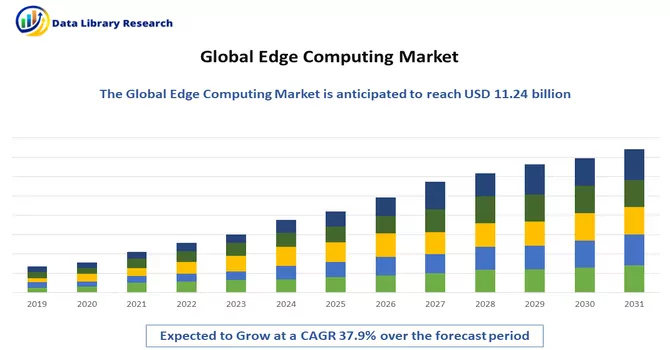

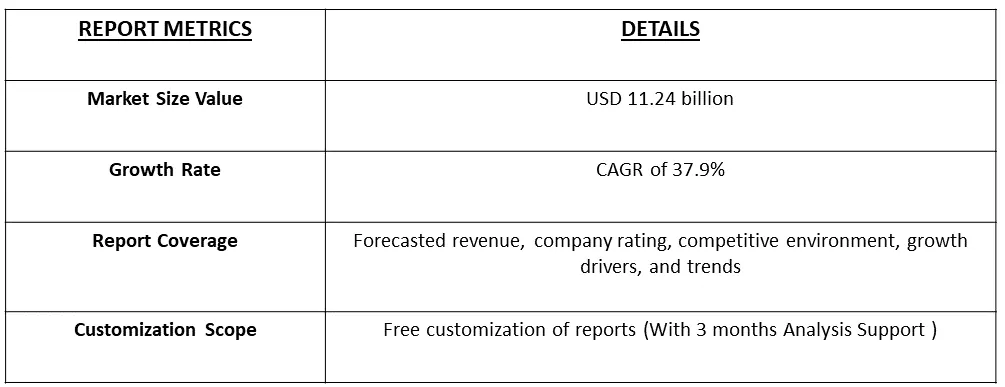

The global edge computing market, valued at USD 11.24 billion in 2022, is projected to experience robust growth with a compound annual growth rate (CAGR) of 37.9% from 2023 to 2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Edge computing refers to a distributed computing paradigm that brings computation and data storage closer to the location where it is needed, rather than relying on a centralized cloud-based system. In edge computing, data processing occurs near the edge of the network, often on devices such as IoT (Internet of Things) devices, routers, or gateways, rather than relying solely on a centralized data center. The primary goal of edge computing is to reduce latency, enhance real-time processing capabilities, and improve the efficiency of data-intensive applications. By processing data closer to the source or endpoint device, edge computing minimizes the need to transmit data back and forth to a centralized cloud server. This can be particularly beneficial in scenarios where low latency and quick decision-making are crucial, such as in IoT applications, autonomous vehicles, industrial automation, and augmented reality.

The adoption of edge computing introduces a layer of intricacy for organizations, empowering a diverse range of stakeholders to oversee IT infrastructures, networking, software development, traffic distribution, and service management. This paradigm combines software, hardware solutions, and networking architecture to address various use cases across diverse industries. Despite being in its nascent stages, edge computing is anticipated to present substantial growth opportunities for newcomers as its deployment and operational models continue to evolve in the coming years.

The growing proliferation of Internet of Things (IoT) devices is a significant trend in the edge computing market. Edge computing is crucial for handling the massive amounts of data generated by IoT devices locally, allowing for real-time processing and reducing the need to transmit all data to centralized cloud servers. The deployment of 5G networks is accelerating the adoption of edge computing. The increased speed and bandwidth of 5G enable more efficient data processing at the edge, supporting applications that demand high-performance connectivity, such as autonomous vehicles, smart cities, and augmented reality. These trends collectively reflect the dynamic evolution of edge computing, driven by advancements in technology, changing business requirements, and the need for more efficient and responsive computing architectures.

