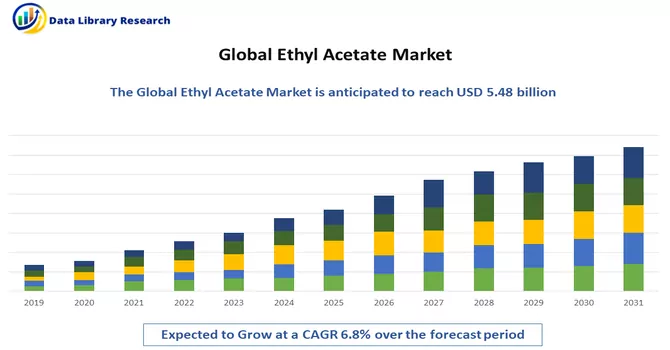

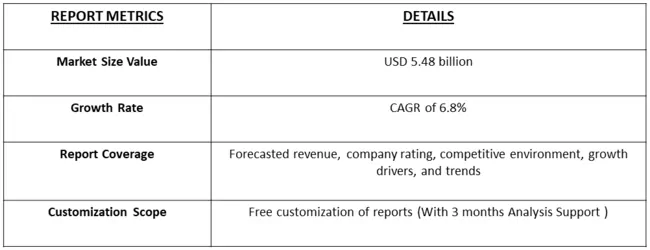

The global ethyl acetate market size was estimated at USD 5.48 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.8% over the forecast period 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Ethyl acetate holds a central position in the global chemical market, serving as a versatile solvent with widespread applications across various industries. Known for its sweet, fruity aroma, ethyl acetate is extensively utilized in the production of paints, coatings, adhesives, and pharmaceuticals. Its favourable characteristics, such as low toxicity and rapid evaporation, make it a preferred choice for diverse formulations. The robust demand for ethyl acetate is driven by the flourishing coatings and printing ink industries, where it acts as a vital component. Additionally, the pharmaceutical sector relies on ethyl acetate for its role in drug formulation processes. The market for ethyl acetate is characterized by dynamic growth, spurred by industrial expansion, technological advancements, and the continuous quest for efficient solvents across a spectrum of applications.

The growth of the ethyl acetate market is propelled by the increasing demand across multiple industries, particularly in the coatings, adhesives, and pharmaceutical sectors. As a versatile solvent, ethyl acetate finds extensive use in the formulation of paints, coatings, and adhesives due to its excellent solvency and low toxicity. The flourishing construction and automotive industries contribute significantly to the heightened demand for coatings, driving the need for ethyl acetate. Moreover, its role as a crucial component in the pharmaceutical sector, particularly in drug formulation processes, further stimulates market growth. The compound's favorable characteristics, including a pleasant odor, rapid evaporation, and compatibility with various materials, make it a preferred choice for manufacturers seeking efficient and versatile solvents. As industrial activities expand and technological advancements drive innovation, the ethyl acetate market is poised for sustained growth, underlining its pivotal role in diverse applications across the chemical industry.

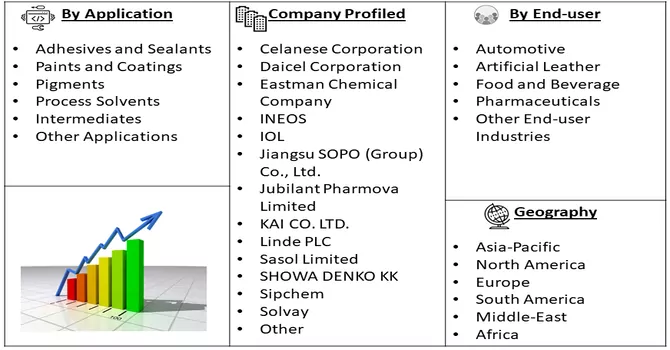

Market segmentation: Ethyl Acetate Manufacturers and the Market is segmented by Application (Adhesives and Sealants, Paints and Coatings, Pigments, Process Solvents, Intermediates, and Other Applications (Flavor Enhancers, Inks)), End-user Industry (Automotive, Artificial Leather, Food and Beverage, Pharmaceuticals, and Other End-user Industries (Packaging)), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). For each segment, the market sizing and forecasts have been done on the basis of volume (kilo ton).

