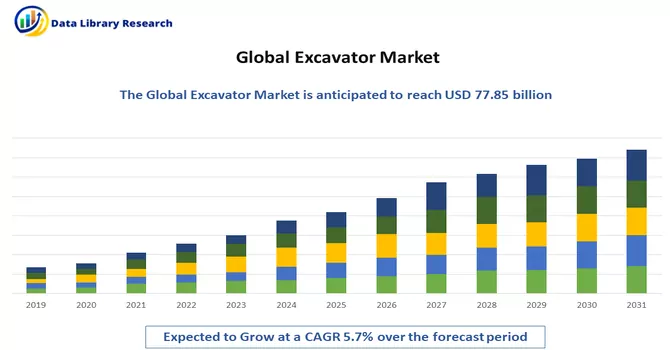

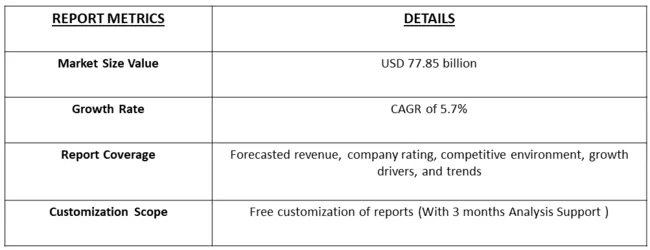

The global excavator market size was estimated at USD 77.85 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.7% from 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

An excavator, in the realm of business and construction, is a heavy-duty machinery designed for digging, excavating, and earthmoving tasks. This versatile piece of equipment is characterized by a hydraulic arm, a bucket or attachment at the end of the arm, and a rotating platform. Excavators are widely utilized in construction projects, infrastructure development, and mining operations to efficiently and precisely move large volumes of soil, rocks, or debris. Their adaptability and powerful digging capabilities make excavators essential for tasks such as trenching, foundation digging, and material handling on construction sites. With various attachments available, excavators can perform a range of specialized functions, contributing to enhanced productivity and efficiency in diverse industrial applications.

The market has witnessed substantial growth due to heightened investments in the construction sector, particularly from emerging economies like India, China, and South Korea. This upsurge is attributed to the increased number of major projects in road and port construction, mining activities, and oil and gas construction. The global demand for excavators has correspondingly risen in response to the expansion of these significant projects. Additionally, the market has benefited from notable advancements in excavator design and functionality, including enhancements in fuel efficiency and overall performance. These technological upgrades have propelled the widespread adoption of excavators across various industries, contributing significantly to the ongoing expansion and development of the market on a global scale.

The global excavator market is witnessing significant growth driven by increased investments in the construction sector, notably from emerging economies such as India, China, and South Korea. The surge is attributed to a rise in major projects within road and port construction, mining, and oil and gas industries. Technological advancements in excavator design, emphasizing improved fuel efficiency and enhanced performance, further contribute to their widespread adoption and market expansion. The industry's evolution is characterized by a growing demand for compact excavators, a focus on sustainability, and the exploration of electric and hybrid models. As the construction industry continues to embrace technological innovations and global infrastructure development accelerates, the excavator market remains dynamic and poised for continued growth.

Market Segmentation: The Global Excavator Market is Segmented by Type (Crawler Excavators and Wheeled Excavators), Application (Construction, Mining, Forestry, Demolition), and Geography (North America, Europe, Asia-Pacific and Rest of the World). The report offers market size and forecasts in terms of value (USD million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Marker Drivers:

Infrastructure Development Initiatives

One major driver for the excavator market is the extensive infrastructure development initiatives undertaken globally. Governments and private entities invest significantly in projects such as road construction, bridge building, and urban development, propelling the demand for excavators. These versatile machines play a crucial role in various construction tasks, including excavation, earthmoving, and foundation digging, driving their adoption in large-scale infrastructure projects.

Expanding Construction and Mining Activities

The persistent expansion of construction and mining activities stands out as a pivotal catalyst driving the excavator market. With the ongoing trend of urbanization and the increasing need for housing and commercial infrastructure, the construction sector relies heavily on excavators for crucial tasks like site preparation, trench excavation, and groundwork. Concurrently, in the mining industry, excavators play an indispensable role in tasks ranging from ore extraction to material handling and land clearing. The global proliferation of these sectors underscores the consistent demand for excavators, emphasizing their vital contribution to meeting the growing requirements of construction and mining projects worldwide. As urban development and resource extraction continue to escalate, the excavator market remains a linchpin in facilitating efficient and productive operations across diverse industrial landscapes.

Market Restraints:

Regulatory Compliance and Emission Standards:

The excavator market faces a notable constraint in the form of stringent environmental regulations and emission standards. Compliance with these regulations, particularly in regions with rigorous emission requirements, necessitates significant investments by manufacturers in advanced technologies. This adherence to environmental standards has a direct impact on production costs, introducing additional expenses related to the integration of emission-reducing technologies. As a result, there is a potential limitation on the affordability of excavators, especially for manufacturers navigating markets where the cost implications of meeting stringent environmental standards may influence pricing structures. The need to balance compliance with these regulations while maintaining competitive pricing poses a complex challenge for excavator manufacturers, requiring strategic planning and innovation in order to navigate this regulatory landscape effectively.

The global excavator market witnessed substantial disruptions amid the COVID-19 pandemic, as construction projects faced delays and cancellations, supply chains experienced disruptions, and the construction industry grappled with financial constraints. Lockdowns and social distancing measures led to project setbacks, impacting the demand for new excavators, while manufacturing closures and reduced capacities disrupted the supply chain. The rental market saw growth as construction companies sought cost-effective alternatives amidst economic uncertainties. The focus on remote work and smaller-scale projects drove increased demand for compact excavators. The pandemic also accelerated the adoption of automation and technology in the construction industry, with telematics and remote monitoring gaining prominence. As the world emerges from the pandemic, the excavator market is expected to rebound, driven by resumed construction activities, stabilized supply chains, and continued advancements in technology.