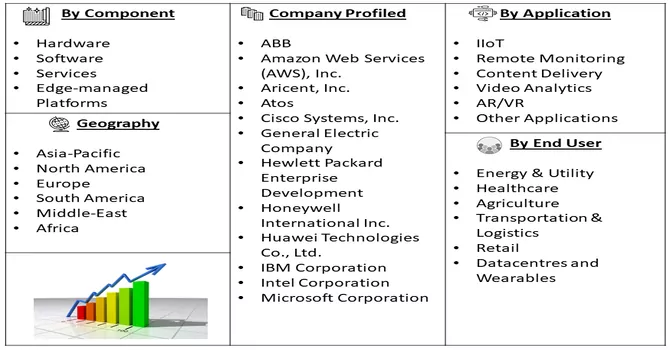

Market Segmentation: The Edge Computing Market is Segmented By Component (Hardware, Software, Services, Edge-managed Platforms), Application( IIoT, Remote Monitoring, Content Delivery, Video Analytics, AR/VR and Other Applications), By End User (Energy & Utility, Healthcare, Agriculture, Transportation & Logistics, Retail, Datacentres and Wearables) and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The value is provided in (USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers :

Growing adoption of IoT across industry verticals

The growing adoption of the Internet of Things (IoT) across various industry verticals is a key driver propelling the expansion of the edge computing market. IoT involves connecting devices and sensors to the internet to collect and exchange data for improved decision-making and operational efficiency. As the number of IoT devices continues to surge across industries such as manufacturing, healthcare, transportation, agriculture, and smart cities, the need for efficient data processing becomes increasingly critical. The proliferation of IoT devices has led to an unprecedented influx of data. These devices generate vast amounts of data in real time, and transmitting all this data to centralized cloud servers can result in latency issues and strain network bandwidth. Many IoT applications require real-time processing and quick decision-making. For example, in manufacturing, IoT sensors on production lines need to quickly detect anomalies or faults to prevent downtime. Edge computing enables the processing of this data locally, reducing latency and enhancing responsiveness. Thus, the growing adoption of IoT across industry verticals is driving the demand for edge computing solutions. This trend reflects the need for decentralized, real-time data processing capabilities to unlock the full potential of IoT applications in diverse sectors.

Increase in the number of smart applications

The surge in the number of smart applications is a pivotal factor contributing to the rapid growth of edge computing. Smart applications, powered by technologies such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML), have become integral to various industries and daily life. Edge computing plays a crucial role in addressing the evolving requirements of these smart applications, enhancing their performance, responsiveness, and overall efficiency. Many smart applications demand real-time decision-making to deliver optimal user experiences. Edge computing enables the processing of data locally, allowing devices to make quick decisions without relying solely on distant cloud servers. This is particularly critical in applications like autonomous vehicles, where split-second decisions are essential for safety. The integration of edge computing with artificial intelligence is a key enabler for smart applications. Edge devices can host AI models locally, allowing them to make intelligent decisions without relying on centralized cloud resources. This is valuable in applications ranging from smart surveillance cameras to personalized AI assistants. Thus, the proliferation of smart applications is closely intertwined with the evolution of edge computing. As the number of connected devices continues to grow and smart technologies become more ingrained in daily life and industrial processes, the role of edge computing in optimizing performance and responsiveness becomes increasingly vital.

Market Restraints :

Security and privacy concerns

Security and privacy concerns stand out as critical factors that could potentially impede the rapid growth of the edge computing market. While edge computing brings forth numerous advantages, including reduced latency, enhanced performance, and real-time data processing, it also introduces unique challenges related to the protection of sensitive information and the preservation of privacy. Edge devices often process data closer to the source, which could involve handling sensitive information at the edge of the network. The decentralized nature of edge computing may expose data to potential security threats if robust security measures are not in place.

The COVID-19 pandemic has had a multifaceted impact on the edge computing market, influencing various aspects of its growth and adoption. The pandemic acted as a catalyst for accelerated digital transformation initiatives across industries. Organizations, compelled to adapt quickly to remote working, increased reliance on digital technologies. Edge computing, with its ability to process data closer to the source, became crucial for optimizing remote operations and ensuring low-latency connectivity.

Post the COVID-19 pandemic, the demand for edge computing is projected to increase in the next few years, driven by a continued focus on enhancing communication infrastructure. Remote work is rapidly becoming the norm, and the healthcare sector is gaining momentum with the adoption of online consultations. This shift emphasizes the need for a network design that offers high security and low-latency connectivity. Telecom companies are expected to capitalize on this opportunity, as the cost-effectiveness of adding additional switching capabilities or establishing smaller edge facilities is anticipated to outweigh the expenses associated with full-sized data centers per unit. This cost advantage is likely to facilitate the migration of telecom businesses towards extensive data center installations in the coming years.

