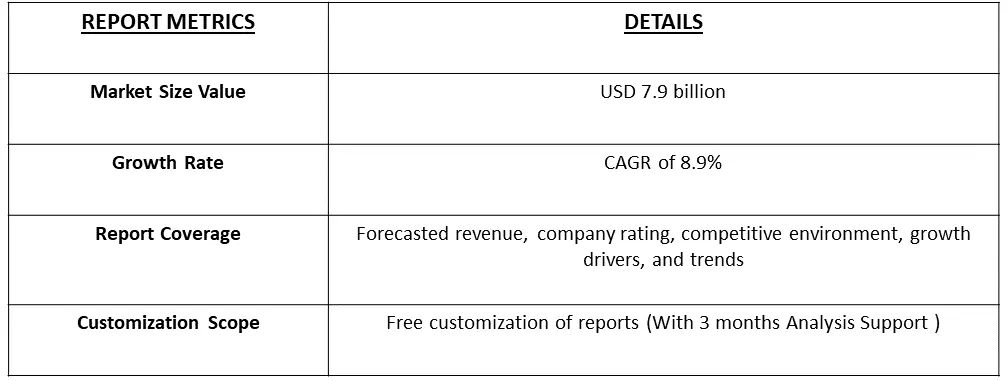

The global drug-eluting stent market size was valued at USD 7.9 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.9% from 2023 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

A drug-eluting stent (DES) is a medical device used in interventional cardiology to treat coronary artery disease. It is a small, tubular scaffold typically made of metal (such as stainless steel or cobalt-chromium) that is coated with a special medication or drug. The stent is designed to be implanted in narrowed or blocked coronary arteries during a medical procedure called angioplasty. Angioplasty involves inflating a balloon within the narrowed artery to widen it and then placing the drug-eluting stent to help keep the artery open. The drug coating on the stent is released gradually over time to prevent the recurrence of blockages or restenosis. The use of drug-eluting stents has become a standard practice in treating coronary artery disease, improving outcomes and reducing the need for repeat procedures compared to bare-metal stents.

The persistent increase in the global elderly population stands out as a key factor propelling the expansion of the drug-eluting stent market. With the growing ageing demographic, there is a heightened risk of developing arterial diseases, thereby creating a greater demand for efficacious treatment solutions such as drug-eluting stents. The prevalence of atherosclerosis, marked by the accumulation of plaque in arteries, has also surged due to sedentary lifestyles and unhealthy dietary patterns.

The drug-eluting stent market is experiencing dynamic trends that significantly influence its growth trajectory. Continuous technological advancements play a pivotal role, in fostering the development of next-generation stents with improved design, materials, and drug coatings. The surge in cardiovascular diseases, particularly coronary artery diseases, propels the demand for effective treatment options, contributing to the market's expansion. Notably, there is a growing focus on biodegradable stents, offering solutions that gradually dissolve over time to address limitations associated with traditional metallic stents. Patient-centric approaches are gaining prominence, emphasizing personalized treatment plans based on factors such as age, comorbidities, and lifestyle. The rise of minimally invasive procedures, including percutaneous coronary interventions, positively impacts the adoption of drug-eluting stents, driven by patient preferences for quicker recovery and reduced risks. Emerging markets present significant opportunities, with improving healthcare infrastructure and growing awareness. Collaborations and partnerships among healthcare organizations, research institutions, and industry players aim to accelerate research and development efforts. Additionally, the regulatory landscape, including streamlined approval processes, influences market dynamics, reflecting a continuous pursuit of advancements, improved patient outcomes, and broader market reach.

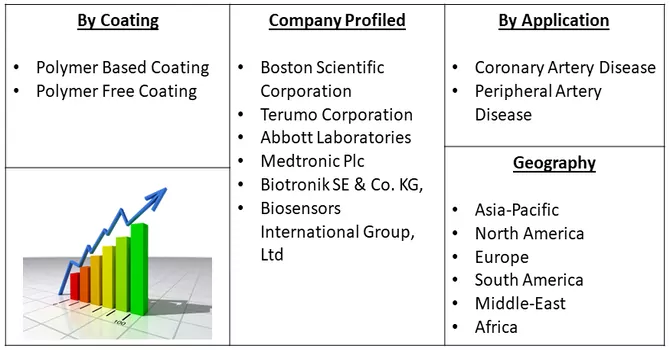

Market Segmentation: The Global Drug Eluting Stent Manufacturers is Segmented By Coating (Polymer Based Coating (Biodegradable, and Non-biodegradable), Polymer Free Coating), By Application (Coronary Artery Disease, and Peripheral Artery Disease), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The market provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Growing Cardiac Diseases