Segmental Analysis:

Wheeled Excavators Segment is Expected to Witness Significant Growth Over the Forecast Period

Wheeled excavators provide a range of advantages that make them well-suited for specific construction applications. Their high mobility and superior maneuverability make them particularly effective in urban environments and confined spaces, where navigating tight areas is crucial. The quick transportation capability allows for easy mobility between job sites without the need for specialized hauling equipment, contributing to time and resource efficiency. Wheeled excavators exert lower ground pressure, minimizing ground disturbance, which proves beneficial in scenarios where surface impact needs to be minimized. Additionally, their versatility across various surfaces, faster travel speeds, ease of operation, and adaptability to various attachments enhance overall productivity. While offering these advantages, the choice between wheeled and tracked excavators depends on project-specific requirements, emphasizing the importance of evaluating factors such as terrain conditions, project duration, and mobility needs for optimal equipment selection.

Construction Segment is Expected to Witness Significant Growth Over the Forecast Period

Excavators play a pivotal role in the construction industry, serving a multitude of functions critical to the success of various projects. Their versatility and robust capabilities make them indispensable in construction activities. Excavators are commonly used for digging and excavating, whether it's creating foundations for buildings, digging trenches for utilities, or preparing sites for landscaping. Their ability to handle different types of soil and terrain makes them suitable for a wide range of earthmoving tasks. Excavators are also utilized in material handling, and lifting heavy objects on construction sites with the assistance of specialized attachments like grapples or buckets. Moreover, they are instrumental in demolishing existing structures, breaking down concrete, and clearing debris from construction sites. The precision and control provided by excavators make them valuable in shaping landscapes, creating slopes, and assisting in grading activities. Overall, excavators contribute significantly to the efficiency and progress of construction projects, enhancing productivity and streamlining various tasks across different phases of construction.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

The North American excavator market remains a crucial component of the region's construction and infrastructure development landscape, driven by ongoing urbanization, robust investment in infrastructure projects, and a focus on renewing aging structures. Excavators play a vital role in various construction activities, including site preparation, foundation digging, and trenching, contributing to the growth of residential, commercial, and infrastructure projects. Technological advancements, such as the integration of telematics and GPS systems, enhance the efficiency of excavators, aligning with North America's inclination towards adopting advanced construction technologies. The region's commitment to environmental sustainability influences excavator manufacturers to incorporate eco-friendly features and comply with stringent emission standards. Additionally, the rental market for excavators has seen growth, providing contractors with a cost-effective option for managing equipment needs. As North America continues to prioritize infrastructure development and construction projects, the excavator market remains dynamic, adapting to evolving trends and regulatory landscapes.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding the company presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. These strategies include investments in research and development to stay at the forefront of technological advancements, mergers and acquisitions to consolidate market share, strategic partnerships for synergies, and innovation to differentiate products and services. The adoption of such multifaceted strategies reflects the competitive nature of the market, with participants continually seeking avenues for growth and sustainability. In essence, the high fragmentation in the studied market not only signifies the diversity of players but also underscores the dynamism and competitiveness that drive ongoing strategic manoeuvres. As companies explore various avenues for expansion, the market continues to evolve, presenting both challenges and opportunities for industry stakeholders.

Some of the key market players working in this segment are:

Recent Development:

1) In December 2023, the influence of the electric vehicle trend is extending into public transport, witnessing a surge in electric bikes, cars, and buses navigating Indian roads. Despite this momentum, the heavy machinery and construction equipment sector has experienced a relative lag in embracing this transformation. Sandeep Singh, Managing Director of Tata Hitachi Construction Co Pvt Ltd, shares insights with DH’s Gyanendra Keshri regarding his company's strategic move toward sustainability. Tata Hitachi is taking a pioneering step by introducing India's first domestically manufactured electric excavator. This innovative initiative signifies a significant contribution to the excavator market, aligning with the broader push towards greener practices in the construction industry. The introduction of an electric excavator reflects Tata Hitachi's commitment to environmental consciousness and positions the company at the forefront of sustainable advancements in the heavy machinery sector.

2) In October 2023, SANY Group, a prominent global machinery manufacturer, unveiled five cutting-edge small excavator products featuring elevated functionality and enhanced performance. Scheduled for an official market release in 2024, the SY60C, SY75C, SY80U, SY95C, and SY135C models have been meticulously developed to cater specifically to the European and North American markets. These advanced excavators, produced at SANY's industry park in Kunshan, Jiangsu Province, signify a significant achievement in the company's overseas product strategy. The launch not only demonstrates SANY's commitment to innovation but also highlights its strategic focus on meeting the distinct requirements of key international markets. The introduction of these state-of-the-art excavators reinforces SANY Group's position as a leading player in the global machinery industry, poised to deliver advanced solutions to construction and excavation needs in diverse geographical regions.

Q1. What was the Excavator Market size in 2023?

As per Data Library Research the global excavator market size was estimated at USD 77.85 billion in 2023.

Q2. At what CAGR is the excavator market projected to grow within the forecast period?

Excavator Market is expected to grow at a compound annual growth rate (CAGR) of 5.7% over the forecast period.

Q3. What are the factors driving the Excavator Market?

Key factors that are driving the growth include the Infrastructure Development Initiatives and Expanding Construction and Mining Activities.

Q4. Which region has the largest share of the Excavator Market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model