Segmental Analysis :

Hardware Segment is Expected to Witness Significant Growth Over the Forecast Period

The hardware segment plays a crucial role in the thriving edge computing market, serving as a fundamental component in the development and implementation of edge solutions. Edge computing relies on a range of hardware devices, including servers, gateways, routers, sensors, and other specialized equipment, to process data closer to the source of generation. As edge computing continues to gain traction, there is a growing demand for robust and efficient hardware solutions that can handle the increased workload at the edge. This includes powerful processors, memory modules, storage devices, and networking equipment specifically designed to meet the requirements of edge deployments. In the hardware and edge computing market, advancements are observed in the form of more powerful and energy-efficient processors, compact and ruggedized devices suitable for harsh environments, and innovations in storage solutions to accommodate the diverse needs of edge applications. The hardware sector plays a pivotal role in supporting the scalability, reliability, and performance of edge computing architectures across various industries.

IIoT Segment is Expected to Witness Significant Growth Over the Forecast Period

The Industrial Internet of Things (IIoT) and edge computing are two interconnected technologies that are revolutionizing industrial processes, enhancing efficiency, and driving digital transformation in various industries. IIoT refers to the integration of smart devices, sensors, and machines in industrial settings, enabling them to communicate, collect data, and share insights. This connectivity facilitates real-time monitoring, analysis, and decision-making, leading to improved operational efficiency, predictive maintenance, and cost savings. Edge computing, on the other hand, involves processing data closer to the source of generation rather than relying solely on centralized cloud servers. This decentralized approach reduces latency, enhances data privacy, and allows for quicker response times. In the context of IIoT, edge computing is particularly beneficial for handling the massive volumes of data generated by sensors and devices in industrial environments. Edge devices can operate independently, ensuring continuity in case of network disruptions. This enhances the reliability of industrial processes, which is vital for sectors such as manufacturing, energy, and logistics. The synergy between IIoT and edge computing is transforming traditional industries, providing them with the tools to optimize operations, reduce downtime, and foster innovation in the era of Industry 4.0.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America dominated the market with a significant revenue owing to the amalgamation of the Industrial Internet of Things (IIoT) with edge computing is creating a conducive environment for manufacturers in the United States to transition towards connected factories. This convergence allows for the seamless integration of smart devices and sensors into industrial processes, enabling real-time data analysis and decision-making at the edge. The U.S. market is witnessing the emergence of various startups dedicated to providing platforms for the development of edge-enabled solutions. These platforms empower businesses to harness the capabilities of edge computing, fostering innovation in connected industrial environments. The proliferation of such solutions is anticipated to contribute significantly to the region's market growth, indicating a dynamic landscape where technology-driven advancements are driving the evolution of manufacturing practices.

Moreover, the recent development is expected to drive the growth of the market in the region. For instance, in July 2022, Lumen Technologies announced its strategic move to extend its Edge Computing Solutions into Europe, concurrently investing in its worldwide Edge network. This initiative aims to provide businesses with a low-latency platform, enabling the extension of high-bandwidth, data-intensive applications to the cloud edge. The expansion reflects Lumen's ongoing dedication to next-generation solutions, poised to transform digital experiences and align with the evolving needs of contemporary global businesses.

Get Complete Analysis Of The Report - Download Free Sample PDF

Key market participants are directing their efforts towards the creation of cutting-edge collaboration software, aiming to expand their customer reach and secure a competitive advantage in the market. This strategic focus involves the development of innovative solutions to meet evolving user needs, enhance collaboration experiences, and stay ahead in a dynamic market landscape. By prioritizing innovation in collaboration software, these major players seek to position themselves as industry leaders, attracting a diverse customer base and staying competitive in the rapidly evolving market. Some prominent players in the global edge computing market include:

Recent Development:

1) As of February 2022, Asana, a provider of work management platforms, introduced Asana Flow—a comprehensive suite of solutions designed for businesses to construct, execute, and optimize their workflows. The growing introduction of such innovative offerings is anticipated to contribute positively to the market's expansion in the foreseeable future.

2) In December 2020, SK Telecom and Amazon Web Services collaborated to provide edge cloud services based on 5G Multi-Access Edge Computing (MEC).

Q1. What was the Edge Computing Market size in 2022?

As per Data Library Research the global edge computing market, valued at USD 11.24 billion in 2022.

Q2. At what CAGR is the edge computing market projected to grow within the forecast period?

Edge Computing Market is projected to experience robust growth with a compound annual growth rate (CAGR) of 37.9% over the forecast period.

Q3. What are the factors driving the Edge Computing Market?

Key factors that are driving the growth include theGrowing adoption of IoT across industry verticals and Increase in the number of smart applications.

Q4. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model