For Detailed Market Segmentation - Download Free Sample PDF

The ethyl acetate market is currently shaped by several notable trends reflecting the evolving landscape of the chemical industry. One significant trend is the increasing emphasis on sustainability, with a growing demand for eco-friendly solvents. As environmental awareness rises, manufacturers are exploring greener production processes and sourcing methods for ethyl acetate. Additionally, there is a trend towards technological advancements and process optimization, aiming to enhance production efficiency and reduce environmental impact. The pharmaceutical industry's continual quest for safer and more efficient solvents is driving the adoption of ethyl acetate in drug formulation processes. Moreover, market players are focusing on strategic collaborations and partnerships to expand their geographical presence and customer base. The ethyl acetate market's trends underscore the industry's commitment to innovation, sustainability, and adaptability to emerging market demands across a diverse range of applications.

Market Drivers:

The global shift towards sustainability and environmental consciousness is driving the demand for eco-friendly solvents

The global shift towards sustainability and heightened environmental consciousness is significantly influencing industrial practices, fostering a robust demand for eco-friendly solvents. As industries and consumers increasingly prioritize environmentally responsible solutions, there is a growing recognition of the impact of traditional solvents on ecosystems and human health. This paradigm shift is particularly evident in sectors such as chemicals, coatings, and pharmaceuticals, where the demand for eco-friendly solvents has surged. The quest for alternatives with lower toxicity, reduced emissions, and minimal environmental impact is propelling innovation in solvent formulations. Manufacturers are responding to this demand by developing and promoting solvents like ethyl acetate, known for their eco-friendly attributes, marking a pivotal transition towards greener and sustainable practices across diverse industries.

The pharmaceutical industry's continual growth and the need for efficient solvents in drug formulation processes are significant drivers for the ethyl acetate market

The pharmaceutical industry's sustained growth and its perpetual demand for efficient solvents in drug formulation processes are pivotal drivers propelling the ethyl acetate market. Ethyl acetate, recognized for its favorable characteristics such as rapid evaporation and compatibility with pharmaceutical ingredients, has become indispensable in the creation of pharmaceutical formulations. As the pharmaceutical sector undergoes continual expansion, driven by research, development, and the demand for innovative therapeutic solutions, the importance of efficient solvents like ethyl acetate amplifies. This dynamic intersection of pharmaceutical industry growth and the necessity for high-performance solvents positions ethyl acetate as a key enabler in drug development, underlining its critical role in advancing pharmaceutical innovations and contributing to the ongoing evolution of the healthcare landscape.

Market Restraints:

The ethyl acetate market faces certain constraints that impact its growth trajectory. One notable restraint is the volatility in raw material prices, particularly those of ethanol and acetic acid, which are key components in ethyl acetate production. Fluctuations in the costs of these inputs can affect the overall production costs, potentially impacting profit margins for manufacturers. Additionally, regulatory challenges related to environmental and safety compliance pose constraints on the production and use of ethyl acetate. Stringent regulations may necessitate modifications to manufacturing processes, leading to increased operational costs for industry players. Furthermore, the emergence of alternative solvents and substitutes, driven by the growing emphasis on sustainability, poses competitive challenges for ethyl acetate in the market. The industry's ability to navigate these challenges and adapt to evolving market dynamics will be crucial for sustained growth and resilience in the ethyl acetate market.

The ethyl acetate market, like many industries, experienced significant disruptions due to the COVID-19 pandemic. The lockdowns, supply chain interruptions, and economic uncertainties associated with the global health crisis impacted various end-use sectors of ethyl acetate, such as coatings, adhesives, and pharmaceuticals. Reduced industrial activities and a slowdown in construction projects led to a decline in demand, affecting the production and consumption of ethyl acetate. However, as economies began to recover and pandemic-induced restrictions eased, there was a gradual rebound in demand, particularly in pharmaceutical applications where the need for drug formulations persisted. The resilience of the ethyl acetate market in adapting to the changing circumstances reflects its essential role in diverse industries, with the recovery indicating a gradual return to pre-pandemic market dynamics.

Segmental Analysis:

Process Solvents Segment is Expected to Witness Significant Growth Over the Forecast Period

The process solvent market, particularly in the context of ethyl acetate, is driven by a range of factors including its versatile properties and diverse applications. Ethyl acetate is a popular solvent known for its low toxicity, pleasant odour, and fast evaporation rate, making it suitable for use in various industries such as pharmaceuticals, coatings, adhesives, and food and beverages. In the pharmaceutical industry, ethyl acetate is used as a solvent in the production of medicines and as a coating for pills and tablets. In the coatings and adhesives industry, it is used as a solvent in paints, varnishes, and glues. The food and beverage industry also utilizes ethyl acetate as a flavouring agent in some products. The market for ethyl acetate is expected to grow steadily, driven by its wide range of applications and the increasing demand for environmentally friendly solvents. However, factors such as fluctuating raw material prices and stringent regulations regarding emissions and safety could pose challenges to market growth. Overall, the process solvent market, particularly in the case of ethyl acetate, is characterized by its versatility and continued growth potential across various industries.