The primary driver for the expansion of the drug-eluting stent market is the escalating prevalence of cardiovascular diseases, including peripheral and coronary artery diseases. Drug-eluting stents are purposefully crafted to mitigate the re-narrowing of blood vessels, incorporating a coating of medications that inhibit the proliferation of smooth muscle cells and diminish the risk of restenosis. A noteworthy example is peripheral artery disease (PAD), which affects over 200 million individuals globally, as highlighted by the American Heart Association's 2021 report. The substantial burden of peripheral artery diseases significantly contributes to the overall growth and demand within the drug-eluting stent market.

Growing Demand for Minimally Invasive Surgeries

Moreover, the increasing demand for minimally invasive surgeries is anticipated to propel market expansion, given their utilization of small incisions and drug-eluting stents for treating narrowed or blocked coronary arteries. Notably, a January 2023 article from the National Library of Medicine revealed an annual calculation of over three million minimally invasive surgery cases in the United States. These procedures offer various benefits, including reduced trauma to the body, shorter hospital stays, quicker recovery times, and fewer complications. The high demand for minimally invasive procedures consequently drives the need for drug-eluting stents, contributing to market growth. Additionally, key market players are implementing various strategies such as product launches, mergers, acquisitions, and partnerships to broaden their product footprint, further fueling market growth. As an example, in October 2021, Boston Scientific Corporation shared positive data for the Eluvia Drug-Eluting Vascular Stent System (Eluvia stent) during a late-breaking clinical trial presentation at the Vascular InterVentional Advances (VIVA) meeting in Las Vegas.

Market restraints:

Strict Regulatory Approval Process of Products

The stringent regulatory approval process for medical products, including drug-eluting stents, has the potential to impede the growth of the market. The development and introduction of new medical devices are subject to rigorous scrutiny by regulatory authorities to ensure their safety, efficacy, and compliance with quality standards. This meticulous evaluation, while crucial for patient safety, often involves extensive clinical trials, data analysis, and adherence to complex regulatory frameworks. The rigorous nature of this approval process may result in delays in bringing innovative drug-eluting stents to the market, slowing down the overall growth trajectory. Companies operating in this sector need to navigate through a thorough and time-consuming regulatory pathway, which can impact the speed at which new products reach healthcare practitioners and patients. Despite the essential role of regulatory oversight in ensuring the safety of medical interventions, the complexity of the approval process remains a challenge for the drug-eluting stent market.

The COVID-19 pandemic has had a significant impact on the drug-eluting stent market. The outbreak led to disruptions in healthcare systems worldwide, affecting the diagnosis and treatment of various medical conditions, including cardiovascular diseases that often necessitate the use of drug-eluting stents. The lockdowns, travel restrictions, and overwhelmed healthcare facilities during the pandemic resulted in delays or cancellations of elective procedures, including stent implantation surgeries. Additionally, the economic downturn and uncertainties related to the pandemic may have influenced patient decisions and healthcare expenditures. The overall slowdown in healthcare activities during the pandemic has affected the growth trajectory of the drug-eluting stent market, although the market is expected to gradually recover as healthcare services normalize.

Segmental Analysis:

Biodegradable Segment is Expected to Witness Significant Growth Over The Forecast Period