Artificial Leather Segment is Expected to Witness Significant Growth Over the Forecast Period

The artificial leather market is closely linked to the ethyl acetate market, as ethyl acetate is commonly used as a solvent in the production of artificial leather. Artificial leather, also known as synthetic leather or faux leather, is a cost-effective and cruelty-free alternative to natural leather, made from various materials such as polyurethane (PU) or polyvinyl chloride (PVC). Ethyl acetate is used in the production of artificial leather as a solvent for coating and finishing processes, where it helps dissolve and disperse the resins and additives used to give artificial leather its desired texture, appearance, and durability. The growing demand for artificial leather, driven by increasing awareness of animal welfare and environmental concerns associated with traditional leather production, is expected to drive the demand for ethyl acetate in the coming years. Additionally, the versatility of ethyl acetate as a solvent, its low toxicity, and its favourable environmental profile make it a preferred choice for use in artificial leather production. Overall, the artificial leather market is a key driver of the ethyl acetate market, with both industries poised for continued growth as demand for sustainable and cruelty-free alternatives to natural leather increases.

Asia Pacific Region is Expected to Witness Significant Growth Over the Forecast Period

The Asia Pacific region is a significant market for ethyl acetate, driven by the region's rapid industrialization, growing population, and expanding manufacturing sector. Ethyl acetate is widely used in various industries in the Asia Pacific region, including coatings, adhesives, pharmaceuticals, and food and beverages. In the coatings and adhesives industry, ethyl acetate is used as a solvent in the production of paints, varnishes, and adhesives. In the pharmaceutical industry, it is used as a solvent in the manufacturing of medicines and as a coating for pills and tablets. The food and beverage industry also utilizes ethyl acetate as a flavouring agent in some products. The Asia Pacific region is home to some of the world's largest and fastest-growing economies, such as China, India, and Japan, which are major consumers of ethyl acetate. The region's expanding manufacturing sector and increasing consumption of consumer goods are driving the demand for ethyl acetate in the region. Additionally, the availability of raw materials and relatively lower production costs in some countries in the region further contribute to the growth of the ethyl acetate market in Asia Pacific. Overall, the Asia Pacific region is a key market for ethyl acetate, with continued growth expected in the coming years.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding the company presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. These strategies include investments in research and development to stay at the forefront of technological advancements, mergers and acquisitions to consolidate market share, strategic partnerships for synergies, and innovation to differentiate products and services. The adoption of such multifaceted strategies reflects the competitive nature of the market, with participants continually seeking avenues for growth and sustainability. In essence, the high fragmentation in the studied market not only signifies the diversity of players but also underscores the dynamism and competitiveness that drive ongoing strategic manoeuvres. As companies explore various avenues for expansion, the market continues to evolve, presenting both challenges and opportunities for industry stakeholders.

Some of the prominent players in the global ethyl acetate market include:

Recent Development:

1) In July 2022, Yip's Chemical revealed that it had entered into an agreement to divest a 51% effective interest in Handsome Chemical, a subsidiary within its solvents business, to the investment firm PAG for approximately CNY 2.3 billion (around USD 0.36 billion). Notably, Handsome Chemical holds the distinction of being the world's largest producer of acetate solvents, boasting an impressive annual production capacity exceeding 1.6 million tons. This strategic move reflects Yip's Chemical's initiative to optimize its business portfolio and align with market dynamics.

2) In March 2021, Celanese Corporation made a significant announcement regarding its Clear Lake, Texas chemical production facility. The company revealed its intention to utilize recycled carbon dioxide (CO2) as an alternative feedstock at this plant, particularly in the production of methanol—a critical raw material for various acetyl products, including ethyl acetate, vinyl acetate monomer (VAM), acetic acid, and other derivatives. This forward-looking approach underscores Celanese Corporation's commitment to sustainable practices, showcasing its innovative efforts to reduce environmental impact and contribute to a more eco-conscious chemical manufacturing landscape.

Q1. What was the Ethyl Acetate Market size in 2023?

As per Data Library Research the global ethyl acetate market size was estimated at USD 5.48 billion in 2022.

Q2. At what CAGR is the Ethyl Acetate Market projected to grow within the forecast period?

Ethyl Acetate Market is anticipated to grow at a compound annual growth rate (CAGR) of 6.8% over the forecast period.

Q3. Which Region is expected to hold the highest Market share?

Asia-Pacific region is expected to hold the highest Market share.

Q4. Who are the key players in Ethyl Acetate Market?

Some key players operating in the market include

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model