The emergence of biodegradable drug-eluting stents represents a significant advancement in cardiovascular intervention. These stents, crafted from biocompatible materials, offer a novel approach to coronary artery disease treatment by combining the benefits of drug-elution technology with a temporary scaffold that gradually degrades over time. The biodegradable nature of these stents addresses some challenges associated with traditional permanent stents, such as the potential for late stent thrombosis or complications during subsequent interventions. As the biodegradable stent dissolves, it allows the vessel to regain its natural functionality. This innovation has garnered attention for potentially reducing the need for long-term antiplatelet therapy and enhancing the overall healing process. The development and adoption of biodegradable drug-eluting stents signify a promising avenue in interventional cardiology, emphasizing a patient-centric approach and improved long-term outcomes in coronary interventions. Furthermore, in April 2023, BIOTRONIK announced the commercial launch of its Orsiro Mission bioabsorbable polymer drug-eluting stent system (BP-DES) in Canada. This system is designed to enhance coronary luminal diameter in patients, encompassing those with conditions such as diabetes mellitus, symptomatic heart disease, stable angina, unstable angina, and non-ST elevation myocardial infarction caused by atherosclerotic lesions. Thus, such factors are contributing to the studied segment’s growth.

CAD Segment is Expected to Witness Significant Growth Over The Forecast Period

Coronary artery disease (CAD) poses a significant health concern globally, and drug-eluting stents (DES) play a crucial role in its treatment. CAD, characterized by the narrowing or blockage of coronary arteries, can lead to reduced blood flow to the heart, causing chest pain and increasing the risk of heart attacks. Drug-eluting stents are specifically designed to address this condition by providing mechanical support to the narrowed arteries and delivering medications to prevent the re-narrowing of blood vessels. These stents, coated with drugs that inhibit the proliferation of smooth muscle cells, are instrumental in reducing the risk of restenosis, a common complication in conventional stents. The use of drug-eluting stents in CAD interventions has become a standard practice, contributing to improved patient outcomes and the management of cardiovascular health. Thus, such factors are contributing to the studied segment’s growth.

North America Region is Expected to Witness Significant Growth Over The Forecast Period

North America has emerged as the dominant market for drug-eluting stents, owing to well-established healthcare infrastructure and widespread adoption of advanced medical technologies. The prevalence of cardiovascular diseases in North America has fueled the demand for effective treatments, with drug-eluting stents being a prominent solution. The presence of key market players and continuous advancements in stent technology further contribute to the region's dominance. A noteworthy development in May 2023 was the U.S. distribution agreement signed between CoSo Health and Medinol for EluNIR, a cutting-edge, thin-strut drug-eluting stent, showcasing the region's commitment to state-of-the-art medical solutions.

The drug-eluting stent market exhibits fragmentation, characterized by the presence of companies operating on both a global and regional scale. This diversity in market participants contributes to a competitive landscape where various companies, ranging from multinational corporations to regional players, actively engage in the development, production, and distribution of drug-eluting stents. The market dynamics are shaped by the collective efforts of these diverse entities, each bringing its own set of strengths, strategies, and market focus. Global players often leverage their extensive resources and research capabilities to address a broader market, while regional companies may excel in catering to specific geographical areas with a nuanced understanding of local preferences and regulatory landscapes. The interplay between these global and regional actors creates a dynamic and multifaceted market environment, fostering innovation and competition within the drug-eluting stent sector. Some of the key market players are:

Recent Development:

1) In August 2022, Medtronic recently introduced its latest drug-eluting coronary stent, the Onyx Frontier™, subsequent to receiving CE Mark approval. This innovative stent incorporates an improved delivery system and builds upon the proven acute performance and clinical data derived from the Resolute Onyx™ drug-eluting stent. Utilizing the same best-in-class stent platform as the Resolute Onyx™ DES, the Onyx Frontier™ features an enhanced delivery system designed to enhance deliverability and boost acute performance, particularly in challenging cases. This development represents a significant stride in advancing drug-eluting stent technology for improved coronary interventions.

2) In June 2021, the Food and Drug Administration (FDA) granted approval to Abbott for its XIENCE Skypoint stent, featuring a distinctive polymer coating. This regulatory approval underscores the region's dedication to embracing cutting-edge solutions in the field of interventional cardiology.

Q1. What was the Drug Eluting Stent Market size in 2023?

As per Data Library Research the global drug-eluting stent market size was valued at USD 7.9 billion in 2023.

Q2. At what CAGR is the Drug Eluting Stent market projected to grow within the forecast period?

Drug Eluting Stent Market is expected to grow at a compound annual growth rate (CAGR) of 8.9% over the forecast period.

Q3. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Q4. What segments are covered in the Drug Eluting Stent Market Report?

By Coating, By Application and Geography these segments are covered in the Drug Eluting Stent Market Report.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model